Choosing the wrong financing option can cost your business thousands in unnecessary interest or give away valuable equity you'll later regret losing. Most business owners face this critical decision point at least once in their growth journey, yet many lack the clear framework needed to make the optimal choice. Business financing options have evolved, and more specialized lending products and innovative equity structures are now available to businesses of all sizes.

This guide breaks down the essential differences between debt and equity financing so you can match your funding strategy to your specific business goals. We'll explore what each financing type entails, their main advantages and drawbacks, how to determine which option aligns with your business stage, and real-world examples of companies that have successfully leveraged both approaches.

What Is Debt Financing?

Debt financing is a funding method where a business borrows money and agrees to repay it with interest over time. This approach lets you keep full ownership while getting the cash you need to grow or handle day-to-day expenses.

When you get debt financing, you're essentially renting money for a specific period. The lender, which might be a bank, online platform, or government program, provides a loan amount based on your creditworthiness and business performance. You then make regular payments according to set repayment schedules until you've paid back the principal plus interest.

The debt financing world offers several options for businesses:

Term loans. These provide a lump sum with fixed monthly payments over a specific timeframe, perfect for major purchases or expansion projects.

SBA loans. Government-backed financing options with competitive interest rates and longer repayment terms for qualified businesses.

Lines of credit. Flexible funding that lets you borrow only what you need for working capital, with interest charged only on the amount used.

Credit cards. Quick access to short-term financing for smaller purchases, though typically with higher interest rates than other options.

Interest rates vary based on your credit score, business history, and current market conditions. Lenders may require collateral — business assets they can take if you default — especially for larger loan amounts or newer businesses. Your debt-to-equity ratio also factors into approval decisions, as it shows lenders how much debt you're already carrying compared to your business equity.

Pros and Cons of Debt Financing

Understanding the advantages and drawbacks of debt financing helps you make smarter choices about funding your business growth.

The advantages of debt financing include:

Ownership retention. You keep 100% ownership and control of your business instead of giving up equity to investors.

Tax advantages. Interest payments on business loans are typically tax-deductible, reducing your overall tax burden.

Predictable costs. Fixed repayment schedules make it easier to budget for loan payments and plan your cash flow.

Credit building. Timely loan payments can improve your business credit score, making future financing easier to obtain.

The cons of debt financing include:

Repayment obligation. You must make monthly payments regardless of your business performance or revenue fluctuations.

Cash flow pressure. Loan payments can strain your available cash, especially during slower business periods.

Qualification requirements. You need a sufficient credit score and business history to qualify for favorable loan terms.

Collateral risk. Many term loans require collateral that could be lost if you default on repayment.

Debt burden. Taking on too much debt can negatively impact your debt-to-equity ratio and limit future borrowing options.

What Is Equity Financing?

Equity financing involves raising capital by selling ownership stakes in your business to outside investors. Instead of taking on debt with repayment obligations, you trade a percentage of your company — and its future profits — for immediate funding without monthly payment requirements.

This financing approach makes the most sense for businesses with high growth potential but limited cash flow or collateral for traditional loans. Startups and early-stage companies often turn to equity financing when they need substantial capital to scale quickly or enter competitive markets.

Common sources of equity financing include:

Angel investors. These wealthy individuals provide capital for startups, typically in exchange for ownership equity in your business.

Venture capital firms. These professional investment companies pool money to fund promising businesses with significant equity stakes.

Private equity firms. These investment management companies acquire established businesses or provide growth capital for substantial ownership positions.

Crowdfunding platforms. These online services allow many small investors to fund businesses in exchange for equity, products, or rewards.

Friends and family. These personal connections may invest in your business under more flexible terms than professional investors.

Unlike debt financing, equity financing doesn't require regular monthly payments to investors. Instead, equity investors receive returns through dividends when the business is profitable and potentially significant gains if the company is sold or goes public.

However, these investors typically gain some control of the business through board seats or voting rights, influencing major business decisions and your company's capital structure.

Pros and Cons of Equity Financing

Equity financing offers distinct advantages for certain business types, particularly those in high-growth industries or with innovative business models. Consider these benefits when evaluating raising capital through equity:

No repayment obligation. You don't have to make regular monthly payments, which preserves cash flow for business operations and growth.

Risk sharing. Investors share the financial risk of your business, absorbing losses if the venture fails or underperforms.

Access to expertise. Equity investors often provide valuable industry connections, mentorship, and strategic guidance beyond just capital.

Growth potential. The amount of money raised can be substantial, enabling rapid scaling and market expansion without debt constraints.

Improved balance sheet. Without debt obligations, your financial statements look stronger to potential future investors or lenders.

However, equity financing comes with significant trade-offs that business owners must carefully consider:

Diluted ownership. You surrender a percentage of your company and its future profits permanently when you take on equity investors.

Shared control. Investors typically gain decision-making influence through voting rights or board positions in your business.

Reporting requirements. You must provide regular updates and financial reports to your investors throughout your business relationship.

Valuation challenges. Determining your business's valuation can be difficult and may lead to giving away more equity than necessary.

Complex legal arrangements. Equity deals involve sophisticated legal agreements that can be costly and time-consuming to negotiate.

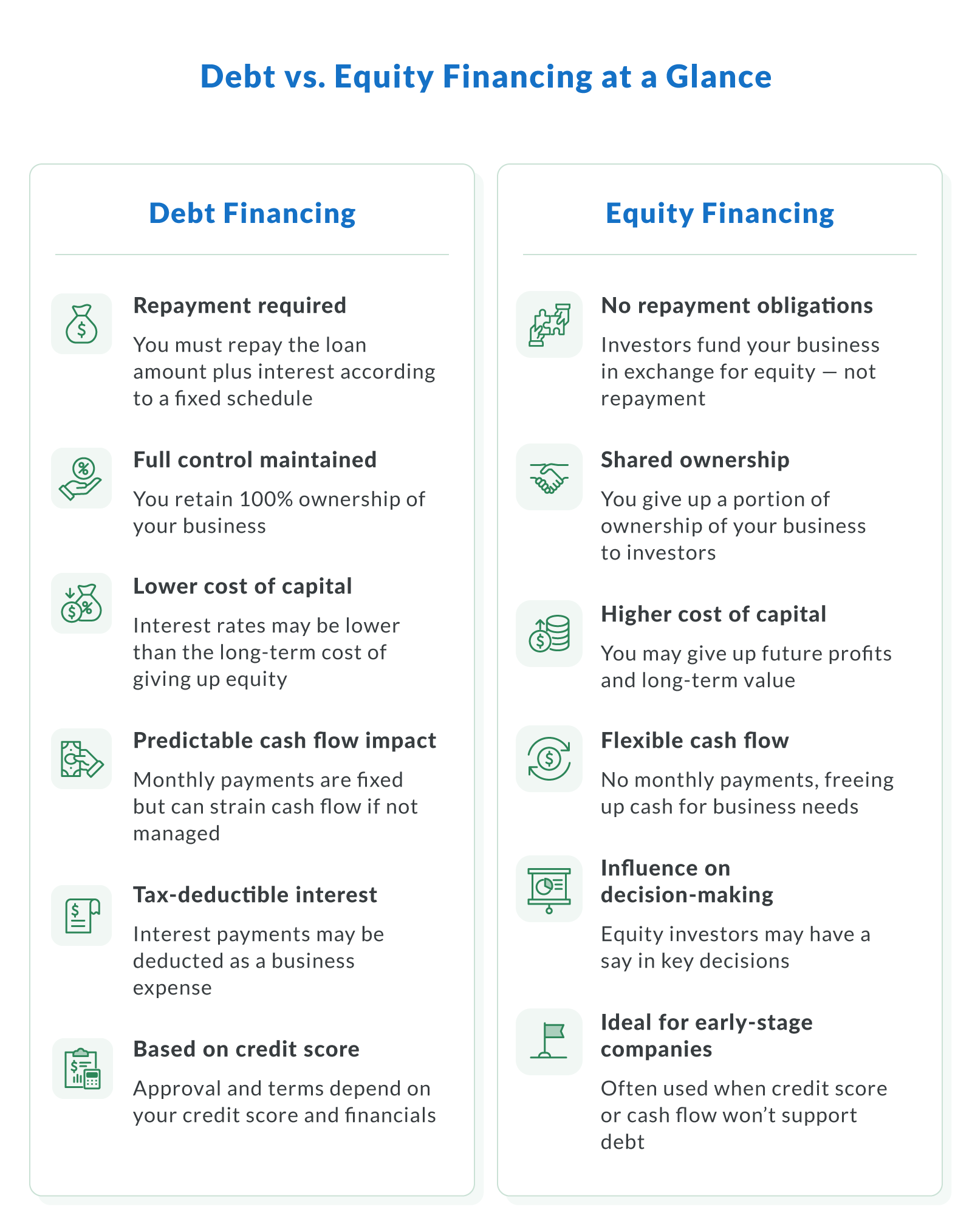

Key Differences Between Debt and Equity Financing

Understanding the core differences between debt financing and equity financing helps business owners choose the right funding strategy for their goals. The two approaches impact repayment obligations, ownership of your business, and long-term decision-making power in very different ways.

Below is a side-by-side comparison to help clarify how each type of financing affects your company's cash flow, control, and cost of capital:

Which Type of Financing Is Right for Your Business?

Choosing the right type of financing depends on your business stage, growth plans, and personal comfort with risk. Both funding approaches have their place in a smart capital structure, with many successful businesses using a strategic combination of debt and equity at different growth stages.

Consider these factors when deciding which financing option makes the most sense for your business needs:

Growth timeline. Debt works well for steady, predictable growth, while equity better supports rapid scaling and higher-risk business models.

Cash flow situation. If your business has reliable cash flow, debt financing allows you to make regular payments while retaining full ownership.

Amount of money needed. Smaller funding needs (under $250,000) often align better with debt, while larger capital raises typically require equity investment.

Control preferences. If maintaining complete decision-making authority is critical, debt financing preserves your autonomy in day-to-day business operations.

Exit strategy. Businesses planning for acquisition or IPO often benefit from strategic equity partners who can help position the company for these events.

Risk tolerance. Debt creates financial obligations regardless of business performance, while equity investors share both the risks and rewards.

Many small business owners start with bootstrapping and debt financing for working capital needs, then strategically add equity partners when ready to scale significantly. This hybrid approach balances the benefits of both financing types while minimizing their respective drawbacks.

Equity financing typically makes more sense initially for startups with innovative but unproven business models. Once these companies establish consistent revenue streams, they can incorporate debt into their capital structure to fund specific growth initiatives without further ownership dilution.

Real-World Examples of Debt vs. Equity Financing

Let's look at how different businesses choose their financing approach based on their unique needs and goals. These hypothetical scenarios illustrate how the right funding decision can support business growth while aligning with owner preferences.

Local Bakery Expansion: Debt Financing Success

When Main Street Bakery needed $75,000 to open a second location, owner Maria chose debt financing through a small business loan from her local bank. With five years of consistent profits and excellent credit, she qualified for competitive interest rates.

Maria preferred bank loans because she wanted to maintain 100% ownership of her business. The predictable monthly payments fit well with her cash flow projections, and the interest was tax-deductible. She used the funding to lease a new space, purchase equipment, and hire additional staff.

The outcome was successful because Maria's steady revenue could support the loan payments. Within three years, both locations were profitable enough that she paid off the loan ahead of schedule and began planning for a third location.

Tech Startup Growth: Equity Financing Strategy

Contrast this with CloudSync, a software startup developing an innovative data management platform. The founders needed $2 million to hire engineers, finish product development, and launch their marketing campaign — far more than they could qualify for through traditional debt financing.

After considering their options, CloudSync pursued venture capital. Their fundraising efforts attracted several interested investors, and they eventually closed a deal with a venture capital firm specializing in B2B software. In exchange for 25% ownership, they received the full $2 million plus invaluable industry connections and strategic guidance.

While the founders gave up some decision-making authority and future profits, the equity investment allowed them to scale rapidly without the pressure of immediate loan repayments. Within 18 months, their customer base grew tenfold, positioning them for a successful Series B round at a much higher valuation.

Retail Chain Hybrid Approach: Combining Financing Types

Fashion Forward, a growing clothing retailer with five locations, took a hybrid approach to finance their expansion to 12 stores. They secured $500,000 through a combination of angel investors (giving up 15% equity) and a $300,000 merchant cash advance for immediate inventory needs.

This strategic approach gave them access to both capital and industry expertise from their investors, while the flexibility of the merchant cash advance (which adjusts payments based on daily sales) helped manage short-term cash flow. The funding mix allowed them to expand more aggressively than debt alone would permit, while retaining more control than a pure equity strategy.

Choose the Best Funding Option

The right financing choice depends on your specific business circumstances, growth trajectory, and personal priorities as a business owner. Both debt and equity financing offer their own advantages that can support your company's financial health when applied strategically.

When deciding between the two, consider your business stage, growth timeline, capital needs, exit strategy, and personal risk tolerance. Many successful entrepreneurs use a combination of both approaches at different growth phases to optimize their capital structure while maintaining appropriate control.

If debt financing aligns with your business needs, Clarify Capital offers several loan products designed to support your specific business growth requirements. Apply today!

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts