Overview

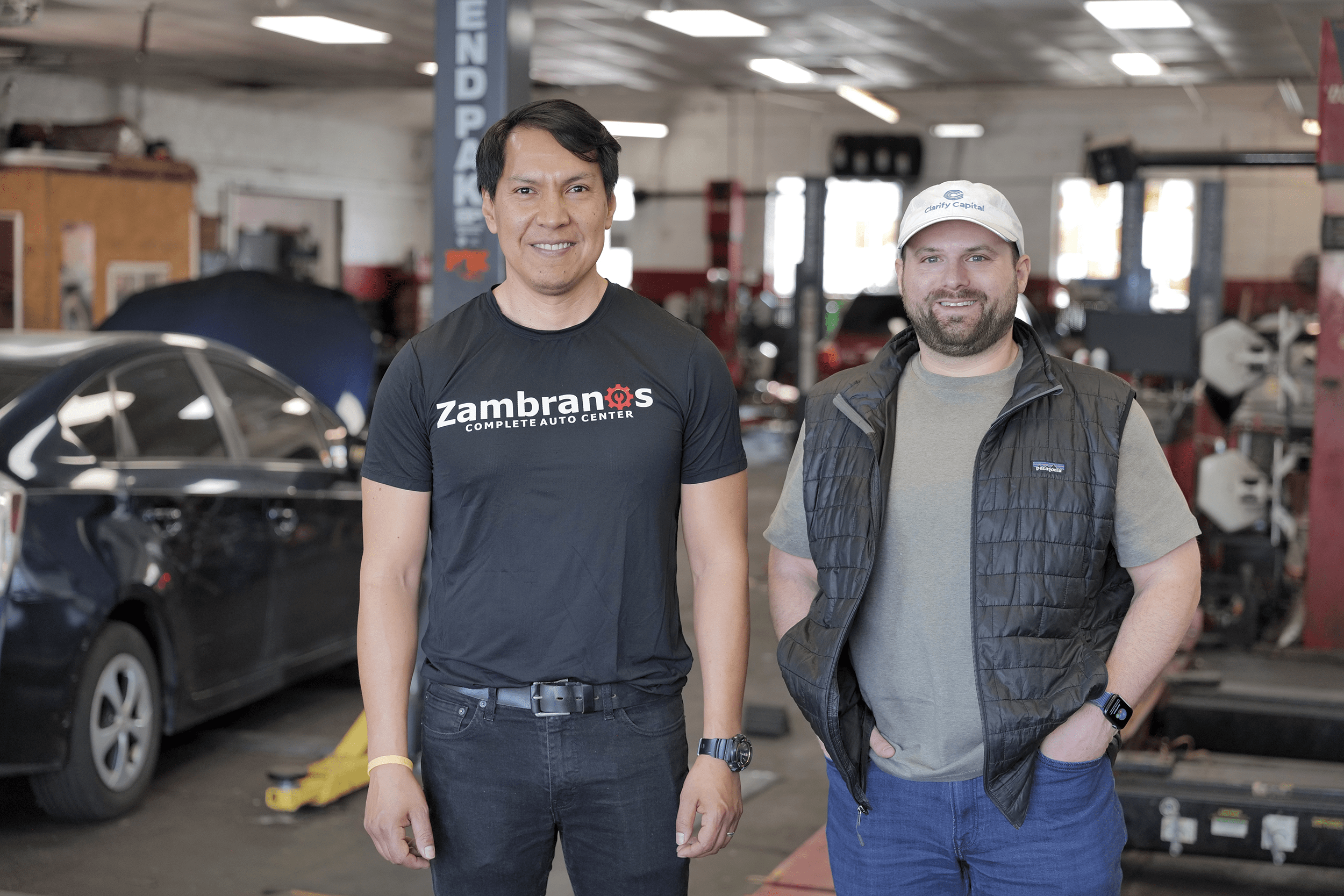

Zambranos Complete Auto Center, a family-owned business in Trenton, New Jersey, turned to Clarify Capital for fast, flexible funding to support critical expansion plans. Through a trusted lending partnership, they acquired real estate for a new location, purchased new equipment, and laid the groundwork for multi-location growth, without the delays of traditional banks.

Background: A Family Legacy Rooted in Service

Founded in 1997 by U.S. Navy veteran Franklin Zambrano and his family, Zambranos Auto Repair started in Brooklyn, New York, as a specialized repair shop for taxi drivers. After two decades of steady business growth, the family relocated to Trenton, New Jersey, to scale operations and serve a broader customer base.

The move allowed them to transition from a high-volume city shop to a full-service auto repair business focused on quality service and community relationships. Like many established businesses, they needed capital to match their ambition.

The Challenge: Funding Time-Sensitive Expansion Plans

Running a small business in the auto repair industry requires agility. Opportunities to purchase equipment or expand shop space don't wait for slow approvals or long underwriting processes.

In 2022, Zambranos faced two major growth opportunities:

Purchase the commercial real estate next door to expand their footprint

Buy a second alignment machine and other high-value equipment to increase service capacity

But like many small business owners, Franklin ran into obstacles with traditional banks. The underwriting process was slow, the paperwork burdensome, and the funding timeline incompatible with their needs. Zambranos needed access to capital that was fast, flexible, and built around the needs of real small business owners.

"Trying to get a loan from the bank is like pulling teeth"

—Franklin Zambrano

The Solution: Fast, Tailored Business Financing From Clarify Capital

Franklin discovered Clarify Capital through a Facebook ad. Within hours, he was connected with a dedicated lending advisor who understood his business goals and urgency.

Clarify helped him secure working capital fast, without the delays, excessive documentation, or red tape typical of bank loans. Over time, Clarify became a long-term partner, helping Zambranos secure multiple rounds of funding designed for:

Facility expansion financing and real estate purchases

New equipment financing to improve operations

Cash flow support to stay competitive and flexible

Building business credit and improving credit score for future funding and financing options

Watch how Zambranos Auto Repair used Clarify's business expansion loans to unlock growth and invest in their future:

Today, Franklin works directly with his Clarify rep, Adam Galperin, who offers real-time support and custom loan options tailored to the shop's evolving business needs.

Loan Details

Here's a breakdown of the funding that helped drive Zambranos expansion:

Type of loan. Working capital and equipment financing tailored for business expansion.

Loan amount. Approximately $100,000 funded across two rounds.

Use of funds. Commercial real estate purchase, new equipment, and operational upgrades.

Repayment terms. Flexible short-term repayment structure under 18 months.

Ease of applying. The application process is simple and easy to complete.

Approval speed. Funds deposited within 48 hours of application.

Support. Direct access to a Clarify advisor throughout the process.

This setup gave Franklin the confidence and agility to pursue growth opportunities without draining reserves or relying on high-interest credit cards.

Results: Expanding the Business, Customer Base, and Future Potential

Thanks to access to capital through Clarify, Zambranos Auto Repair has:

Doubled their space by acquiring the neighboring property

Boosted service output with advanced equipment

Laid the groundwork for additional locations

Built a credit history with a lender that understands small business needs

What started as a single location in Brooklyn is now a thriving New Jersey operation with its sights set on a second and even third shop. With Clarify in their corner, the Zambranos team knows they have a reliable partner who understands the realities of running and scaling a small business.

Why It Worked: Key Takeaways for Other Business Owners

Speed matters. Clarify provided same-day responses and credit approvals to support urgent timelines and purchasing decisions.

Human support counts. A dedicated rep ensured Franklin had a trusted advisor, not just a lender.

Tailored funding. Each round of capital was aligned to a specific business goal, from equipment to real estate.

Long-term vision. Clarify's flexible working capital allowed the business to grow at its own pace without overextending.

Final Thoughts: Smart Financing Can Power Real Growth

Zambranos Complete Auto Center is proof that the right financing partner can change the trajectory of a business. Clarify Capital is proud to support small business owners like Franklin — entrepreneurs who are building generational businesses, creating local jobs, and strengthening their communities.

Whether it's expanding locations, purchasing new equipment, or just smoothing out cash flow, Clarify Capital helps small business owners seize opportunities when they matter most.

Looking for flexible, fast small business financing? Apply now or speak with one of our funding specialists to learn how Clarify can support your next big move with competitive rates.

FAQs for Business Expansion Loans

Here are some frequently asked questions about business expansion loans:

What Are Business Expansion Loans?

These small business loans offer owners funding upfront for things like new equipment, new products, commercial real estate, or entering a new market.

What Are the Eligibility Requirements?

Typically, businesses need at least $10K per month in revenue, a 500+ credit score, and 6+ months in operation.

Can I Use the Funds for Equipment and Real Estate?

Yes. Clarify matches loan types to specific business needs, including property purchases and specialty equipment.

How Fast Can I Get Approved?

Many borrowers receive funds in a lump sum in 24 to 48 hours after applying.

What's the Repayment Process Like?

Clarify offers flexible repayment terms based on your cash flow and loan amount, including monthly payments.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts