Building and growing a medical practice is no small feat. From purchasing equipment to leasing office space, medical professionals face numerous financial demands.

Whether you're a physician, dentist, or veterinarian, understanding the right financing options can make a big difference in managing operational costs and expanding your practice. Let’s explore how physician practice loans and other business financing options can help.

What Are Physician Practice Loans?

Physician practice loans are financing solutions designed specifically for healthcare professionals. These loans cover a wide range of financial needs, from startup costs to operational expenses and everything in between. Whether you’re starting a new practice or managing an existing one, they provide the funding flexibility medical professionals need to succeed.

Medical practice loans can help with the following:

Purchasing equipment. From diagnostic machines to office furniture, equipment financing or leasing can make acquiring costly items easier.

Managing cash flow. Cover day-to-day operational costs or bridge gaps during slower months.

Real estate investments. Buy, lease, or renovate office space to expand your practice.

Debt refinancing. Consolidate high-interest loans or improve repayment terms to reduce financial strain.

By offering tailored funding options, these loans enable healthcare professionals to focus on patient care rather than financial stress.

Why Medical Professionals Need Financing

Running a medical practice comes with significant financial responsibilities. In addition to providing excellent care, healthcare professionals must manage costs like staff salaries, medical supplies, and operating expenses. Financing helps bridge gaps and cover large expenditures without depleting cash reserves. Common reasons for seeking financing include:

Launching a new practice. Startups require significant upfront investments in medical equipment, office space, and marketing.

Upgrading or purchasing equipment. Advanced technology is expensive but necessary to stay competitive.

Expanding operations. Growing your patient base means hiring more staff, leasing larger office space, or purchasing commercial real estate.

Handling emergencies. From unexpected repairs to delayed insurance reimbursements, having access to funds ensures smooth operations.

Understanding your practice's financial needs is the first step in choosing the right type of loan.

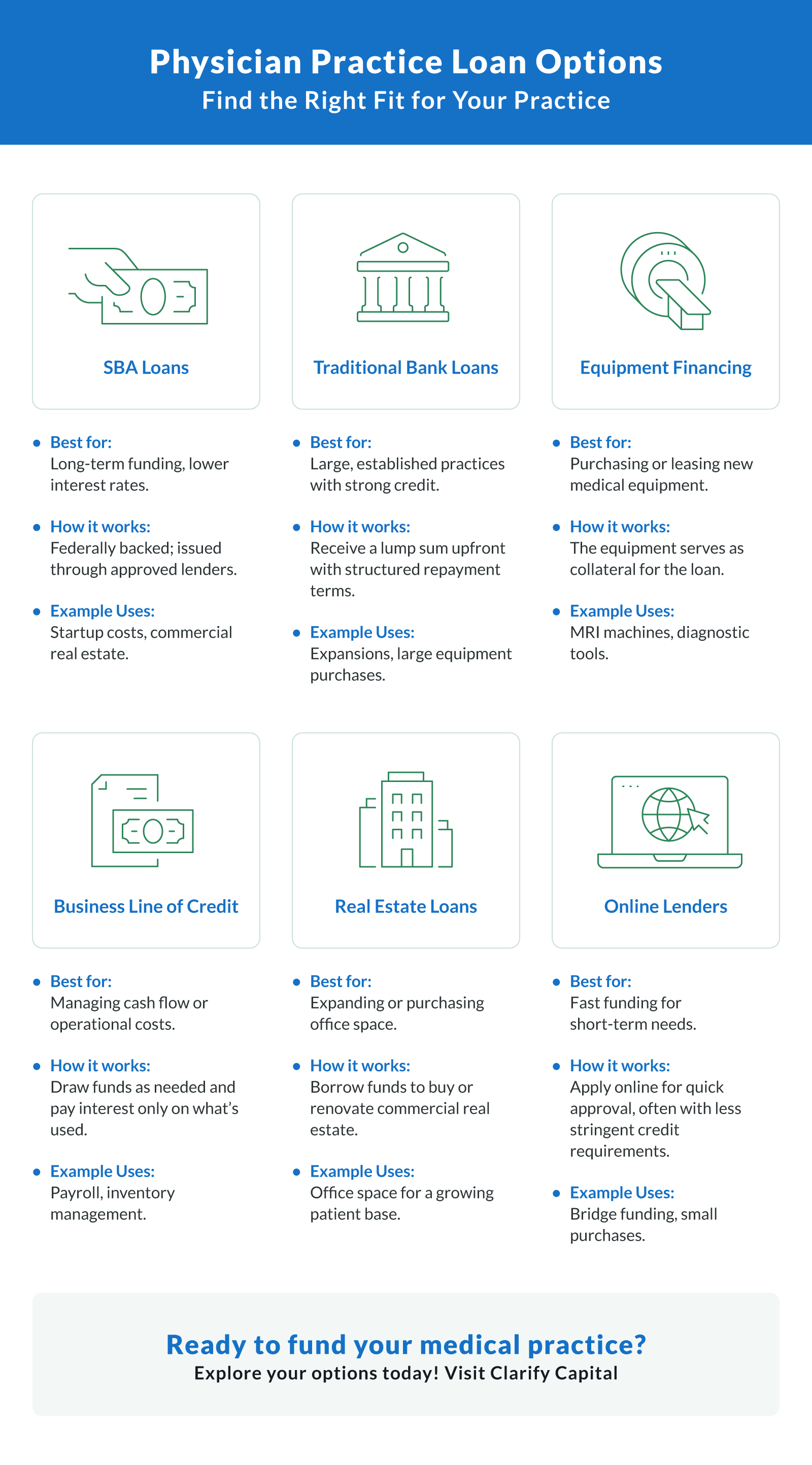

Types of Financing Options for Medical Practices

Healthcare professionals have access to a variety of financing options. Here’s a breakdown of common loan types, how they work, and their pros and cons.

Traditional Bank Loans

Traditional banks and credit unions offer loans for established practices with strong financials.

How it works. You receive a lump sum that is repaid over time with interest.

Best for. Borrowers with strong credit, an existing practice, and detailed financial statements

Pros:

- Lower interest rates compared to other options

- Flexible loan amounts for large purchases like commercial real estate

Cons:

- Lengthy application process and strict eligibility requirements

- Requires extensive documentation, such as tax returns and financial statements

SBA Loans

The Small Business Administration (SBA) offers popular loan programs, such as the SBA 7(a) loan, which caters to small business owners.

How it works. SBA loans are backed by the federal government and issued through approved lenders, reducing risk for banks and credit unions.

Best for. Medical professionals looking for lower interest rates and longer repayment terms

Pros:

- Low down payments and competitive interest rates

- Long repayment terms, making monthly payments manageable

Cons:

- Extensive paperwork and a time-consuming application process

- Requires strong credit and detailed financial projections

Equipment Financing

This type of loan is designed to help medical professionals purchase or lease new equipment.

How it works. The equipment itself serves as collateral, and you pay off the loan over time.

Best for. Practices needing specific medical equipment without large upfront payments

Pros:

- Easy approval process since the equipment secures the loan

- Frees up working capital for other needs

Cons:

- Limited to equipment purchases

- Higher interest rates for borrowers with weaker credit

Business Line of Credit

A business line of credit gives you flexible access to funds as needed, up to a set limit.

How it works. Similar to a credit card, you can withdraw funds as needed and only pay interest on what you use.

Best for. Managing cash flow or covering short-term operational expenses

Pros:

- Flexible and reusable as long as you stay within the credit limit

- Helps with unexpected expenses or gaps in cash flow

Cons:

- Higher interest rates than traditional loans

- Requires a strong credit score to secure the best rates

Real Estate Loans

Real estate loans help with purchasing or renovating office space.

How it works. Borrowers receive funds to buy or improve commercial properties for their practice.

Best for. Medical professionals expanding their practice by acquiring or upgrading office space

Pros:

- Ideal for long-term investments in real estate

- Often comes with tax benefits

Cons:

- Requires significant upfront costs, including down payments

- Lengthy approval and underwriting process

Fast Business Loans From Online Lenders

For practices needing quick access to cash, online lenders offer fast funding.

How it works. Applications are submitted online, with funds disbursed quickly after approval.

Best for. Borrowers who need immediate working capital or who may not qualify for traditional bank loans

Pros:

- Fast and convenient application process

- Lower credit requirements compared to traditional banks

Cons:

- Higher interest rates

- Shorter repayment terms, which can strain cash flow

Key Factors Lenders Evaluate

When applying for medical practice loans, lenders look closely at your financial health to determine your eligibility.

Lender Considerations:

Credit score. A strong credit score demonstrates your ability to manage debt responsibly.

Financial statements. Lenders review bank statements, tax returns, and profit-and-loss statements to assess financial health.

Business plan. A clear plan outlining how funds will be used and repaid strengthens your application.

Cash flow. Practices with stable cash flow and manageable existing debt are more likely to qualify.

How to Prepare for the Loan Application Process

To improve your chances of approval, take these steps before submitting your loan application:

Check your credit score. Address any issues to improve your creditworthiness.

Organize financial documents. Gather tax returns, financial statements, and bank statements in advance.

Build a solid business plan. Highlight your practice’s financial goals and repayment strategy.

Research lenders. Compare options from traditional lenders, online lenders, and credit unions to find the best fit.

Alternative Financing Options

If traditional loans aren’t a good fit, consider alternative funding options.

Leasing. Equipment leasing is a cost-effective alternative to purchasing new equipment.

Credit cards. Use for small, short-term expenses, but avoid carrying a balance due to high interest rates.

Refinancing. Consolidate existing debt for lower interest rates or better repayment terms.

Grants. Some programs offer funding for medical professionals to support specific initiatives.

Unlock Growth for Your Medical Practice

Finding the right financing option can be a game-changer for your medical practice. From SBA loans to equipment financing, there’s a solution tailored to your needs.

Ready to take the next step? Visit Clarify Capital to explore funding options and grow your practice today.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts