Top-line revenue is total sales; bottom-line is net profit after expenses. These two numbers, often found at the top and bottom of your income statement, represent how much money your business brings in and how much you keep after covering all costs.

Understanding the difference between top-line and bottom-line performance is essential for small business owners. While revenue shows your company's ability to generate income, profit reveals whether your operations are financially sustainable. Knowing how each metric works helps you track business growth, optimize efficiency, and qualify for financing.

In this guide, we'll compare top-line and bottom-line metrics side by side, explore strategies to grow both, and explain how lenders view each when evaluating your loan application.

What Is Top-Line Revenue?

Top-line revenue refers to your company's total sales or gross revenue before any deductions. It appears at the very top of your financial statements, specifically the income statement, and represents all income generated from selling products or services during a specific period.

This number reflects your ability to drive top-line growth through your primary revenue streams. Whether from product sales, service fees, or subscription income, total revenue shows how much business you're generating, regardless of costs.

While a high top line can signal strong market demand or effective marketing, it doesn't tell the full story of your financial health. To understand your company's profitability, you also need to look at your bottom line; what's left after all expenses.

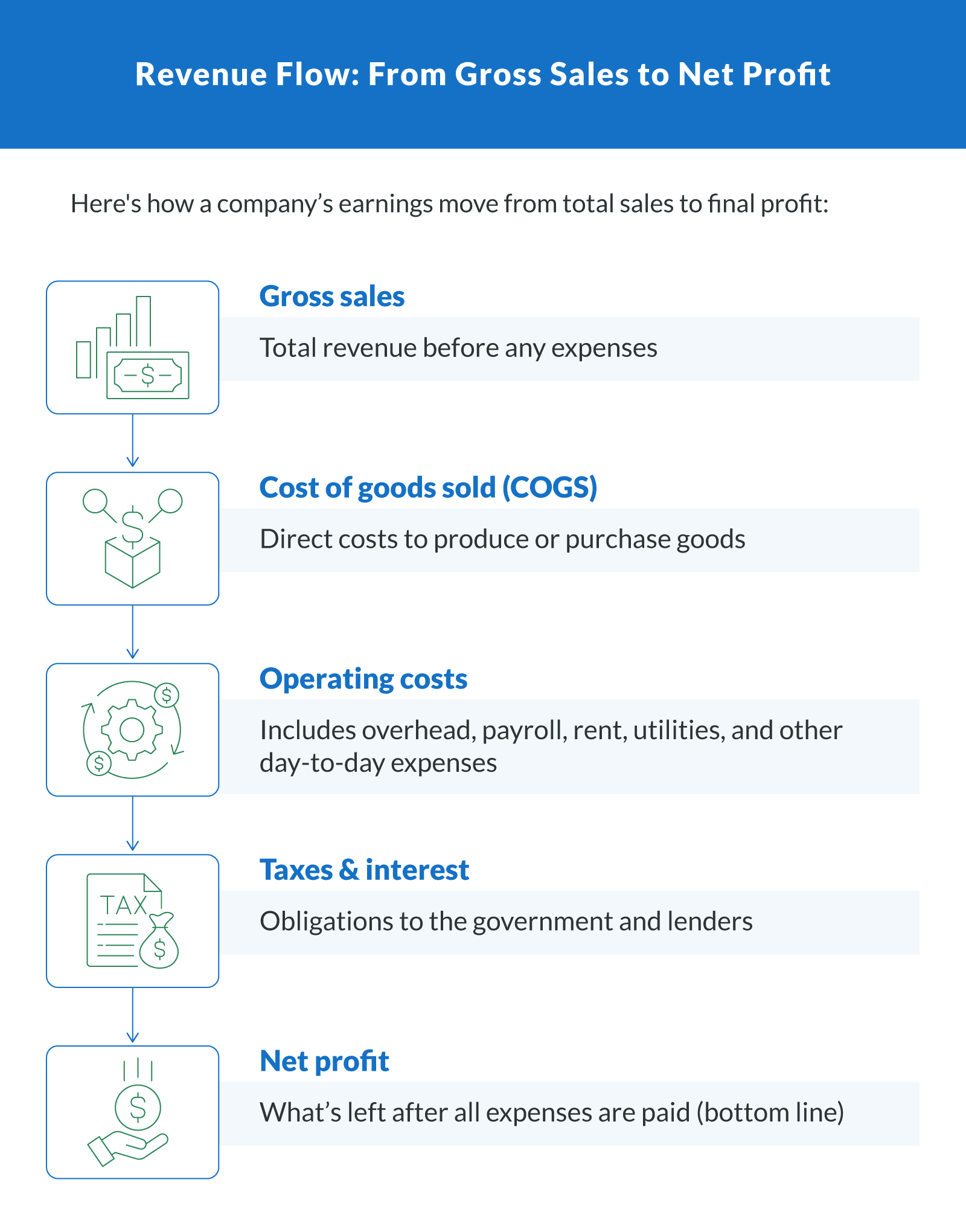

What Is Bottom-Line Profit?

Bottom-line profit, also known as net income or net profit, is the amount your business keeps after subtracting all expenses, including operating costs, taxes, interest, depreciation, and amortization, from your total revenue. It's the last line on your income statement, which is why it's referred to as the “bottom line.”

This figure reflects your company's financial efficiency. While top-line revenue shows your sales performance, bottom-line revenue shows whether those sales actually translate into profit.

Key expenses that reduce your company's net income include:

Cost of goods sold (COGS)

Salaries, rent, and utilities

Loan interest

Taxes

Non-cash expenses like depreciation and amortization

One way to assess your profit strength is through net profit margin, which is calculated as net income divided by total revenue. In 2024–2025, net profit margins for small businesses average:

Service businesses: 10%–20%

Retail businesses: 2%–6%

Manufacturing: 5%–10%

Another useful metric is EBITDA (earnings before interest, taxes, depreciation, and amortization), which offers a clearer view of operational performance by stripping out non-operating and non-cash expenses.

Even with strong sales, high costs, or inefficient operations can shrink your bottom line. That's why lenders and investors look closely at net profit when evaluating your business's long-term viability.

Top-Line vs. Bottom-Line: Key Differences at a Glance

To fully understand your company's financial performance, it helps to see how top-line and bottom-line metrics compare side by side. Both appear on your income statement, but they serve very different purposes in assessing your company's financial health.

Use this table to quickly compare what each metric reveals and how it can guide smarter business decisions:

| Metric | What It Measures | Appears Where (Income Statement) | Why It Matters | Ideal Business Use Case |

|---|---|---|---|---|

| Top-Line Revenue | Total gross revenue or total sales before any expenses | Top of income statement | Shows sales performance and growth potential | Tracking demand, pricing impact, and new customer acquisition |

| Bottom-Line Profit | Net income after all costs, taxes, and deductions | Bottom of income statement | Reflects company's profitability and operational efficiency | Measuring profitability, qualifying for loans, investor reporting |

How Top-Line vs. Bottom-Line Affects Loan Qualification

When you apply for funding, lenders look at different financial metrics depending on the type of loan. Both your top-line revenue and bottom-line profit play a role in how lenders assess your business's ability to repay, just in different ways.

Term Loans = Focus on Net Income

For fixed-term loans, lenders pay close attention to your bottom-line performance, specifically, your net income and profit margins. They want to know if you can comfortably manage monthly payments after covering all operating expenses. A strong bottom line signals healthy cash flow and makes you more attractive for long-term financing.

Lines of Credit = Focus on Revenue Consistency

With business lines of credit, lenders often prioritize top-line revenue consistency over high profitability. They look at monthly or quarterly revenue trends to determine whether your business generates steady income. If your revenue growth is stable, even if profits are tight, you may still qualify for a revolving credit line to manage short-term needs or unexpected costs.

Why It Matters for Loan Qualification

Understanding how each figure impacts loan qualification helps you prepare better financials and set realistic expectations. Whether you're applying for funding through a traditional lender, online marketplace, or alternative provider, showing strong performance in either area increases your odds of approval.

Smart financial planning often includes improving both revenue and profit metrics to strengthen your lender profile. This might include writing a business plan or reducing expenses to increase your likelihood of approval.

Real-World Case Study: Profit Over Revenue Pays Off

A local retailer in North Carolina was bringing in $600,000 in annual revenue, but struggled to get approved for a business expansion loan. Their net profit margin hovered around 8%, weighed down by high operating costs and low inventory turnover.

After working with a financial advisor, the business streamlined staffing schedules, renegotiated vendor contracts, and automated inventory reordering. Within 12 months, their profit margin improved to 14% without increasing revenue.

When they reapplied for financing, the improved bottom-line figures made all the difference. Clarify Capital matched them with a lender offering a lower interest rate, longer repayment terms, and a $75,000 loan to fund their second store location.

This example shows that lenders often value net income more than just top-line growth. By improving profitability, the retailer went beyond boosting their margins and unlocked better financing options and long-term growth potential.

Top-Line Growth Strategies

If your goal is to grow gross revenue, focus on growth strategies that boost sales volume or increase average transaction size. These initiatives and tactics help expand your revenue streams and capture more growth potential:

Adjust pricing strategies. Small, strategic price increases can significantly impact top-line revenue without needing more new customers. Just be sure to monitor demand elasticity and competitor pricing.

Expand into new markets. Targeting new regions or customer segments allows you to grow your customer base and increase total gross sales. This is especially effective if your core market is saturated.

Introduce new product lines or services. Diversifying your offerings can attract repeat purchases and unlock entirely new streams of top-line revenue.

Invest in marketing efforts to attract new customers. Digital advertising, referral programs, and partnerships can help you reach new audiences and fuel sales growth.

While these tactics focus on increasing revenue, make sure they align with your long-term goals. Growth for growth's sake can strain resources if your operating costs climb faster than revenue.

Bottom-Line Growth Tactics

Improving your bottom-line profitability often comes down to smarter spending and efficient operations. These tactics focus on boosting net earnings by reducing operating expenses and improving margins:

Cost-cutting. Audit recurring expenses, like subscriptions, vendor contracts, and overhead, and trim what doesn't support revenue. Strong cost management helps you protect cash flow without sacrificing performance.

Automate manual processes. Investing in automation tools, like billing software or CRM systems, can reduce labor costs and free up time for high-value tasks. Many of these upgrades pay for themselves quickly in savings.

Streamline operations for efficiency. Simplifying workflows and eliminating bottlenecks improves output without raising costs. Greater operational efficiency directly improves your profitability.

Even small improvements in expense control can have a big impact on your bottom-line revenue, especially for businesses with slim margins or high fixed costs.

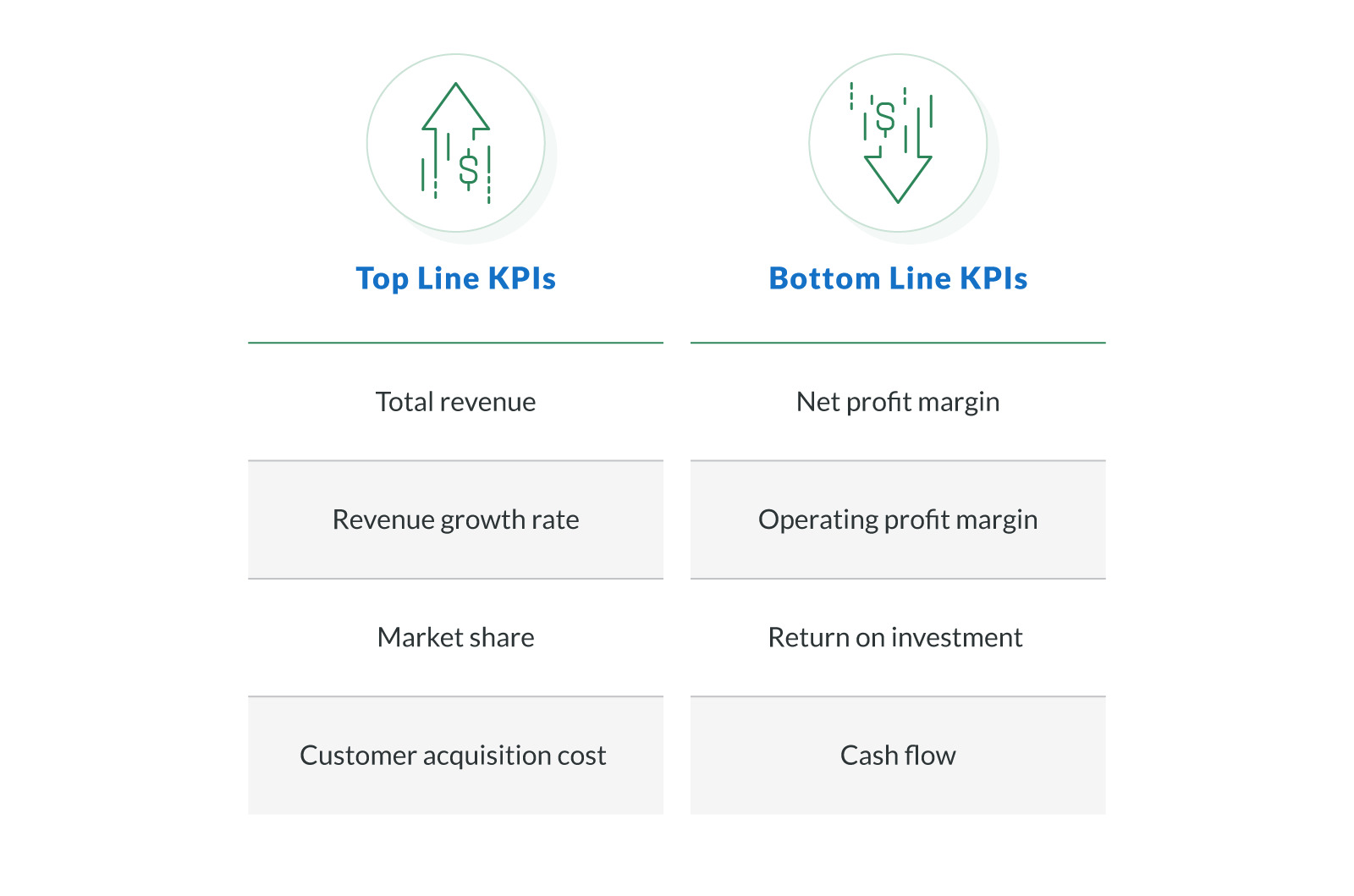

KPIs for Top-Line and Bottom-Line Health

Tracking the right financial metrics gives you a clearer picture of your business's performance over any specific period. Use these KPIs to assess both top-line revenue and bottom-line profitability and make adjustments in real time.

Top-line KPIs to monitor:

Total revenue. Track gross sales monthly and quarterly to spot seasonal patterns and growth trends.

Customer acquisition cost (CAC). Measure how much it costs to gain each new customer, ideally monthly, alongside marketing spend.

Revenue growth rate. Compare monthly or quarterly totals year-over-year to evaluate expansion and financial health.

Market share. Assess semi-annually using industry data to understand your competitive position.

Bottom-line KPIs to watch:

Net profit margin. Calculate monthly by dividing net income by total revenue. Indicates how much of each sales dollar becomes profit.

Return on investment (ROI). Review after any large spend or project—gauges how efficiently capital turns into returns.

Cash flow. Track weekly or monthly to ensure you can meet obligations, even when revenue timing is uneven.

These metrics are key components of your financial statements. Use them to catch red flags early, spot growth opportunities, and guide smart decision-making across all areas of your business.

FAQs: Revenue vs Profit in Business Finance

Understanding how top-line revenue and bottom-line profit influence your company's financial health is essential, especially when seeking funding or planning for growth. These frequently asked questions clarify how these metrics affect operations, loan qualification, and strategic planning.

Does Top-Line Growth Always Mean Better Profits?

Not necessarily. Top-line growth means your total sales or gross revenue is increasing, but it doesn't guarantee higher net profit. If your operating costs, cost of goods sold (COGS), or marketing expenses rise at the same rate or faster, your bottom-line profit could remain flat or even decline. Sustainable growth comes from improving both revenue and profit margins.

Which Ratio Do Lenders Care About More: Revenue or Profit?

It depends on the loan type. For term loans, lenders focus more on your bottom-line metrics, like net income, EBITDA, and cash flow, to assess your ability to make regular payments. For lines of credit or short-term funding, lenders often prioritize top-line revenue consistency to determine creditworthiness. Strong performance in both areas improves your loan eligibility and terms.

How Can I Boost My Bottom Line Quickly?

You can improve your bottom-line revenue by reducing operating expenses, increasing pricing strategically, and streamlining inefficient processes. Even small steps, like automating manual tasks or renegotiating vendor contracts, can quickly enhance your net earnings. Prioritize changes that have an immediate impact but don't compromise long-term growth.

Mastering Both Lines for Smarter Growth

Understanding the difference between your top-line revenue and bottom-line profit gives you a full picture of your business's financial performance. Focusing on just one metric can create blind spots, but tracking both helps you manage growth, improve efficiency, and strengthen your case when applying for funding.

Ready to improve your top line or strengthen your bottom line? Apply with Clarify Capital to get matched with the right funding solution in under 2 minutes—no fees, no obligation.

Apply today for fast, flexible financing tailored to your business goals.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts