As economic conditions tighten and tech adoption accelerates, small business money management is more important than ever in 2025. From inflation and interest rate shifts to evolving lender expectations, today's entrepreneurs face mounting pressure to stay on top of their business's financial health.

This guide offers clear, tactical advice for improving small business finances, reducing risk, and using smart tools to streamline everyday operations. Whether you're managing bookkeeping in-house or scaling with a team, solid financial management sets the foundation for long-term stability and growth. Let's break down the key strategies to help small business owners take control of their numbers and their future.

Why Smart Money Management Matters in 2025

Effective money management is all about staying competitive and resilient in an unpredictable economy. As we head deeper into 2025, small business owners are dealing with tighter margins, stricter lending standards, and more pressure to prove financial stability.

Operating expenses continue to rise, while interest rates remain elevated compared to pre-2020 levels. At the same time, advancements in AI-based accounting software are changing the game, giving small businesses more tools to manage spending, track income, and forecast needs with precision.

Lenders are also expecting more from borrowers. A clear view of cash flow management, strong financial records, and a thoughtful approach to growth are now essential to secure business funding or expand on your own terms.

Bottom line: Smart financial practices aren't just helpful, they're a non-negotiable part of your business's financial health.

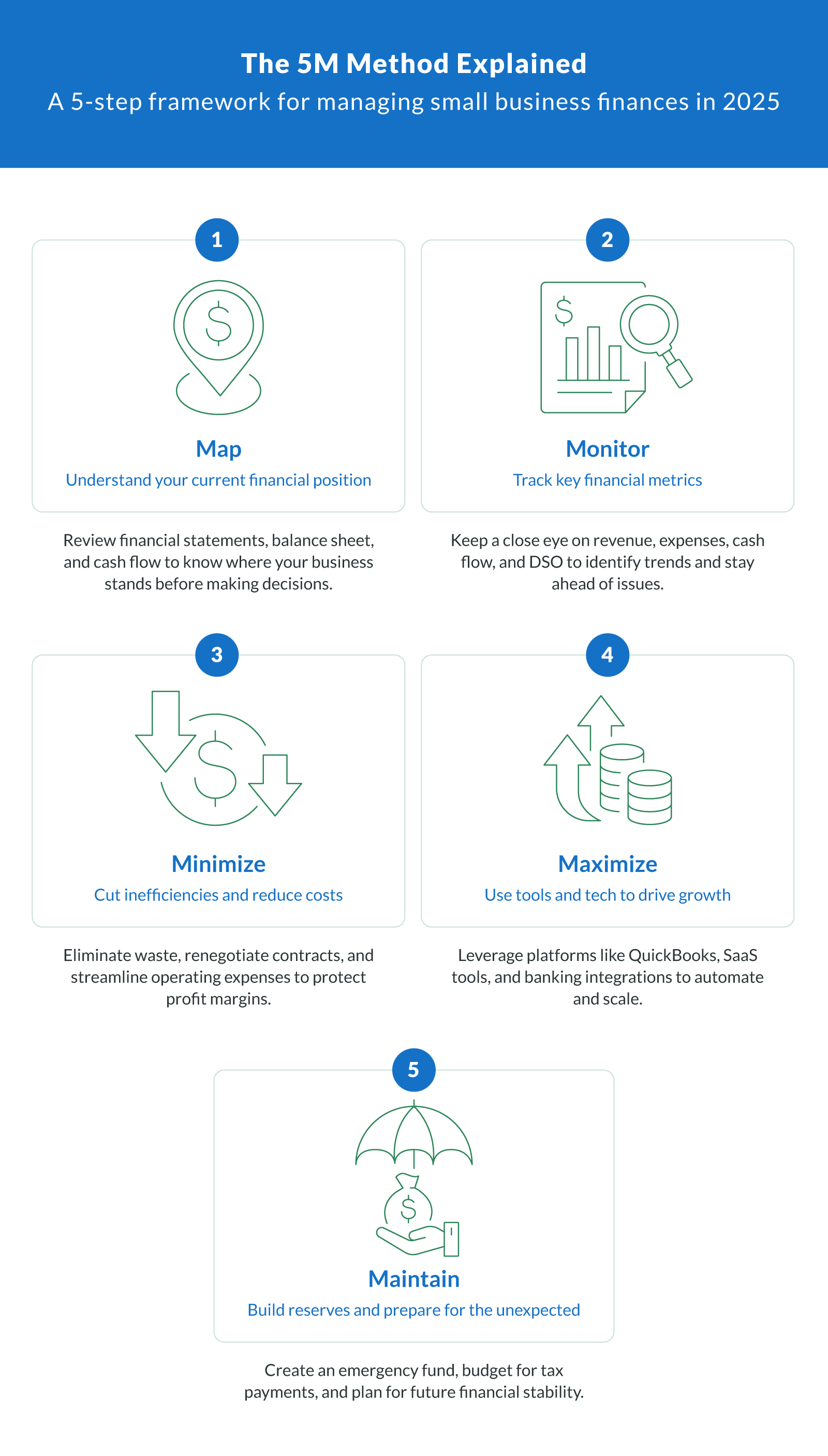

Introducing the 5M Method: A Framework for Financial Success

Every small business needs a clear framework to guide financial decisions and stay resilient in a changing economy. Clarify Capital's 5M Method offers a simple but powerful approach to small business financial management. This five-part system helps you get a handle on your numbers, make smarter choices, and build long-term stability.

Map: Understand Your Current Financial Position

Before you can grow or pivot, you need a full picture of where you stand. Review your financial reports — especially your balance sheet, income statement, and cash flow — to assess assets, liabilities, and liquidity. A clear baseline is essential for making informed financial decisions.

Monitor: Track Key Metrics (Revenue, Cash Flow, DSO)

Healthy businesses keep a close eye on key performance indicators. Track revenue trends, monitor cash flow, and calculate DSO (Days Sales Outstanding) to understand how quickly you're getting paid. Use tracking tools or bookkeeping software to maintain visibility in terms of your financial health.

Minimize: Cut Inefficiencies and Reduce Costs

Identify areas where you're overspending or underutilizing resources. Review fixed costs, cancel unused subscriptions, and renegotiate vendor contracts. Trimming unnecessary business expenses helps protect profit margins and improve day-to-day operations.

Maximize: Leverage Tools and Tech for Profit Growth

Invest in automation and cloud-based financial tools that reduce admin time and support better forecasting. Small business platforms like QuickBooks or AI-driven SaaS tools can integrate with your business bank account and streamline everything from invoicing to payroll.

Maintain: Build Reserves and Plan for Contingencies

Unpredictable events are part of business ownership. Establish an emergency fund, set up a savings account for tax payments or seasonal slowdowns, and prepare for unexpected expenses. Proactive planning supports long-term financial stability and peace of mind.

Budgeting Best Practices for Modern Entrepreneurs

Smart budgeting is a cornerstone of strong financial planning, especially as small businesses navigate tighter margins and faster growth cycles in 2025. Whether you're a startup or scaling toward your next milestone, a flexible, data-driven budget helps control spending, avoid surprises, and prepare for growth.

How to Create a Month-to-Month Budget

Start by identifying fixed and variable costs, including rent, payroll, subscriptions, and inventory. Use a budgeting calendar to plan for recurring bookkeeping tasks and upcoming obligations like tax payments or annual renewals — factor in seasonal shifts in revenue so you're not caught off guard by dips in cash flow. Allocate funds for savings, reinvestment, and marketing, making sure every dollar has a purpose.

Using Budgeting Software Like QuickBooks, Xero, or Zoho

Instead of juggling spreadsheets, many entrepreneurs use business budgeting tools to streamline monthly planning. Platforms like QuickBooks, Xero, and Zoho Books offer built-in automation, real-time syncing with your business checking account, and easy categorization of expenses. These tools make it easier to spot trends, cut waste, and stay on track with your financial goals, all without spending hours manually reconciling numbers.

By upgrading your approach to budgeting, you're not just managing costs — you're building a flexible system that supports decision-making, improves visibility, and drives long-term performance.

Mastering Cash Flow in a Fluctuating Economy

Strong cash flow is the backbone of a healthy business. In today's shifting economy, being able to manage small business cash flow effectively can mean the difference between staying afloat and scaling up. Business owners must focus on both accelerating incoming payments and optimizing outgoing expenses to keep the business's finances stable.

Solving Late Payments and Understanding DSO

One of the biggest challenges is getting paid on time. To address this, start by calculating your DSO (Days Sales Outstanding) — a key metric that shows how long it takes, on average, to collect customer payments.

DSO = (Accounts Receivable ÷ Total Credit Sales) × Number of Days

A high DSO means slower payments, which can choke cash flow. Tighten payment terms, send automated reminders, and offer incentives for early payments to improve liquidity.

Forecasting Cash Flow with SaaS Tools

Use digital tools to gain visibility into both short-term needs and long-term trends. Cloud platforms like Float, Pulse, or QuickBooks Cash Flow Planner help forecast cash position based on real-time financial statements, sales trends, and expense schedules. With clear cash flow statements and projections, entrepreneurs can time payables more strategically and avoid sudden shortfalls.

Improving cash flow management is more than just a finance task; it's a critical strategy for protecting your margins and funding your next phase of growth.

Debt Reduction and Emergency Fund Tactics

Balancing debt repayment with the need for operational flexibility is a common challenge for small business owners, especially in a market where costs are rising and liquidity is critical. Smart financial decisions around debt and reserves can strengthen your foundation and prevent cash crunches.

How to Prioritize Debt in Tight Margin Scenarios

Start by reviewing all outstanding liabilities, including credit cards, lines of credit, and vendor terms. Focus first on high-interest debt, which can erode profit margins quickly. Use a tiered approach:

Step 1: List all debts by interest rate and minimum payment.

Step 2: Pay more than the minimum on high-interest balances while staying current on the rest.

Step 3: Reinvest freed-up funds into growth or reserve building.

This strategy keeps your business expenses manageable while preserving flexibility for essential operations.

How Much Should You Set Aside in 2025?

Emergency fund planning is more important than ever. A general rule of thumb is to keep 3–6 months' worth of operating expenses in a separate savings account, adjusted based on your industry's volatility. If you're in a seasonal or high-risk space, aim for the higher end of that range.

Setting aside funds may feel difficult when margins are thin, but even small monthly contributions add up. Having reserves in place gives you the confidence to make strategic moves and absorb unexpected shocks without taking on new debt.

Tax Planning and Regulatory Readiness in 2025

Staying ahead of tax payments and compliance requirements isn't just about avoiding audits. It's essential for maintaining strong financial health and keeping your business running smoothly. In 2025, evolving tax laws and heightened scrutiny make proactive financial planning more important than ever.

Latest Tax Law Changes for Small Businesses

The IRS and state agencies have rolled out new regulations aimed at digital payment reporting, deduction limits, and payroll compliance. For example, recent changes to 1099-K thresholds now require platforms like Venmo or PayPal to report lower transaction totals, which could impact startups or small service-based businesses.

Visit IRS.gov and SBA.gov for the latest updates.

Working with CPAs or Using Tax Software

If your finances are complex, working with a CPA can save time and reduce costly errors, especially when preparing a loss statement, maximizing deductions, or planning for business structure changes.

For leaner operations or seasonal businesses, accounting software like QuickBooks Tax or TurboTax Business offers automation, filing support, and integrations with your existing tools. Many platforms now sync with business bank accounts, helping ensure accuracy in your business taxes and cash flow tracking.

Whether you work with a pro or manage your filings digitally, building tax readiness into your annual strategy protects your business and frees you up to focus on growth.

Real-Life Success Stories: How Two Small Business Owners Recovered Financially

Here are two compelling case studies of small business owners who overcame significant financial challenges through strategic planning, resilience, and the right tools. These recent examples demonstrate how entrepreneurs can recover from financial setbacks and build thriving businesses.

Case Study 1: Jerry Suhrstedt - From Bankruptcy to $12 Million Home Building Empire

When Jerry Suhrstedt launched his first home-building company, sales took off, but operational missteps quickly led to disaster. A key employee's failure to order materials caused construction delays, and lenders pulled funding, leaving dozens of custom homes unfinished. Revenue dropped 90%, subcontractors went unpaid, and Jerry was forced to file for bankruptcy.

The financial devastation was severe and very real: customers faced thousands of dollars in property liens, including over $30,000 in liens on a home belonging to a mayor who was also a prosecuting attorney. Revenue dropped by 90%, forcing Suhrstedt to lay off all employees and ultimately file for Chapter 13 bankruptcy.

The Strategic Recovery

Rather than abandoning the industry, Suhrstedt applied hard-learned lessons to launch Stanbrooke Custom Homes with a comprehensive turnaround strategy. He recognized his blind spot in financial and administrative operations and recruited a business partner who was a former CPA with expertise in numbers and day-to-day operations.

Key Recovery Strategies:

Strategic Partnership: Partnered with a financial expert to handle operations while focusing on marketing and sales

Financial Controls: Implemented robust financial tracking and profit margin monitoring

Market Focus: Leverage growing market conditions with innovative marketing techniques

Ethical Responsibility: Maintained integrity by eventually paying remaining debts to affected customers

The Results

The turnaround was remarkable. By the end of the first year, Stanbrooke Custom Homes had secured $2 million in signed contracts. The company grew to generate between $600,000 and $700,000 in monthly revenue, reaching over $11 million in revenue by year three. The business was ranked 6th place in Washington State's 100 Fastest Growing Companies by the Puget Sound Business Journal.

Case Study 2: Sweet Pete's Candy - Strategic Relocation and Partnership Success

Sweet Pete's Candy started with passion but struggled with high overhead and poor foot traffic at its original location. Facing mounting financial pressure, the owners made bold moves: relocating to a historic mansion downtown, creating new revenue streams with events and tours, and partnering with an experienced investor.

The Transformation Strategy

The company implemented a comprehensive turnaround approach that addressed each core challenge systematically.

Strategic Initiatives:

Relocation and Expansion: Moved to a historic mansion in downtown Jacksonville, dramatically increasing foot traffic and tourist appeal while creating multiple revenue streams through retail, production, and event spaces.

Strategic Partnership: Formed a partnership with Marcus Lemonis, host of CNBC's "The Profit," who invested $1 million and provided crucial business expertise.

Brand Revitalization: Redesigned visual identity, developed interactive experiences like candy-making classes and factory tours, and enhanced social media presence.

Financial Management: Implemented robust accounting systems, reduced unnecessary costs, and focused on high-margin products and services.

The Recovery Results

Sweet Pete's transformation was comprehensive and successful. The strategic relocation and new revenue streams significantly boosted sales, while national TV exposure solidified the brand's recognition. The combination of streamlined operations and improved financial management resulted in sustainable profitability. The business evolved from a struggling local candy shop into a beloved confectionery brand with national recognition.

Key Success Factors Across Both Cases

Both entrepreneurs demonstrated several critical elements that enabled their financial recovery:

Strategic Planning: Each business owner conducted a thorough analysis of their failures and developed comprehensive recovery strategies

Partnership and Expertise: Both recognized their limitations and brought in partners or investors with complementary skills

Financial Discipline: Implemented robust financial tracking and cost management systems

Market Positioning: Leveraged their strengths while addressing market demands

Resilience and Ethics: Maintained integrity and commitment to stakeholders despite financial pressures

These case studies demonstrate that with the right strategy, partnerships, and commitment to sound financial practices, small business owners can not only recover from significant financial setbacks but also build stronger, more profitable enterprises than before.

Take Control of Your Business Finances in 2025

Strong small business money management is the cornerstone to scaling with confidence and resilience. By using the 5M framework and the right digital tools, entrepreneurs can simplify daily decisions, reduce risk, and build a path to long-term success.

Whether you're optimizing your cash flow, preparing for tax season, or planning your next big move, the foundation lies in understanding your numbers and acting on them with purpose. Your business's financial health shapes every growth opportunity, from cutting costs to qualifying for a small business loan.

Need help putting your financial plan into motion? Clarify Capital connects small business owners with flexible funding options and trusted lenders so that you can act on your goals with confidence.

Ready to move forward? Apply today and explore your best-fit financing strategy for 2025.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts