If you’re a small business owner or entrepreneur, understanding how to get a short-term business loan is essential for your financial toolkit. These loans are designed to address your immediate financial needs. Unlike long-term financing, they typically feature a shorter repayment period, making them a practical choice for quick funding requirements.

One of the key benefits of short-term loans is the speed at which you can access funds. This can be especially helpful when your business needs a rapid cash injection. However, navigating the qualification process requires knowledge of several factors, including your credit score, the lender’s eligibility criteria, and how interest rates and repayment terms will affect your loan.

As you consider your options, you’ll encounter various loan types and lenders, from online platforms to traditional banks and credit unions. Each offers different terms and conditions, which can impact your borrowing experience. Some loans may even have a prepayment penalty, so it’s important to understand all terms before committing.

We’ll walk you through the steps to qualify for a short-term business loan, helping you make an informed decision that aligns with your business’s financial needs and goals.

What Is a Short-Term Business Loan?

A short-term business loan is designed to provide your business with quick access to capital that you repay within a relatively short period.

Unlike long-term loans, which may have repayment schedules extending over several years, some lenders may expect you to repay short-term loans within six months to two years. This shorter repayment period can result in higher monthly payments but often comes with less interest due to the shorter loan duration.

Some types of short-term loans include merchant cash advances (MCAs), where lenders provide a lump sum in exchange for a percentage of future sales, and business lines of credit that offer flexible access to funds up to a certain limit. Other short-term loans you might encounter include invoice factoring and installment loans like personal loans.

Short-term loans also don’t typically don’t require collateral, which can include real estate, personal assets, and business property. So, they can help you address immediate needs like emergencies, bridging cash flow gaps, or taking advantage of time-sensitive business opportunities.

Factors That Affect Loan Qualification

Several key factors can influence your qualification chances when applying for a short-term business loan. Understanding these elements can help you prepare your loan application to maximize your chances of approval.

-

Credit score. Your credit score is a pivotal factor in the loan qualification process. Lenders use this score to assess your creditworthiness. A higher score generally indicates good credit habits and can result in more favorable loan offers, potentially with lower interest rates and better repayment terms. If your score is lower, indicating fair or bad credit, you might face high interest rates or difficulty getting a loan. The good news is that you can get by with a minimum credit score of 500+ through Clarify Capital.

-

Business revenue. Lenders will closely examine your business revenue to gauge your ability to make monthly payments. Consistent and solid revenue streams can demonstrate to lenders that your business has the financial capacity to handle the loan repayment, especially for loans without collateral. For example, with Clarify Capital, your business will need to generate at least $10,000 per month in gross sales or revenue.

-

Time in business. Generally, a business operating successfully for a longer period is considered less risky by lenders. On the other hand, new businesses or startups might face more challenges in loan qualification due to their limited operational history. Specifically, Clarify Capital requires your company to be operational for at least six months.

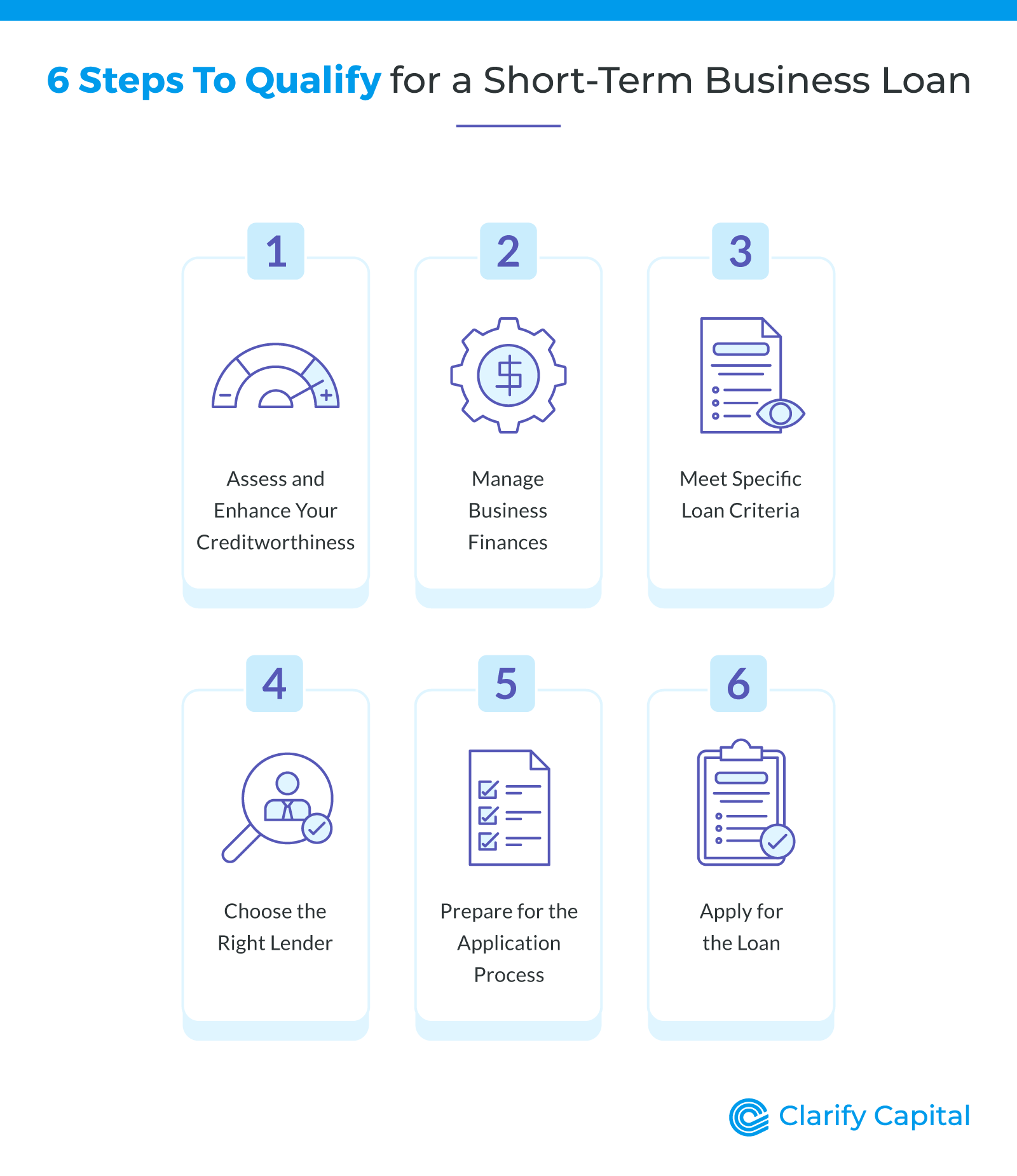

6 Steps To Qualify for a Short-Term Business Loan

Here’s a detailed guide to help you through each stage of the loan application process to help you get a short-term business loan.

1. Assess and Enhance Your Creditworthiness

Before you jump into applying for a short-term business loan, take a good look at your credit history and score. Lenders use to figure out how good you are with money and if you can pay back a loan.

Make it a habit to peek at your credit report from the credit bureaus. This way, you can spot areas where you can do better and match up with what lenders are looking for. To give your credit score a little lift, focus on things like paying your bills on time, chipping away at any debt you have (credit card debts are a biggie), and fixing any mistakes you find in your credit report.

An excellent credit score not only boosts your chances of loan approval but could also lead to more favorable terms like lower annual percentage rates (APRs) and flexible repayment terms. However, don’t stress. Clarify Capital just recommends you have a minimum credit score of 550.

2. Manage Business Finances

When going for a short-term business loan, lenders look at how healthy your business’s finances are. They’re interested in how much money you’re making and how well you’re managing your cash flow.

You want to show them that your business is doing well with a steady income and that you have a good grip on managing your cash. This gives them confidence that you’ll be able to handle the monthly payments.

Work on boosting your sales and keep an eye on your expenses so they don’t get out of hand. Try to keep a comfortable amount of money in your checking and savings accounts too. Showing that you’re on top of your financial game, with strong bank statements to prove it, can improve your chances of getting a wider range of loans, like emergency loans.

Specifically, most lending companies expect your business to generate at least $10,000 a month to qualify for short-term loans.

3. Meet Specific Loan Criteria

Different lenders and loan types have varying eligibility criteria. So, make sure your business meets these requirements.

For instance, some lenders might have specific credit score requirements or prefer businesses in certain sectors. Carefully review these criteria for each lender to find the best fit for your business needs.

4. Choose the Right Lender

Picking the right lender is the next step. Consider various financial institutions, including online lenders, credit unions, and traditional banks. Compare their loan offers, interest rates, fees, repayment terms, and customer service reputations.

For instance, Clarify Capital provides flexible loan options and caters to a wide range of business needs, making it a viable option for many entrepreneurs.

5. Prepare for the Application Process

Be prepared with all the necessary documentation for your loan application. This includes:

- Proof of identity like a Social Security number (SSN)

- A comprehensive business plan

- Detailed financial statements

- Recent pay stubs

- Proof of direct deposit

Organizing these documents beforehand can make the application process go faster and increase your chances of a smooth loan approval experience.

6. Apply for the Loan

When applying for the loan, make sure all the information you provide is accurate and complete. Pay close attention to the loan amount, repayment terms, due date, and any disclosures or origination fees involved.

What To Consider After Applying

After submitting your application for a short-term business loan, you’ll want to plan for what comes next.

-

Awaiting loan approval. Once your application is submitted, the waiting period begins. Most short-term loan providers, especially online lenders like Clarify Capital, tend to have quick turnaround times, often providing instant approval. During this time, keep your financial documents organized and easily accessible, as the lender may request additional information.

-

Post-approval steps. If your loan application is accepted, the next step is understanding the disbursement process. Funds from short-term loans are typically deposited directly into your bank account, sometimes as soon as the next business day. Remember to verify the loan amount and ensure the loan funds were deposited correctly.

-

Loan repayment strategies. Effective loan repayment is key to maintaining good credit and financial health. Plan your budget to accommodate the monthly payment schedule, keeping track of the due date to avoid late fees. Consider setting up automatic payments from your checking account to ensure timely payments.

-

Refinancing options. If you find the terms of your current loan becoming challenging or if you identify a more favorable loan option later, you might consider refinancing. This involves taking a new loan, often with better terms or lower interest rates, to pay off the existing one. Refinancing can help you reduce monthly payments, extend the loan duration, or consolidate multiple debts for easier management.

Get a Short-Term Business Loan With Clarify Capital

At Clarify Capital, we understand the unique challenges and needs of small business owners like you. That’s why we’ve made getting short-term business loans straightforward and user-friendly.

We offer a range of loan options with flexible terms tailored to your business’s specific financial situation. Whether you need a merchant cash advance, a line of credit, or another type of short-term financing, our goal is to provide the right solution for you.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts