Scaling a business starts with hiring — but bringing on a new hire without a clear view of total employment costs can create more problems than it solves. Many business owners underestimate the full cost of employment, focusing only on salary and missing hidden expenses like taxes, benefits, onboarding, and overhead. These oversights can lead to cash flow issues, delayed growth, or even layoffs.

This article breaks down what goes into the true cost of hiring and why understanding it is essential to scaling smart. You'll also get access to an interactive employee cost calculator that simplifies this process by helping you project expenses and assess whether your next hire is financially sustainable. Whether you're planning your first hire or expanding a growing team, this tool helps ensure every decision is grounded in cost-effective planning and long-term stability.

Understanding the Total Cost of Hiring an Employee

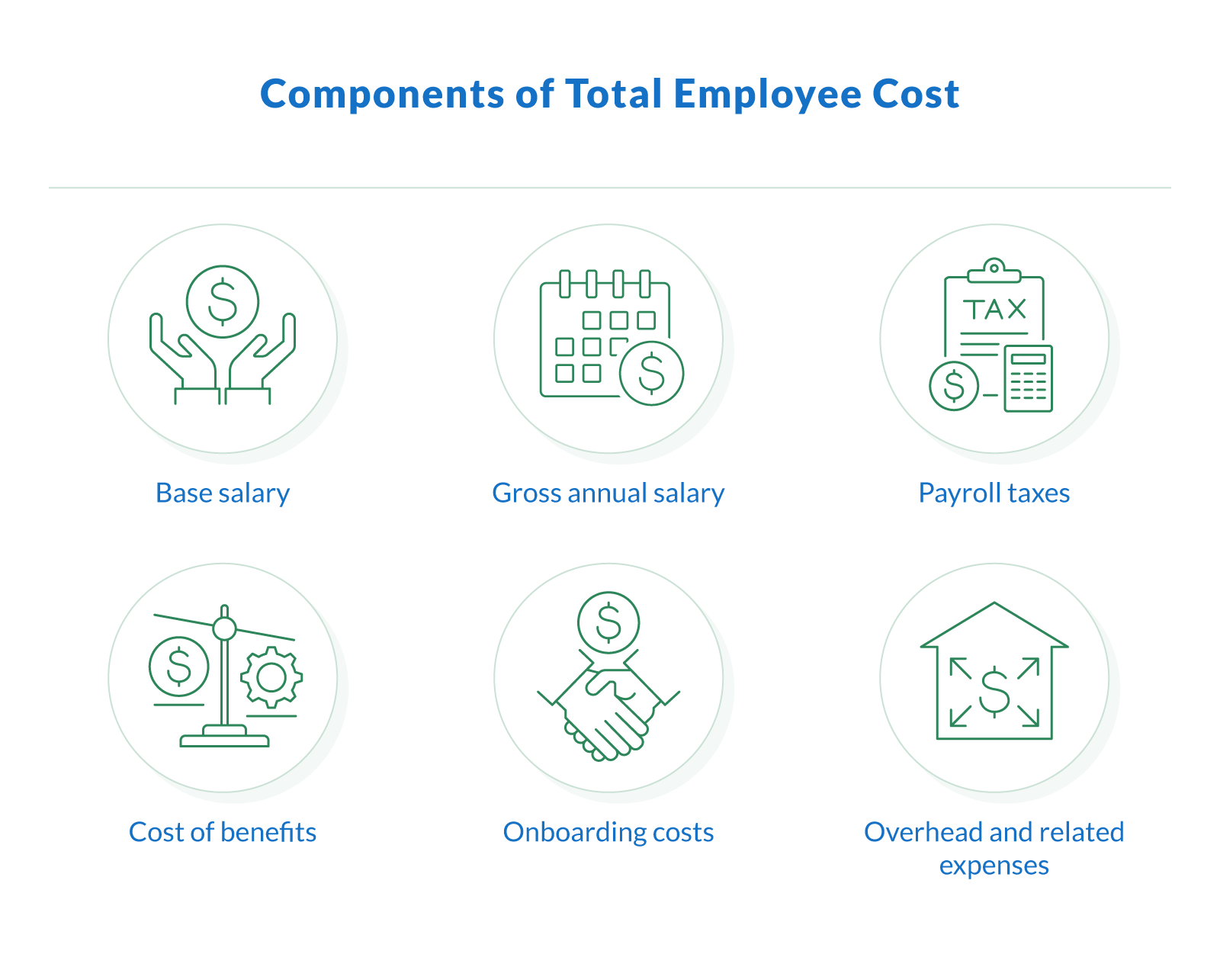

Hiring a new team member involves far more than just offering a base salary. To truly understand whether you can afford to scale, it's important to consider all the expenses that make up the total cost of employment. These factors go beyond wages and can significantly impact your business's bottom line:

Base salary. This is the agreed-upon compensation for the role, typically reflected as an annual salary or hourly rate based on the employee's expected workload.

Gross annual salary. The total amount paid to an employee before deductions, bonuses, or taxes is often confused with the base salary but includes additional compensation.

Payroll taxes. These include employer-paid contributions such as Social Security, Medicare, and other government-mandated taxes.

Cost of benefits. Health insurance, retirement contributions, and paid leave fall into this category and can vary widely based on your company's offerings.

Onboarding costs. Training, setting up accounts and equipment, and lost productivity during ramp-up all contribute to onboarding expenses.

Overhead and related expenses. Think office space, software licenses, team tools, and other resources that support the new hire's role.

When budgeting for a new hire, evaluate the full annual cost: the total cost of employment when all factors — salary, benefits, and overhead — are considered.

Need to hire employees? Consider applying for a business expansion loan.

Beyond Salary: Overhead and Hidden Expenses

Hiring a new employee means taking on more than just a salary. Many business owners overlook the full picture, which includes a range of overhead costs and related expenses that can quickly add up. These hidden costs influence whether a hire is truly affordable — and whether it's the right time to grow your team.

Here are some common expenses that should be factored into your decision:

Health insurance and health care contributions. Employer-paid premiums for health care and other medical benefits are often a major expense.

Medicare and payroll taxes. Employer contributions to government programs like Medicare, Social Security, and unemployment insurance are required by law.

Office space and equipment. Whether in-person or hybrid, new hires often require physical space, furniture, or upgrades to existing setups.

Software and tools. Adding seats to project management systems, CRMs, or communication platforms can raise monthly operating costs.

Training and onboarding. Setting up accounts, providing guidance, and getting employees up to speed takes time and resources.

Understanding these employer contributions and overhead costs allows you to streamline your budgeting process and avoid surprises down the line.

How Global Hiring Changes the Equation

Building a global team opens new doors — but it also brings a different set of employment costs. Hiring across different countries means navigating varying tax laws, benefits requirements, and payroll systems. Without the right support, that complexity can slow your global expansion or create compliance risks.

This is where an employer of record (EOR) becomes valuable. An EOR handles global payroll, legal compliance, and global benefits for your employees in other countries, allowing you to focus on hiring the best talent without setting up foreign entities. Whether you're hiring contractors or full-time staff abroad, working with an EOR simplifies the process and helps ensure you're meeting local regulations.

For companies looking to scale internationally, global hiring doesn't have to be overwhelming — it just needs the right structure and partners in place.

Interactive Employee Cost Calculator: Estimate the True Cost of a New Hire

Before you commit to your next hire, it's essential to run the numbers. Our employee cost calculator helps you understand the true cost of an employee by factoring in all the variables that affect your budget — not just the base salary.

The calculator takes key inputs like gross annual salary, hourly rate, job location, and benefits offered. It then calculates the total annual cost of that employee, factoring in taxes, benefits, and other employment costs. It's a simple way to evaluate affordability, compare different hiring scenarios, and plan ahead for sustainable growth.

Whether you're hiring locally or internationally, this tool is designed to simplify decision-making and help you build a cost-effective workforce.

When To Consider an Employer of Record (EOR) or HR Partner

Hiring across borders comes with complexities — from legal requirements to tax compliance. An employer of record (EOR) can help simplify global employment by handling everything from contracts and payroll to benefits and local labor laws. This allows your team to onboard talent anywhere in the world without setting up a local entity.

Partnering with an EOR is especially useful when hiring a full-time employee in another country or expanding quickly across multiple regions. It also helps reduce risk tied to misclassification, which can lead to penalties if a contractor is treated like an employee without the proper structure.

For fast-moving teams, working with an EOR or HR partner can streamline the process, offer peace of mind, and free up time to focus on building your business.

Looking to cover costs for an EOR or HR partner? Working capital loans through Clarify offer fast, flexible funding to help you hire confidently and scale smarter.

Can You Afford to Grow Your Team?

Before hiring a new employee, it's critical to understand the full cost of employment — not just the salary. From taxes and benefits to training and tools, every line item affects your bottom line. For business owners looking to scale sustainably, having a clear view of the annual cost of a new hire can make the difference between steady growth and a budget shortfall.

The employee cost calculator shared in this article is a simple way to run the numbers and make informed decisions about hiring. Whether you're adding one person or planning to grow a full team, it helps you estimate labor costs accurately and prepare your business for what's next.

Ready to move forward? Check your funding options with Clarify Capital to support your hiring plans with fast, flexible financing.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts