In the health care industry, access to modern medical equipment can mean the difference between efficient patient care and operational delays. However, the cost of purchasing high-tech devices, like imaging machines, monitors, or surgical tools, can quickly overwhelm even established practices. That's where medical equipment leasing comes in.

Instead of tying up capital in upfront purchases, many providers turn to medical equipment financing or lease agreements to stay up to date with the latest tools while protecting cash flow. It's a flexible strategy that helps you scale, upgrade, or replace equipment as your practice grows.

And the demand is booming. The U.S. medical equipment rental industry alone is projected to generate $5.0 billion in revenue by 2025, while hospitals dedicate a significant portion of their budgets to equipment costs that vary based on size, specialty, and care level.

In this guide, we'll compare leasing and financing options, walk through approval requirements, and help you decide what makes the most sense for your health care facility or private practice.

Leasing vs. Financing Medical Equipment: Key Differences

If you're weighing your options for acquiring new equipment, understanding the structural and financial differences between leasing and financing is essential. Each method offers a different path, affecting ownership, tax strategy, and long-term flexibility.

Use the chart below to quickly compare the two structures based on real-world lender standards and Clarify's typical borrower experience. These differences can help you make a confident decision that supports both patient care and practice growth.

| Medical equipment: Lease vs. finance | ||

|---|---|---|

| Feature | Lease | Finance |

| Ownership | No (option to buy later) | Yes |

| Upfront costs | Low to none | May require down payment |

| Monthly payments | Fixed lease payments | Fixed loan payments |

| Tax benefits | Fully tax-deductible as an expense | Section 179 depreciation and interest |

| Upgrade flexibility | Easy to upgrade at lease end | Requires resale or reinvestment |

| Contract length | Shorter lease terms (1-5 years) | Longer loan terms (2-7 years) |

| Best for | Keeping up with technological advances | Long-term ownership and asset building |

Below, we break it down to help you choose the best fit for your health care business needs.

Medical Equipment Leasing

Medical equipment leasing gives you access to essential tools without the responsibility of full ownership. Through a structured lease agreement, you pay to use the equipment for a set period, usually with options to upgrade, renew, or purchase at the end of the term. This is one of the most flexible leasing options for practices that frequently adopt cutting-edge technology or want to preserve working capital.

Leasing is often preferred for short-term or rapidly depreciating equipment. It's also typically easier to qualify for and requires little to no down payment. Additionally, lease payments may be fully tax-deductible, depending on your business setup.

Medical Equipment Financing

With a loan, you're financing the full purchase of the equipment, which becomes a long-term asset. Medical equipment financing is ideal for practices that want full ownership and are looking to maximize return over the equipment's lifespan. This route usually involves a higher credit threshold and may include a down payment, but it provides greater long-term value.

Many financing options come with fixed loan terms ranging from two to seven years. You'll also gain access to tax benefits, including depreciation and interest deductions. Under current guidelines, you can deduct up to $1,250,000 through Section 179 in 2025 for qualifying equipment.

Leasing Medical Equipment: Pros and Cons

Medical equipment leasing can be a smart, flexible option for many practices, especially when balancing tight budgets with the need for advanced tools. Like any financial decision, though, leasing has trade-offs. Below, we break down the major advantages and disadvantages to help you decide whether these leasing solutions align with your practice's goals.

Pros

Leasing is often the go-to choice for startups, urgent care centers, and medspas looking to scale quickly without draining reserves. Here's why:

Preserves cash flow. Leasing avoids large upfront costs, helping providers maintain working capital for staffing, supplies, and other core expenses.

Access to the latest health care equipment. Leasing gives you the flexibility to upgrade to cutting-edge technology every few years, ideal for diagnostic tools or imaging systems that quickly become outdated.

Tax-deductible lease payments. Most lease agreements can be fully deducted as operating expenses, simplifying accounting and potentially lowering your tax burden.

In fact, over 75% of U.S. businesses use equipment financing to preserve cash flow, a clear indicator of how valuable this strategy is across industries.

Cons

While leasing delivers flexibility and speed, there are some limitations to keep in mind:

No ownership at the end. You'll return the equipment unless a buyout clause is included, unlike with financing, where you build equity over time.

Higher total cost. Depending on the lease term and structure, you may end up paying more than the equipment's purchase price.

Long-term dependency. Leasing can become a recurring expense that impacts your future budgeting if not strategically managed.

Whether you're launching a new medical practice or upgrading diagnostic systems, leasing can be a smart part of your financial strategy, but only if it supports your long-term plans.

Financing Medical Equipment: Pros and Cons

Financing solutions offer a long-term path to owning essential medical equipment outright, especially helpful when the tools in question have a long shelf life or are critical to daily operations. But like leasing, financing has its own trade-offs that practice owners need to weigh before signing a loan agreement.

Pros

For dental offices, surgery centers, and diagnostic labs that rely on high-use equipment, financing makes strong business sense:

Full ownership at the end of the term. Once your loan is paid off, the equipment is yours to keep, repurpose, or resell, making it an asset on your balance sheet.

Lower long-term cost. Although upfront costs may be higher, financing often results in less total spend compared to a lease, especially for durable, long-life equipment.

Powerful tax benefits. Interest on business loans and depreciation are often tax-deductible. Section 179 of the IRS tax code allows qualifying purchases to be written off, sometimes in full, during the year of purchase.

Financing puts you in control of your long-term investment, making it a strong fit for equipment that stays relevant for five to 10 years or more.

Cons

That said, financing may not be the best route for every practice. Here's where it can become challenging:

Larger upfront costs. Many lenders require a down payment, anywhere from 5% to 20%, depending on your credit profile.

Depreciation risk. If the equipment becomes obsolete before your loan is paid off, you may still owe money on something no longer in use.

Slower approval process. Traditional business loans may involve more underwriting, stricter credit requirements, and longer wait times compared to leases.

If you're planning to keep a piece of equipment for many years or need it daily, financing typically provides the best ROI.

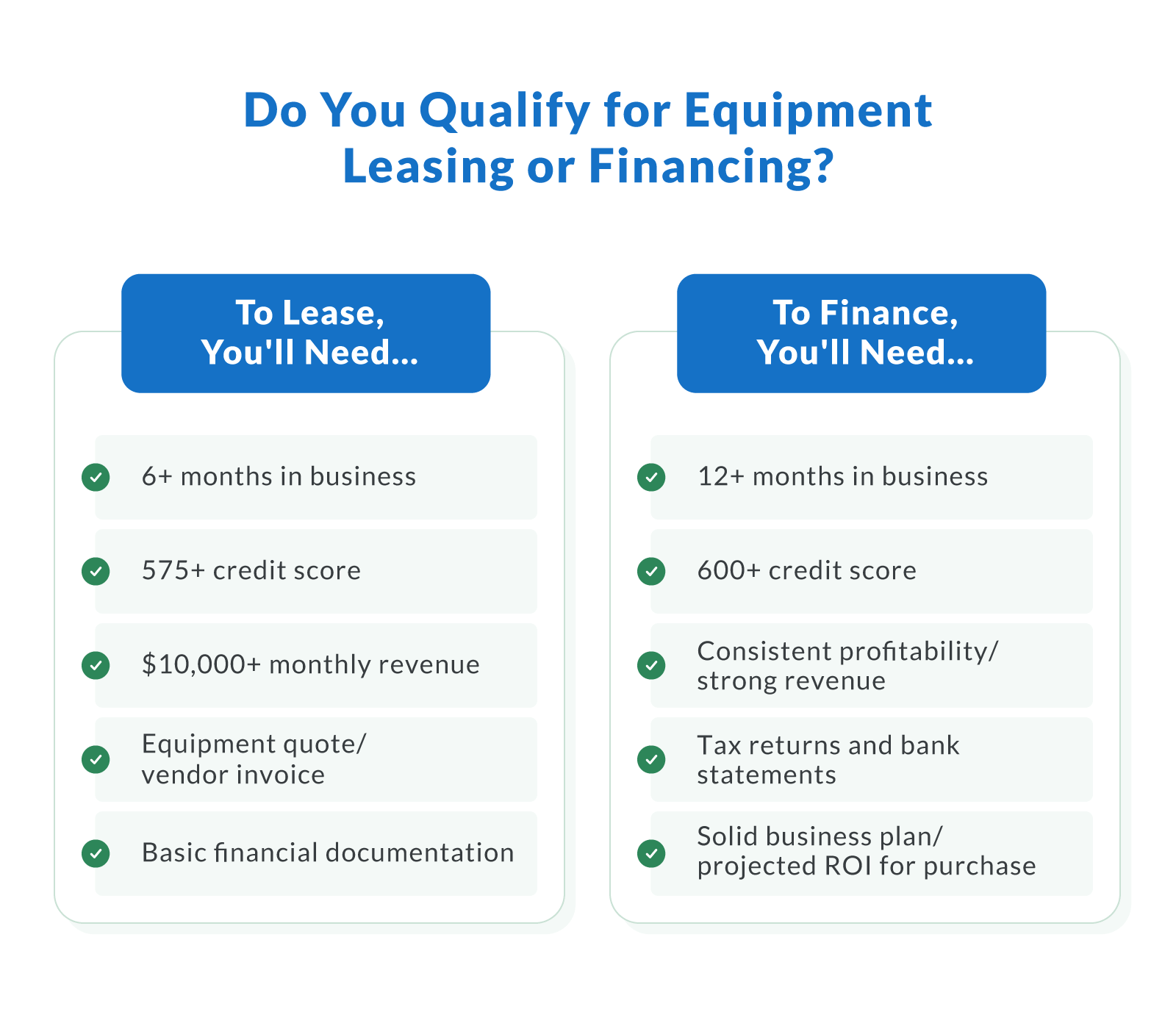

Who Qualifies for Leasing vs. Financing?

Before you can decide between leasing or financing your equipment needs, it's important to understand what lenders look for. While both options are accessible to health care providers, the requirements vary slightly depending on your business history, financials, and credit score.

Leasing Eligibility

Medical equipment leasing is often more accessible for newer or smaller health care practices. Lenders that specialize in leasing solutions typically look for:

6+ months in business

Credit score of 575+

Minimum monthly revenue of $10,000

Equipment quote or vendor invoice

Basic financial documentation (e.g., business bank statements)

Because leasing involves lower upfront costs and shorter lease terms, the application process is faster and usually less paperwork-heavy than traditional lending.

Financing Eligibility

To qualify for medical equipment financing, the requirements are slightly higher. Lenders offering equipment loans or business loans often ask for:

12+ months in business

Credit score of 600+

Consistent profitability or strong revenue

Tax returns and bank statements

A solid business plan or projected ROI for the purchase

Pre-approval tip: Have your financials organized and a specific piece of equipment in mind. This shows lenders that you're prepared and makes the application process smoother.

Fortunately, health care remains one of the most stable sectors in the lending world. According to Kaufman Hall's 2025 Outlook, credit agencies continue to view health care as a resilient industry with long-term funding potential.

How To Decide What's Best for Your Practice

Choosing between leasing and financing starts with understanding your business needs and the role each piece of equipment plays in your operations. From cash flow to ownership strategy, several factors should guide your decision, especially for a health care facility balancing daily demands with long-term goals.

Here's how to think through it:

Startups and New Practices

For new or cash-conscious practices, leasing often makes sense. It reduces upfront equipment needs, preserves working capital, and provides flexibility to scale. Clinics can also benefit from faster upgrades; most leased devices can be refreshed every three to five years, which is ideal in sectors where technology advances quickly.

Growing Practices

If your practice is stable and expanding, a combination of leasing and financing may be smart. Lease items with high turnover (like diagnostic monitors), but finance core tools that will serve you for the long haul. This helps control cash flow while building equity in strategic assets.

Replacing Outdated Equipment

When replacing aging equipment, financing may offer better long-term value. Full ownership supports ROI, tax deductions, and avoids renewals. For essential-use items like sterilizers or imaging systems, financing aligns with consistent use and reliable patient care delivery.

Ultimately, the best option depends on your current equipment needs, budget flexibility, and how long you expect to keep the device. Clarify Capital can help assess your situation and match you with the right lender and terms, whether you're leasing or financing.

Final Thoughts on Leasing and Financing for Health Care Providers

Staying competitive in today's health care landscape means having access to the right tools without draining your budget. Whether you're running a private clinic, urgent care center, or specialty practice, flexible leasing programs and financing options can help you access the latest technology while protecting your bottom line.

For many health care providers, the right decision comes down to how long you plan to use the equipment, how fast your tech needs change, and how much working capital you want to keep on hand. Leasing offers flexibility and speed. Financing builds long-term value. Both options can be tailored to your goals.

Clarify Capital makes the process simple. With access to over 75 lenders and a dedicated advisor guiding you every step, you'll get matched with the best solution for your practice's growth.

Ready to move forward? Check eligibility for personalized medical equipment financing today.

FAQs About Medical Equipment Leasing and Financing

Below are some of the most common questions health care professionals ask when weighing their options for acquiring medical equipment.

Should I Lease or Buy Medical Equipment?

That depends on your budget, usage, and how often the technology becomes outdated. Leasing from equipment leasing companies is cost-effective if you want lower upfront costs, predictable monthly payments, and easier upgrades. Buying is better if you plan to use the same equipment for many years and want to build long-term value. Many practices use a mix of both.

What Credit Score Do You Need To Lease Medical Equipment?

Most lenders require a minimum credit score of 575 for medical equipment leases. However, terms may improve with stronger credit or longer time in business. Some financing companies offer flexible options for newer practices or those with lower credit.

Is Leasing Medical Equipment Tax-Deductible?

Yes. In most cases, equipment leasing companies structure agreements so lease payments can be written off as business expenses. This creates tax advantages, especially for short-term equipment needs where depreciation isn't a factor.

What Is an Operating Lease in Health Care?

An operating lease is a short- to mid-term rental agreement where the equipment remains the property of the lessor. It's common in the health care space for tools that need frequent upgrades. At the end of the term, you typically have the option to renew, return, or upgrade, without carrying the asset on your balance sheet.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts