Starting a business is exciting, but vague advice like “follow your passion” doesn't cut it when real money and livelihoods are on the line. Many new business owners jump in with enthusiasm, only to face unexpected challenges they weren't prepared for.

That's why structured, research-backed planning is essential for any startup aiming to become a successful business. Entrepreneurship demands more than just inspiration — it requires hard work, preparation, and strategic thinking to build something that lasts. The reality is sobering: only 34.7% of businesses started in March 2013 were still operating a decade later, according to Bureau of Labor Statistics data. Long-term success isn't guaranteed, but with the right foundation, it's far more achievable.

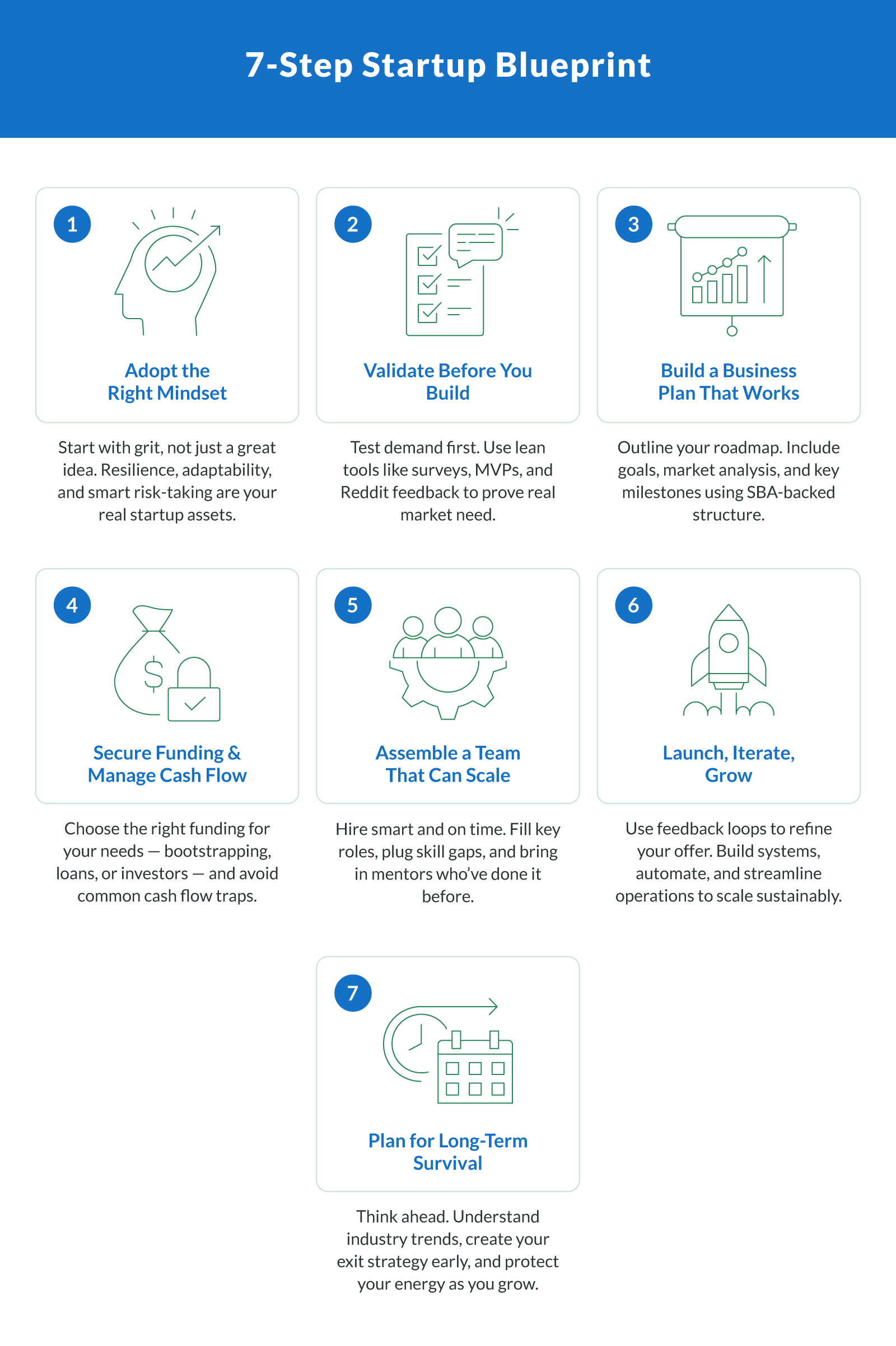

This guide offers a step-by-step blueprint for becoming a successful business owner — from mindset and validation to planning, funding, and scaling. If you're ready to approach entrepreneurship with clarity and direction, this is your starting point.

Step 1 – Adopt the Right Entrepreneurial Mindset

Getting your mindset right is the bedrock of successful entrepreneurship. You're not just chasing an idea — you're choosing a path that demands resilience, adaptability, and a willingness to work hard when the going gets tough. Every entrepreneur needs more than ambition — they need mental toughness.

What Sets Successful Founders Apart

Successful entrepreneurs bounce back from failure, adapt quickly, and lean into risk with calculated courage.

Take Airbnb's founders: When Brian Chesky and Joe Gebbia couldn't afford rent, they turned their apartment into a pop-up bed-and-breakfast and launched their own website. That early experiment led to three bookings — but their growth didn't stop there.

They used scrappy, unconventional tactics to gain traction, including designing and selling political cereal boxes to raise funding and reaching out to property owners on Craigslist to recruit hosts. They even built bots to auto-post listings on Craigslist — an unsanctioned but clever workaround to tap into an existing user base. At one point, they lived off unsold cereal and faced repeated investor rejections.

That mix of resilience, hustle, and creative problem-solving helped them build what became a $10 billion business.

More than a vision, great founders need the grit to turn obstacles into opportunities. That's what sets successful entrepreneurs apart.

Frameworks To Guide You

These mental frameworks help you clarify roles, make decisions faster, and stay focused on what actually drives growth.

Hacker, Hipster, Hustler. This model maps out three essential startup roles — the builder (Hacker), the designer (Hipster), and the seller (Hustler) — to help identify team strengths and fill gaps early.

Growth mindset. Believing skills can be learned through effort and feedback keeps you flexible and coachable — two traits every founder needs.

First-principles thinking. Break problems down to the basics and build solutions from the ground up, just like Airbnb's team did when they created a listing platform from scratch.

10x thinking. Ask what it would take to improve something by 10 times, not 10%. It challenges assumptions and opens space for breakthrough solutions.

Mental models like these can shape your day-to-day approach and help you stay aligned with your goals and team.

Step 2 – Validate Before You Build

Before investing heavily in development or marketing, make sure there's real demand. Building something people don't want is a fast path to failure, and one of the most common mistakes for new founders.

Start With Demand, Not Ideas

According to a CB Insights study, 35% of startups fail due to a lack of market need. The lesson? A good business idea isn't enough — your idea needs a paying audience. Start by testing the problem you're solving and the urgency behind it.

Use Lean Validation Tools

There are simple, cost-effective ways to confirm demand:

Surveys and polls. Reach out to your target audience with three to five key questions.

No-code MVPs. Use platforms like Carrd, Glide, or Tally to create quick landing pages or product demos.

Reddit feedback loops. Post in relevant subreddits and gauge reactions to your concept.

Podcast interviews. Talk to potential customers on your show or as guests — these conversations can reveal real-world pain points.

These tools help you avoid wasted effort and build something people will actually buy.

Step 3 – Build a Business Plan That Works

A business plan isn't just for banks or investors — it's your day-to-day roadmap for building, managing, and growing your company. It gives you direction, helps you stay accountable to your goals, and forces you to think critically about your market, competition, and growth strategy.

Essential Sections to Include

The Small Business Administration recommends building your plan around these key components:

Executive summary. A quick overview of your mission, offering, leadership, and goals.

Company description. Details about your business, customers, and competitive edge.

Market analysis. Research on your industry, competitors, and market trends.

Organization and management. Legal structure and team roles.

Service or product line. What you're selling and why it matters to customers.

Marketing and sales. How you'll attract and retain customers.

Funding request. How much money you need and how you'll use it.

Financial projections. Five-year forecast — include income, expenses, and cash flow.

Appendix. Licenses, resumes, permits, visuals, or anything investors may ask for.

Whether you choose a traditional or lean format, use your plan as a living document. It should evolve alongside your business, not gather dust in a drawer.

SMART Goals and KPIs

Your business plan should turn vision into action. That starts by setting SMART goals — specific, measurable, achievable, relevant, and time-bound — and pairing them with meaningful KPIs (key performance indicators).

For example:

Revenue growth targets based on your market research.

Monthly signups or trials from potential customers.

Customer retention rates or sales per channel.

Tracking progress toward these benchmarks helps you course-correct and scale with intention.

Step 4 – Secure Funding and Manage Cash Flow

Money can make or break a startup. Without solid financing and strong cash flow habits, even promising businesses run out of time before they gain traction.

Understand Your Financing Options

There's no one-size-fits-all approach to funding — your choice depends on your business needs, timeline, and appetite for risk. Here are common options:

Bootstrapping. Using your own savings or revenue to fund the business without outside help.

Small business loans. Borrowing funds from a lender with fixed repayment terms and interest.

Angel investors. Wealthy individuals who invest in early-stage companies in exchange for equity.

We'll break down the pros and cons of each:

| Funding method | Pros | Cons |

|---|---|---|

| Bootstrapping | Full control, no debt | Slower growth, limited runway |

| Small business loans | Predictable repayment, retain equity | May require strong credit or revenue |

| Angel investors | Strategic support, fast capital | Diluted ownership, investor expectations |

Avoiding Common Cash Flow Mistakes

Good bookkeeping habits are a survival skill. According to CB Insights, 38% of startups fail due to cash flow issues — the top reason for failure. Poor budgeting, slow invoicing, and overestimating early revenue can all drain your runway.

Keep tight books. Use software or a professional to track income and expenses in real time.

Forecast often. Run monthly projections — not just annual — to spot cash gaps early.

Limit unnecessary spending. Focus on must-haves until you've built predictable revenue.

Step 5 – Assemble a Team That Can Scale

You can't build a lasting business alone. Your first hires — and how well you work together — will shape everything from culture to execution speed.

Team-Building Lessons From Failed Startups

Bad team dynamics sink companies. In fact, 14% of startup failures are caused by team problems, according to CB Insights.

For a small business, that might mean unclear roles, conflicting visions, or skill gaps that go unaddressed. The key is not just hiring smart people — it's hiring the right people for the right stage.

When and Who To Hire First

Here's a typical early-stage hiring sequence:

Founder(s). Cover core skills — usually product, sales, and ops.

Freelancers or agencies. Handle specialized or project-based work affordably.

First full-time hires. Think customer success, marketing, or product support — based on bottlenecks.

Mentors or advisors. Bring in trusted experts for strategic guidance.

Hiring before you're ready can burn runway — but waiting too long can slow momentum. Talk to mentors who've done it before to help time your next move.

Step 6 – Launch, Iterate, Grow

Launching is only the beginning. Sustainable growth comes from constant iteration — listening to customers, adapting quickly, and building systems that scale. The most successful businesses don't just grow once. They grow better, smarter, and faster with each cycle.

Use Customer Feedback Loops

Great founders don't guess — they test. A test-measure-learn cycle helps you stay close to what customers want and fix what's not working.

Cami, a former nurse turned laundromat owner, is a perfect example. After launching her business, she layered on a pickup and delivery initiative based on customer need, and tripled her income.

She didn't stop there: She listened to followers on TikTok and built courses that now earn thousands monthly. Her story shows how customer feedback, when acted on, can reshape a business entirely.

The key is staying open to feedback and being willing to adjust. Sometimes your customers will show you a better opportunity than the one you started with.

Growth Isn't Just Marketing

Scaling isn't just about ads and awareness — it's about building a machine that works without you.

Systematize tasks. Use tools like Trello or Notion to manage workflows, assign tasks, and track progress.

Automate where possible. Set up recurring systems for billing, onboarding, scheduling, or lead generation.

Hire for leverage. Bring on people or tools that give you time back — not more work.

A strong marketing strategy matters, but so does your back end. Operations are what keep customers happy and make growth sustainable. If it's repeatable, build a system around it.

Step 7 – Plan for Long-Term Survival

Running a successful business isn't just about launching strong — it's about staying strong over time. Surviving those early years is just the beginning. To build something that lasts, you need to look ahead, make smart decisions based on data, and prepare for eventual transitions.

Understand What Industries Survive the Longest

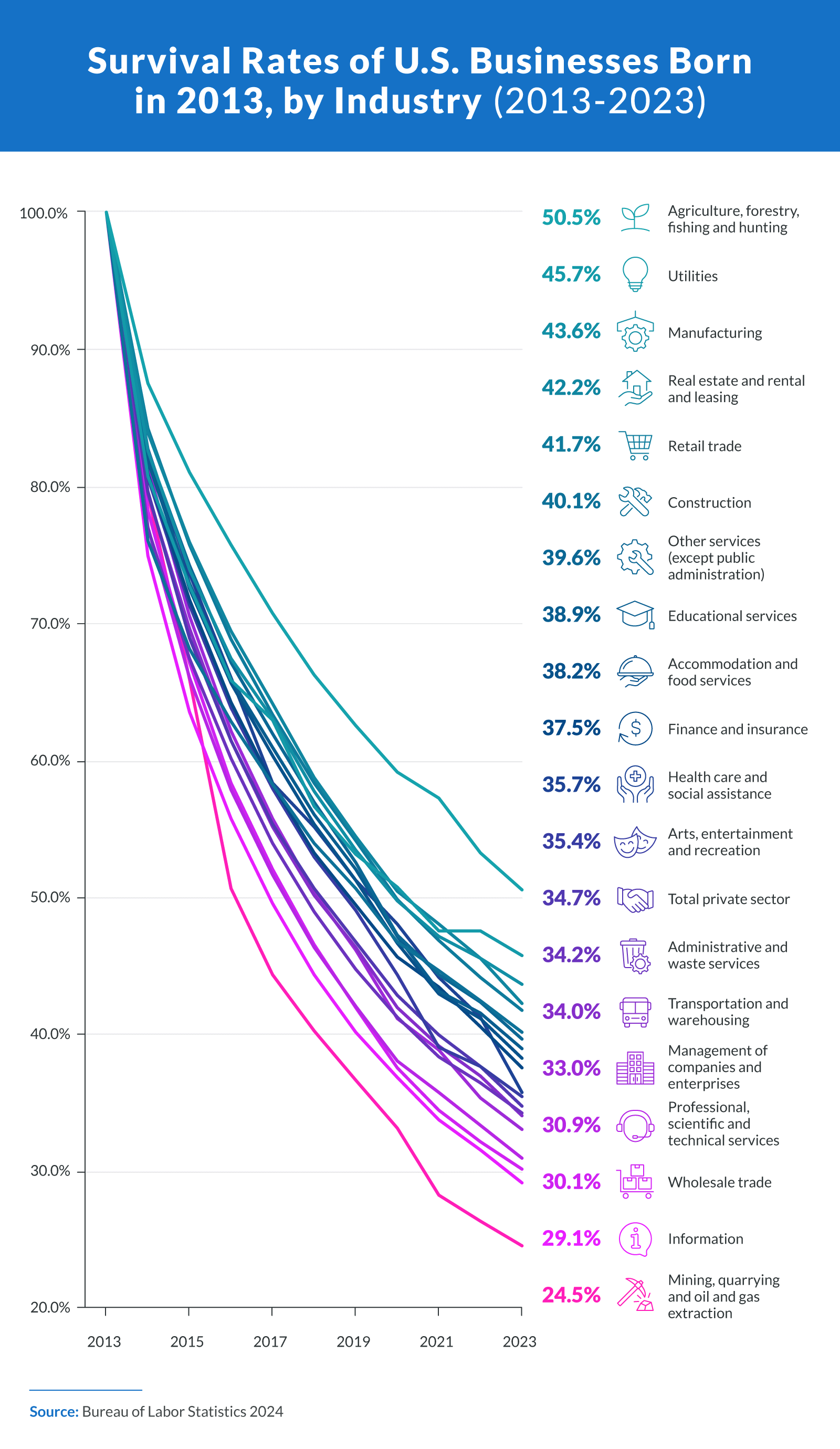

Some industries simply have better staying power than others, and the type of business you choose can make a real difference.

This chart gives a side-by-side comparison of how different industries performed over a ten-year stretch, using data from the Bureau of Labor Statistics.

The takeaway: While only about one in three businesses overall (34.7%) made it to year 10, agriculture, manufacturing, and utilities saw significantly higher survival rates than sectors like construction, retail, and information services.

If you're weighing your options for what kind of business to start — or what area to expand into — these patterns offer a valuable perspective.

Prepare for Succession or Exit Early

Even if you're just getting started, it's smart to plan for what happens down the line. Whether you want to sell, pass it on, or wind things down, a clear exit plan protects your business — and your peace of mind:

Plan with your future goals in mind. Know if you're building to sell, sustain, or transfer, and let that shape your business decisions now.

Get your paperwork in order early. Solid contracts, documented ownership, and succession agreements save time and headaches later.

Watch for burnout. Running a business can take a toll. Having a plan to step back — or shift responsibilities — helps you protect both your health and your company.

These steps are especially important for businesses with major physical assets like real estate, equipment, or long-term leases. Without an exit strategy, even a thriving business can run into complications. Planning ahead gives you more control, more flexibility, and more options when the time comes.

Real Business Owner Stories

It's one thing to talk strategy — it's another to see it in action. These entrepreneurs built successful businesses in very different ways, but they all started small and figured it out as they went. Their journeys offer honest lessons for anyone launching a new business or growing as a freelance founder.

From Ph.D. Dropout to Full-Time Dog Chaperone

Rebecca McBride left a Ph.D. program she found unfulfilling and launched a business helping couples include their dogs in their weddings. Just two weeks after starting McBride\&Groom, she booked her first client. She's now fully booked through 2025 and preparing for international expansion.

Her dog-chaperone services start at $268 a day, and social media has helped drive word-of-mouth growth. McBride built her brand around her strengths — animals, event support, and client care — and leaned into a niche most people didn't know they needed.

Takeaway: If you're stuck in a career that doesn't fit, building a business around what you love — no matter how niche — can be the right next move.

Experience and Lessons From the Long Game

This Reddit user shares how he built a small manufacturing business, grew fast, and learned hard lessons when the economy shifted:

“I worked my way through college in the 70s by building stuff in my garage. I managed to accumulate customers and a reputation, so after college, I opened a shop making similar stuff.

Customers were happy, and orders increased. I delivered quality products at a fair price, so sales rolled in effortlessly without any advertising. I hired employees and leased more space, probably too much. I'm a tool junkie, so I spent all of my profit on tools and borrowed to buy more tools. The tools allowed me to make better stuff and make it faster, so they weren't totally a stupid mistake. Things went well for years.

Then, economic problems forced all of my customers out of business. I had high expenses, no sales skills, and no cash reserve. After bankruptcy, I spent the next 35 years working for others.

Now, semi-retired, I have another business making stuff, only this time I have plenty of retirement savings and experience. Things are going very well. I have a great reputation among demanding customers.”

Takeaway: A solid product isn't enough. Have a cash reserve and sales strategy before scaling your new business too fast.

Need working capital to weather slow sales or invest in smarter growth? Clarify Capital offers flexible small business loans to help you stay cash-ready through every business cycle.

Building a Business Without Burning Out

In this Reddit post, a plumbing company founder explains how intentional systems helped him scale quickly without sacrificing his time or energy:

“I started a plumbing company and designed it to be the most efficient plumbing company ever... We are only a little over a year old, but [achieved] 4x our goals last year, and I only work about 40 hours a week. I've read [hundreds] of business books, and I actually believe hustle culture makes you less productive as an entrepreneur because ideas are worth so much and save you time, and you don't have those when you are exhausted and not giving yourself space to come up with them, and meeting with other business owners.

PS: Hustle culture is great for employees/people who work for someone else.”

Takeaway: Systems and rest fuel smart decisions. If you're a freelance founder, protect your time; creativity and clarity are more valuable than overwork.

Need funding to hire help, streamline operations, or invest in tools that save you time? Clarify Capital offers fast, no-collateral business loans so you can grow smarter.

Expand Your Business Today With Help From Clarify Capital

Success takes more than hustle. You need a solid mindset, a practical plan, and consistent execution — and that's where we come in. Whether you're starting a business venture, entering a new target market, or trying to reach a different target audience, Clarify Capital can help fund your next step.

Get funding with Clarify Capital and bring your business strategy to life. From e-commerce launches to acquiring new customers, we help business owners move forward with confidence.

FAQs

Starting and growing a business comes with a lot of questions. These quick answers address some of the most common concerns for new founders and small business owners.

What Are the Most Important Business Startup Tips?

Validate demand before you build. Talk to customers early. Keep your operations lean. Build relationships with peers, mentors, and funders. And don't wait for perfect — just get started.

How Do I Write a Business Plan?

Use a proven structure: executive summary, company details, market analysis, team, product, marketing, and financial projections. A business plan isn't just for investors — it's your internal roadmap for building your own business.

What Causes Most Small Businesses To Fail?

The most common reason is lack of cash flow. Other reasons include poor planning, weak marketing, founder burnout, and misreading the market. Successful small business owners adapt quickly and budget wisely.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts