For health care providers, investing in modern diagnostic tools is essential for staying competitive and improving patient care. But with equipment like X-ray machines costing anywhere from $45,000 to $190,000, most medical professionals need reliable financing to afford the technology their practices demand.

Whether you're opening a new medspa, upgrading an urgent care facility, or expanding a dental clinic, there are two main ways to fund these purchases: medical equipment loans or equipment leasing. Choosing the right path can affect everything from your cash flow to your long-term tax strategy.

In this guide, we'll break down the pros and cons of each financing method, share real-world examples, and outline the steps to secure fast, flexible funding through Clarify Capital. Whether you're focused on cutting-edge tech or predictable monthly payments, this article will help you choose the best solution for your practice.

Equipment Loans vs. Leasing: Key Differences for Medical Providers

When it comes to acquiring essential technology, most health care providers face a key decision: Should you buy with a medical equipment loan or opt for leasing? Both health care equipment financing methods can help you get the tools you need, like X-ray machines or diagnostic scanners, but they differ in cost structure, tax benefits, and long-term ownership.

With a medical equipment loan, you borrow a set amount to purchase a piece of equipment outright. This means you own the asset, can deduct depreciation over time, and may build equity. For example, a medspa purchasing a $100,000 X-ray machine through a loan would make fixed monthly payments until the balance is paid off. This option works best for businesses that want to hold onto the equipment long-term.

Leasing, on the other hand, allows you to access equipment with lower upfront costs. Rather than owning the asset, you pay a monthly fee over a defined lease term, often with the option to buy, renew, or upgrade at the end. This model is especially attractive to practices using fast-evolving technologies, as leasing often allows for upgrades to newer technology every few years.

In fact, 82% of U.S. businesses that acquired equipment or software in 2023 used some form of financing, reflecting how critical it is for managing capital efficiently.

Clarify Capital simplifies both paths. With fast credit approval, competitive rates, and flexible structures for both medical equipment loans and leases, we help medical professionals choose the right structure based on their goals, tax strategy, and budget.

Pros and Cons of Each Option

Both equipment leasing and medical equipment loans offer valuable financing solutions, but the right choice depends on your cash flow, business goals, and the pace of change in your medical field.

Here's a quick look at how each option fits different business needs, budgets, and practice sizes, followed by a detailed breakdown:

| Equipment loan vs. lease | ||

|---|---|---|

| Criteria | Equipment loan | Equipment lease |

| Upfront costs | Typically requires a down payment (10%-30%) | Minimal or no upfront cost |

| Monthly payments | Fixed monthly payments based on loan terms | Predictable lease payments over defined lease term |

| Ownership | You own the equipment after loan is paid off | Lender retains ownership unless buyout option is exercised |

| Tax benefits | May deduct depreciation or use Section 179 | Lease payments may be fully deductible as business expenses |

| Best for | Practices needing long-term assets and stable cash flow | Startups or tech-heavy practices needing frequent upgrades |

Equipment Loans

For practices that prioritize long-term asset ownership, medical equipment loans offer a straightforward path. You borrow a lump sum to purchase equipment, then repay it in fixed monthly installments. This option is especially attractive for stable clinics or urgent care centers looking to invest in assets with a long useful life.

Benefits of equipment loans include:

Asset ownership.You own the equipment outright after payoff.

Tax advantages. May allow for Section 179 deductions or depreciation.

Long-term savings. Often cheaper over time compared to lease payments.

Better fit for durable tools. Ideal for assets like exam tables or imaging machines that last 10+ years.

For newer or cash-strapped practices, these loans may pose challenges such as:

Higher upfront costs. Down payments can strain your cash flow.

Maintenance responsibility. You're responsible for repairs and servicing.

Depreciation. Equipment may lose value faster than it's paid off.

Equipment Leasing

Equipment leasing is often the go-to option for practices that rely on rapidly evolving technology or need to preserve working capital. Leasing enables access to top-tier tools with minimal upfront investment and added flexibility.

Here are the key benefits of leasing:

Low upfront costs. Preserves working capital for other needs.

Flexibility. Easier to upgrade to new equipment every few years.

Simple budgeting. Predictable lease payments make cash planning easier.

Fewer maintenance burdens. Some leases include service agreements.

While leasing reduces short-term strain, it can come with certain challenges as well:

No ownership: You don't build equity in the equipment.

Higher long-term cost. May end up costing more over time.

Limited customization. Restrictions may apply to how the equipment is used.

Different financing programs work better for different practice types. Solo practitioners and startups may benefit from leasing's lower initial costs, while established clinics might prefer the long-term value of ownership through business loans.

How To Decide: Equipment Loan or Lease?

If you're a medspa owner investing in aesthetic lasers, a dentist upgrading imaging tools, or an urgent care operator replacing diagnostic systems, choosing the right financing medical equipment strategy comes down to understanding your goals and limitations. Each medical practice has different priorities, so your choice should align with your business needs, budget, and how often your equipment becomes outdated.

Start by asking these key questions:

Do you need ownership? If long-term use and resale value matter, a medical equipment loan could be a smarter path.

How often will the tech be obsolete? Practices using rapidly evolving tools, like diagnostic devices or patient-facing tech, may benefit from the flexibility of leasing.

What's your cash flow like? Leasing offers lower monthly obligations and minimal upfront costs, which is helpful for newer practices with limited reserves.

Are you trying to conserve credit lines? Loans can preserve your line of credit for emergencies or operating expenses.

What kind of tax benefits do you need? Ownership can allow for asset depreciation, while leases may qualify for full expense deductions.

For health care professionals unsure which route is best, Clarify Capital helps you compare options side by side. Our experts walk you through interest rates, terms, and tax considerations, so you can feel confident you're choosing the most practical and cost-effective solution.

Real-World Scenario: Medspa X-ray Machine Purchase

Let's say a growing medspa is ready to invest in an advanced X-ray system to support in-house diagnostics and imaging. The machine costs $100,000, and the practice is deciding between financing the purchase with a loan or signing a lease agreement. This is a common scenario across the health care industry, especially for clinics investing in high-value diagnostic tools.

Loan Option

If the medspa chooses a medical equipment loan with a five-year term at a 7% interest rate:

Estimated monthly payments: ~$1,980

Total paid over time: ~$118,800

Ownership: Yes, the equipment is fully owned after the final payment

Best for: Practices with strong credit scores and long-term equipment plans

Lease Option

If the same equipment is leased with a five-year lease term and no down payment:

Estimated monthly payments: ~$2,100

Total paid over time: ~$126,000

Ownership: No, unless a buyout option is exercised at the end

Best for: Practices that want to preserve cash or plan to upgrade frequently

While leasing results in slightly higher monthly payments and a larger total cost, it offers flexibility and preserves capital for other equipment purchases or staffing needs. Loans, on the other hand, are more cost-effective over time and allow full ownership.

With Clarify Capital, the medspa could get matched with a lender in minutes and receive funds within 24-48 hours. Our flexible terms and fast approval process are tailored to help health care businesses finance high-cost tools without delays or red tape.

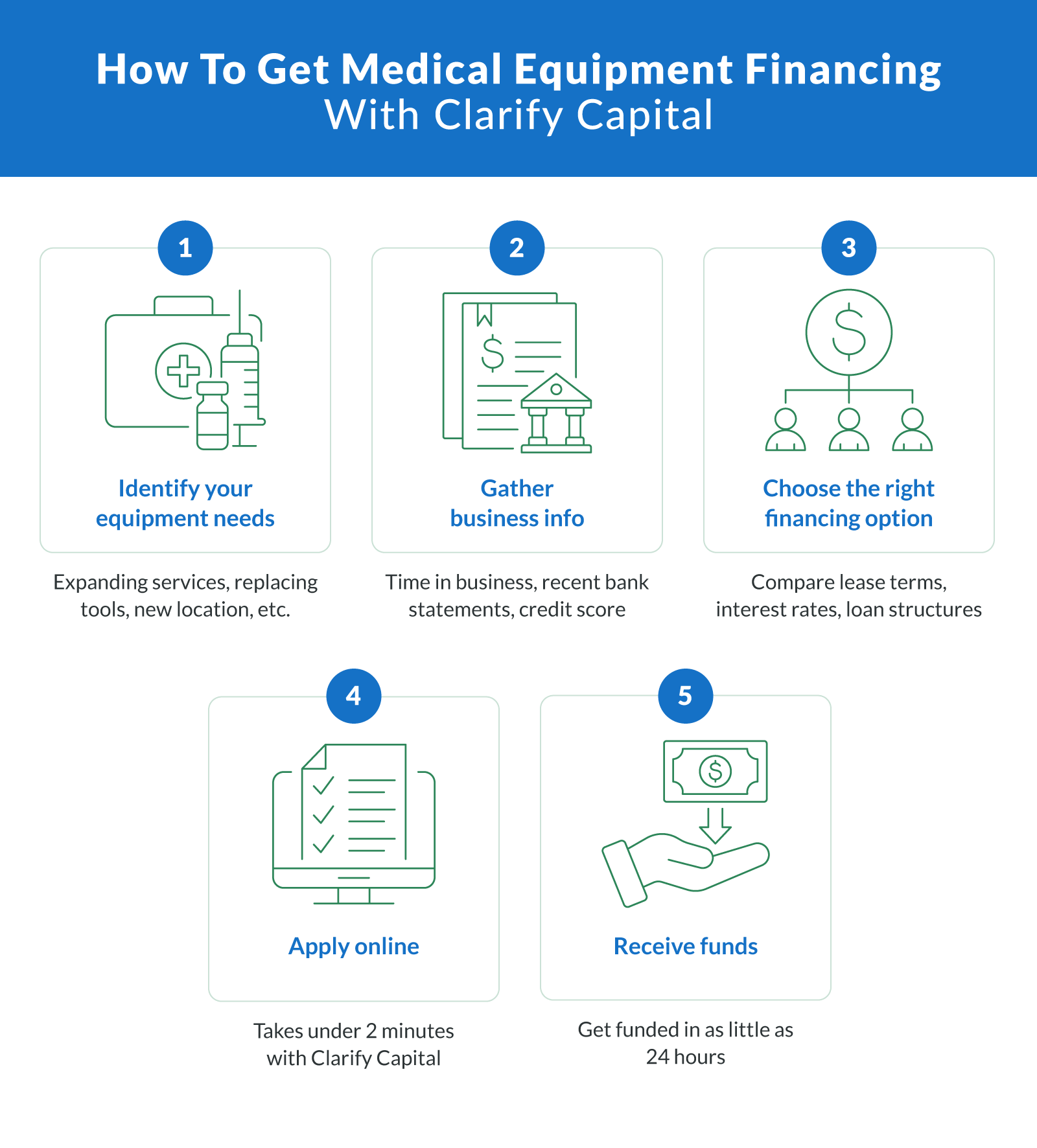

Steps To Secure Medical Equipment Financing

Getting funding for new health care equipment doesn't need to be complicated. With the right partner and a clear plan, you can streamline the application process and get approved quickly, without the paperwork overload typical of traditional finance companies. Here's how to get started:

1. Identify Your Equipment Needs

Start by determining what you're purchasing and why. Are you expanding services, replacing outdated tools, or launching a new location? Knowing your financing needs helps clarify the type of funding that fits best, whether it's a term loan, lease, or line of credit.

2. Gather Key Business Info

Lenders will typically ask for basic documentation: time in business, monthly revenue, and your business or credit score. Having this ready speeds up your credit approval and helps you get matched with stronger offers.

3. Choose the Right Financing Option

Compare lease terms, interest rates, and loan structures. Equipment with long life spans often makes sense to buy; fast-evolving tools may be better leased. Not sure? A Clarify advisor can walk you through the pros and cons.

4. Apply Online With Clarify Capital

Our application process takes just two minutes. There's no obligation or fee to apply. You'll be matched with offers from multiple finance companies, all vetted to meet health care industry standards.

5. Receive Funds and Finalize the Purchase

Once approved, you can receive funds in as little as 24-48 hours. Your Clarify advisor will help finalize paperwork, coordinate with the vendor, and make sure your equipment arrives on time.

Choose the Best Option for Your Practice

For health care providers looking to invest in the future of their practice, choosing between leasing and medical equipment loans comes down to your business goals, budget, and how often your medical technology needs updating. Each path offers benefits, ownership, and long-term savings with loans or flexibility and low upfront costs with leasing.

Whether you're opening a new medspa, upgrading urgent care diagnostics, or simply replacing aging equipment, Clarify Capital offers equipment financing solutions tailored to your timeline and cash flow. Our advisors help you weigh loan vs. lease options, compare interest rates, and secure fast funding, so you can focus on providing excellent patient care.

Get a personalized quote or speak with a Clarify Capital advisor today to explore your best-fit equipment financing strategy.

Frequently Asked Questions About Medical Equipment Financing

Here are answers to common questions health care professionals ask when comparing medical equipment leasing and loan options for their practice.

What Is the Difference Between Medical Equipment Loans and Leasing?

Medical equipment loans let you purchase equipment outright and pay it off over time with fixed interest rates. You own the asset and may qualify for tax benefits like depreciation. Leasing, on the other hand, is more like renting; you make monthly payments to use the equipment for a set period, often with an option to upgrade or buy at the end. Leasing offers more flexibility, while loans provide long-term ownership.

Are Equipment Loans Easier To Get?

It depends on your business profile. Established practices with strong revenue and solid credit may find business loans easier to secure. However, for newer or smaller practices, medical equipment leasing may offer more accessible terms with fewer approval hurdles. Many lenders assess your credit history, revenue, and how long you've been in business.

How Long Does It Take To Get Approved for Financing?

Through Clarify Capital, most health care professionals receive credit approval within 24 hours, often much faster than traditional banks. Once approved, funds can be disbursed in as little as one to two business days, allowing you to move forward with financing medical equipment quickly and without delay.

What Is the Best Bank for Equipment Loans?

The "best" lender depends on your business's specific financing needs, credit profile, and the type of equipment you're purchasing. Traditional banks may offer low interest rates, but they can be slow and require extensive documentation. Online marketplaces like Clarify Capital streamline the process by matching you with top-tier lenders offering competitive terms tailored to health care professionals.

Can I Finance Used Medical Equipment?

Yes, many lenders allow you to finance or lease pre-owned equipment, especially if it's certified and comes from a reputable vendor. This can be a smart move for small practices looking to reduce costs while still upgrading their capabilities. Used equipment financing options are often more flexible and easier to qualify for.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts