Get Funding Without Putting Assets at Risk | |

|---|---|

Loan Amounts$10,000 – $5M | Funding SpeedAs fast as 24 hours |

Minimum Qualifications

| |

Traditionally, lenders require collateral such as real estate, equipment, or personal assets to approve a business loan. However, if you are a business owner with limited assets, this can be a major barrier. Worse, putting up collateral means risking your property, and potentially your business, if things don't go as planned.

Luckily, there are financing options available for business owners and LLCs through unsecured business loans. Unsecured loans, also known as uncollateralized loans, allow you to borrow capital without collateral. Unsecured business loans have two key advantages over secured business loans:

First, with an unsecured business loan, a lender can't seize your business assets if you fail to pay back the loan. Second, you can get funded faster.

Here's what you'll learn in this guide to unsecured business loans:

What you can use unsecured loans for

The different types of unsecured loans available

The advantages of each type of loan

How to qualify for business funding, a.k.a. the credit approval process

How to get approved quickly, even with a bad credit history

The best ways to use uncollateralized capital to grow your company

Answers to frequently asked questions about business loans

Keep reading if you want to access working capital without putting your assets on the line.

| Unsecured Loan Comparison | ||||||

|---|---|---|---|---|---|---|

| Loan type | Funding speed | Interest rate range | Required documentation | Personal guarantee required | Best use case | Link to apply |

| Unsecured term loan | 1–3 business days | 7% – 30% APR | Basic financials, credit check | Sometimes | One-time business investments | Apply for an unsecured term loan |

| Business line of credit | 24–48 hours | 6% – 25% APR | Bank statements, credit check | Often | Ongoing line of credit needed | Apply for a business line of credit |

| Merchant cash advance | Same day | Factor rate: 1.1 – 1.5 | Minimal docs, past sales history | No | Quick cash for emergencies | Apply for a merchant cash advance |

| Invoice financing | Same day | Varies | Invoices | No | Cash flow support tied to unpaid invoices | Apply for invoice financing |

Do I Qualify for an Unsecured Business Loan?

To qualify for an unsecured business loan through Clarify Capital, your business must meet a short set of baseline requirements. These criteria help ensure fast approvals and accurate loan matching without collateral.

At least $10,000 in monthly business revenue.

More than six months in business.

An active business bank account.

Three months of your most recent bank statements available to verify income.

Located or incorporated in the U.S.

If your business meets these requirements, you're well-positioned to move forward with an unsecured business loan application and receive funding quickly through Clarify's lender network.

How Do Unsecured Business Loans Work?

Unsecured business loans let you borrow money without requiring collateral, such as business assets or personal property. Instead, lenders evaluate your creditworthiness based on factors like your credit score, cash flow, time in business, and monthly revenue.

If approved, your loan offer will include key details such as the interest rate, repayment terms, and any applicable fees, including an origination fee charged by the lender for processing your loan.

Because there's no collateral backing the loan, lenders take on more risk, so they offset that risk in other ways:

Stricter eligibility requirements. You'll typically need stronger revenue or credit history to qualify.

Higher interest rates. Rates are often higher than those on secured loans because there's no collateral to recover in case of default.

Shorter repayment terms. Most unsecured loans have terms ranging from three to 24 months.

Personal guarantees. Many lenders require the borrower to personally guarantee the loan, meaning you're responsible for repayment even if the business is unable to pay.

Unsecured business loans are a popular choice for working capital, inventory purchases, and covering short-term expenses, especially when speed and flexibility matter more than securing the lowest possible rate.

Types of Unsecured Business Loans

There are different types of unsecured business loans, which is a good thing, as one financing option may offer a better solution for your business needs than another. Here are a few unsecured business loans to consider.

Whether you need a short-term loan, line of credit, or merchant cash advance, unsecured loans offer flexible credit products that don't require collateral, making them a good fit for many small business owners.

Unsecured Short-Term Loans

Best loan for: Business owners who need fast funding with minimal documentation.

For many, traditional business loans refer to unsecured short-term loans, which are the simplest form of financing to understand.

With a short-term loan, you can get a lump sum of cash at a fixed rate without collateral. You repay the money in set monthly payments based on the specific life of the loan, usually up to two years.

At Clarify Capital, we've streamlined our online application to get you approved within minutes. Interest rates start at 7% for credit scores over 550.

These are the key benefits of unsecured short-term loans:

Any type of business can get approved

No collateral requirements

Competitive interest rates offered by over 75 lenders

Highest approval ratio

Early payoff incentives

Unsecured Business Line of Credit

Best loan for: Entrepreneurs who need a revolving line of credit without collateral.

A business line of credit is a form of revolving credit. It's similar to a business credit card in that you can draw funds from your credit line when business expenses arise. You're only charged interest on the funds you withdraw. This condition makes a revolving business line of credit a great loan option to cover day-to-day working capital.

Lenders typically offer unsecured credit lines with lower loan amounts and shorter term lengths compared to their secured alternatives. However, it's still a great financing option for business owners looking to borrow capital with flexible repayment terms.

These are the key benefits of unsecured business lines of credit:

No prepayment penalties

Lower interest rates than credit cards (starting at 6%)

Helps increase your personal credit rating

Funds are available for use on demand

Unsecured Invoice Financing

Best loan for: Business owners who want to get paid for outstanding accounts receivable.

Also known as factoring, invoice financing lets borrowers sell their outstanding invoices and get paid in advance. The invoices themselves are collateral, so you don't need to risk any assets.

You get between 85% and 100% of the invoice value up front. When the invoices come due, the factoring company collects from your customers. Then they take their fee and pay you any remaining balance.

This type of loan is one of the few options where your personal credit score isn't one of the main criteria in the approval process. Lenders focus more on your customer's creditworthiness, making invoice factoring a good funding option for owners with bad credit.

Here are the key benefits of unsecured invoice financing:

No personal credit score requirement

Get instant cash flow without taking on new business debt

Quick approvals

Your unpaid invoices act as collateral

Merchant Cash Advance

Best loan for: Entrepreneurs who need a lump sum of cash in exchange for a percentage of future sales.

A merchant cash advance (MCA) is a financing solution based on your creditworthiness, past sales, and future sales. You receive a lump-sum loan that you repay daily or weekly through a portion of your future sales. It's a loan option that can help business owners bridge cash flow gaps and deal with unexpected expenses.

An MCA covers your immediate needs for cash but won't leave you taking on more debt. The loan payment schedule is flexible, as you only pay as much as your sales. That's why retail businesses and restaurants are a good fit for merchant cash advances due to the seasonality of the industry.

Here are the key benefits of a merchant cash advance:

Personal credit score isn't a factor

Easy approval process

You're borrowing against future credit card transactions

No collateral needed

Flexible payment terms

How To Apply for an Unsecured Business Loan

Access to capital is a common necessity for business survival and growth. As a business owner, you wear multiple hats, and your to-do list is long.

You don't have the time to spend researching lenders and going to the bank to apply for loans, especially if you don't have many assets to act as collateral or a personal guarantee.

That's why our application process at Clarify is quick and easy. Filling out the online form takes just minutes, and then we do the work to get your business approved and funded in as little as 24 hours.

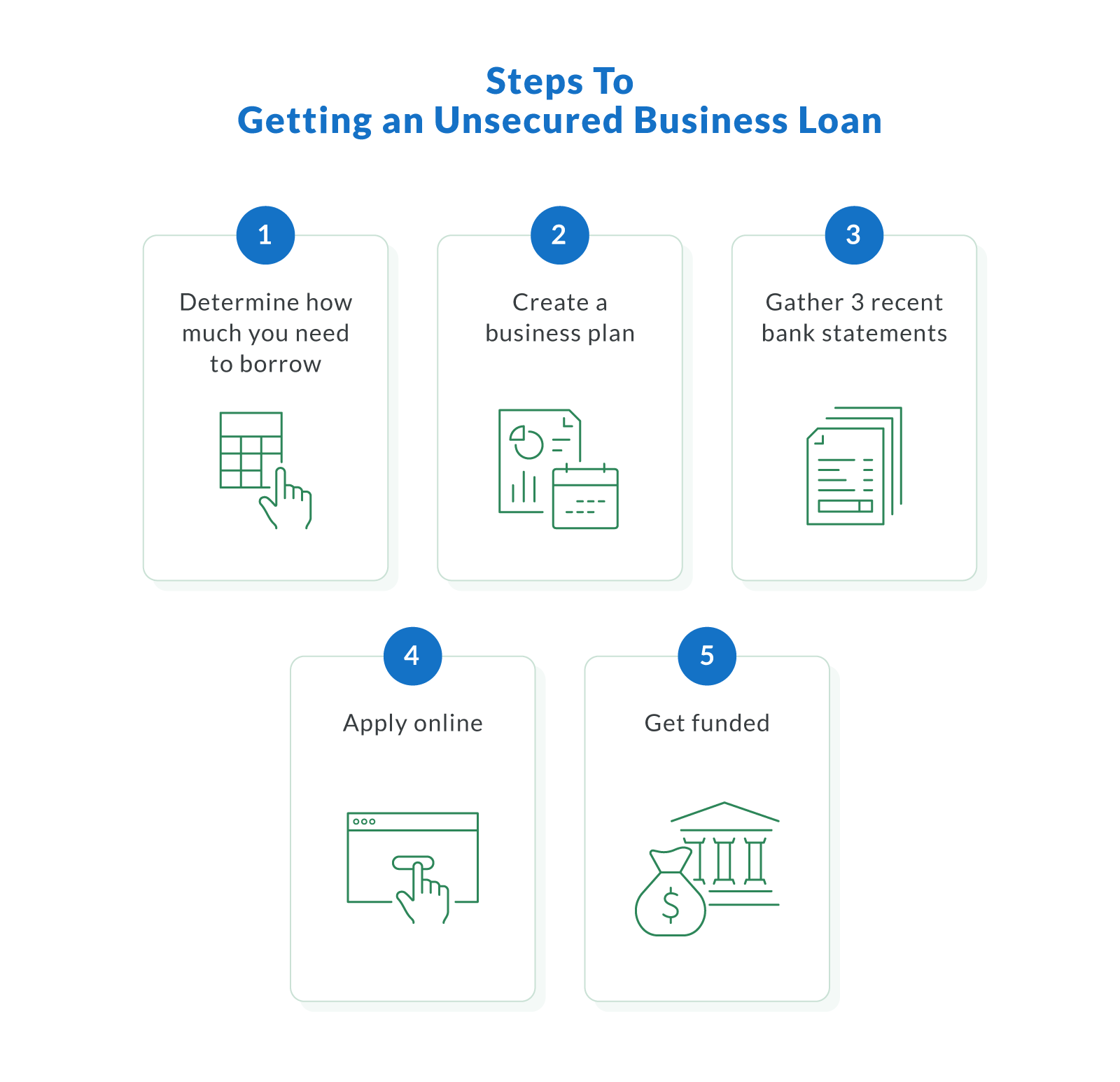

Here's a complete look at how our simple lending process works:

1. Determine How Much You Need To Borrow

Applying for a loan without knowing how much you need and for what purpose can put your business in a difficult situation when it's time to repay. It's good to go in knowing how much you need and how much you can afford to borrow.

If you're using the money for working capital, list the business expenses you expect to pay soon. These expenses may include office rent, employee salaries and wages, and inventory.

If you're using the capital to fund business expansion, jot down all expenses you may incur and add at least 10% for contingency. Crunching the numbers will give you a reliable estimate of how much capital you really need.

2. Create a Business Plan

While many unsecured business loan providers don't require a formal business plan, having one can strengthen your application, especially if you have a limited credit history.

A business plan is especially helpful if:

You're applying for a higher loan amount

Your personal credit score is on the lower side

You're seeking business financing for a new product, expansion, or major capital expense

Including a clear plan helps lenders understand your business model, how you'll use the working capital, and how you expect to generate the revenue to repay the loan. It builds confidence in your creditworthiness, even when you're not offering collateral.

3. Gather the Necessary Documents

After we review your application, we'll match you with a dedicated advisor who will answer any questions you may have and help you choose the best loan option based on your personal financial needs.

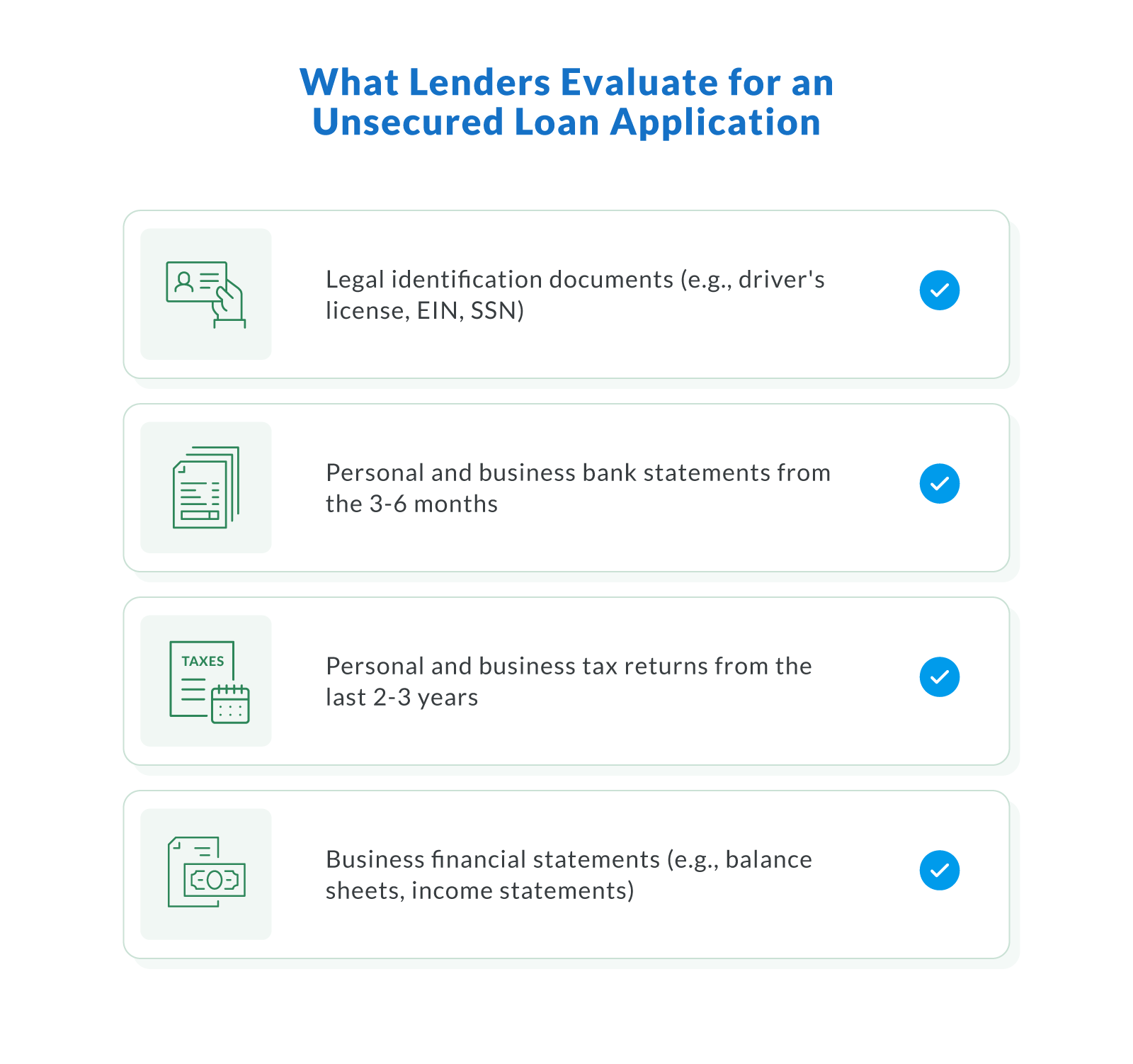

To make the process quick and easy, we suggest keeping the following documents handy:

Legal identification documents, such as a driver's license, employer identification number (EIN), and Social Security number (SSN)

Personal and business bank statements from the last three to six months

Personal and business tax returns from the last two to three years

Business financial statements, such as balance sheets and income statements

Lenders don't just look at your personal or business credit score; they evaluate several factors when reviewing your loan application.

Here's what most online lenders and financing providers consider when assessing your eligibility for an unsecured business loan:

4. Apply Online

At Clarify, we take ease of funding and quick approval times seriously. That's why our application process takes three quick steps.

Fill out our online application, which takes two minutes, or call to speak with a Clarify advisor.

5. Get Funded

Depending on the loan amount and eligibility requirements you're able to present when applying for a loan, you may be able to get approved within one business day. Once you're approved, the money is wired to your bank account (either business checking account or savings) in as little as 24 hours!

How To Qualify With a Low Credit Score

If your credit score isn't perfect, you can still qualify for an unsecured business loan, especially with alternative lenders who take a more holistic view of your financial picture.

Here are ways to improve your approval odds:

Show consistent revenue. Lenders prioritize stable cash flow. If your business brings in $10,000+ per month, that's often more important than a high credit score.

Highlight business performance. Documentation like bank statements, profit/loss summaries, or POS reports to show financial stability and growth trends.

Build a short-term plan. Even if not required, having a simple plan for how you'll use and repay the loan helps show you're prepared.

Consider a co-signer. If your credit score is below 550, having someone with stronger credit vouch for the loan can improve your chances, and may even help lower your rate.

Clarify works with over 75 lenders, so even if you've been turned down before, we'll help you find the best available option for your situation.

How Fintech Lenders Are Reshaping Unsecured Business Loans

The rise of fintech lenders has made unsecured business loans more accessible than ever. Unlike traditional banks, which often require extensive documentation and collateral, fintech lenders streamline the process by using technology-driven underwriting models.

Here's how fintech lenders are revolutionizing business financing:

Faster approval times. Automated risk assessments allow some lenders to approve loans within minutes and disburse funds the same day.

Flexible requirements. Rather than focusing solely on good credit scores, fintech lenders consider factors like cash flow, revenue trends, and digital payment history.

Alternative funding options. Many fintech lenders offer invoice factoring, merchant cash advances, and revenue-based financing, providing businesses with more tailored funding solutions.

As digital banking and AI-driven underwriting continue to evolve, unsecured loans will become even more accessible to startups and small business owners who need quick, flexible financing solutions.

Ways Fintech Lenders Are Using Data To Offer Smarter Loans

Modern fintech lenders are going beyond traditional credit scores. Many now analyze business performance data like POS transactions, accounting software activity, and digital banking behavior to assess creditworthiness.

This shift means businesses with strong operations, even without perfect personal credit, can still qualify for competitive financing. It's part of a broader move toward real-time underwriting, where up-to-date business metrics help lenders deliver faster, more accurate loan decisions.

At Clarify, we partner with tech-forward lenders who look at the whole picture, not just your credit report, to match you with smart funding options.

Ways To Use an Unsecured Business Loan

Most business owners use short-term loans, lines of credit, invoice factoring, and merchant cash advances (MCAs) as working capital. Flexibility in terms of use is one of the advantages of unsecured financing.

Here are the most common ways entrepreneurs use unsecured loans:

Inventory purchases. Inventory is the biggest expense for many businesses, and it's the reason why most small business owners take out loans. It's especially true in industries like retail and restaurants, where keeping inventory stocked is key to success, especially for peak seasons with higher product demands.

Getting operational cash flow. Managing cash flow is one of the most challenging aspects of running a business. Cash flow gaps can happen for many reasons, such as delayed customer payments or emergencies. In the event of cash flow gaps, entrepreneurs rely on small business loans to handle day-to-day expenses without worrying about hitting the credit limit on a high-interest credit card.

Refinancing debt. Refinancing existing debt is another way business owners use unsecured loans. Often, borrowers consolidate their debt to lower their monthly payments or receive additional funds.

Hiring employees. At times, companies need to hire new staff to grow their business. When growth opportunities are available, an unsecured business loan allows you to expand your team. The funding lets you pay salaries and employee training.

Comparing Secured & Unsecured Business Loans

When evaluating financing options, understanding the key differences between secured and unsecured loans can help you choose the right type of funding for your business goals. The table below highlights how these two options compare across core lending criteria:

| Secured vs. Unsecured Business Loans | ||

|---|---|---|

| Feature | Secured business loan | Unsecured business loan |

| Collateral required | Yes — typically real estate, equipment, or other business assets | No collateral required |

| Approval requirements | More flexible due to lower lender risk | Stricter, with emphasis on credit score, revenue, and cash flow |

| Interest rates | Lower, due to reduced lender risk | Higher, to offset increased risk |

| Loan amounts | Typically higher | Often lower than secured loans |

| Repayment terms | Longer, often several years | Shorter, usually three to 24 months |

| Speed of funding | Slower due to asset verification | Faster — sometimes same-day approval |

| Risk to borrower | Lender can seize pledged assets if the loan defaults | May require a personal guarantee, but no asset seizure risk |

| Best for | Businesses with assets seeking larger or lower-cost loans | Fast cash needs, asset-light businesses, or newer companies |

Is an Unsecured Business Loan Right For You?

Unsecured business loans are best for owners who need fast, flexible funding and don't want to put business or personal assets at risk. If any of the situations below sound like yours, this type of financing may be a strong fit:

You don't have collateral. Your business is asset-light, or you'd rather not pledge property to secure a loan.

You need funding quickly. You have an urgent expense and can't wait weeks for a traditional loan decision.

You have solid revenue but limited credit. A consistent $10,000+ in monthly income can outweigh a lower credit score with many lenders.

You're a newer business. Startups and businesses under two years old often find unsecured options more accessible than bank loans.

You want shorter terms. You're looking to borrow a modest amount and repay it in under two years.

If your top priority is speed and simplicity, not the lowest possible rate, an unsecured business loan can help you move fast without tying up your business assets.

Why Choose Clarify Capital To Get an Unsecured Business Loan?

At Clarify, we believe every business owner deserves fast, reliable access to capital, no matter what industry you're in. Our streamlined application process makes it easy to secure funding without the hassle. We offer no-collateral business loans with competitive APRs, so you can focus on growth, not paperwork.

Here are just a few ways Clarify is changing the business lending industry:

A simple, three-step online application that takes just minutes to complete, with support from a dedicated Clarify advisor

Faster approvals than traditional banks, with decisions often made in as little as one business day

Flexible repayment terms ranging from six months to two years, tailored to your cash flow

One application that connects you to a network of more than 75 lenders, reducing paperwork and delays

No collateral required, helping protect your business and personal assets

Clear, transparent terms with no hidden fees, so you know exactly what you're signing

Competitive interest rates based on your credit profile and revenue, not just your credit score

Interest payments that may be tax-deductible, which can help lower your overall borrowing cost

Get an Unsecured Business Loan Today

Need funding without putting your assets on the line? Clarify Capital offers unsecured business loans tailored to your needs, from short-term working capital to merchant cash advances.

Our streamlined application process gets you approved in as little as 24 hours. Use the funds for inventory, equipment, expansion, or everyday operations; no collateral, no hassle.

With a dedicated financing advisor by your side, you'll receive expert guidance on making the smartest financial decisions and choosing the best loan option for your business's growth.

Ready to get a small business loan? Get instant approval when you apply online with Clarify Capital. APRs starting at just 6%. Flexible repayment options are available for credit scores of 550 or higher.

FAQ About Unsecured Business Loans

Here are our answers to common questions from business owners looking to get a loan without collateral.

How Fast Can I Get Funded With an Unsecured Business Loan?

Lenders will approve most unsecured loans within 24 to 48 hours. Funds can be deposited in your business bank account as soon as the same day, depending on the lender and your business credentials.

How Long Does It Take To Get Approved for an Unsecured Loan?

Approval times vary, but many online lenders offer same-day approval if your documents are in order and your business meets the revenue and credit requirements.

Are There Penalties for Paying Off an Unsecured Business Loan Early?

Some lenders charge prepayment penalties or fees. Always check your loan agreement for details. Clarify Capital does not charge prepayment penalties on most unsecured term loans.

Is a Personal Guarantee Required for Unsecured Business Loans?

Yes, most lenders require a personal guarantee, even if no collateral is needed. This guarantee means you agree to repay the loan personally if your business is unable to do so.

What's the Difference Between a Secured and Unsecured Business Loan?

A secured loan requires you to pledge assets as collateral (like equipment or property), while an unsecured loan does not. Unsecured loans often have higher interest rates but faster approvals.

Do Unsecured Business Loans Affect My Credit Score?

Yes, lenders may perform a soft or hard credit check during the application process, and your repayment behavior can impact your personal and business credit scores.

Can an LLC Get a Loan With No Credit?

LLCs almost always need a minimum credit score of 550 to get unsecured business loans. Most banks will deny loans to LLCs with no credit.

Keep in mind, though, that most banks prioritize your revenue stream, and by meeting other eligibility criteria, it may be possible for startups with low credit to get a loan.

Discuss your situation with your financial advisor, and they will likely be able to provide solutions that meet your needs.

What's the Minimum Credit Score for an Unsecured Loan?

In most cases, the minimum credit score needed for unsecured business loans is 550. However, with a co-signer, it may be possible for business owners to get a loan with a credit score lower than 550.

What's the Average Interest Rate on Unsecured Business Loans?

On average, interest rates can range between 8.99% and 29.99%, depending on your specific lender, credit score, loan terms, and business revenue. The stronger your credit score and revenue stream are, the more likely it is that your business can qualify for lower interest rates.

Can I Get a Loan With Just My EIN?

EIN-only business loans are rare, but possible in specific cases. Most lenders still review the owner's personal credit and often require a personal guarantee. EINs matter more for revenue-based options like invoice financing or merchant cash advances. In most cases, “EIN-only” means flexible credit requirements, not zero credit review.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts