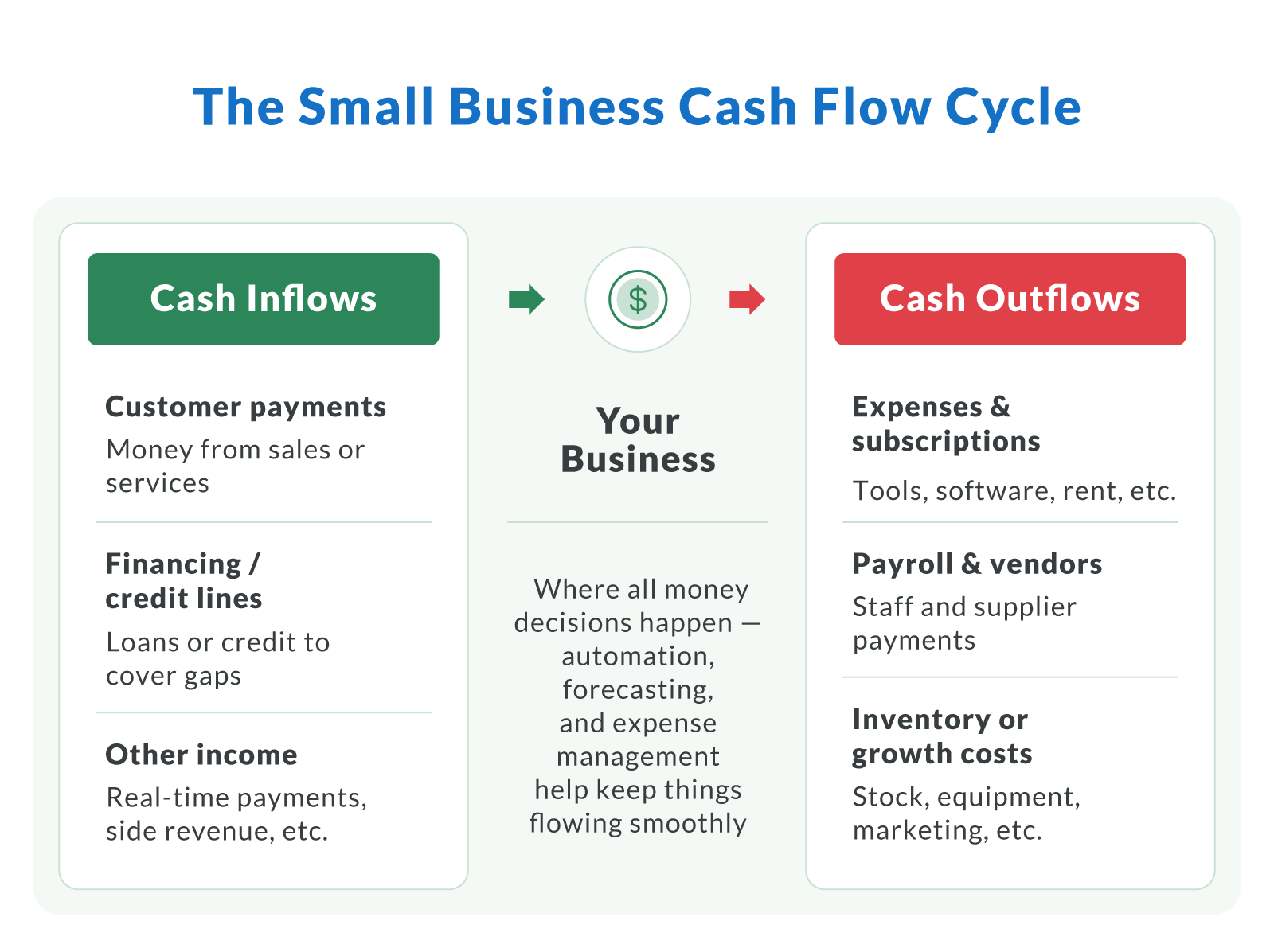

Cash flow is the lifeline of your business, and in 2025, it's more important than ever to keep it strong and steady. Between rising costs, shifting consumer habits, and faster financial tech, managing your money well isn't optional — it's essential. For small business owners facing late payments, tight margins, or sudden dips in revenue, the ability to pivot quickly can mean the difference between growth and closure.

If you're feeling the pressure, you're not alone. A full 82% of small businesses fail due to cash flow problems.

This guide gives you practical ways to increase cash flow for small businesses, using smart tools and repeatable strategies. From automating invoicing to adjusting payment terms, you'll find techniques that strengthen your financial health — and help you stay ahead in today's economy.

12 Smart Cash Flow Techniques for Small Businesses in 2025

Managing cash flow is about more than tracking what comes in and out. It's about making smart decisions that improve timing, reduce delays, and give your business more breathing room. These 12 tactics are built for small businesses navigating 2025's challenges — from automation to inflation to tightening payment cycles.

1. Automate Your Accounts Receivable Process

Manually managing invoices is time-consuming and full of risk. Automating your AR process helps streamline operations, reduce errors, and improve cash inflows. Businesses that use AR automation report speeding up invoice cycles by as much as 60%, and some save over $34,000 a year by reducing processing costs.

How to implement:

Use tools like QuickBooks, FreshBooks, or Zoho to manage invoices.

Set up recurring billing and automated follow-up emails.

Monitor AR dashboards to optimize collection timelines.

2. Negotiate Early Payment Discounts

One of the simplest and most effective cash flow techniques is offering early payment discounts to improve payment speed. Even a 1% to 2% discount can motivate clients to pay ahead of schedule. Payment terms like “2/10 Net 30” are commonly used by B2B companies and have been shown to reduce average days-to-pay.

How to implement:

Add terms like “2/10 Net 30” to invoices.

Configure your accounting software to apply discounts automatically.

Track how different customers respond to fine-tune your strategy.

3. Extend Payables — Without Damaging Vendor Relationships

Delaying your own payments — without burning bridges — can protect working capital during tight cycles. In the UK, over a quarter of small businesses report being owed £5,000 to £20,000 because of delayed receivables. That kind of lag makes it even more important to manage your payables strategically.

How to implement:

Ask long-time vendors for 45-60 day terms.

Group payments to better manage cash outflows.

Use a line of credit for tight months to avoid default and keep your accounts payable on track.

4. Perform a Subscription and Expense Audit

Recurring charges sneak up fast — especially when you're juggling tools, platforms, and software. A quarterly audit can reveal hidden costs and free up cash that's better used elsewhere. One business, U Inc., slashed over $15,000 in SaaS spending within two months by auditing its subscriptions using Applogie.

How to implement:

Review all active SaaS tools and services every quarter.

Cancel or downgrade anything underused.

Use spend management software to flag recurring charges early.

5. Use a Line of Credit as a Buffer

An open line of credit gives you financial breathing room when invoices are late or sales are slow. According to the FDIC, nearly 89% of small businesses with a credit line use it for working capital, and over 85% use it to purchase inventory.

How to implement:

Apply through fintech platforms for faster decisions.

Use funds only to cover temporary cash gaps.

Compare rates and terms regularly to minimize cost.

6. Incentivize Faster Customer Payments

Chasing payments is a time drain — and a major source of stress. Offering loyalty perks or small discounts can encourage clients to pay faster. In fact, small business owners spend up to 10% of their workday following up on unpaid invoices.

How to implement:

Create loyalty programs tied to on-time payments.

Test different discount levels to see what motivates faster action.

Combine with AR automation to trigger reminders and apply rewards automatically.

7. Forecast Cash Flow Weekly

Cash flow surprises can derail even the most promising businesses. That's why building a rolling 12-week forecast is one of the smartest habits you can adopt. In early 2025, 63% of small businesses said their confidence in cash management had dropped, largely due to poor forecasting.

How to implement:

Use tools like Float or Pulse to automate your forecast.

Update it weekly with real-time cash inflows and outflows.

Use it to guide spending and funding decisions ahead of schedule.

8. Shift to Real-Time Payment Platforms

Traditional payment methods like checks or ACH can take days to clear, but real-time platforms like RTP, Zelle, and PayPal speed things up significantly. Nearly 79% of small businesses now say they want their primary financial institution to offer faster payment options.

How to implement:

Enable real-time options within your invoicing or POS software.

Educate clients on how to use these platforms.

Prioritize payment methods that reduce processing time and boost cash inflow.

9. Implement Spend Controls for Teams

When expenses go unchecked, cash flow takes the hit. Unlike traditional credit cards, prepaid business cards allow you to control spending before it happens. Tools like Volopay note that prepaid business cards can reduce overspending and give you real-time visibility into team spending.

How to implement:

Use platforms like Divvy, Ramp, or Brex to issue employee cards.

Set spending limits by category or department.

Review dashboards weekly to spot overages or policy issues.

10. Prepare for Seasonal Fluctuations

Seasonal dips often lead to negative cash flow, especially when expenses stay steady but sales drop. Whether it's a summer lull or a holiday spike, modeling your cash inflows and outflows around your busy and slow periods helps you stay balanced. Still, 22% of small businesses say they struggle to cover bills during seasonal dips.

How to implement:

Use past sales and expense data to forecast seasonal highs and lows.

Build reserves during peak months to cushion the slow ones.

Negotiate flexible payment terms with vendors in advance.

11. Use Supply Chain Financing

If you need to delay payments to suppliers without harming relationships, supply chain financing (SCF) can help. Businesses using SCF platforms have reported up to 30% improvements in liquidity, especially in industries with long lead times.

How to implement:

Explore fintech lenders that specialize in SCF.

Talk to major suppliers about financing options they offer.

Use SCF for large orders or high-value invoices where flexibility matters.

12. Build a Cash Reserve Fund

A cash reserve is your safety net when the unexpected hits — whether it's a late client payment or a sudden expense. Aim to save an amount of cash that covers at least three to four months of operating expenses. Yet, over 70% of small businesses report holding less than four months of cash in reserve.

How to implement:

Allocate 5% to 10% of profits each month into a separate savings account.

Use high-yield business savings accounts to grow the balance.

Review your reserve quarterly and adjust targets based on upcoming needs.

Need help crafting follow-up emails that get results? Download our free pack of follow-up email templates designed to help you get paid faster — with less stress.

Download The templatesLeverage Automation and AI Forecasting

Cash flow isn't just about watching what's in the bank today — it's about predicting what's coming next. With tighter margins and more volatility in 2025, small businesses need smarter ways to stay ahead. That's where automation and AI forecasting come in.

Tools like Float, Pulse, and LivePlan use AI to automate projections based on your historical data and real-time transactions. They flag potential shortfalls, help you adjust quickly, and take a lot of guesswork out of planning. And it's not just forecasting — invoice automation alone can cut processing costs by up to 70%.

You don't need to be a financial expert to benefit from this tech. Most modern accounting software platforms include built-in tools for cash flow visualization, trend spotting, and proactive alerts. These features give you a clearer picture of your financial health, without hours of spreadsheet work.

As 2025 continues to demand faster, leaner decision-making, leveraging automation is one of the most reliable ways to boost efficiency and build resilience.

Renegotiate Payment Terms With Customers

Late payments aren't just frustrating — they're one of the biggest threats to your cash flow. Over 55% of B2B invoices are overdue, and small business owners spend an average of 14 hours per week just following up on unpaid invoices.

To fix this, take a proactive approach to your payment terms. Offer early payment discounts, enforce stricter due dates, and build a structured follow-up system to keep your accounts receivable process on track.

Steps to implement:

Add incentive-based terms like “2/10 Net 30” to encourage prompt payments.

Send polite but firm follow-up messages on and after the due date — and escalate if needed.

Segment customers based on payment habits and assign different terms for frequent late payers.

You don't have to overhaul your system overnight; tightening your approach can lead to fewer delays and stronger cash flow.

Explore Alternative Financing Options

Even the best-run businesses experience cash flow gaps. When that happens, having access to short-term financing can give you the flexibility to cover expenses without halting operations. Whether it's a line of credit, a merchant cash advance, or invoice factoring, alternative funding solutions are faster and often more accessible than traditional bank loans.

Unlike long-term debt, short-term financing is designed to support day-to-day operations — especially when you're waiting on receivables or dealing with a seasonal slowdown. And you don't need perfect creditworthiness to qualify. Many online lenders look at revenue history and cash flow, not just your credit score.

Steps to explore financing:

Research fintech lenders that specialize in fast approvals for small businesses.

Use a line of credit as a cushion — only draw when you need it, and pay it back quickly.

Compare interest rates carefully. The average rate for SMB term loans was 7.31% in 2024, but it ranges widely depending on the product.

Alternative financing isn't a long-term solution, but it can keep your business moving when cash is tight.

Cash Flow Management by Business Type

Cash flow challenges look different depending on your business model. A seasonal retailer, for example, faces very different risks from a subscription-based software company. Tailoring your cash flow management strategy to your business type can help you anticipate problems and plan more effectively.

Retail Businesses

Inventory and overhead can tie up large amounts of cash. It's crucial to balance inventory management with demand forecasting so you're not overspending before your revenue arrives.

Tips:

Use historical sales data to set purchasing schedules.

Negotiate payment terms with suppliers based on your sales cycle.

Reduce slow-moving stock to improve cash on hand.

Service-Based Businesses

Your challenge is often delayed payments and high labor costs. Getting paid faster improves cash inflows without adding debt.

Tips:

Require upfront deposits for large projects.

Use automated invoicing to speed up collections.

Offer early payment incentives to reduce late payments.

Seasonal Businesses

Fluctuations in revenue require extra planning. Operating expenses don't stop just because your customers do.

Tips:

Build reserves during high-revenue months.

Consider a subscription model to flatten out your revenue curve.

Use supply chain data to project seasonal shortages or delays.

Across the board, knowing your business's cash rhythm — and adjusting your tools and strategy accordingly — helps keep your operations strong and predictable.

Build a Healthier Cash Flow Strategy

In today's economy, small businesses need more than a basic budget — they need a plan to increase cash flow, protect against surprises, and fuel sustainable growth. From automating invoices to adjusting payment terms and using alternative financing, the strategies in this guide are built to help you take control of your financial future.

The goal isn't just survival — it's long-term financial growth. When you're managing cash intentionally, you can make better hiring decisions, invest in marketing, and expand your offerings with confidence. A well-maintained cash flow statement isn't just paperwork — it's your roadmap to smart decision-making.

Ready to take the next step?

Download the Free Cash Flow ToolkitYou can also check out Clarify Capital 's funding options or schedule a call with an advisor to get personalized cash flow support.

Frequently Asked Questions

Still have questions? Here are clear, actionable answers to common concerns about managing cash flow for small businesses.

What Is the Best Way To Manage Cash Flow in a Small Business?

The most effective approach to cash flow management includes tracking cash inflows and outflows weekly, forecasting ahead, and maintaining enough cash on hand for at least two to three months of expenses. Automating your invoicing and payment reminders can also reduce delays and improve predictability.

How Can Automation Help Improve Cash Flow?

Automation speeds up your accounts receivable process, cuts invoicing costs, and lets you spot issues early with real-time dashboards. You'll spend less time chasing late payments and more time focusing on growth.

What Are Early Payment Discounts, and How Do They Work?

These are incentives you offer to customers who pay their invoices before the due date. For example, “2/10 Net 30” means a 2% discount if paid within 10 days. This can significantly improve cash inflows and reduce the time your cash is tied up in outstanding invoices.

How Do Late Payments Impact My Cash Flow?

Late payments create unpredictable cash flow, making it harder to cover your operating expenses or take advantage of growth opportunities. They often force businesses to dip into reserves or take on debt to stay afloat.

What Should Be Included in a Cash Flow Forecast?

A good cash flow forecast should include projected income, expected expenses, due dates, seasonal variations, and a rolling view of your working capital. It helps you anticipate shortfalls and make smarter decisions ahead of time.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts