Ever dreamed of owning a successful business but didn't want to start from scratch? There are tons of financing options available to help you make that dream a reality.

Enter business acquisition loans. These financial tools are designed specifically to help entrepreneurs like you buy existing businesses. They bridge the gap between your dreams of business ownership and the often substantial price tag that comes with acquiring an established company.

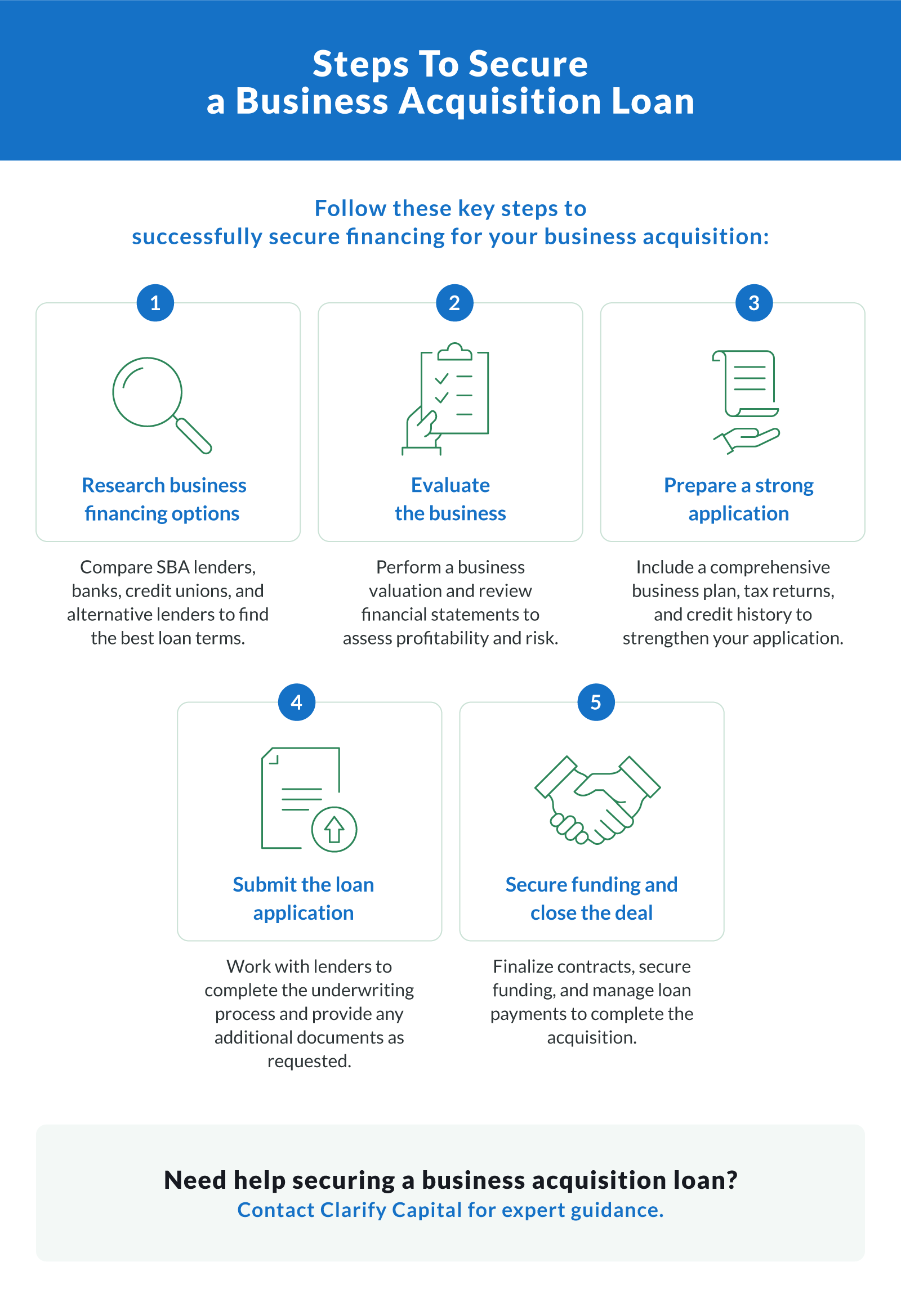

In this comprehensive guide, we'll walk you through everything you need to know about business acquisition loans. From understanding the different types available to navigating the application process, we've got you covered. You'll learn how to evaluate the business you want to buy, compare loan options, and increase your chances of approval.

Whether you're a first-time buyer or a seasoned entrepreneur looking to expand your portfolio, this guide has all the knowledge you need to make informed decisions about business acquisition financing. Let's get started on your journey to business ownership!

Types of Business Acquisition Loans

When you're looking to buy a business, you'll find several types of loans at your disposal. Let's break them down:

SBA loans. These government-backed loans are a popular choice for many buyers. The SBA 7(a) program, in particular, offers competitive terms and can cover up to 90% of the purchase price.

Traditional bank loans. Many banks offer acquisition financing, often with favorable rates for qualified borrowers. These loans often call for a strong credit history and substantial collateral.

Lines of credit. While not specifically for acquisitions, these can provide flexible working capital during and after the purchase process.

Equipment financing. If the business you're buying has valuable equipment, you might secure a loan specifically for those assets.

Alternative financing options. Online lenders and other non-traditional sources can offer more flexible terms, often with a faster approval process.

Each loan type has its pros and cons, so always consider your specific situation when choosing. For example, SBA loans offer great terms but have a lengthy application process, while alternative lenders might be quicker but charge higher interest rates.

How Business Acquisition Loans Work

The process of getting a business acquisition loan isn't too different from other business loans, but there are some unique aspects to keep in mind:

Application process. You'll need to submit a loan application along with detailed information about the business you want to buy. This includes financial statements, tax returns, and often a business plan.

Approval timeline. The timespan from your application to loan approval can vary widely, from a few days with some online lenders to several months for SBA loans.

Loan amount and purchase price. Lenders typically won't finance 100% of the purchase price. You'll usually need to contribute a down payment, often 10-30% of the total.

Disbursement. Once approved, the lender will typically pay the seller directly rather than giving you the funds.

Repayment terms. These can range from a few years to 25 years for some SBA loans. Your monthly payment amounts will be based on your loan amount, interest rate, and term length.

Working capital. Some acquisition loans include extra funds for working capital to help you manage cash flow in the early days of ownership.

Your loan's structure can significantly impact your new business's financial health, so make sure you understand all the terms before signing.

Eligibility Requirements for Business Acquisition Loans

Qualifying for a business acquisition loan isn't always easy, but knowing the requirements can help you prepare. Here's what most lenders look for:

Credit score. A good personal credit score is crucial. Many lenders require a score of at least 680, with some demanding 700 or higher for the best terms.

Down payment. Be prepared to put down 10-30% of the purchase price. The total amount is based on the lender and loan type.

Creditworthiness. Beyond your credit score, lenders will examine your overall financial health. This includes your debt-to-income ratio and any past bankruptcies or defaults.

Business financials. The business you're buying needs to show strong financial performance. Lenders will scrutinize its cash flow, revenue, and profitability.

Industry experience. Many lenders prefer borrowers with experience in the industry they're entering.

Collateral. You may need to offer business or personal assets as collateral.

Eligibility requirements can vary significantly based on the lender and loan types you go with. For example, SBA loans might have more stringent requirements but offer better terms, while some online lenders might be more flexible but charge higher rates.

Costs To Consider and How To Prepare

When securing a business acquisition loan, it’s crucial to be aware of potential costs beyond just the purchase price. Understanding these financial considerations upfront can help borrowers plan effectively and avoid unexpected cash flow strain.

Loan Fees and Interest Rates

Origination fees. Lenders typically charge a percentage of the loan amount as an upfront fee.

Interest rates. Rates vary based on credit history, lender type (SBA lenders, credit unions, or online lenders), and loan program.

Prepayment penalties. Some loans charge fees for early repayment, especially term loans with long repayment terms.

Down Payment and Working Capital

Down payment requirements. Most lenders require 10-30% down, depending on the loan program and borrower eligibility.

Working capital needs. Many small business acquisition loans provide additional working capital to help fund the transition period.

Legal and Due Diligence Costs

Business valuation. Hiring a professional for an existing business valuation ensures you’re not overpaying.

Letter of intent and contracts. Legal fees for structuring contracts, seller financing, and compliance with financial institutions can add up.

Tax obligations. Understanding the tax returns and financial health of the existing company prevents post-acquisition surprises.

By planning for these factors early in the loan process, business owners can better manage cash flow and ensure a smooth transition into business ownership.

The Role of SBA Loans in Business Acquisitions

SBA loans, particularly the SBA 7(a) program, play a significant role in business acquisitions. Here's why they're worth considering:

Favorable terms. SBA loans tend to include lower interest rates and longer repayment terms than conventional loans. This can mean lower monthly payments, which is crucial when you're taking over a business.

Lower down payments. While you'll still need to put money down, SBA loans typically require smaller down payments than traditional bank loans.

Flexibility. SBA loans can be super helpful for many things beyond just buying the business, including working capital or equipment purchases.

However, SBA loans aren't without drawbacks:

Lengthy process. The application and approval process can take several months, which might not work if you need to move quickly on a purchase.

Strict requirements. The Small Business Administration sets stringent eligibility criteria that both you and the business must meet.

Paperwork. Be prepared for a lot of documentation. SBA loans require extensive financial records and business plans.

Despite these challenges, many entrepreneurs find that the benefits of SBA loans outweigh the drawbacks when it comes to financing a business acquisition. They can provide the substantial funding needed to buy a business while offering terms that help set you up for long-term success.

Preparing Your Business Acquisition Loan Application

A strong loan application can make or break your chances of securing financing for your business acquisition. Here's how to put your best foot forward:

Craft a solid business plan. This isn't just a formality—it's your chance to show lenders you've thought through every aspect of running the acquired business. Include:

Market analysis

Growth strategies

Financial projections for at least the next three years

Gather comprehensive financial documents. Lenders will want to see both your personal finances and the target business's financial health. Prepare:

Personal and business tax returns for the past three years

Recent financial statements, including balance sheets and income statements

A detailed list of assets and liabilities

Draft a clear letter of intent. This document outlines the terms of your proposed acquisition. Make it thorough but concise.

Prepare realistic financial projections. Show how you plan to grow the business and repay the loan. Be optimistic but grounded in facts.

Lenders look for assurance that you can successfully run the business and repay the loan. The more thorough and professional your application, the better your chances of approval.

Evaluating the Business You Want To Acquire

Before you commit to buying a business, conduct thorough due diligence. This process helps you understand what you're getting into and can inform your loan application. Here's what to focus on:

Business valuation. Determine a fair price for the business. You may want to hire a professional appraiser to get an objective valuation.

Financial health assessment. Dig into the company's financial track record. Look for:

Consistent revenue growth

Healthy profit margins

Stable or improving cash flow

Asset and liability review. Understand what you're buying:

Tangible assets: equipment, inventory, real estate

Intangible assets: brand reputation, customer lists, intellectual property

Outstanding debts or potential legal issues

Market position analysis. Evaluate the business's competitive standing:

Customer base stability

Market share

Growth potential in the industry

Lenders will consider these same factors. A thorough evaluation helps you make an informed decision and strengthens your loan application by demonstrating your understanding of the business you're planning to acquire.

Checklist for Due Diligence

Financial records. Review tax returns, profit and loss statements, and balance sheets.

Legal and compliance. Ensure proper business licenses, contracts, and regulatory compliance.

Business operations. Assess customer retention, employee stability, and supplier relationships.

Debt obligations. Identify any existing company liabilities affecting business valuation.

Competitive landscape. Evaluate the market to ensure long-term business success.

Comparing Lenders and Loan Terms

Not all business acquisition loans are the same. Here's what to look into when comparing your options:

Interest rates. This is often the first thing borrowers look at, and for good reason. Even a small difference in interest rate can turn out to be thousands of dollars over the life of the loan. Compare lenders' annual percentage rates (APRs) to get the full picture of each loan's cost.

Repayment terms. Consider:

Loan duration. Longer terms might mean your monthly payments are nice and low, but you'll likely also pay more interest overall.

Payment frequency. Monthly payments are standard, but some lenders offer bi-weekly options.

Prepayment penalties. Will you be allowed to pay off the loan early without fees?

Lender types. Each has its pros and cons:

Traditional banks often offer competitive interest rates but have stringent requirements.

Credit unions might provide more personalized service and flexible terms for members.

Online lenders typically have faster approval processes but may charge higher rates.

Additional fees. Look out for:

Origination fees

Closing costs

Annual fees

Loan limits. Make sure the lender can provide the amount you need.

The lowest interest rate doesn't always mean the best deal. Consider the total cost of the loan and how well it fits your business's needs and cash flow projections.

Cash Flow Impact

| Loan Type | Loan Amount | Monthly Payments | Repayment Term | Cash Flow Impact |

|---|---|---|---|---|

| SBA 7(a) Loan | Up to $5M | Lower | 10-25 Years | Positive due to long repayment terms |

| Traditional Bank Loan | Varies | Medium | 5-10 Years | Moderate; requires strong revenue |

| Seller Financing | Varies | Negotiable | 3-7 Years | Flexible but may include higher rates |

| Lines of Credit | Varies | Revolving | Ongoing | Great for short-term working capital |

Alternative Financing Options for Business Acquisitions

While traditional loans are common, they're not the only way to finance a business acquisition. Here are some alternatives to check out:

Seller financing. In this situation, the seller is the lender. Benefits include:

Potentially easier qualification

Flexible terms

Seller's vested interest in your success

However, be prepared to provide a personal guarantee and negotiate terms carefully.

Equity financing. Bringing in investors can provide capital without the burden of debt. Consider:

Angel investors

Venture capital firms

Private equity groups

Remember, this means giving up some ownership and control of the business.

Asset-based financing. Use the business's assets as collateral. This can include:

Accounts receivable financing

Inventory financing

Equipment financing

Rollover for Business Startups (ROBS). This lets you use retirement funds to buy a business without incurring tax penalties. It's complex, so consult with a financial advisor.

Crowdfunding. While less common for acquisitions, platforms like Mainvest allow you to raise funds from multiple small investors.

Each of these options has its own set of pros and cons. The right choice depends on your specific situation, the business you're acquiring, and your long-term goals.

How To Structure a Business Acquisition Deal

When buying an existing business, structuring the deal properly can affect loan payments, tax implications, and business financing. The right structure depends on the business valuation, lender requirements, and seller financing options.

Common Deal Structures

Seller financing. The seller acts as the lender, allowing the buyer to pay over time. This often comes with competitive rates and fewer eligibility hurdles than traditional business lending.

SBA 7(a) loan structure. These small business loans often combine real estate, equipment, and working capital into one loan with long repayment terms.

Earnouts. A portion of the purchase price is contingent on future annual revenue, reducing upfront risk.

Equity partnerships. Entrepreneurs may bring in investors to reduce reliance on debt and share business assets.

Structuring the deal strategically helps borrowers secure financing with favorable loan terms while ensuring long-term profitability.

Tips for a Successful Business Acquisition Loan Process

Navigating the loan process can be challenging, but these tips can help smooth the way:

Build a strong credit history. This takes time, so start improving your credit score well before you apply for a loan. Pay all your bills on time, every time, and reduce outstanding debts.

Improve cash flow. Lenders want to see that you can manage money effectively. If you're already running a business, focus on:

Increasing revenue

Reducing unnecessary expenses

Improving collection of accounts receivable

Align the acquisition with clear business goals. Be prepared to explain how this purchase fits into your long-term strategy. This shows lenders you're thinking beyond just the acquisition.

Understand your financials inside and out. Be ready to discuss:

Your personal financial situation

The target business's financial health

Projected financial performance post-acquisition

Prepare for due diligence. Gather all necessary documents before you apply. This includes tax returns, financial statements, and business plans.

Be realistic about the business's value and your ability to repay. Overestimating can lead to taking on more debt than you can handle.

Consider working with a broker or advisor. Their expertise can be invaluable, especially if this is your first acquisition.

Keep in mind that lenders assess not just the business you want to buy but also your ability to run it successfully. The more prepared and knowledgeable you are, the better your chances of securing favorable loan terms.

Post-Acquisition Financial Management

Once you've secured business acquisition financing, managing cash flow, loan payments, and business expenses effectively is crucial.

Loan repayment strategy. Optimize monthly payments to maintain positive cash flow.

Operational efficiency. Reduce unnecessary costs and increase working capital reserves.

Growth investments. Use lines of credit or additional financing options for expansion.

Strong post-acquisition financial management ensures that your existing business thrives under new ownership.

The Future of Business Acquisitions

As the business acquisition landscape evolves, entrepreneurs must stay informed on financing trends and lender expectations.

Trends to Watch

Increased use of seller financing. More deals involve seller financing to navigate high interest rates.

Tech-driven underwriting. Financial institutions are using AI for faster loan applications and credit approvals.

More SBA-backed acquisitions. SBA loans continue to support small business owners with favorable repayment terms.

Understanding these shifts can help borrowers make informed decisions about business lending and acquisition financing.

The Road to Business Ownership

Acquiring a business is a significant step in your entrepreneurial journey, and securing the right financing is one of the main keys to your success. Throughout this guide, we've covered the ins and outs of business acquisition loans, from understanding the various types available to preparing a stellar loan application.

A successful business acquisition involves thorough preparation and careful consideration of your financing options. Whether you opt for an SBA loan, traditional bank financing, or alternative methods, make sure you understand the terms and how they align with your business goals.

As you move forward, keep these main points in mind:

Do your due diligence on the business you want to acquire

Write a solid business plan and financial projections

Improve your personal and business credit scores

Compare multiple lenders and loan terms

Consider working with financial advisors or loan brokers for expert guidance

Business acquisition financing can be complex, but with the right approach, it can also be the key to unlocking your entrepreneurial dreams. Don't be afraid to ask questions, seek professional advice, and take your time to find the best financing solution for your needs.

Ready to own your dream business? Visit Clarify Capital to explore your options and start your business acquisition journey today. With the right financing partner, you'll be well on your way to becoming a successful business owner.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts