What Are the Differences Between Short-Term and Long-Term Business Loans?

Understanding the difference between short-term vs. long-term loans is key to making smart financing decisions. Both types of business loans serve different purposes, each with distinct repayment periods, interest rates, and eligibility criteria.

Short-term loans typically have faster approval, higher interest rates, and shorter repayment windows, making them ideal for covering immediate cash flow gaps or urgent expenses. Conversely, long-term loans often offer lower interest rates and extended repayment periods, making them better suited for large investments or expansion efforts. The loan term you choose will directly impact your monthly payments and financial flexibility.

Choosing the right loan isn't just about qualifying; it's about aligning the repayment structure with your business goals and cash flow. This article compares payoff scenarios and discusses how different loan terms affect your bottom line.

Understanding Short-Term vs. Long-Term Business Loans

Business loans are generally categorized as short-term or long-term based on their repayment period and financing structure. Short-term loans typically have repayment periods ranging from three months to two years. They often come with higher interest rates but require smaller total borrowing amounts. These loans are designed for quick cash needs, such as covering inventory purchases or managing seasonal expenses.

In contrast, long-term loans usually extend from three to ten years or more. They offer lower interest rates and higher loan amounts, but require a longer commitment and stricter eligibility standards. This form of long-term financing is often used for significant investments like equipment, real estate, or business expansion.

The repayment period and interest rate structure directly impact your monthly payments. Short-term loans result in higher monthly payments due to compressed repayment schedules, while long-term loans spread payments out over time, making them more manageable month-to-month. Choosing between the two depends on your business's immediate needs, long-term goals, and ability to manage cash flow over the loan term.

Loan Type Comparison Table

The table below compares four common business loan types, merchant cash advance (MCA), SBA 7(a), equipment loans, and lines of credit, across loan term, interest or cost, repayment schedule, loan amounts, and best use cases. It highlights key differences between short‑term and long‑term financing so you can pick what works best for your business needs.

| Short-Term vs. Long-Term Loans | |||||

|---|---|---|---|---|---|

| Loan type | Typical loan term/Loan term length | Interest rate/Cost structure | Repayment schedule | Typical loan amount (loan amount) | Best use case |

| Merchant cash advance (MCA) | Short term: three to 18 months | Factor rates apply | Based on the sales volume | Usually ranges from $5,000 — $500,000 | Short‑term cash flow gaps, emergency expenses, seasonal inventory, urgent repairs |

| SBA 7(a) | Long‑term financing: five to 25 years | The average interest rates range from about 5% — 10%. | Monthly payments are steady and predictable for fixed‑rate loans | Small loans have a maximum loan amount of up to $350k, while a maximum of $5 million is available for standard loans under 7(a) | Long‑term investments, expansion plans, purchasing real estate, refinancing debt, large purchases that benefit from spreading costs over many years |

| Equipment loans | Terms vary, but the average is 24 to 72 months | May start as low as 6% but APR can depend on lender, creditworthiness, useful life of equipment; often higher than SBA for the same term but lower than MCAs; may include lease vs. purchase distinctions | Payment terms can depend on the machinery, and choosing a term close to how long you expect to use the equipment is recommended. | Varies widely: could cover full cost of equipment, sometimes up to 100% for smaller items; amounts from a few thousand to several million, depending on the business and type of equipment | Acquiring or upgrading machinery or technology, when equipment will generate revenue over time, when you want to preserve working capital but still invest in productive assets |

| Line of credit (LOC) | Many LOCs are structured for six to 18 months | Can be fixed-rate or variable | Interest is typically revolving | Amounts can range from small to large ($10k — $1 million) | Best for flexible cash flow needs or managing working capital |

Key contrasts:

Short‑term loans, such as MCAs and some lines of credit, can be accessed quickly but tend to have much higher interest rates and more variable or unpredictable repayment schedules.

Long‑term financing options such as SBA 7(a) and equipment loans require more documentation and are slower to obtain. However, they offer lower monthly payments, more predictability, and a total interest cost spread over years.

Your loan term should depend on how soon you need capital, how steady your income or revenue is, and what you need the funds for (e.g., fixing urgent issues vs. making investments that will pay off over time).

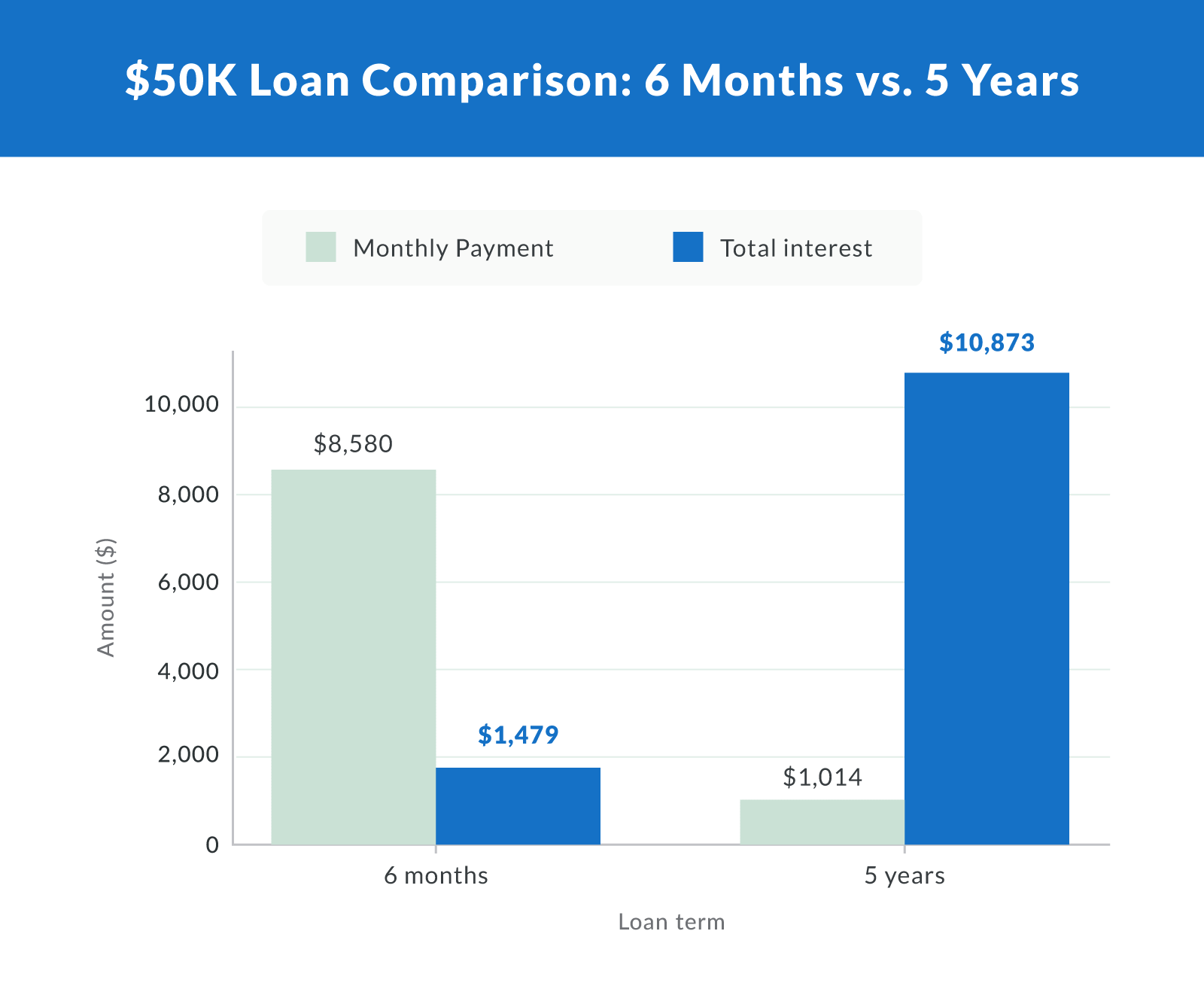

Visual Payoff Scenarios: $50K Loan Examples

The repayment term you choose for a $50k loan dramatically affects your monthly payments and the total interest you'll pay over time. A shorter repayment term, like six months, means higher monthly payments but less interest paid overall. A longer repayment term, such as five years, offers lower monthly payments but significantly increases your total interest across the life of the loan.

The chart below compares a $50k loan repaid over six months vs. five years:

Six-month term. $8,580 monthly payment with $1,479 total interest

Five-year term. $1,014 monthly payment with $10,873 total interest

While spreading payments over a longer period eases monthly cash flow, it adds substantial interest costs. Shorter loans reduce interest payments but require more cash upfront each month. For small businesses, the right choice depends on cash flow flexibility, business model, and how quickly the borrowed money is expected to generate returns.

Clarify Capital customers rave about their experience getting a loan for their small businesses.

“I had the pleasure of Shane McDonald from Clarify Capital help me get a loan for my small business so I could cover inventory and payroll costs. He was very helpful, informative, honest, cut and dry, and got me a really good deal that is affordable with no hidden costs. This is a wonderful company. I would refer them to anyone if they are looking for easy, quick financing.” — Callista B.

“My Representative, Steven, was professional and knowledgeable from first contact. He was in contact daily and had several loan options for our company to provide us with the best option. He worked diligently on our file until funding. Great company for small business funding solutions.” — Don F.

What Loan Term Means for Your Bottom Line

The repayment term you choose directly impacts your cash flow, cost of capital, and how your loan appears on the balance sheet. Short-term financing usually leads to higher monthly payments, but it limits the total interest you pay.

Long-term financing, in contrast, spreads payments over several years, reducing month-to-month pressure but increasing overall interest payments.

Beyond payment size, your loan term also affects financial reporting. Short-term liabilities appear differently from long-term debt on your balance sheet, influencing how lenders and investors evaluate your business's financial health.

Ultimately, the right term should support your broader planning goals, whether maintaining lean operations or preserving runway for future growth. Matching your loan structure to your cash flow cycle and strategy is key to maintaining financial flexibility.

Mini-Profiles of Common Loan Providers

Profile 1: Clarify Capital

Rates and Terms. APRs start at 6%. They offer both short-term loans and longer financing (SBA, equipment, etc.). Loan amounts can reach $5 million in some cases. For qualified borrowers, terms can be fast (same-day or within 24 hours).

Credit Score/Fees/Eligibility. Some quicker funding options require a minimum credit score of around 550. Depending on the product, they need at least six months in business and a certain level of revenue (e.g., $10k/month or more). No collateral is required in many cases.

Documentation and Approval Speed. Short application (two minutes to start), matched with 75+ lenders, with funds available in as little as 24 hours for approved borrowers. There is often less paperwork/“light collateral” compared to banks or SBA loans.

Best For. Businesses that need funding quickly may not qualify for strict bank/SBA lenders, want to compare multiple lender options at once, or need flexible repayment or loan structure. Particularly suited if you have reasonable credit, solid revenue, and need something fast. Clarify Capital is subtle in positioning: it isn't always cheapest, but its speed + flexibility + range of lender matches often make it a practical pick.

Profile 2: OnDeck

Rates and Terms. Term loans up to $250,000, lines of credit up to $100,000, typically up to 24 months. APRs tend to be high, depending heavily on credit, business history, etc.

Credit Score/Fees/Eligibility. Usually requires a personal credit score of 625 or higher; at least one year in business; $100k+ annual revenue (may vary). There are origination fees, maintenance fees on lines of credit, and frequent repayment schedules (weekly or daily), which can increase the burden.

Documentation and Approval Speed. Fairly streamlined (online process), faster than many bank/SBA loans. But not “instant” for all amounts. Larger or riskier loans may take more time. Requires financial statements, business bank statements, and revenue history.

Best For. Businesses that need relatively short-term capital (for example, over three — 24 months) can make frequent repayments, have solid revenue, but perhaps not perfect credit, or not enough time in business to satisfy stricter lenders. Suitable for bridging gaps, buying inventory, reacting to unforeseen expenses, or seizing time-sensitive opportunities.

Profile 3: Bluevine

Rates and Terms. Business lines of credit up to $250,000. Terms are often six to 12 months for draws/repayment. Rates begin at 7.8% simple interest (but actual APRs can be significantly higher depending on profile, plus fees, etc.).

Credit Score/Fees/Eligibility. Minimum credit score is often 625; at least 12 months in business; sometimes minimum revenue thresholds (e.g., $120,000/year, depending on state or state of business) for higher credit lines. Fees may include wire transfer or late payment fees; some products avoid prepayment penalties.

Documentation and Approval Speed. Fast online application, often soft credit pull to check eligibility, and bank account statements are needed. Once approved, funding can be quick (same-day or a few days).

Best for: Businesses with moderate credit and consistent revenue that need flexible access to cash for shorter durations (six to 12 months), want revolving credit rather than a lump-sum one-time loan, or have variable expenses. This type of loan is good for smoothing out cash flow, covering seasonal dips, or covering unexpected expenses.

Profile 4: SBA Loans (via banks/credit unions or brokers)

Rates and Terms. SBA 7(a) loans can go up to $5 million for many uses; terms are often longer (five to 25 years, depending on what you're funding: real estate vs. working capital vs. equipment). Interest rates are generally lower than those of many online/alternative lenders, especially for well-qualified businesses.

Credit Score/Fees/Eligibility. Requirements are more stringent: good personal/business credit, detailed financials (tax returns, profit and loss statements, sometimes collateral), and longer time in business. There are application fees, origination fees, and guarantee fees in some cases. Approval can take longer than with alternative lenders.

Documentation and Approval Speed. Much more paperwork and underwriting is more thorough. Approval often takes weeks rather than hours/days, sometimes months, for larger amounts.

Best For. Businesses making longer-term plans (expansion, real estate purchase, refinancing existing debt, large equipment purchases) who can wait for the process, have a good financial history, and want to minimize interest cost over the life of the loan.

How These Providers Fit Different Financial Situations

Choosing the right small business lender often depends on your priorities: speed, cost, flexibility, or long-term financing. The table below shows how different providers may fit specific financial situations.

These are examples of which lender might lean in your favor depending on your financial situation:

| Which Lender Is Best for You? | |

|---|---|

| Situation | Provider likely best fit |

| Need funds in 24 hours to patch cash flow | Clarify Capital, OnDeck, Bluevine |

| Strong credit, low-cost priority, not urgent | SBA loan via bank or qualified broker |

| Credit isn't great, but revenue is steady; need flexibility | Clarify Capital, Bluevine |

| Managing seasonal sales swings; want revolving funds | Bluevine line of credit, Clarify Capital's LOC options |

| Buying expensive equipment or making a long-term investment | SBA loans or equipment financing via Clarify Capital's network |

Choosing the Right Type of Loan for Your Business

Selecting the right type of loan involves aligning your financial situation with your business goals and repayment ability. Every small business faces different challenges, so the best option, whether that's a short- or long-term loan, a line of credit, or a merchant cash advance, depends on where you are in your growth stage, the amount of money you need, how urgently you need funds, and how predictable your cash flow is.

When comparing loans, consider a few core factors:

Budget. How much can you realistically allocate to loan repayment each month without straining operations?

Credit history. Your credit profile affects eligibility, application process requirements, and the loan amount you can secure.

Repayment period. A shorter term saves on interest but requires higher payments, while a longer term lowers payments but increases overall cost.

Business goals. Whether covering payroll, buying equipment, or expanding locations, the loan you choose should directly support your objectives.

The right loan should do more than provide capital; it should strengthen your business strategy. Matching the repayment period and structure to your goals ensures that debt works as a growth tool rather than a burden. Taking the time to weigh your options will help secure financing that supports long-term success.

Use-Case Analysis: Real Scenarios

Consider a small retail shop facing a sudden demand surge. The owner turns to short-term loans to quickly stock shelves with urgent inventory. The short-term financing process is fast, but the trade-off is higher interest rates and larger monthly payments. While this helps the store capture sales and generate quick returns, it puts added pressure on working capital and requires careful planning to avoid cash flow strain.

On the other hand, a startup preparing to expand into a second location secures a long-term loan. This type of long-term financing offers lower interest rates and extended repayment, allowing the startup to spread costs across years.

This eases pressure on monthly budgets and creates stability for growth. However, the downside is committing to debt that remains on the balance sheet for an extended period, often requiring stronger financials and collateral like real estate.

Both options highlight how loan structure directly affects cash flow, repayment flexibility, and financial reporting. Choosing between a short-term and a long-term approach depends on balancing immediate needs with sustainable growth.

Eligibility and Documentation Checklist

Lenders evaluate eligibility based on both personal and business credit history, as well as overall financial situation. A strong credit score can unlock better rates and larger loan amounts, while weaker credit may limit options or increase costs.

Typical documentation often includes:

Bank statements. Proof of cash flow and account balances.

Tax returns. Personal and business filings to verify income.

Financial statements. Profit and loss statements, balance sheets, or cash flow projections.

Business licenses and incorporation documents. Evidence of legal business structure.

Debt schedules. List of existing loans or obligations.

Identification documents. Driver's license or other government-issued ID.

Business owners can demonstrate readiness and credibility by organizing these materials in advance. Strong preparation speeds up approval and signals to lenders that your business is financially stable and capable of managing repayment.

Making the Smartest Loan Decision for Your Business

When weighing business loans, your choice should align with three key factors: repayment term, interest rate, and business goals. Each type of loan affects loan payments differently; short terms reduce total costs but increase monthly strain, while longer terms lower payments but raise overall expenses. The right path depends on your financial situation, the amount of loan you need, and how debt will support long-term growth.

Different structures also impact flexibility. A line of credit offers agility for cash flow gaps, while SBA or equipment loans provide stability for expansion.

Because every business is unique, it's worth consulting a financial advisor or loan expert to understand which loan best matches your stage, goals, and application process. If you're ready to secure financing that fits your needs, you can start with Clarify Capital and apply today to explore tailored options.

FAQ About Short- vs. Long-Term Loans

Business owners often have common questions when comparing short- and long-term financing. Below, we answer some of the most frequent ones to help clarify how different loan terms affect costs, eligibility, and cash flow.

Is a Five-Year Loan Considered Long Term?

Yes, a five-year loan is generally considered a long-term loan. In lending, any repayment period longer than three years typically falls into the long-term category. This standard applies to both personal and business financing.

Most business term loans with a repayment period of more than 36 months are classified as long-term loans.

Which Loan Term Is Better?

Choosing between a short-term or a long-term loan depends on factors like credit score, cash flow, and how quickly the funds are needed. There isn't a single best option; it comes down to what fits your financial situation and goals.

Can I Refinance a Short-Term Loan Into a Long-Term One?

Yes, it is possible to refinance a short-term loan into a long-term loan. Refinancing extends the repayment period, which typically leads to lower monthly payments. This approach can relieve cash flow pressure and stabilize ongoing expenses.

However, refinancing usually requires a stronger credit profile or improved business performance compared to when the original loan was taken out. Lenders want reliable repayment history and financial stability before approving a long-term loan to replace a short-term loan.

Curious to see if a short-term or long-term loan is best for your business? Take the first step and start an application with Clarify Capital. Your credit score won't be impacted, and one of Clarify Capital's loan advisors will work to secure the best rate for you.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts