Securing funding for your construction project can feel like trying to build a skyscraper with a toy hammer. In the dynamic world of construction, where each project is unique, finding the right financing can be a formidable challenge for business owners.

The construction industry is a cornerstone of our economy, yet many companies struggle to secure capital for their next big opportunity. Traditional lenders often view the industry as high-risk, leaving many borrowers searching for alternatives.

Lucky for you, this article demystifies construction business loans and financing options. We're about to walk you through the various funding types, from commercial construction loans to alternative methods. We'll tell you everything you need to know to make informed decisions about your business financing.

Now, grab your hard hat, and let's dig into the foundation of construction business loans!

| Construction Business Loan Comparison | |||||

|---|---|---|---|---|---|

| Loan type | Best for | Loan amount | Interest rate | Repayment terms | Requirements |

| Commercial construction loans | Large-scale commercial real estate projects | $500K - $5M+ | 6-12% | 12-36 months (convertible to permanent loans) | Strong credit score, 20-30% down payment |

| SBA loans (7a & 504) | Small construction companies looking for low rates | Up to $5M | 5-8% | 10-25 years | Businesses must meet Small Business Administration eligibility |

| Short-term loans | Quick access to working capital | $50K - $500K | 8-25% | 6-24 months | Faster approval, higher interest |

| Business line of credit | Flexible funding for smaller projects | $10K - $1M | 7-15% | Revolving | Requires strong credit history and financial statements |

| Equipment financing | Buying new equipment or upgrading machinery | $25K - $1M+ | 5-15% | 2-7 years | Equipment serves as collateral |

| Invoice factoring | Covering cash flow gaps using unpaid invoices | Varies (based on invoices) | 1-5% per month | Until invoices are paid | Works best for businesses with strong accounts receivable |

Common Types of Construction Business Loans

When trying to get financing for your construction project, one size definitely doesn't fit all. Construction business owners have a variety of loan options to choose from, each tailored to different needs and project scales. Let's explore the main types of construction loans and how they can help you build your business — literally!

Commercial Construction Loans

Commercial construction loans are the heavyweight champions of the construction financing world. These loans are specifically designed for business owners embarking on large-scale commercial real estate projects. Whether you're building a new office complex, retail space, or industrial facility, commercial construction loans have you covered.

Here's how they typically work: Instead of getting a lump sum up front, you'll receive the loan in stages as your project progresses. This process, known as a draw schedule, helps ensure that funds are used appropriately and can potentially save you on interest payments.

The loan amount is usually based on the projected value of the completed project, and you'll generally need to make a substantial down payment — often 20-30% of the total project cost.

But here's the kicker: Once construction is complete, you'll need to refinance into a permanent loan. This transition can be smooth sailing if you plan ahead, but you need to factor it into your long-term financial strategy.

SBA Loans for Construction

If you're a small business owner looking to construct, renovate, or expand your facilities, SBA loans might be your ticket to success. The Small Business Administration doesn't directly lend money, but it does guarantee loans from participating lenders, which can result in more favorable terms for borrowers.

Two SBA loan programs are particularly relevant for construction projects:

SBA 7(a) loans. These loans are versatile for a wide range of business purposes, including construction and renovation. With loan amounts up to $5 million and repayment terms as long as 25 years for real estate, they offer flexibility and breathing room for growing businesses.

SBA 504 loans. These loans are for major fixed asset purchases, including new construction and the renovation of existing facilities. They typically involve a structure where a bank provides 50% of the financing, a Certified Development Company provides 40%, and you contribute a 10% down payment.

Lower down payments, longer repayment terms, and competitive interest rates make SBA loans attractive options for eligible small business owners. However, be prepared for a thorough application process and stricter eligibility requirements than conventional loans.

Short-Term Loans and Lines of Credit

Need quick cash for a smaller project or to bridge a financial gap? Short-term loans and lines of credit could be your go-to solution. These financing options are perfect for managing cash flow, purchasing materials, or tackling unexpected expenses during your construction project.

Short-term loans provide a lump sum that you repay over a brief period, typically less than a year. They're great for one-time expenses but come with higher interest rates because of their quick turnaround.

On the other hand, a business line of credit offers more flexibility. Think of it as a financial safety net — you can draw funds as needed up to a predetermined limit and only pay interest on the amount you use. This can be invaluable for managing the ebb and flow of construction project expenses.

Don't forget about working capital loans, either. These term loans are designed to finance your day-to-day operations, helping you keep the lights on (literally and figuratively) while you focus on your construction projects.

Each of these loans has its pros and cons. Your choice should be based on factors like your credit score, the size of your project, and your long-term business goals. It's always a good idea to look around to compare offers from different lenders. Check out traditional banks, credit unions, and online lenders to find the best fit for your construction business.

Alternative Financing Options for Builders

Let's face it: construction projects can be as unpredictable as the weather. You might need new equipment yesterday, or your cash flow might be tighter than a drum. That's where alternative financing options come in handy. These financial tools can help you keep your projects moving forward without breaking the bank or tying up all your working capital.

Equipment Financing

Need a new excavator or crane but don't want to drain your bank account? Equipment financing might be your new best friend. This option allows you to acquire necessary construction equipment without a massive up front cost.

Here's how it works: You can either get an equipment loan or opt for a leasing arrangement. With an equipment loan, you borrow money specifically to purchase the equipment. You'll own the equipment outright once you've paid off the loan.

Leasing, on the other hand, is more like renting. You make monthly payments to use the equipment, and at the end of the lease term, you can often choose to buy the equipment, return it, or lease new equipment.

The benefits are that you can preserve your working capital, potentially get tax advantages, and can often secure the equipment with little to no down payment. Plus, if you're using the latest and greatest equipment, you might even boost your efficiency and competitiveness.

Invoice Factoring

Ever feel like you're constantly waiting for clients to pay their invoices while your bills keep piling up? Invoice factoring can help bridge that gap. This financing method allows you to sell off any of your unpaid invoices to a factoring company at a discount.

Here's the scoop: The factoring company gives you a percentage of the invoice value up front (often 70-90%). When your client pays the invoice, you get the remainder minus the factoring company's fee. It's not free money, but it can significantly increase your cash flow, particularly if you have large invoices with long payment terms.

The best part is that factoring isn't a loan, so it doesn't add debt to your balance sheet. It can be a lifesaver when you need cash quickly to pay suppliers, meet payroll, or take on new projects.

Working Capital Loans

Sometimes, you just need a financial cushion to cover day-to-day expenses while you're waiting for bigger projects to pay off. That's where working capital loans come in. These short-term loans are designed to finance your company's everyday operations.

Working capital loans can cover a wide range of operational costs, from payroll and rent to supplies and unexpected expenses. They're typically easier to qualify for than larger, long-term loans and can be a great option when you need a quick cash injection.

The downside is that interest rates can be higher than traditional loans, and repayment terms are usually shorter. But if you need to smooth out cash flow bumps or take advantage of a time-sensitive opportunity, a working capital loan could be just the ticket.

Hidden Costs in Construction Financing and How To Budget for Them

Securing construction loans for a commercial property or new construction project comes with more than just the principal and interest rates — there are hidden costs that many business owners overlook. Proper budgeting for these expenses ensures your construction financing remains on track without unexpected cash flow issues.

Common Hidden Costs in Construction Loans

You don't want to be caught off guard. Here are a few hidden costs to look out for when seeking a construction loan:

Permit and inspection fees. Most construction projects require multiple permits and regular inspections, adding thousands to your loan amount before work even begins.

Site preparation and environmental studies. Clearing land, addressing zoning issues, and conducting environmental impact assessments can significantly increase costs.

Material price fluctuations. The construction industry is vulnerable to unpredictable price changes for essential materials like steel, lumber, and concrete.

Interest-only payments. Many commercial construction loans require borrowers to pay interest during the construction phase before transitioning into full repayment terms.

Loan origination and administrative fees. Lenders, credit unions, and online lenders may charge up front fees for processing your loan application, often totaling 1-3% of the loan amount.

Cost overruns and delays. Unexpected delays due to weather, subcontractor availability, or unforeseen site conditions can lead to additional expenses.

How To Budget for Unexpected Costs

Here are a few key tips to be prepared for unexpected costs that may pop up:

Include a contingency fund. Set aside at least 10-20% of your budget for unexpected expenses to avoid cash shortages.

Factor in longer repayment terms. Some types of construction loans, like SBA loans, offer longer-term repayment schedules, allowing flexibility in managing monthly payments.

Compare financing options. Evaluate short-term loans, equipment loans, and business lines of credit to cover different stages of the project.

Plan for refinancing. Many business construction loans require a transition to permanent loans once the project is complete, so prepare for potential refinancing costs.

Construction Financing Challenges

Construction loans are notoriously tricky to obtain. But why? Let's break down the barriers and explore why lenders often view construction projects as high-risk ventures.

Why Are Construction Loans Hard To Get?

First off, construction projects are complex beasts. They involve multiple stages, numerous contractors, and a whole lot of variables that can throw a wrench in the works. Lenders are essentially betting on a project that doesn't exist yet, which makes them understandably nervous. Will the project be completed on time? Will it stay within budget? These uncertainties make lenders extra cautious.

The construction industry's volatility also plays a significant role. Economic downturns, material price fluctuations, and labor shortages can all impact a project's profitability. Lenders need to be confident that your business can weather these storms and still repay the loan.

Construction loans also often involve larger loan amounts compared to traditional business loans. This increased financial exposure means lenders impose stricter eligibility criteria and more rigorous approval processes. They're not just evaluating your current financial situation; they're also assessing your project's viability and your ability to manage it successfully.

Minimum Credit Score Requirements

Your credit score can unlock (or block) your access to financing. So, what's the magic number? Well, it depends.

For conventional construction loans, most lenders look for a minimum credit score of 680, but many prefer scores of 720 or higher. If you're eyeing an SBA loan for your construction project, you might squeak by with a score of 640, but a score of 680 or above will significantly improve your chances.

Keep in mind that these are just general guidelines. Some online lenders might be more flexible, while traditional banks and credit unions will typically have stricter requirements. Your personal credit score is crucial, but for business loans, lenders will also consider your business credit profile.

It's not just about meeting the minimum, either. A higher (better) credit score can lead to more favorable interest rates and loan terms. So, if your score is on the border, it might be worth taking some time to boost it before applying.

Cash-Flow Timing Issues in Construction

Construction businesses often deal with erratic cash flow. Here's what to watch for:

Retainage. Contractors may only receive 90–95% of each payment until project completion, delaying income.

Payment applications (pay apps). Funds are only released once specific milestones are documented and approved, leading to lags.

Seasonal slowdowns. Winter or weather delays can halt progress — and revenue.

Understanding how these timing issues affect loan repayment schedules is critical when choosing financing.

How To Improve Your Chances of Approval

Feeling daunted? Don't hang up your hard hat just yet. Here are eight strategies to enhance your eligibility and increase your chances of getting that coveted "approved" stamp:

Polish your credit. Both your personal and business credit matters. Pay down existing debts, fix any errors on your credit reports, and try not to take on new debt before applying.

Beef up your down payment. A bigger down payment reduces the lender's risk and shows you have skin in the game. Aim for at least 20% of the project cost.

Show your profitability. Lenders love to see a track record of successful projects and steady cash flow. Prepare detailed financial statements and tax returns to showcase your business's financial health.

Have a solid business plan. Outline your project in detail, including cost projections, timeline, and how the new construction will boost your profitability.

Gather your team. Having experienced contractors, architects, and project managers on board can reassure lenders about your project's viability.

Consider collateral. Offering additional collateral beyond the construction project itself can make lenders more comfortable with the loan amount.

Shop around. Different lenders have different risk appetites. Don't be discouraged if one turns you down — another might see your project's potential.

Prepare for scrutiny. Be ready to provide extensive documentation. The more prepared you are, the smoother the application process will be.

Securing a construction loan is as much about proving your project's potential as it is about your creditworthiness. By addressing these challenges head-on and presenting a compelling case, you'll be much closer to breaking ground on your construction dreams.

Construction Loans vs. Mortgages

Construction loans and traditional mortgages are like apples and oranges. Sure, they're both fruits (or, in this case, ways to finance property), but they have distinct characteristics that set them apart. Whether you're building a new home or developing commercial real estate, understanding these differences is crucial for making informed financial decisions.

Structure and Disbursement

The most striking difference between construction loans and mortgages is how the funds are distributed. With a traditional mortgage, you receive the whole loan amount in a single lump sum at closing. It's straightforward — you get the money, buy the property, and start making payments.

Construction loans, on the other hand, operate more like a line of credit. Instead of getting all the money up front, you receive it in stages, known as "draws." These draws align with your construction timeline and are typically disbursed after specific milestones are completed and inspected. For example, you might receive a portion of the funds after the foundation is laid, another chunk when the framing is complete, and so on.

This staged disbursement serves two purposes:

It ensures that funds are used appropriately for the construction project.

It helps you avoid paying interest on the entire loan amount before you need all the money. Speaking of interest...

Interest Rates and Repayment Terms

If you're hoping for rock-bottom interest rates on a construction loan, you might be in for a surprise. Construction loans will usually have higher interest rates than traditional mortgages. Why? It all comes down to risk. Lenders view unbuilt properties as riskier investments, and they offset this risk with higher rates.

But here's the silver lining: you only pay interest on the amount disbursed, not the total loan amount. So, while the rate might be higher, you're not paying interest on money you haven't used yet. During the construction phase, you might only have to make interest-only payments, which can help keep your costs manageable while your project is underway.

Repayment terms for construction loans are also shorter than traditional mortgages. While a typical mortgage might stretch over 15 or 30 years, construction loans often have terms of one year or less. The idea is that you'll refinance into a permanent loan once construction is complete.

Traditional mortgages, in contrast, offer lower interest rates and longer repayment terms. You start repaying both principal and interest immediately, with payments spread out over many years. This structure results in lower monthly payments compared to construction loans, but you'll be paying interest on the full loan amount from day one.

Transitioning to Permanent Financing

So, what happens when your construction project is complete? This is where construction-to-permanent loans come into play. These hybrid products start as construction loans and then convert to permanent mortgages once the building is finished.

The advantages are:

You only have to go through one approval process and pay one set of closing costs.

You're able to lock in your permanent mortgage rate at the beginning of the construction process, protecting you from potential rate increases.

If you don't have a construction-to-permanent loan, you'll have to refinance your construction loan into a permanent mortgage when the project is complete. This means going through another approval process and paying additional closing costs. However, it also gives you the flexibility to search for better mortgage rates and terms once your property is built.

The transition from a construction loan to permanent financing is an important part of the process. This refers to when a long-term mortgage replaces your short-term, higher-interest construction loan with more favorable rates and repayment terms. The shift lets you spread out the repayment of your real estate investment over a much longer period, making it more manageable for most borrowers.

Best Construction Financing by Use Case

Choosing the right financing depends on what you're trying to fund. Here's a breakdown:

Equipment purchases. Equipment financing offers fast access to new machinery without large up front costs. Best for bulldozers, cranes, or specialty tools.

Covering payroll or overhead. Working capital loans and business lines of credit help manage day-to-day expenses when payments are delayed.

Winning government contracts. Surety bond financing ensures you meet bonding requirements — key for public sector jobs.

Buying materials up front. Invoice factoring or short-term loans can cover supply costs before your next client payment comes in.

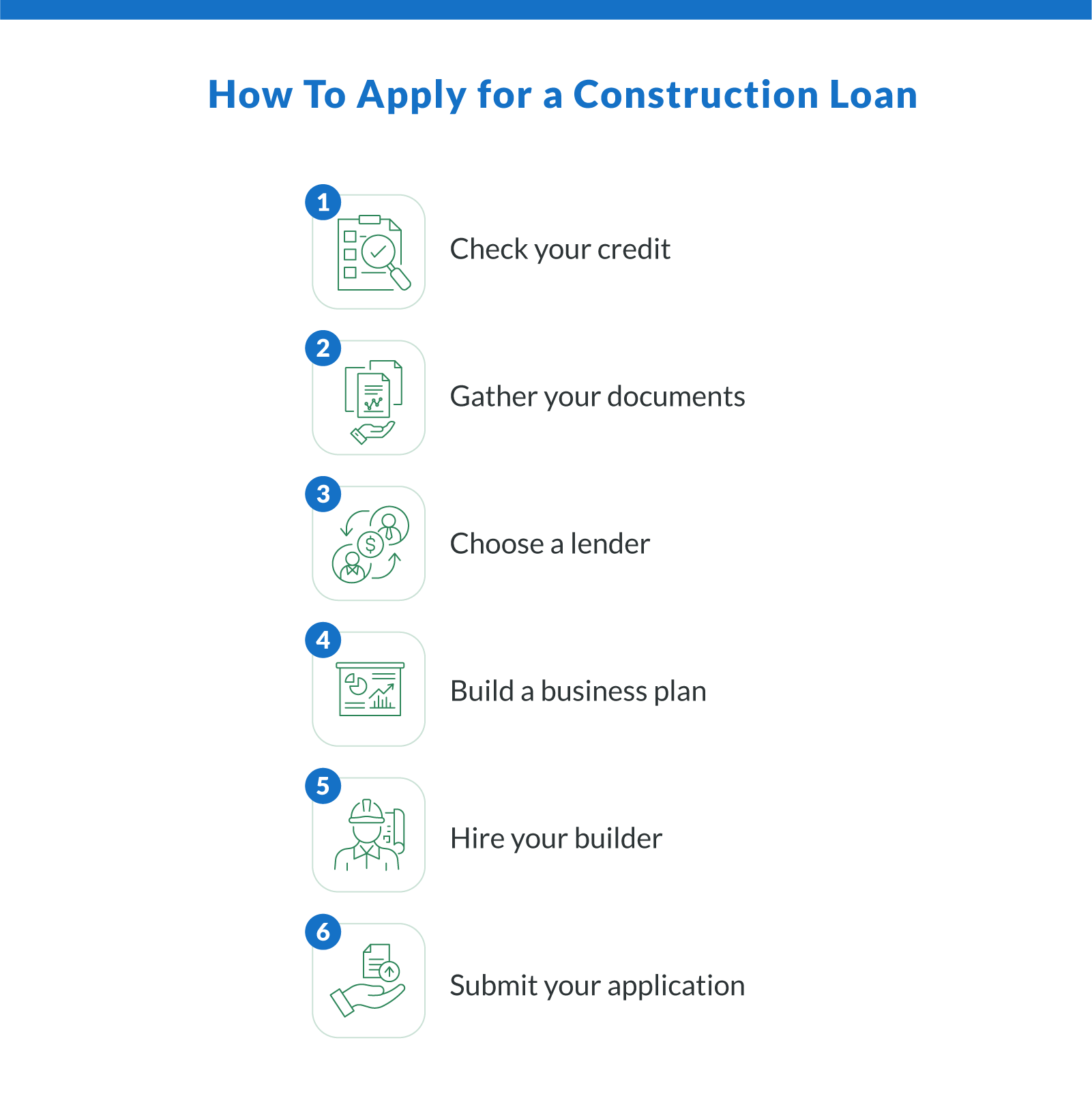

The Construction Loan Application Process

Applying for a construction loan isn't always a walk in the park, but we're here to help you navigate the process like a pro. Let's break down what you need to know to put your best foot forward.

Required Documentation

Construction financing lenders want to see everything but the kitchen sink (and they might ask for that, too, if it's part of your construction plans). For most types of loans, here's a rundown of the documents you'll typically need:

Personal and business tax returns. These are usually required for the past two to three years to demonstrate your financial history.

Financial statements. You'll need to provide all financial documents, including balance sheets, income statements, and cash flow statements, to show your business's financial health.

Bank statements. Both personal and business bank statements are typically required for the last few months to verify your cash flow and financial stability.

Project plans and specifications. You'll need to submit detailed blueprints and construction plans to illustrate the scope of your project.

Cost breakdown. Prepare a line-item budget for the entire project to show you've accounted for all expenses.

Construction timeline. You should provide a schedule of the building process to demonstrate your project management skills.

Contractor details. Include information about your chosen contractor, including their license and insurance, to prove you're working with qualified professionals.

Appraisal. An estimate of the completed project's value is necessary to determine the potential return on investment.

Proof of income. You'll need to submit pay stubs or other income verification to show you can afford the loan payments.

Legal documents. These might include business licenses, articles of incorporation, and partnership agreements to verify your business's legal status.

The exact requirements may be different for you depending on the lender and the type of construction loan you're applying for. Some lenders might ask for additional documents, while others (especially some online lenders) might have a streamlined process with fewer requirements.

Tips for a Successful Application

Now that you know what you need, here are some strategies to increase your chances of approval:

Check your credit. Look into your personal and business credit reports before you apply. Address any errors and work on improving your scores if needed.

Gather your documents. Be ready with essential paperwork like tax returns, bank statements, financials, and project plans.

Choose a lender. Compare loan options from banks, credit unions, and online lenders.

Build a business plan. Show lenders you've thought through every aspect of your project and have a clear path to profitability.

Hire your builder. Choose an experienced contractor and collect all project details and cost breakdowns required by the lender.

Make your down payment. Be prepared to contribute capital at closing. It shows lenders you're financially invested in the project.

With the right approach, you'll be breaking ground on your project before you know it.

Lender Requirements at a Glance

Credit score. 640 minimum (SBA), 680+ preferred; Clarify Capital may approve scores as low as 550

Monthly revenue. At least $10,000

Business age. Minimum six months in business (startups not eligible)

Business structure. Must have a business bank account and be incorporated or located in the U.S.

Bank statements. Three most recent months required for income verification

Collateral. Not required. Clarify offers revenue-based financing, not collateral-backed loans

Contractor Loan Document Checklist

Business tax returns (two to three years)

Personal tax returns (two years)

Profit and loss statements

Construction plans and permits

Cost breakdown and budget

Contractor license and insurance

Proof of business ownership and entity documents

Three months of business bank statements

Ways To Use Construction Loans for Long-Term Growth

Construction business loans can do more than just fund a single construction project — they can be a stepping stone to long-term business expansion. When used strategically, financing can help construction companies secure larger projects, improve profitability, and strengthen financial stability.

Invest in high-quality equipment. Using equipment financing instead of a lump sum loan can help you acquire necessary machinery while keeping capital available for other investments.

Expand into larger projects. With commercial construction loans and business lines of credit, you can take on larger projects without overextending your cash reserves.

Strengthen business credit. Timely repayments on loan options like term loans and small business loans improve your credit score, qualifying you for lower interest rates on future financing.

Develop a competitive edge. Using funding options to hire skilled subcontractors, invest in training, or upgrade project management software can position your business as a leader in the construction industry.

Build a Strong Financial Foundation

The range of funding options for construction business owners is vast, from commercial construction loans to SBA programs, equipment financing, and invoice factoring. Success hinges on understanding these options and choosing the right financial tools for your needs.

As a construction business owner, your financial strategy is as crucial as your building plans. Try to improve your credit score, prepare thorough documentation, and develop a solid business plan to increase your chances of loan approval and set your business up for long-term success.

Ready to secure funding for your construction business? Visit Clarify Capital to explore your options and start building your financial future today. With the right financing, you'll be well-equipped to tackle new projects, grow your business, and construct a legacy in the industry.

FAQ About Construction Business Loans

Here are answers to the most common questions about construction financing.

What Is Retainage Funding?

Retainage funding allows contractors to access the withheld 5–10% of project payments up front, improving cash flow. Lenders offer this based on your contract terms and payment history.

How Do Draw Schedules Work?

Draw schedules outline when a lender disburses funds during a construction project, typically after hitting specific milestones. It protects the lender and ensures funds match progress.

What Credit Score Is Needed for a Construction Loan?

Most lenders require a credit score of at least 680 for construction business loans, though SBA loans may accept borrowers with scores as low as 640. A higher credit score can qualify you for lower interest rates and better repayment terms.

Can I Get a Construction Loan With Bad Credit?

Yes, but financing options may be limited. Invoice factoring, equipment loans, and short-term loans offer alternatives for borrowers with lower credit history. Expect to pay higher interest rates or provide additional collateral.

How Much Down Payment Is Required for a Construction Loan?

Most commercial construction loans require a down payment of 20-30%. Some SBA loans and business lines of credit may offer lower requirements, but additional collateral may be needed.

What Is the Difference Between a Construction Loan and a Mortgage?

A construction loan funds a building project and is disbursed in stages, while a mortgage loan is a long-term permanent loan used to finance a completed property. Many construction companies refinance into a mortgage loan after project completion.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts