Key Takeaways:

31% of small business owners (SBOs) are cutting spending across the board this holiday season.

SBOs are most often relying on personal savings (20%), holiday revenue (20%), or business credit cards (20%) to finance holiday-related expenses.

22% aren't taking an owner's salary this holiday season to reduce costs.

23% have put a business expense on a personal credit card without telling their family or partner, and 8% have already done so this year.

24% have used buy now, pay later to cover business expenses.

Nearly 1 in 4 SBOs (23%) are worried about their financial outlook for 2026.

More than 1 in 10 SBOs (11%) have skipped or reduced holiday bonuses this year.

How Small Businesses Are Spending and Surviving This Holiday Season

31% of small businesses say they've cut spending across the board in an effort to stay lean this holiday season. Still, 30% are investing in seasonal marketing efforts to boost visibility and sales before the end of the year.

To fund holiday operations, 20% of SBOs are turning to personal savings, holiday revenue, or business credit cards.

Some are making sacrifices behind the scenes: 22% aren't taking an owner's salary this season, and 23% have put a business expense on a personal credit card without telling their family or partner (8% have already done so this year).

13% of owners now regret giving out holiday bonuses they couldn't comfortably afford.

The Hidden Holiday Costs Putting Pressure on Small Business Owners

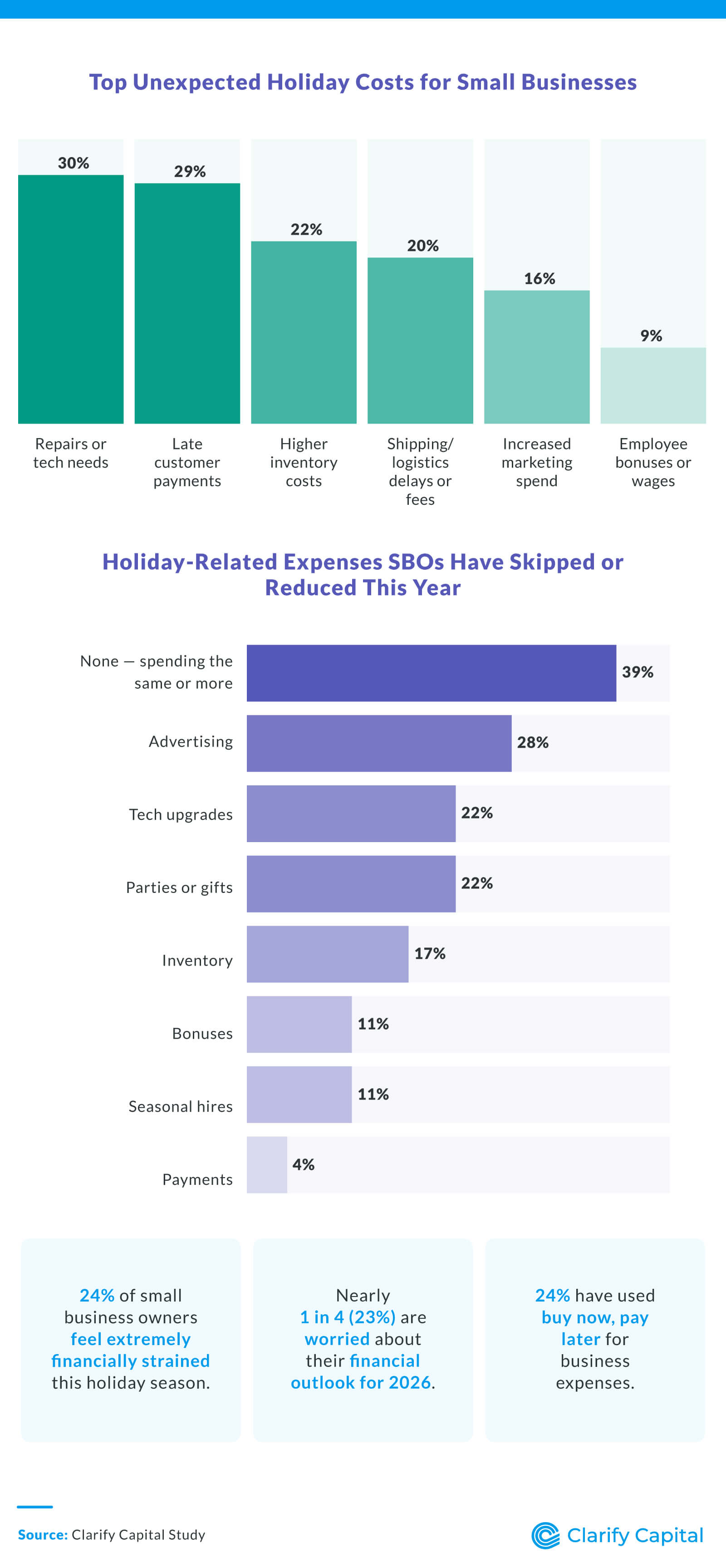

Surprise expenses added pressure for many: 30% were hit with unexpected repairs or tech issues, the top unforeseen cost this season. Late customer payments impacted 29% of small businesses, compounding cash flow challenges.

To trim costs, 22% scaled back on holiday parties or gifts, and 11% skipped or reduced employee holiday bonuses this year.

Nearly a quarter (24%) reported feeling extremely financially strained, and about the same number (23%) is worried about their financial outlook for 2026.

24% have leaned on buy now, pay later options for business expenses to keep operations running through the holiday crunch.

What SBOs Regret Most, and What They Need to Thrive This Holiday Season

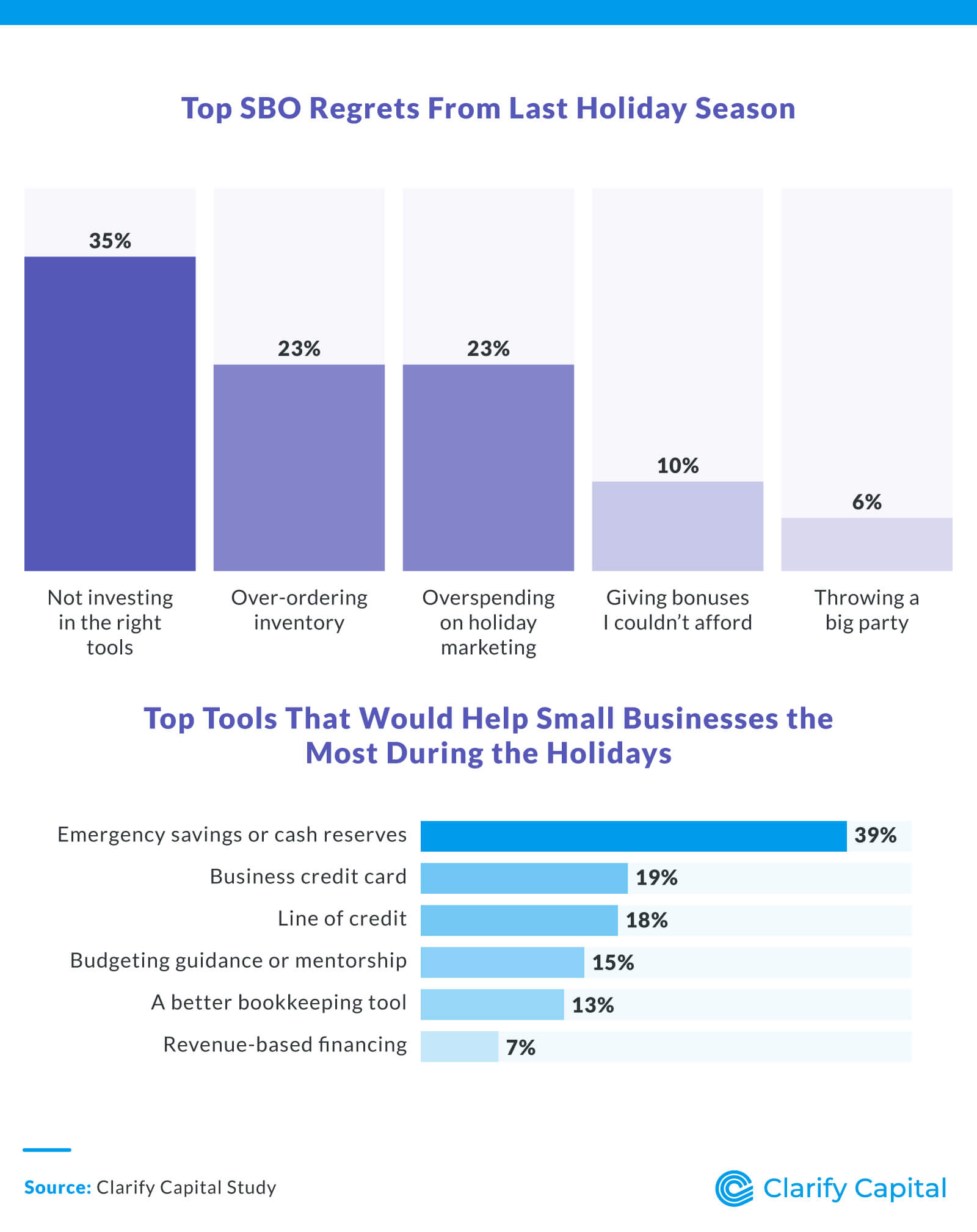

The most common regret among SBOs was not investing in the right tools, cited by 35%.

Another 23% wish they hadn't over-ordered inventory, which may now tie up much-needed cash.

Tools SBOs say would help them most this season:

39% say emergency savings or cash reserves would be the biggest game-changer.

19% would benefit from having a business credit card.

18% believe a line of credit would help them navigate financial ups and downs.

15% want budgeting guidance or mentorship to make smarter financial decisions moving forward.

Methodology

Clarify Capital surveyed 283 small business owners on December 9, 2025, to understand how they're navigating the financial pressures of the holiday season. The study explored how entrepreneurs are covering costs like inventory, seasonal marketing, employee bonuses, and year-end expenses.

About Clarify Capital

Clarify Capital helps small businesses access fast, flexible funding solutions without the paperwork headaches. Whether you're looking for no-doc business loans, fast business loans, or financial guidance to power through the holiday season, Clarify is here to support your growth year-round.

Fair Use Statement

If you'd like to share or report on this study, you're welcome to do so for noncommercial purposes. Just include a link back to this page and credit Clarify Capital as the source.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts