Launching or growing an optometry practice takes a lot more than just clinical experience. Whether you're starting from scratch or scaling an existing location, optometry practice financing can help you cover large upfront costs without draining your savings. From exam lane equipment and EMR systems to real estate and optical retail renovations, tailored funding makes these investments more manageable and profitable.

Opening a cold start optometry practice can cost between $150,000 and $500,000, depending on location, size, and services offered. While average OD income sits at $134,830, most early-stage optometrists can't afford to pay for everything out of pocket. Loans for eye care clinics can help by offering flexible terms and repayment options that align with your revenue cycle.

In this guide, we'll walk through the top financing options for optometrists, including SBA loans, equipment financing needs, and working capital lines of credit. You'll learn how each option works, what it takes to qualify, and how Clarify Capital can help secure the funding your optometry practice needs to thrive.

Why Financing Matters for Optometry Practices

Opening or expanding an optometry clinic comes with steep capital demands. Whether you're outfitting an exam lane, investing in EMR systems, or building out an optical retail space, the upfront costs can quickly add up. For most health care practice owners, financing is crucial for maintaining cash flow and staying competitive in a high-overhead health care market. It's also a key part of practice management.

Core business needs include equipment like slit lamps, autorefractors, and retinal cameras, which can cost between $100,000 and $250,000. Additionally, hiring qualified opticians, technicians, and front office staff typically accounts for 18% to 24% of gross revenue, according to ODs on Finance. Add in marketing costs, rent, and software licensing, and the pressure on liquidity becomes clear.

Equipment financing allows optometrists to invest in essential tools without making a large upfront payment, while working capital loans can bridge operational gaps during seasonal dips or expansion phases. Whether you're a solo OD launching a new clinic or a multi-location provider investing in growth, smart financing supports sustainable eye care delivery while preserving financial flexibility.

Loan Options for Optometrists: Full Breakdown

Optometrists have a wide range of financing options available, depending on their practice size, goals, and timeline. Whether you're looking to buy your first autorefractor or acquire a second location, the right optometry practice loan can make it possible without draining your reserves. Here's a breakdown of the top loan types, each with specific use cases, loan terms, and borrower profiles.

| Loan Options for Optometrists | |||

|---|---|---|---|

| Loan type | Typical terms | Interest rate range | Ideal use case |

| SBA loan |

| 6%–9% | Expanding into a new office with funding for both new equipment and tenant improvements |

| Equipment loan |

| 7%–14% | Financing a $60,000 exam lane upgrade with fixed monthly payments over five years |

| Working capital line of credit |

| 8%–18% | Covering quarterly inventory restocking during a seasonal patient slowdown |

| Commercial real estate or acquisition loan |

| Varies | Purchasing a $900,000 clinic generating $750,000 in revenue, using a mix of SBA and conventional financing |

SBA Loans for Optometry Practices

SBA loans, particularly the SBA 7(a) program, from the Small Business Administration are a top choice for optometrists seeking large amounts of capital at competitive rates. You can borrow up to $5 million, with repayment terms up to 10 years for equipment and up to 25 years for real estate. Rates typically fall between 6% and 9%, depending on the lender.

To qualify, borrowers must go through a rigorous credit approval and loan process, often submitting a full business plan, personal and business financials, and tax records. While SBA loans offer favorable terms, they tend to move more slowly than alternative lenders, often taking 30 to 90 days to fund.

Use case: A practice owner expanding into a new office who needs funding for both new equipment and tenant improvements.

Equipment Loans for Exam Lanes & Tech Upgrades

Equipment financing is tailored for high-cost tools like OCT machines, retinal scanners, and EMR integrations. Equipment loans typically cover 80%–100% of the purchase price, with terms from 3 to 7 years. Rates range from 7% to 14%, depending on your credit and the equipment's lifespan.

Most practice owners use this structure to conserve cash and match payments to expected ROI. Many lenders will use the equipment itself as collateral, meaning less strain on your working capital or credit lines.

Use case: Financing a $60,000 exam lane upgrade with fixed monthly payments over five years.

Working Capital Lines of Credit

Unlike a lump-sum loan, business lines of credit give optometrists flexible access to funds that can be drawn and repaid repeatedly. These are ideal for managing short-term working capital needs like vendor payments, payroll, or covering gaps in insurance reimbursements.

Credit limits typically range from $10,000 to $250,000, and you only pay interest on the amount used. Rates vary but often fall between 8% and 18%. Approval timelines are usually fast, with funding in as little as 1–3 days.

Use case: Covering quarterly inventory restocking during a seasonal patient slowdown.

Commercial Real Estate & Practice Acquisition Loans

For ODs looking to purchase their clinic property or buy out an existing practice, long-term business loans or commercial real estate loans may apply. These often require a 10%–20% down payment and a detailed valuation of the property or practice.

Lenders will consider revenue trends, patient retention rates, and existing debt. Acquisition loans can also cover intangible assets like goodwill, especially if the practice is well-established and cash-flow positive.

Use case: Purchasing a $900,000 optometry clinic that generates $750,000 in annual revenue, using a mix of SBA and conventional financing.

How To Improve Loan Eligibility as an Optometrist

Getting approved for optometry practice financing is all about positioning yourself as a low-risk borrower. Whether you're launching a new office or expanding an existing clinic, improving your credit score and financial readiness can significantly boost your credit approval odds and help secure better terms.

Lenders review both your personal and business credit histories, debt-to-income ratios, cash flow projections, and industry experience. Strong loan applications often include three years of tax returns, financial statements, and a well-prepared business plan. If you're a newer practice owner or looking to borrow a high amount, you may also need a co-signer or additional collateral.

Here are the key steps to improve your underwriting profile:

Raise your credit score. Aim for 680+ to unlock lower interest rates; medical equipment financing can go as low as 5% with excellent credit.

Keep business finances organized. Clean tax returns and monthly profit/loss statements help lenders assess financial strength.

Maintain a healthy income margin. Net income should be 27–35% of gross revenue, per industry benchmarks.

Reduce unnecessary debt. Lowering outstanding balances can improve your debt-service ratio.

Forecast realistic revenue. Especially for new practices, clear projections help lenders trust your financial trajectory.

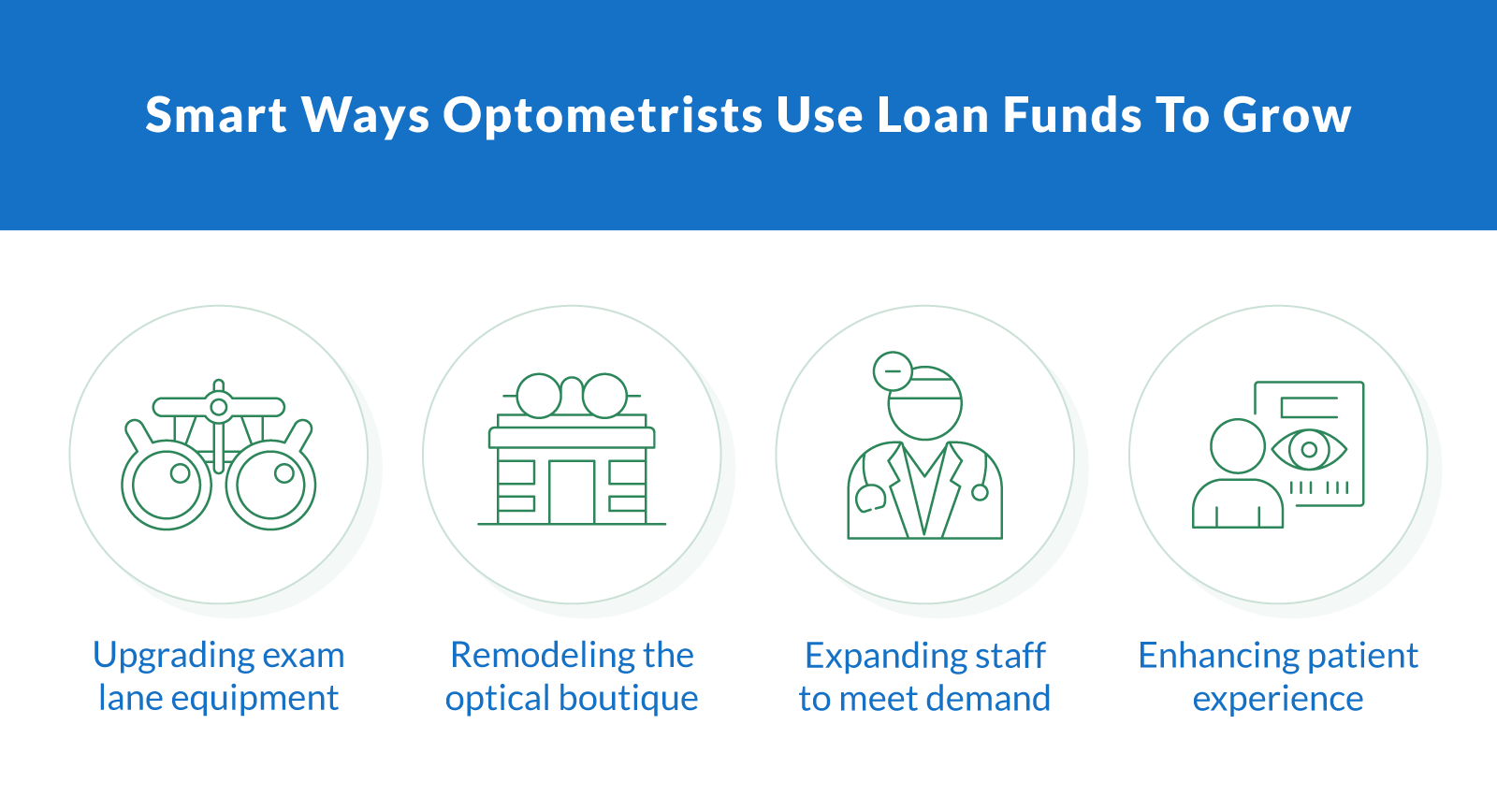

Real-World Use Cases: Where Optometrists Invest Loan Funds

Whether you're building from the ground up or improving an existing office, optometry practice financing can unlock meaningful upgrades that drive revenue and improve patient care. Practice financing helps optometrists invest in strategic growth tied to clear ROI.

Below are real-world examples of how optometrists apply loan capital toward key business needs:

Upgrading exam lane equipment. A new digital refractor, slit lamp, and autolensmeter can cost $35,000–$50,000. Many ODs finance these purchases to improve diagnostic speed and enhance clinical credibility. With an average revenue per patient of $484, even modest efficiency gains add up quickly.

Remodeling the optical boutique. Optical dispensary renovations, including custom cabinetry, POS system upgrades, and new lighting, typically range from $25,000 to $75,000. This investment not only boosts aesthetics but also encourages higher retail conversions.

Expanding staff to meet demand. Bringing on another OD or adding a technician requires upfront capital for recruitment, salaries, and training. Staffing growth supports higher patient volume and improves appointment availability.

Enhancing patient experience. Financing can also support softer improvements like adding a massage chair in the waiting room, offering complimentary eyewear cleanings, or integrating teleoptometry tools. Each small touch strengthens retention and word-of-mouth referrals.

Clarify Capital supports ODs in turning these goals into action by matching them with fast, flexible funding options designed for health care professionals.

Plan Your Financing Strategy with Confidence

Building or expanding an optometry clinic takes smart financial planning. With so many loan options available, the right optometry practice financing can help you secure the equipment, real estate, or staffing you need to stay competitive in today's eye care market.

Whether you're launching a new practice, upgrading diagnostic tools, or acquiring a second location, Clarify Capital offers financing solutions designed for health care professionals. From SBA loans to short-term working capital and flexible equipment financing, you can find funding that fits your goals, timeline, and repayment preferences.

Don't let capital barriers slow your growth. Explore your options, compare terms, and work with a team that understands the unique financial needs of optometrists.

Apply now with Clarify Capital or schedule a free consultation to find out how much you qualify for. We'll match you with the right lender, fast.

FAQ: Optometry Financing Essentials

Below are common questions from optometrists exploring practice loans and funding options to grow their eye care clinics.

What Are the Best Loans for Optometry Clinics?

The best loans for optometry clinics depend on your stage of growth and financial needs. For large investments like real estate or new construction, SBA 7(a) loans are a popular choice thanks to low interest rates and long repayment terms. If you're upgrading equipment or remodeling an optical shop, equipment loans or working capital lines of credit offer flexibility and faster approval.

Optometrists looking for short-term support, such as cash flow management or covering insurance delays, may benefit from merchant cash advances or unsecured practice loans.

How Do I Qualify for an SBA Loan as an Optometrist?

To qualify for an SBA loan, optometrists must meet certain eligibility standards, including a strong credit score (typically 680+), a detailed business plan, and proof of revenue or financial projections. The loan application also requires submitting tax returns, practice financials, and licenses. Clarify Capital can help you assess your eligibility and streamline the SBA loan process from underwriting to approval.

Can I Finance Used Equipment for My Optometry Practice?

Yes, many equipment financing programs allow optometrists to fund used exam lane systems, autorefractors, or OCT machines, especially if the equipment is in good condition and comes from a verified vendor. This is a smart move for practice owners trying to reduce upfront costs or expand affordably. Be sure to check with your lender, as some may require a condition report or valuation for used assets.

How Much Working Capital Does a New Clinic Need?

Start-up loans for optometry practices often cover working capital needs ranging from $50,000 to $250,000, depending on location, size, and specialty services offered. This funding helps cover payroll, rent, supplies, and early marketing campaigns during your ramp-up period. Clarify Capital helps new clinic owners calculate exact needs based on projected revenue, average patient volume, and service mix.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts