If you've asked yourself, “Should I get a small business loan?” you're already thinking like an entrepreneur. A loan can be a powerful tool for managing cash flow, hiring staff, or upgrading equipment. But it also comes with risk. Understanding the upsides and tradeoffs can help you make a smarter business loan decision.

About 37% of small businesses applied for financing in 2024, according to the Federal Reserve's Small Business Credit Survey. That's a sign of how common borrowing has become in today's business world. At the same time, 82% of businesses that fail cite cash flow problems as the reason.

Loans can help close those cash flow gaps, but only if your business is ready. In this guide, we'll break down loan types, eligibility, repayment terms, and real-world experiences so you can make the best choice for your goals. Let's dive in.

Signs Your Business Might Be Ready To Borrow

Taking out a small business loan is a big decision. The right timing can mean the difference between manageable growth and unnecessary debt. So, how do you know if your business is ready?

Start by evaluating your current business needs and financial stability. Lenders look for signs that your operation is mature enough to handle loan repayment — both in the short term and long term.

Here are signs your business may be ready for financing:

Consistent monthly revenue. Lenders want to see that your business earns steady income, even if it's seasonal. This helps demonstrate your ability to cover monthly payments.

Clear business plan. You should know exactly how you'll use the loan, whether it's for working capital, inventory, marketing, or equipment. A strong business plan shows purpose and preparedness.

Solid credit score. A higher credit score increases your eligibility for better terms. Many lenders prefer a score of 600 or higher, but options exist for those with lower scores too.

Positive cash flow. If your business brings in more than it spends, that's a green flag. It tells lenders you can likely manage repayment without overextending.

At least six months in business. Most lenders require some operating history. If you're a startup, you may still qualify, but expect stricter terms.

Here are red flags that may mean you should wait:

You don't know how much you need. Borrowing without a plan often leads to overspending or misallocation.

Your revenue is unpredictable. If you're struggling with inconsistent cash flow, a loan might add pressure rather than relief.

Your credit is in poor shape. While bad credit loans exist, they typically come with high interest rates and short repayment terms.

You don't have a clear repayment strategy. If you're unsure how you'll pay back the loan, it's better to revisit your financials before applying.

Before moving forward, use our downloadable Loan Readiness Checklist to assess your situation. Being loan-ready means more than just meeting eligibility — it's about borrowing with confidence and control.

Types of Small Business Loans

Once you know your business is ready, the next step is choosing the right type of loan. Not all financing options are created equal. Some are built for fast funding, while others offer better rates for borrowers with strong credit.

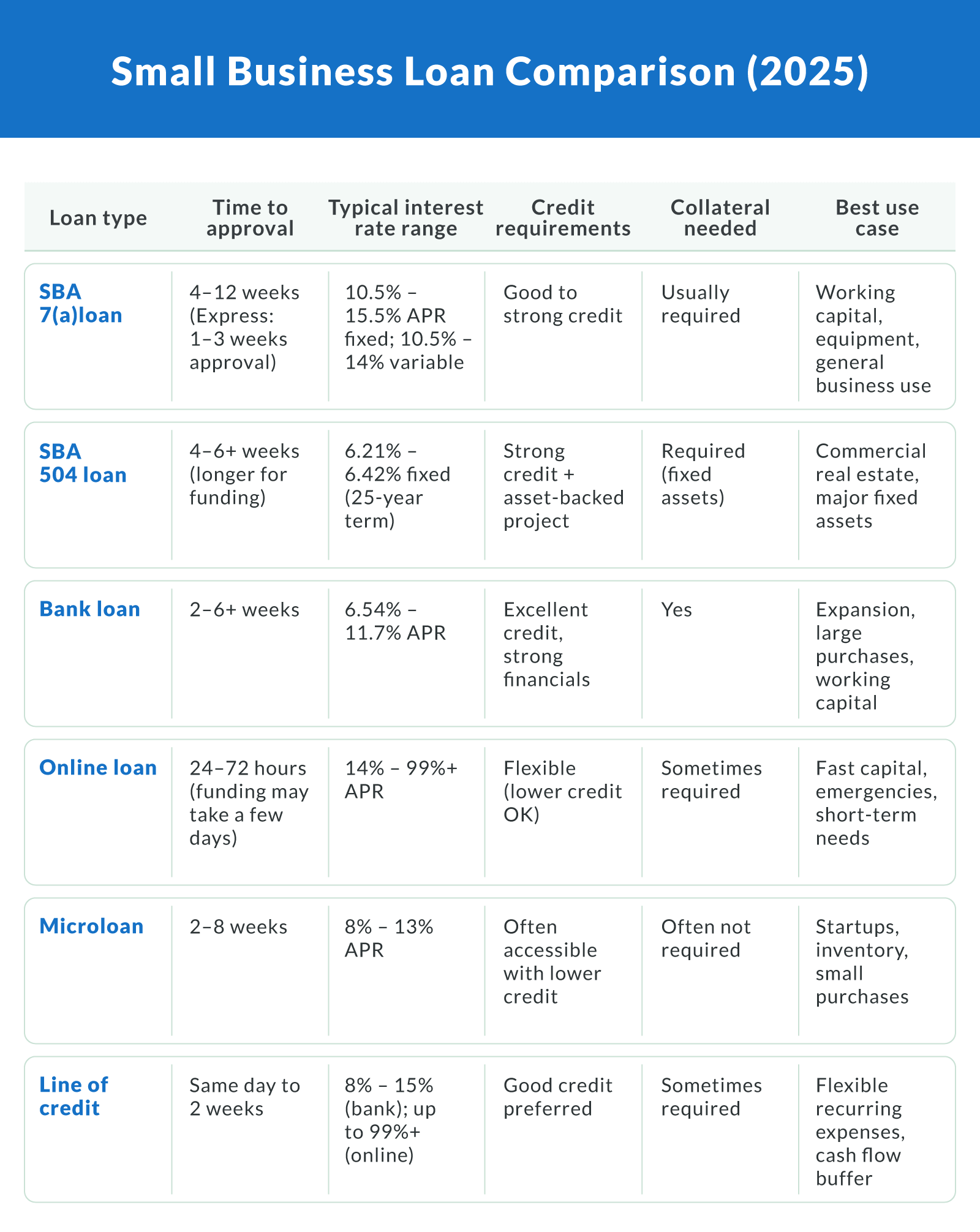

Here's a breakdown of the most common loan types available to small business owners:

SBA Loans

Backed by the U.S. Small Business Administration, SBA loans offer long repayment terms and relatively low interest rates. The SBA 7(a) loan is the most popular, used for working capital, equipment, and even real estate. The SBA 504 loan is ideal for fixed assets like buildings or machinery. These loans are harder to qualify for but offer great terms for eligible businesses.

Bank Loans

Traditional bank loans typically offer competitive rates and structured repayment plans. They're best suited for established businesses with good credit and solid financials. However, the application process can take weeks, and approval rates are lower compared to other sources.

Online Lenders

Online business loans are known for fast approvals and flexible terms. These lenders often work with businesses that don't qualify for bank loans, including startups or those with bad credit. Rates are usually higher, but the speed and convenience are major benefits.

Microloans

Microloans are smaller loans, usually under $50,000, offered by nonprofits, community lenders, or government programs. They're often used by startups or businesses in underserved communities. These loans can be easier to get but may have higher interest rates or limited usage flexibility.

Each loan option has tradeoffs. Before applying, compare factors like approval speed, interest rates, repayment terms, and the lender's requirements.

Business Lines of Credit

A line of credit offers revolving access to funds, similar to a credit card. You borrow only what you need and pay interest on the amount used. It's a great option for managing short-term expenses or covering seasonal cash flow gaps.

Small Business Loan Comparison (2025)

Pros and Cons of Taking Out a Business Loan

Every funding option comes with tradeoffs. A small business loan can be a smart tool for growth, but it's not a one-size-fits-all solution. Understanding the benefits and risks helps you make a more informed business loan decision.

Here are the key pros of business loans:

Quick access to capital. Many lenders offer funding in as little as 24 to 48 hours, which can help you respond quickly to business opportunities.

Retain full ownership. Unlike equity funding, you don't have to give up a stake in your business. You keep full control over decisions and profits.

Build business credit. Making on-time payments can boost your business credit score, opening the door to better financing options in the future.

Tax-deductible interest. In most cases, loan interest is a tax-deductible business expense, reducing your taxable income.

Flexible loan amounts. You can borrow anywhere from a few thousand dollars to several million, depending on your needs and qualifications.

Now, here are the cons to watch out for:

Interest and fees add up. APRs can range widely—from 6% for SBA loans to 75% or more from online lenders, especially for bad credit borrowers.

Repayment pressure. Monthly payments are mandatory, regardless of your cash flow. Missing them can hurt your credit and lead to penalties.

Collateral or personal guarantee. Some loans require business assets or a personal guarantee, putting your property or credit at risk.

Strict eligibility requirements. Bank loans and SBA programs often require high credit scores, detailed documentation, and a proven business model.

It's not ideal for every use. Some loans, especially SBA and equipment loans, limit how you can use the funds.

According to the Federal Reserve's 2025 report, 59% of businesses sought new financing, and 40% of them asked for under $50,000. That shows how many businesses look for small loans to handle cash flow or fuel growth, but also how important it is to match the loan amount and terms to your specific use case.

Weigh the pros and cons of business loans carefully before moving forward. The right loan can help your business thrive, but the wrong one can strain your finances.

Understanding Costs, Repayment, and Risk

Before signing any loan agreement, it's important to understand the full cost of borrowing — not just the loan amount or monthly payment. Interest rates, fees, and repayment terms vary widely by lender and loan type, and these details can significantly impact your bottom line.

Interest Rates and APR

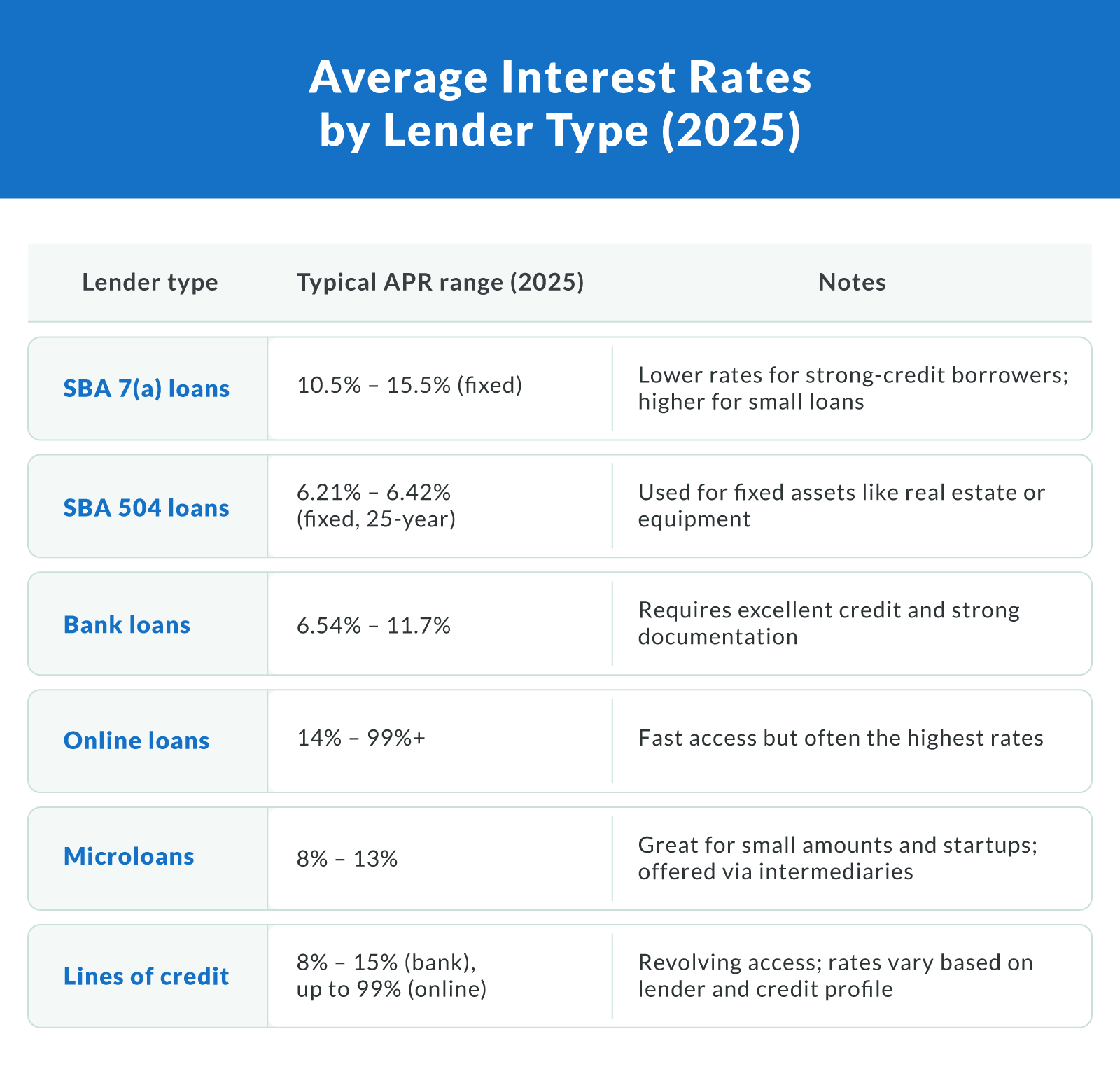

Your interest rate is the percentage charged on the loan principal. The APR (annual percentage rate) includes the interest plus any fees, giving you a more complete picture of the cost. SBA loans usually offer the lowest rates, typically between 13%–16% APR as of 2025. Online lenders may charge much more, especially for short-term loans or borrowers with bad credit.

Repayment Terms

Repayment periods can range from a few months to 25 years. Short-term loans have higher monthly payments but may cost less in total interest. Long-term loans spread payments out, making them more manageable, but they usually result in more interest over time.

Fees and Penalties

Some loans include origination fees (1%–6% of the loan amount), late payment penalties, or prepayment charges. Be sure to read the fine print to avoid surprises.

Collateral and Personal Guarantees

Many lenders require collateral — such as equipment or real estate — or a personal guarantee. If you default, the lender can seize the collateral or pursue your personal assets.

Example:

If you borrow $50,000 with a 14% APR and a 36-month term, your monthly payments will be around $1,707, and you'll pay about $11,466 in total interest.

The Risk of Borrowing With Bad Credit

Borrowing with a low credit score usually means higher APRs and shorter terms. While there are options for bad credit borrowers, they often come with steep costs. It's better to build your credit history first or seek secured loans through a nonprofit or credit union if possible.

To help compare costs, check out our infographic: Average Interest Rates by Lender Type. Understanding how much a loan will actually cost over time is key to making a smart financing choice.

Application Process and Eligibility Requirements

Getting a small business loan involves more than filling out a form. Lenders want to assess your business's financial health, repayment ability, and overall risk. While the application process varies by lender and loan program, most follow a similar path.

Here's what to expect during the application process:

Gather documentation. Be ready to submit bank statements, tax returns, profit and loss statements, and a solid business plan. Lenders will also ask for personal identification and business licenses.

Credit check. Lenders evaluate both your business credit score and personal credit score. Most lenders prefer scores above 600, but online lenders may approve lower scores at higher rates.

Submit your loan application. Whether applying with a bank, SBA lender, or online platform, you'll need to complete a detailed loan application outlining your business and funding needs.

Wait for underwriting. During this stage, the lender reviews your documents, credit history, and business profile. They may ask follow-up questions or request additional paperwork.

Accept the offer. If approved, you'll receive a loan agreement with terms and repayment details. Review it carefully before signing.

Eligibility requirements vary depending on the lender and type of loan:

SBA loans require your business to be based in the U.S., meet size standards, and operate for profit. You must also show reasonable credit and repayment ability.

Bank loans generally need strong credit, solid revenue, and a longer time in business — often two years or more.

Online lenders tend to be more flexible. Many accept businesses with six months of operations and $10,000 in monthly revenue.

As of Q1 2025, the delinquency rate on business loans was just 1.30%, showing most borrowers are still keeping up with payments. But high debt or poor documentation can hurt your chances.

If you're funding a startup, keep in mind that most new businesses rely on personal savings or credit cards in the early stages. Traditional loans can be tough to secure without an operating history.

Before applying, make sure your financials are in order. A strong loan application increases your chances of approval and better terms.

Real Stories and Entrepreneur Experiences

Sometimes the best insights come from those who've been through it. Entrepreneurs across industries have shared both positive and cautionary stories about their small business loan experiences. These real accounts can help you decide whether borrowing is right for your startup or new business.

One Reddit user shared how a loan helped them take their business to the next level:

"I started my business with a $150,000 SBA loan with almost no cash to my name. I paid it completely off in [two] years and I'm on year [four] making more money than I would have in 20 years playing the game for someone else… If you think you can do it, do it. If I didn't take the leap I'd have regretted it every day of my life.”

Another user had a rougher experience:

"I was lured by the promise of fast cash with minimal paperwork and hassle. The MCA lender offered a straightforward application process and the allure of quick funding, making it seem like the perfect solution for my immediate financial needs. However, this initial convenience masked the impending storm… I was blindsided by the hidden costs, and it became evident that I was paying far more than I initially anticipated.”

Stories like these show that success depends on how and why you borrow. A small business loan can fuel growth if you use it to fund inventory, marketing, or working capital with a clear ROI. But high-interest loans or unclear repayment plans can backfire.

Many entrepreneurs also highlight the value of working with trusted lenders. Some found banks too slow, while others appreciated how online lenders simplified the process — even if the rates were higher. Others found SBA loans worth the wait due to lower interest and flexible terms.

Loan repayments are often the biggest stressor. That's why it's important to choose a loan program with repayment terms that match your cash flow and business model.

Before borrowing, speak with other business owners, your accountant, or a loan advisor. First-hand experience can reveal pitfalls you might not see on paper.

Alternatives to Borrowing

A small business loan isn't your only path to funding. If you're not ready to take on debt — or just want to compare options — there are other ways to get the capital you need without repayment pressure.

Here are some popular alternatives to traditional loans:

Bootstrapping. Using personal savings is one of the most common funding options for startups. It gives you full control without interest payments. According to DeFacto, 44% of business owners planned to use savings, while only 29% leaned on loans.

Crowdfunding. Platforms like Kickstarter or Indiegogo let you raise money from the public in exchange for early access, perks, or products. It's a great option for consumer-facing businesses with a strong marketing pitch.

Grants. Federal, state, and local agencies — as well as nonprofits — offer small business grants. These don't require repayment, but competition is high, and applications can be time-consuming.

Venture capital. If you're building a scalable tech company or fast-growth startup, equity investment might make more sense. You give up a percentage of ownership but gain funding and often strategic support.

Personal loans or business credit cards. These can be quicker to access than traditional loans, but come with higher interest rates and lower loan limits. They work best for short-term needs or small purchases.

Alternative funding isn't risk-free, but it can be a better fit depending on your stage, goals, and credit profile. If cash flow is tight or your business is still finding its footing, look into grants or nonprofit support before borrowing.

Clarify Capital also helps connect small business owners with flexible, non-loan funding options. If you're unsure whether a loan is right for you, speaking with a funding advisor can help you explore all your choices.

Final Decision-Making Framework

Still unsure whether to move forward with a small business loan? A structured approach can help clarify your thinking. Use this quick framework to assess your readiness and make a more confident business loan decision.

Identify your purpose. What specific need will the loan cover? Whether it's buying equipment, improving cash flow, or expanding locations, having a clear goal helps you choose the right type of loan.

Check your financials. Review your monthly revenue, business banking history, and cash flow. If you can comfortably cover monthly payments, that's a green light. If not, consider building your finances first.

Evaluate your credit profile. Look at both your business credit score and personal credit score. A score of 600 or higher improves your odds of approval with better repayment terms.

Compare loan programs. Different loans serve different needs. SBA loans offer low rates but require more paperwork. Online lenders move fast but charge more. Decide which loan program fits your use case and timeline.

Be honest about risk. Are you prepared to sign a personal guarantee or offer a down payment? Do you have a backup plan if revenue dips? Risk awareness is key to borrowing wisely.

Watch out for red flags like:

Unclear use of funds. If you don't know how much you need or why, hold off.

No repayment strategy. Don't borrow unless you're confident in how you'll repay.

Poor or unverified financials. Lenders will see through weak documentation.

Making the right decision starts with asking the right questions. Use this framework to weigh your financing options carefully. If you're still not sure, connect with a Clarify Capital loan advisor to walk through your goals and get expert feedback.

Making the Smart Choice for Your Business

A small business loan can open the door to new growth—but only if you borrow for the right reasons and on the right terms. With the right lender, strong financials, and a clear repayment strategy, financing can boost your cash flow, fund expansion, or help you take advantage of opportunities.

But borrowing also means taking on responsibility. Interest rates, monthly payments, and credit impact should all factor into your decision. Whether you're running a startup or managing an established business, it's worth comparing all financing options before moving forward.

The key is finding a loan that fits your business, not the other way around. If you're ready to take the next step, speak with a Clarify Capital loan advisor today. They'll help you compare offers, find the best terms, and get funded fast.

Apply now to see what you qualify for — no obligation, no pressure. Your business deserves smart funding that supports your goals.

FAQs About Business Loans

Here are some of the most common questions entrepreneurs ask when considering a small business loan. These answers can help clarify what to expect, what to watch out for, and how to move forward with confidence.

What Are the Pros and Cons of Getting a Small Business Loan?

Small business loans can provide essential working capital, improve cash flow, and help fund growth or expansion. However, they often come with interest payments, potential collateral requirements, and personal guarantees. It's important to evaluate your repayment capacity and long-term plans before committing.

How Do I Know if My Business Is Eligible for a Loan?

Eligibility typically depends on your business credit score, time in business, annual revenue, and ability to repay. SBA loans, for example, have specific eligibility requirements around business size, U.S. operation, and legal status. Lenders may also review your personal credit score and business plan.

What Types of Loans Are Available for Small Businesses?

Options include SBA loans, traditional bank loans, online business loans, microloans, lines of credit, and equipment financing. Each loan type has different repayment terms, approval requirements, and ideal use cases. Some are better suited for short-term needs while others are built for long-term growth.

What Is a Good Interest Rate for a Small Business Loan?

As of 2025, SBA loans typically offer fixed rates between 13%–16% APR, while online lenders may offer rates as high as 75% APR depending on creditworthiness. Bank loan interest rates are usually lower but harder to qualify for. Always compare APRs and total repayment cost, not just monthly payments.

Can I Get a Business Loan With Bad Credit?

Yes, but options may be limited to short-term, high-interest loans or alternative lenders. These come with higher APRs and more risk, so it's wise to explore building your business credit first or seeking secured financing options through credit unions or CDFIs.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts