A bridge loan (sometimes referred to as a swing loan, gap financing, or interim financing) is a temporary financing option that businesses and individuals use to “bridge the gap” between times when funding is needed but not yet available — in other words, it's a loan to help meet your immediate cash flow needs.

Key Takeaways:

Bridge loans provide fast cash flow to help cover funding gaps

Home equity can influence how much funding you'll get with a bridge loan

Bridge loans normally come in small sums with short repayment terms

How Do Bridge Loans Work?

A `bridge loan typically serves as a temporary source of financing while a business or a person secures a more permanent solution, like equity financing or a long-term, low-interest loan. On average, most bridge loans have repayment terms that range from six months to a year.

For real estate transactions, bridge financing lets borrowers take out a loan equal to their home equity. Home equity is the home's value minus the homeowner's balance on their mortgage.

Bridge loans are commonly offered by online lenders, local banks, credit unions, and asset-based lending companies. Homeowners who seek this type of loan may not always get funding from traditional mortgage lenders. Lastly, bridge loans usually have higher interest rates than other financing options, like home equity lines of credit (HELOC).

When Should You Consider a Bridge Loan?

Taking out a bridge loan can be the best financial option available for homeowners, especially in the following scenarios:

A borrower wants to ensure they get a house they've chosen and are confident they can sell their current house quickly

If a borrower wants to buy another home without making the purchase conditional on selling their existing home

A borrower can't afford a down payment on the new home without selling their existing property first

If a borrower is scheduled to close on the purchase of the new property before closing on the sale of their old home

How Do You Qualify for a Bridge Loan?

If you're looking to get approved for a bridge loan, lenders heavily weigh four factors: your personal credit score, your debt-to-income ratio, and the equity on your current property.

Collateral

Collateral refers to any assets you can offer to a lender if you can't fully pay off a loan. Borrowers normally offer personal possessions like cars, jewelry, stocks, and bonds as collateral for secured loans.

Credit Score

Lenders often use a borrower's credit score to gauge the likelihood of someone repaying a loan. Since accounts owed and payment history make up 65% of your FICOⓇ credit score, borrowers with high credit are often viewed as financially responsible individuals.

Debt-to-Income Ratio

A person's debt-to-income ratio weighs the total amount of debt they owe against their reported income. Funds from a salary, investments, and business transactions play a role here.

Equity on Your Current Home

Since you're borrowing against your current home's equity, you need a decent amount of equity to qualify for a bridge loan. This is why you'll find that most lenders require at least 20% home equity before they approve a bridge loan application.

Note that the loan is also secured by your current home. Even though a bridge loan is a short-term loan, there are several things to consider. So, take your time and understand how the requirements affect your application.

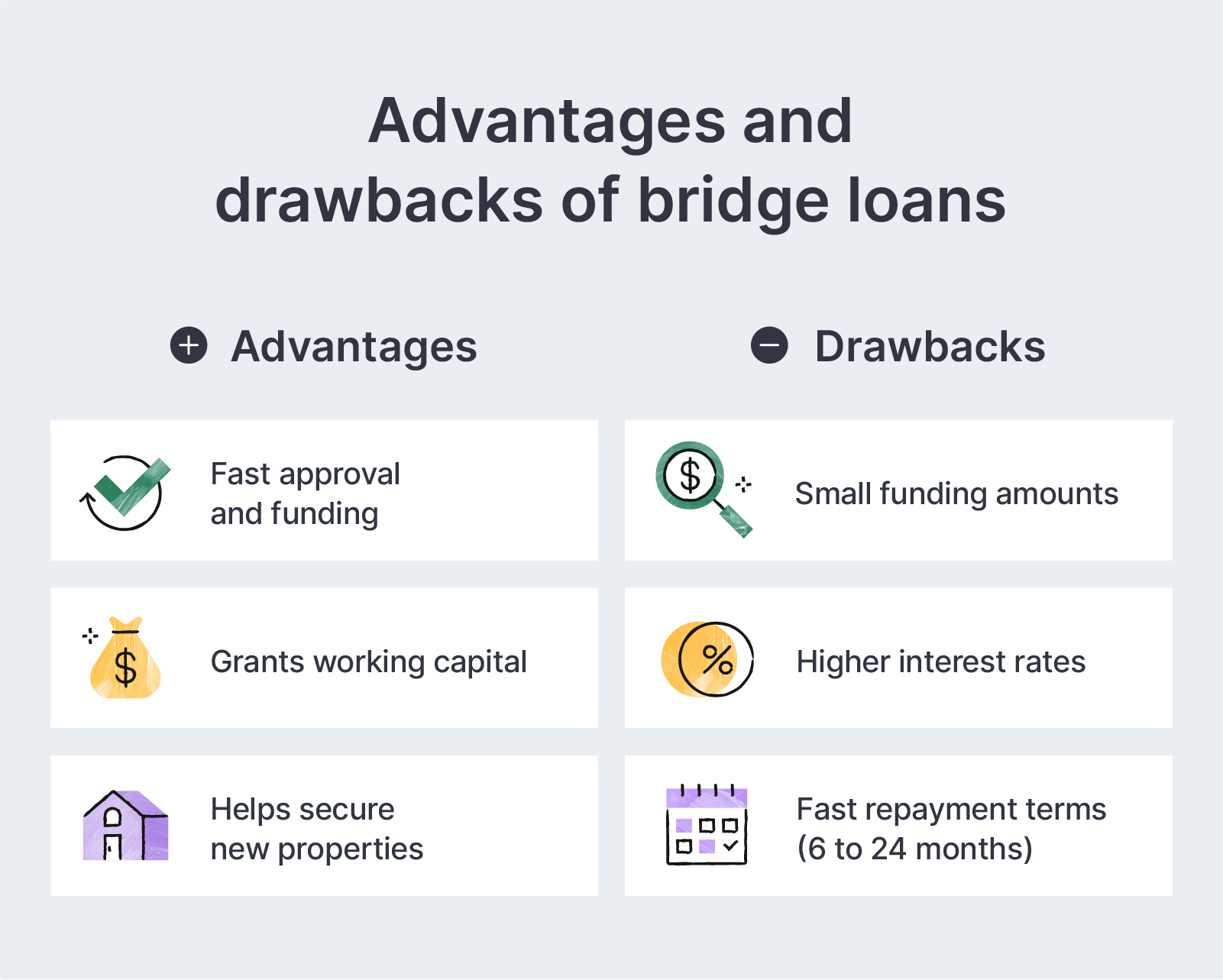

Pros and Cons of Bridge Loans

In this section, we discuss the pros and cons of bridge loans to help you consider if it's the right type of financing option for you.

Pros of Bridge Loans

They provide a fast and easy source of funding for businesses that are awaiting capital from another form of long-term financing.

They allow homebuyers to purchase a new property even before selling their current home.

They offer flexibility and peace of mind for business owners and homeowners to have cash available when they need it.

They grant working capital to businesses during periods of time-sensitive transitions.

Cons of Bridge Loans

They come with higher interest rates and fees than small business financing or other personal loan options, such as business lines of credit, term loans, home equity loans, etc.

They can cause a financial burden to homebuyers who may need to pay the interest plus two mortgage loans.

The cost of debt and interest payments could impact a business's cash flow negatively.

They have more strict requirements than other financing options, so it can be difficult to qualify for.

Since bridge loans are customized to the borrower, the terms, costs, and conditions can vary widely.

Borrowers have to put up collateral, such as property or inventory, to get approved for a bridge loan. The collateral can be foreclosed or seized when the loan expires.

Alternative Options to Bridge Loans

High interest rates and potential collateral requirements are the biggest drawbacks to bridge loans, so review as many alternatives as possible before committing to one. Some of these options include:

Home equity lines of credit (HELOC): Homeowners can access a steady line of revolving credit based on the equity of their homes. Many homeowners use this option to fund home improvements that can boost their property's value.

Hybrid mortgage: A hybrid mortgage will start with a fixed interest rate before transitioning into an adjustable interest rate later. They can benefit people with low credit scores by requiring borrowers to make consistent monthly payments—which can help them manage their budget more easily.

Remortgaging: If possible, refinance your mortgage to obtain a lower interest rate or monthly payments. You'll have to check with your lender and possibly a mortgage broker for this option.

Bridge Loans vs. Traditional Loans

| Bridge Loans vs. Traditional Loans | ||

|---|---|---|

| Bridge Loans | Traditional Loans | |

| APR | 10%+ | Varies |

| Term Length | 6 months-1 year | Up to 30 years |

| Loan Amount | Based on home equity | Based on various factors |

| Collateral Required | Real estate or business inventory | Varies/ Not always needed |

| Credit Check | Yes | Yes |

| Best used for | Temporary funding | Long term financial operations |

Bridge loans and traditional loans both excel at handling specific financial situations. Here's a breakdown of how bridge loans compare to more traditional funding options.

Bridge loans provide fast funding within several business days. Traditional loans can take weeks to secure.

Bridge loans have high-interest rates that can well exceed the 10% range. Traditional loans normally have competitive rates.

Traditional long-term loans can offer repayment terms that span several years. Bridge loans are exclusively offered with short-term repayment plans that normally cap out at 1 year.

Repaying both bridge loans and traditional loans can improve your credit score over time, though repaying a traditional funding option may impact your score more significantly.

Bridge loan amounts are based on your current home equity and the next property you'd like to buy. Traditional loans can offer a wider range of payment options.

How To Get a Small Business Bridge Loan

Small businesses can experience ebbs and flows in revenue as they begin to establish themselves. And even experienced entrepreneurs may need extra capital to address unexpected circumstances. If you'd like to apply for a bridge loan for your small business and want a knowledgeable person to guide you, contact Clarify Capital today and speak to our dedicated advisors.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts