With the small business lending market projected to hit $7.2 trillion by 2032, there's no shortage of options — but the challenge is picking the right one.

This guide breaks down the top 2025 small business loan options to help you compare features, funding speed, and credit score requirements. We'll look at both traditional and online lenders offering SBA loans, term loans, merchant cash advances, and more. Whether you're just starting out or expanding operations, you'll find a lender tailored to your needs.

We'll also show you how to streamline the search using a comparison tool built to filter results based on your credit score, business age, and preferred loan type. So you can spend less time guessing — and more time growing your business.

How To Compare Small Business Lenders in 2025

Choosing a lender in 2025 means balancing cost, flexibility, speed, and service. Here's how to compare small business lenders efficiently:

Review eligibility criteria. Each lender sets its own credit score, revenue, and time-in-business requirements.

Evaluate loan amounts and terms. Some lenders cap loan amounts at $150,000, while others offer up to $5 million. Term lengths vary from months to several years.

Understand the application process. Traditional banks might need financial statements, tax returns, and a business plan. Online lenders tend to have faster, digital-first applications.

Check repayment terms. Fixed daily, weekly, or monthly payments can affect your cash flow differently. Make sure the repayment structure aligns with your revenue cycle.

Factor in speed and flexibility. If you need fast funding, online lenders or marketplaces often approve and fund within 24 to 72 hours.

To simplify your search, use our interactive comparison tool. It lets you filter by loan type, funding speed, credit score range, and time in business — helping you identify the most relevant lenders without the guesswork.

9 Best Small Business Lenders for 2025

Here's a look at the top small business lenders for 2025. Each option offers unique strengths depending on your funding needs, credit score, and how fast you need the money.

1. Clarify Capital (Top All-Around Choice)

Clarify Capital connects small business owners to over 75 lenders, offering flexible financing options across many industries. Whether you're a startup or a more established business, they help match you with tailored loan solutions.

Primary loan types: Term loans, working capital loans, merchant cash advances, business lines of credit, and equipment financing.

Approval rate: High — especially for applicants with $10,000+ in monthly revenue and 500+ credit score.

Pros:

Fast funding. Capital can be delivered in as little as 24 hours.

Multiple loan options. Access a broad range of products from SBA loans to merchant cash advances.

Flexible underwriting. Personalized review process supports borrowers with nontraditional credit profiles.

Cons:

May require personal guarantee. Common for higher-risk applications.

Customer sentiment: Positive. Business owners praise the speed, transparency, and hands-on guidance from loan advisors.

Clarify Capital is a standout for business funding thanks to its variety, speed, and support — especially for those looking for working capital or quick access to merchant cash advances.

2. Lendio

Lendio offers a marketplace that connects borrowers to over 75 lenders with just one application. It's ideal for small business owners who want to compare multiple loan options quickly.

Primary loan types: SBA loans, short-term loans, equipment financing, merchant cash advances, business lines of credit, and commercial real estate loans.

Approval rate: Moderate to high, depending on lender matches and applicant creditworthiness.

Pros:

Single application. One form connects you with dozens of loan providers.

Wide range of loan types. Covers nearly all small business financing needs.

Customer support. Dedicated funding managers help guide borrowers through the process.

Cons:

Match-based system. You don't choose the lender upfront—offers come from Lendio's network.

Customer sentiment: Generally positive. Users appreciate the convenience and speed, but note that experiences can vary by partner lender.

Lendio is a strong option for business owners who want access to multiple top small business loan providers without applying separately at each one.

3. OnDeck

OnDeck is known for fast, short-term financing — often used to cover unexpected expenses or bridge temporary cash flow gaps. The platform is built for speed, with funding available in as little as 24 hours.

Primary loan types: Short-term business loans and business lines of credit.

Approval rate: Moderate — generally better for businesses with consistent revenue and a credit score of 625+

Pros:

Quick funding. Many loans are approved and funded within one business day.

Simple application. No extensive paperwork required for most borrowers.

Business-friendly platform. Designed for small businesses needing up to $250,000.

Cons:

Higher rates. APRs tend to be higher than traditional loans.

Short repayment terms. Typically 24 months or less.

Customer sentiment: Mixed to positive. OnDeck is often praised for speed and ease, but receives some critiques for higher costs.

OnDeck is a solid option for entrepreneurs needing fast cash without a lengthy application process, especially for short-term working capital needs.

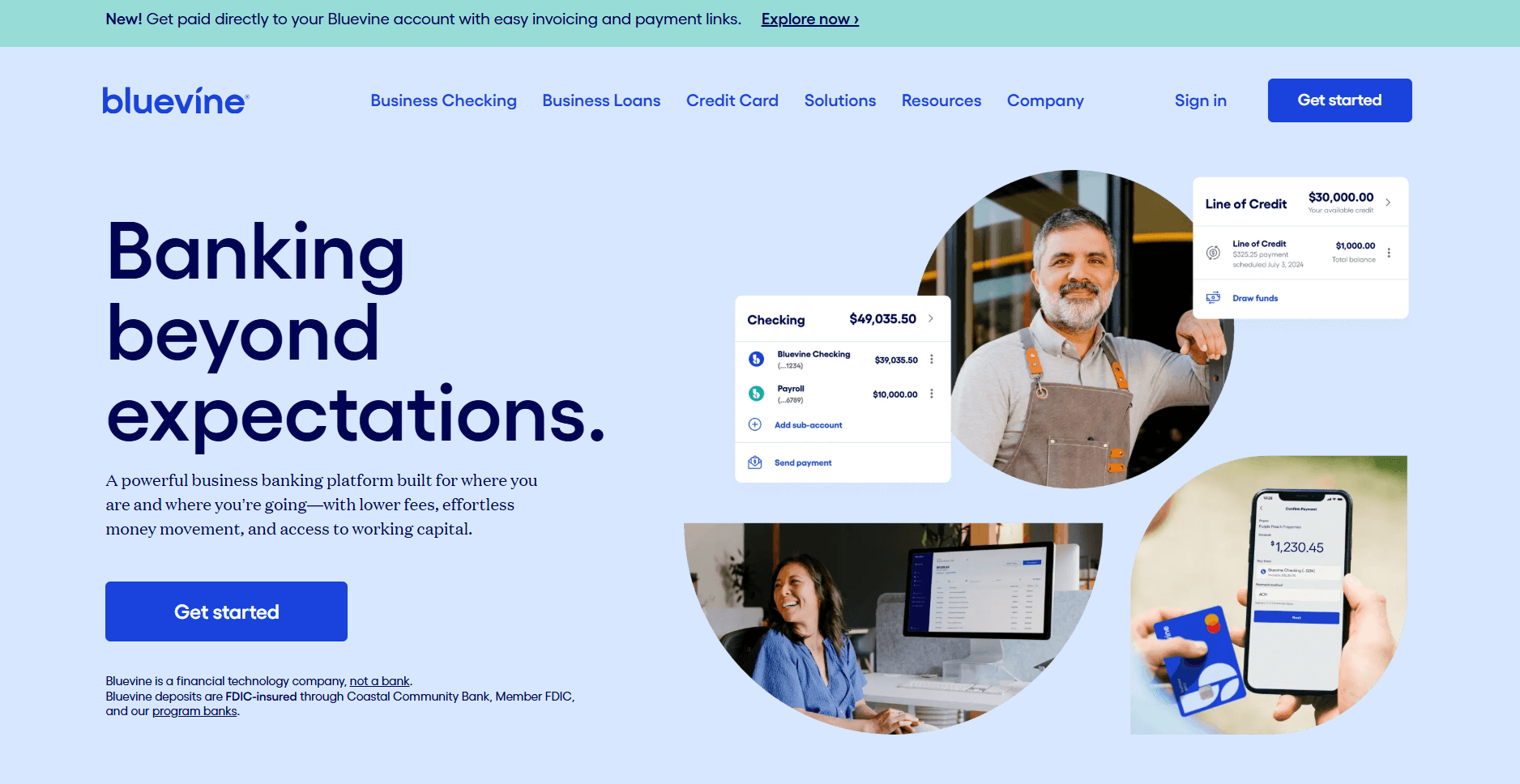

4. BlueVine

BlueVine stands out for its flexible business line of credit, making it a great choice for recurring working capital needs. Its online platform is built for speed and ease of use.

Primary loan types: Business lines of credit, term loans, and SBA loans.

Approval rate: Moderate — suitable for businesses with 625+ credit scores and $10,000+ in monthly revenue.

Pros:

Revolving credit. Draw funds as needed and only pay interest on what you use.

Fast access. Approvals often happen in minutes, with same-day funding possible.

No prepayment penalties. Repay early without extra fees.

Cons:

Higher rates for lower credit. APRs increase significantly for riskier profiles.

Limited to lines of credit. Fewer loan products compared to some competitors.

Customer sentiment: Generally positive. Small business owners appreciate the convenience and transparency, especially those needing flexible working capital.

BlueVine is ideal for entrepreneurs who want ongoing access to funds without reapplying every time they need capital.

5. Fundbox

Fundbox focuses on helping newer or credit-challenged businesses access quick funding. It offers a fast, automated lending experience with lines of credit that are easy to use and understand.

Primary loan types: Business lines of credit and short-term loans.

Approval rate: High for borrowers with a 600+ credit score and steady business activity.

Pros:

Low credit requirement. Accepts credit scores as low as 600.

Quick application. Approvals in minutes with minimal paperwork.

Transparent terms. Weekly repayments and clear fee structure.

Cons:

Limited loan options. Offers fewer products than marketplace lenders.

Short repayment window. Terms typically range from 12 to 24 weeks.

Customer sentiment: Mostly positive. Users highlight the easy process and quick access to working capital.

Fundbox is a good fit for small businesses that need fast funding without meeting strict credit or documentation requirements.

6. Live Oak Bank

Live Oak Bank is one of the top SBA 7(a) lenders by dollar volume, making it a go-to for business owners seeking government-backed financing. It's ideal for established businesses looking for large loan amounts and long repayment terms.

Primary loan types: SBA 7(a) loans and SBA 504 loans.

Approval rate: High among SBA-prepared applicants with strong credit profiles.

Pros:

Specialized SBA lending. Deep experience and support for SBA loan applications.

Higher loan amounts. Offers up to $5 million for qualified borrowers.

Experienced advisors. Guidance throughout the process.

Cons:

Longer process. SBA loans take more time and paperwork.

Higher qualification bar. Strong credit and detailed documentation required.

Customer sentiment: Generally positive. Business owners appreciate the support and knowledge of SBA lending specialists.

Live Oak Bank is a strong fit for businesses with a solid foundation and a need for larger SBA-backed financing.

7. Kabbage by American Express

Kabbage offers automated lines of credit with quick funding and minimal friction. Now part of American Express, it combines speed with a trusted brand.

Primary loan types: Business lines of credit.

Approval rate: Moderate — higher for businesses with 640+ credit scores and solid banking history.

Pros:

Fast decisions. Automated approvals often within minutes.

Flexible use. Draw what you need, when you need it.

Reputation. Backed by American Express.

Cons:

Limited products. Focuses only on lines of credit.

Higher rates. Can be expensive depending on draw amount and repayment.

Customer sentiment: Mixed to positive. Users like the convenience but sometimes note the costs.

Kabbage is ideal for tech-savvy entrepreneurs who want on-demand access to funding with minimal paperwork.

8. Credibly

Credibly specializes in working capital loans and same-day funding for small businesses. It offers personalized options for businesses with fair to good credit.

Primary loan types: Working capital loans, merchant cash advances, and equipment financing.

Approval rate: High for businesses with $15,000+ in monthly revenue and 500+ credit score.

Pros:

Fast approval. Decisions and funding within 24 hours.

Bad credit options. Accepts lower credit scores.

Multiple loan products. Variety of funding types.

Cons:

Higher costs. Rates can be steep, especially for MCAs.

Shorter terms. Loans often under 18 months.

Customer sentiment: Mostly positive. Business owners cite fast service and a smooth process.

Credibly is a practical choice for businesses that need quick working capital or funding despite credit challenges.

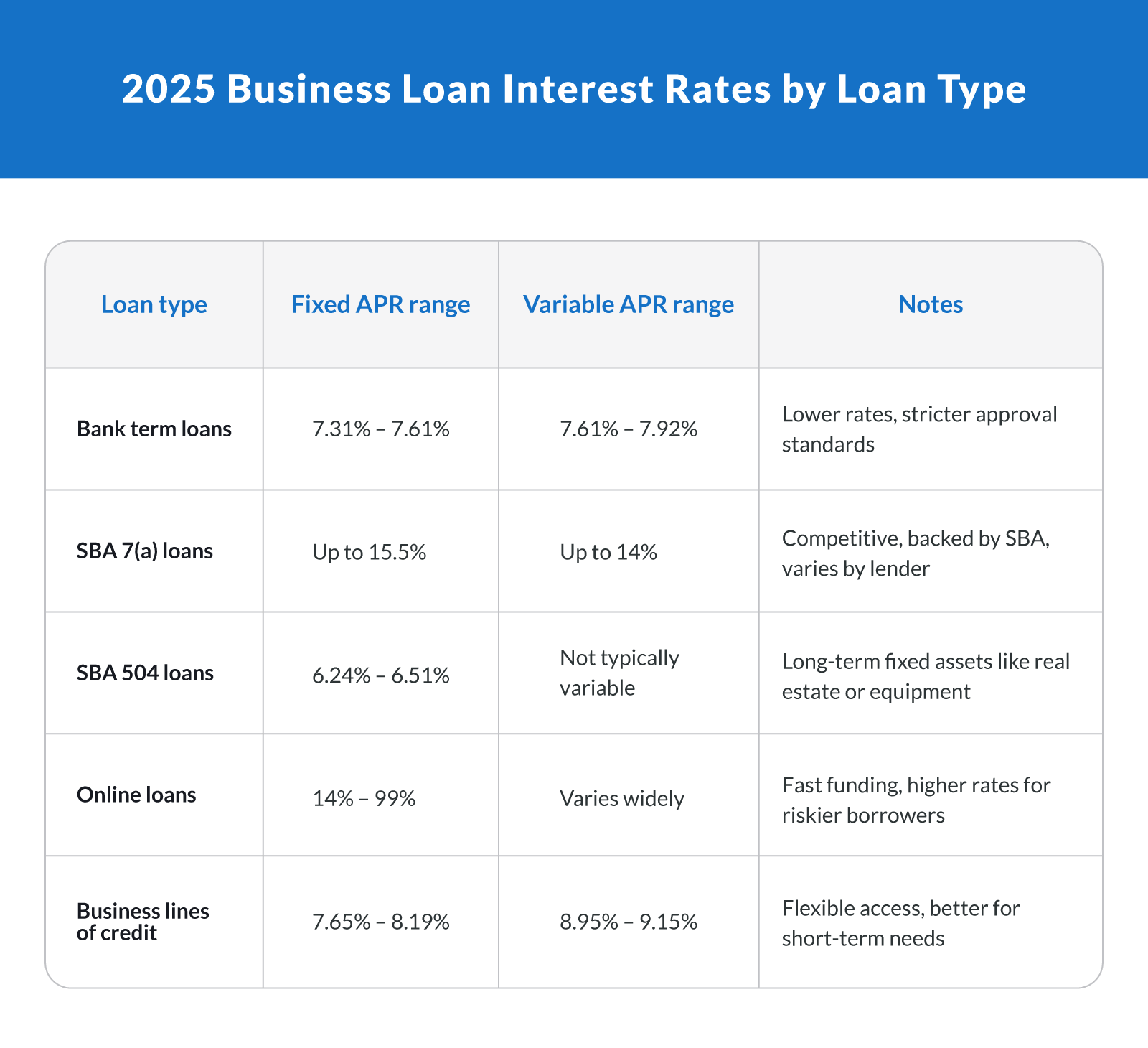

Interest Rate Landscape in 2025

Interest rates for small business loans in 2025 vary widely depending on the lender, loan type, and your credit profile. As of this year, SBA 7(a) loans can reach up to 14% variable APR. Online lenders typically charge higher rates than banks, but they also approve loans faster and accept broader credit ranges.

Lenders adjust rates based on your business revenue, credit score, industry risk, and time in business. Shopping around helps you find the best offer, especially if you compare offers from both traditional banks and online lenders.

Borrowers with stronger credit and financial statements typically receive lower rates and better terms. Using the comparison tool can highlight rate ranges by lender, so you can quickly identify affordable financing options.

Local and Niche Lender Options

For small business owners looking beyond national lenders, local and niche options can offer competitive rates and personalized service. These include credit unions, community development financial institutions (CDFIs), and nonprofit loan programs focused on underserved markets.

Credit unions. Often provide lower interest rates and flexible terms for members. They focus on relationship-based lending and are ideal for businesses with local roots.

CDFIs. These lenders specialize in funding businesses in low-income areas or those overlooked by traditional banks. They may offer grants or technical assistance along with financing.

Nonprofit lenders. Some nonprofit organizations provide microloans, business coaching, and mentoring alongside financing. These programs are designed to help minority- and women-owned businesses succeed.

Local banks. Regional banks often offer SBA loans and understand the specific needs of businesses in their geographic area. They can be more flexible in underwriting when they know your market.

These lenders might not have the fastest application process, but they make up for it in community support and mission-driven funding. For newer businesses or those with imperfect credit histories, these options are worth exploring, especially if traditional merchant cash advances or online lenders feel too expensive.

Choosing the Right Fit for Your Business

Finding the right lender starts with knowing your business needs. Are you prioritizing low monthly payments, fast approval, or flexible repayment terms? With so many 2025 small business loan options available, it pays to take your time and weigh what matters most.

Apply today with Clarify Capital and see which lenders match your eligibility and goals. Whether you're applying for your first small business loan or refinancing an existing one, having a clear sense of your needs helps you make smarter financial decisions.

FAQs

Here are answers to common questions small business owners have when applying for financing in 2025.

What Credit Score Is Needed for a Small Business Loan in 2025?

Most lenders look for a minimum credit score of 600 to 650. However, some options — like merchant cash advances or Fundbox lines of credit — accept scores as low as 500 to 600. A higher score opens doors to better interest rates and longer repayment terms.

How Fast Can I Get Approved for a Small Business Loan?

Approval speed depends on the lender and loan type. Online lenders like OnDeck or Clarify Capital can approve and fund in as little as 24 hours. SBA loans or traditional bank loans may take several weeks due to stricter underwriting and documentation requirements.

What Are the Pros and Cons of SBA Loans?

SBA loans offer low interest rates, long repayment terms, and high loan amounts. They're great for established businesses with solid financial statements. However, they require more paperwork, a longer application process, and often a personal guarantee.

What's the Difference Between Short-Term and Long-Term Business Loans?

Short-term loans are typically repaid in three to 18 months and have higher interest rates. They're useful for quick cash flow needs. Long-term loans can span several years with lower APRs and are better for larger investments like equipment or commercial real estate.

Can Startups Qualify for Small Business Loans?

Yes, but options may be limited. Startups often qualify for loans through online lenders, microloans, or personal credit-based products. Lenders may require a strong business plan, personal credit history, and recent bank statements to assess creditworthiness.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts