Every asset your business buys eventually loses value, but knowing exactly how much and how fast is key for smarter accounting and tax planning. If you've ever wondered how to track that value drop in a simple, consistent way, straight-line depreciation is your answer. It's the most commonly used depreciation method by small business owners, accountants, and bookkeepers alike. Why? Because it's straightforward, predictable, and easy to apply across different types of assets.

Whether you're managing vehicles, machinery, or office equipment, understanding how straight-line depreciation works helps you stay on top of your finances and tax obligations. In this guide, you'll learn what straight-line depreciation is, how to calculate it (manually and with our free calculator), how it compares to other methods, and when it's the best fit.

What Is Straight-Line Depreciation?

Straight-line depreciation is a method of depreciation that spreads the cost of a depreciable asset evenly over its useful life. It's called "straight-line" because the depreciation expense stays the same each year. This predictable approach makes it one of the most widely used methods among small business owners and accountants.

The straight-line depreciation method assumes the value of an asset drops at a steady rate until it reaches its salvage value. It works well for items that lose value gradually, like office furniture, buildings, or equipment.

Want to see how depreciation affects your bottom line? Understand the difference between revenue and profit.

Straight-Line Depreciation Calculator

Use our straight line depreciation calculator to estimate your annual depreciation with just a few inputs. It's a useful tool for business owners managing real estate, vehicles, machinery, and more.

You'll need to enter the following details:

Purchase price. This is the original cost of the asset.

Salvage value. The estimated value of the asset at the end of its useful life.

Useful life. The number of years the asset will be in service.

The depreciation calculator will return the depreciation value for each year of the asset's useful life. Whether you're tracking the cost of an asset or planning deductions, this tool helps simplify the math and saves time.

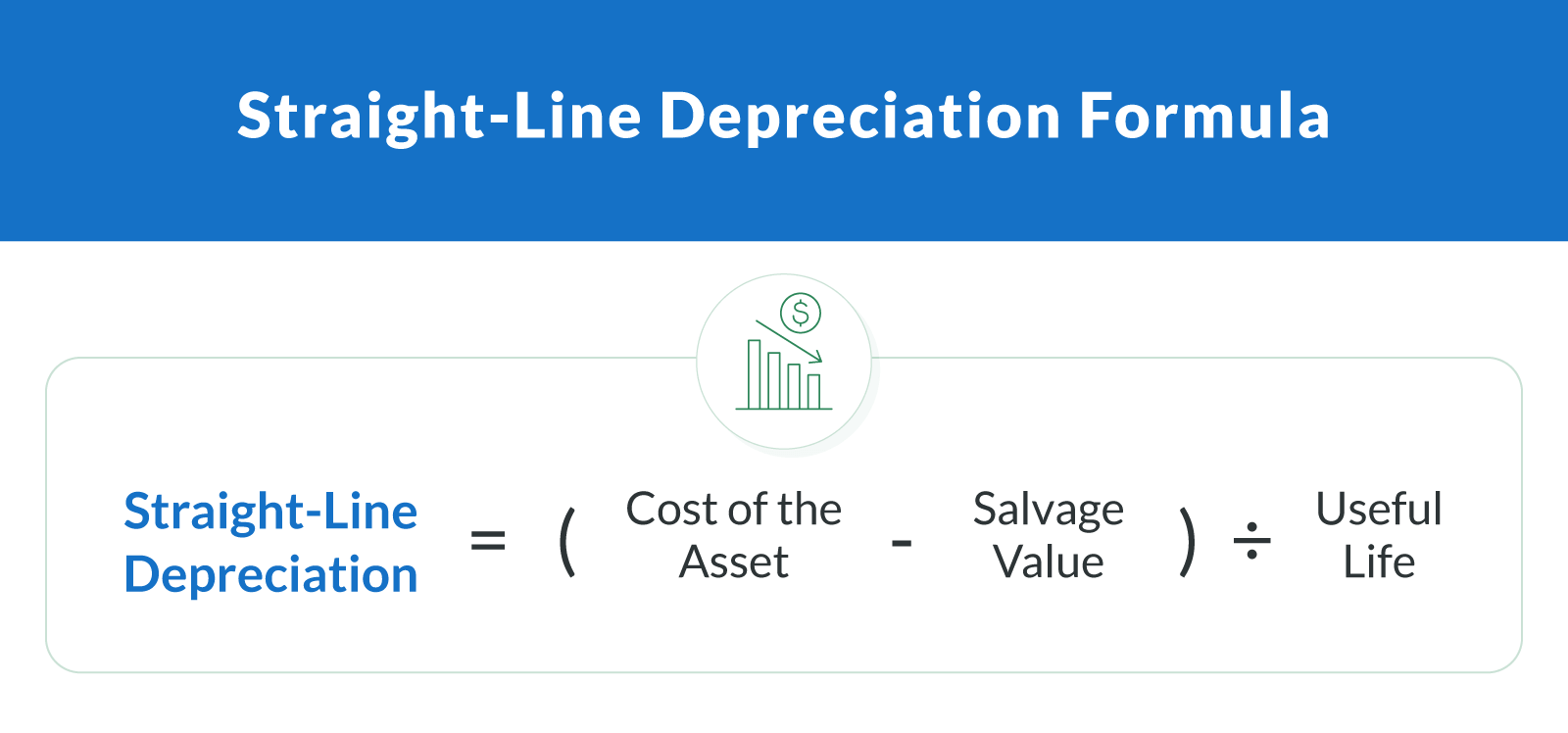

Straight-Line Depreciation Formula

Here's the straight line depreciation formula:

(Cost of the Asset − Salvage Value) ÷ Useful Life = Annual Depreciation Expense

Here's what each term means:

Cost of the asset. The amount paid to acquire the item, including taxes and delivery fees.

Salvage value. The estimated resale or scrap value of the asset after its useful life ends.

Useful life. The expected time (in years) the asset will be used in your business.

Annual depreciation expense. The amount of depreciation you record each year.

For example, let's say a piece of machinery costs $12,000, has a salvage value of $2,000, and a useful life of five years:

($12,000 − $2,000) ÷ 5 = $2,000 in annual depreciation

The amount of depreciation stays the same each year until you've fully depreciated the asset.

How To Calculate Straight-Line Depreciation, Step by Step

Here's how to calculate straight-line depreciation manually using a five-year asset:

Find the cost of the asset. Start with the total purchase price. For example: $15,000.

Estimate the salvage value. This is what you expect the asset to be worth at the end of its life. Example: $3,000.

Calculate the depreciable cost. Subtract salvage value from the purchase price: $15,000 − $3,000 = $12,000.

Determine the useful life of the asset. Say it's five years. Divide the depreciable cost by that number: $12,000 ÷ 5 = $2,400.

Use the depreciation rate if needed. Divide "1" by the number of years: 1 ÷ 5 = 20%. Multiply that by the depreciable cost: $12,000 × 20% = $2,400.

In this case, your annual depreciation is $2,400. That amount is subtracted from the asset's book value every year until the end of its useful life.

Straight-Line vs Other Depreciation Methods

Each method of depreciation fits a different type of asset or use case. Here's how straight-line compares:

Straight-line method. Equal depreciation each year; best for assets with steady value loss like real estate or office equipment.

Double declining balance method. Higher depreciation upfront; good for assets that lose value quickly, like computers or machinery.

Units-of-production method. Depreciation based on actual usage; works well for vehicles or machines with measurable output.

Sum-of-the-years' digits method. Accelerated method using a fraction of the asset's life span; ideal for high-use assets with quick early depreciation.

Each option reduces asset depreciation differently over time, but the straight-line method is the most consistent and easiest to implement.

When To Use Straight-Line Depreciation

Straight-line depreciation is a good choice when your business owns long-term assets that lose value steadily over time. It's ideal for:

Real estate. Commercial buildings and improvements depreciate evenly over multiple years.

Office equipment and fixtures. These items have predictable wear and tear.

Vehicles and general tools. If their usage doesn't fluctuate much, this method keeps things simple.

According to IRS guidelines, most depreciable assets can use the straight-line method if the value of the asset is expected to decline gradually over a set period of time. For many businesses, this method aligns best with how assets lose value during their lifespan.

Need funds for furniture or upgrades? Check out our Retail Business Loans Guide.

Know Your Numbers, Then Apply With Clarify Capital

Tracking asset depreciation doesn't have to be complicated. With our handy straight line depreciation calculator, you can estimate your annual depreciation value quickly and consistently.

This method offers simplicity with consistent yearly deductions, clarity for easy documentation, and efficiency that saves time during financial planning and tax season.

Bookmark this page and try the depreciation calculator whenever you need to calculate total depreciation for your assets.

Need help with working capital or equipment financing? Apply for funding with Clarify Capital today — it takes just two minutes.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts

![Business Action Plan Template for 2025 Growth [Free]](/assets/blog/business-action-plan-template-2025/business-action-plan-template-2025-small-cda22747f8266c0ffbaec17daaaae20a84835bff0f9e94315070bb25a2d95f6b.jpg)