Here, we'll discuss five of the best same-day business loan options and how Clarify Capital can help you find the right type of financing for you.

| Types of Same-Day Business Loans | |||||

|---|---|---|---|---|---|

| Business line of credit | Equipment financing | Invoice factoring | Merchant cash advances | Short-term loans | |

| APR | 7-25% | 8-30% | 0.5-3% | 1.14-1.18 factor rate | 7% |

| Term length | 2 years | 2-6 years | Varies | Varies | 3 months-2 years |

| Loan amount | Up to $250K | Equipment value | Invoice amount | Up to $250K | Up to $50K |

| Collateral required | ❌ | Equipment is collateral | ❌ | ❌ | ❌ |

| Credit check | Varies | ❌ | ❌ | ❌ | Varies |

| Best used for | Fast funding | Purchasing equipment | Maintaining cashflow | Working capital | Emergency expenses |

Instant business loans provide businesses with immediate access to capital, typically within 24 hours. Unlike traditional bank loans, which can take weeks or even months to process, online lenders can offer a faster alternative when you need same-day funding.

Business Line of Credits

A business line of credit offers flexible access to a preset amount of capital. Businesses can draw from the credit line as needed and only pay interest on funds they use. This revolving credit option provides ongoing access to working capital for businesses with fluctuating cash flow needs.

Equipment Financing

Equipment financing is a type of loan specifically designed to help businesses acquire, upgrade, or replace essential equipment, machinery, or technology. The equipment itself is collateral, reducing the risk for lenders and often resulting in more equipment financing rates.

Invoice Factoring

Invoice factoring lets businesses borrow funds from lenders by using unpaid invoices as collateral. Invoice financing can help businesses bridge the gap between issuing invoices and receiving customer payments.

Merchant Cash Advances

A merchant cash advance (MCA) provides your business with a lump sum in exchange for a percentage of your future credit card sales. This option is ideal for businesses with strong credit card sales, as repayments are made through automatic deductions from your daily or weekly sales. MCAs typically don't require credit checks or collateral to obtain.

Short-Term Loans

Short-term business loans grant quick access to funds and help businesses take advantage of time-sensitive opportunities. These working capital loans are designed to be repaid within a short period, usually 3-18 months.

How To Get a Same-Day Business Loan

Getting approved for a same-day business loan is faster and easier when you know what to expect from the approval process. By preparing your documents and understanding your creditworthiness, you can improve your chances of qualifying and potentially secure lower interest rates.

Here's how to get started, including tips for meeting the minimum credit score and revenue requirements.

1. Review Your Finances and Credit

Same-day business loans often come with shorter terms and specific borrowing limits. Review your revenue, expenses, and credit history to determine how much you can realistically afford to borrow. This step also helps you avoid overborrowing or applying for loans that don't match your financial profile.

2. Compare Funding Options

Not all loans are created equal. Compare lenders, terms, and repayment schedules to find the best fit for your business. For example, a $50,000 loan with a three-month repayment term may not suit a business with fluctuating monthly revenue. Prioritize loans that align with your needs and credit standing.

3. Complete Clarify Capital's Quick Online Application

The application process is fast and simple. Provide basic details about your business, including annual revenue, time in operation, and creditworthiness. This allows lenders to assess if you meet the minimum credit score and revenue thresholds.

4. Submit Your Documentation

To verify your income and strengthen your application, submit three months of your most recent bank statements. This documentation gives lenders a clearer view of your cash flow and financial health.

5. Get a Fast Approval Decision

Your Clarify Capital advisor will review your application and documents. Most applicants receive a decision within 24 hours — sometimes even faster. During this phase of the approval process, you'll also have a chance to discuss loan options and interest rates.

6. Receive Same-Day Funding

Once approved, your funds will be deposited directly into your business bank account. Many Clarify Capital clients receive their loan disbursement on the same day they apply.

Ready to apply? Start your same-day loan application with Clarify Capital and get the funding you need — fast.

Eligibility Requirements for Same-Day Business Loans

To qualify for a same-day business loan through Clarify Capital, your business must meet the following criteria:

At least $10,000 in monthly revenue

Operating for more than 6 months

Have a business bank account

Located or incorporated in the U.S.

Able to provide 3 months of recent bank statements

These requirements help lenders verify your business's financial health and ensure you're positioned for a quick and successful funding process.

Common Funding Delays and How To Avoid Them

Even with same-day or next-day approval, delays can still occur. Here are common issues that can slow down funding — and how to avoid them:

Incomplete documentation. Submit all required business bank statements, tax returns, and disclosures up front.

Unclear business plan or loan purpose. Be specific about how you'll use the funds.

Credit report discrepancies. Resolve credit issues or review your report for inaccuracies ahead of time.

Delays in underwriting. Choose providers known for fast business loan processing.

Instant business loans provide businesses with immediate access to capital, typically within 24 hours. Unlike traditional bank loans, which can take weeks or even months to process, online lenders can offer a faster alternative when you need same-day funding.

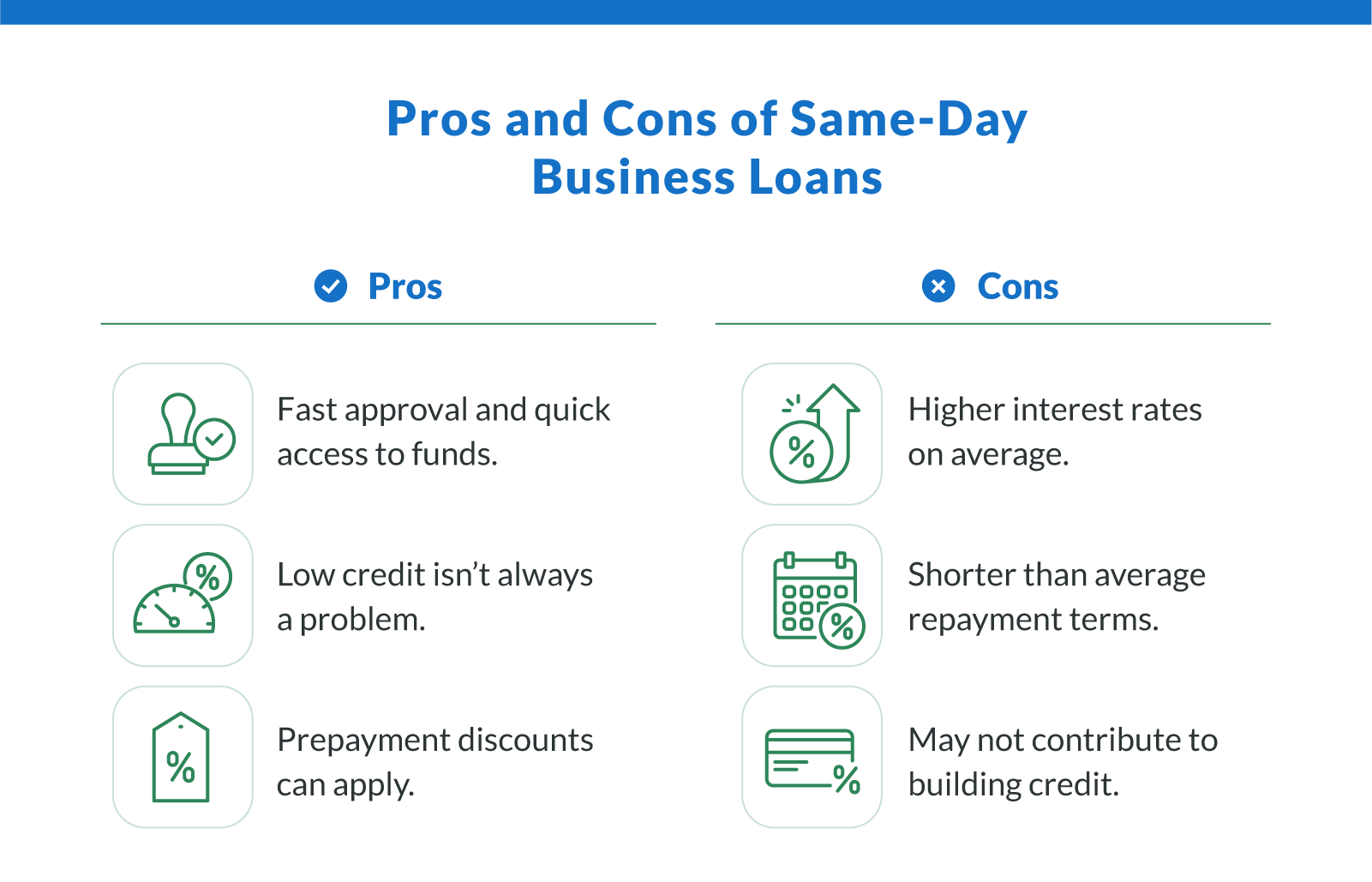

Pros and Cons of Same-Day Business Loans

All loans come with advantages and disadvantages, so it's crucial to account for them when you're speaking to lenders. Here are some of the pros and cons that come with same-day business loans.

Pros

Fast approval and quick access to funds

Low credit isn't always a problem

Prepayment discounts can apply

Cons

Higher interest rates on average

Shorter than average repayment terms

May not contribute to building credit

Get the Funding You Need, Without the Wait

Same-day business loans can give you fast access to capital when timing matters most, whether you're covering unexpected expenses or jumping on a new opportunity. The key is choosing the right option for your cash flow, repayment ability, and long-term goals.

If you're ready to explore quick financing, start your same-day business loan application with Clarify Capital and get matched with funding solutions designed for speed and flexibility.

Same-Day Business Loans FAQ

You can find a large variety of same-day business loans online or in person, which might create confusion about how they all work. Here are a few frequently asked questions about same-day business loans.

Can You Get an SBA Loan in 24 Hours?

No — Small Business Administration (SBA) loans are not designed for same-day business funding. Even the fastest SBA loan options, such as microloans, SBA Express, or 7(a) Small loans, typically take 2 to 10 business days to process. These loans involve underwriting, documentation review, and government-backed guarantee steps that prevent 24-hour turnaround times.

Borrowers who need funding within a day should consider alternative lenders instead. Platforms like Clarify Capital connect small businesses with private lenders who can offer same-day loan approvals and fund disbursement — a much faster solution than SBA-backed loans.

How Long Does a Business Need To Operate To Get a Loan?

Lenders like Clarify Capital typically require that your business has been operational for six months to 1 year. Banks, on the other hand, typically require businesses to be active for a minimum of 2 years.

What Are the Disadvantages of Same-Day Business Loans?

Same-day business loans may have much shorter repayment terms which may add additional strain on your cash flow. The ease and convenience of a same-day loan might also lead to several small business mistakes, like overborrowing or forgetting to make payments on time.

Can You Get a Same-Day Business Loan With Bad Credit?

Yes, lenders like Clarify Capital offer multiple business loans for bad credit. We consider various factors, such as your business's revenue, cash flow, and growth potential when evaluating loan applications.

However, a lower credit score may result in higher interest rates or less favorable loan terms.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts

![7 Best Equipment Financing Companies and Loan Options [2024]](/assets/blog/best-equipment-financing-companies/best-equipment-financing-companies-small-3874c9814fbefadd9f9419a140059f72e2893541ce88c7548a49986f0e852ee2.jpg)