If your business only accepts cash and cards as payment methods, it may be time to upgrade. With the rise of mobile pay and other innovative payment systems, business owners must adapt to stay ahead of the competition.

Offering various payment options makes the checkout process convenient for your customers, even helping attract new customers and boost conversion. But which payment options are best?

After surveying over 1,000 small business owners and shoppers about their checkout experience, we rounded up the top eight small business payment options to consider for your firm and key features to keep in mind.

1. Credit and Debit Cards

Card payments have been, and still are, the most preferred method of payment for consumers. After all, you can use them both in person and online, and transactions typically deposit right into your business bank account.

Though extremely convenient, fees for processing credit and debit card payments are a drawback. Credit card companies can also set their own fees, which your business has to cover. If your small business is new or low in sales, these fees can eat into your working capital.

Pros:

Most preferred method of payment

Immediate transaction

Works in-person and online

Cons:

Processing fees

2. Mobile Payment Apps

Mobile payment apps process through mobile devices such as smartphones. Also known as “digital wallets,” these apps connect directly to your bank account and process transfers just like card payments but without the transaction fee.

Use this payment option to keep users informed of transactions, where both senders and receivers can opt for text and email payment notifications.

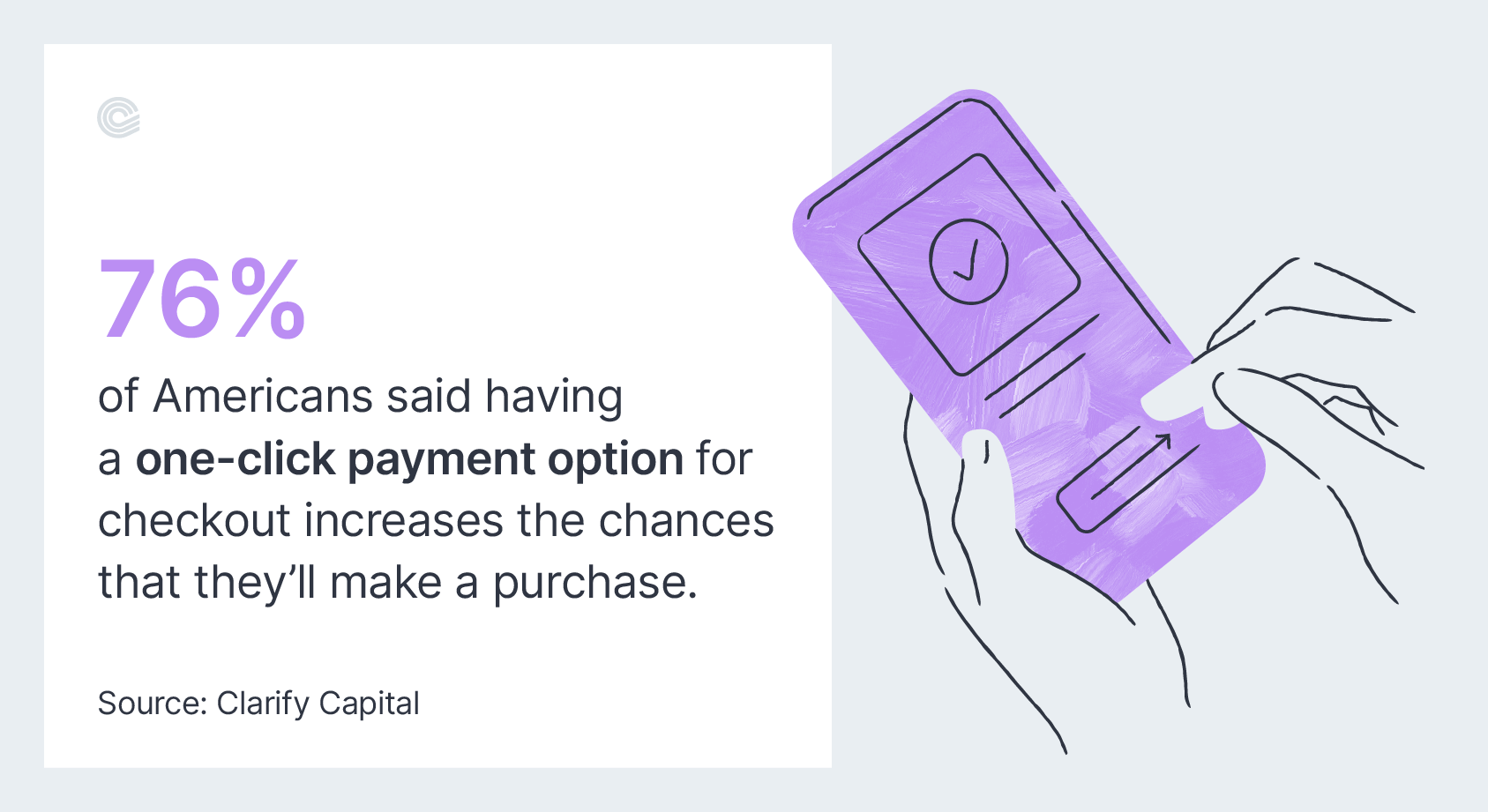

Mobile payment apps enable you and your customers to complete transactions in one or two simple clicks. When it comes to checkout preferences, our survey revealed that shoppers are more likely to make purchases with a one-click payment option.

Some mobile apps, like PayPal Zettle, double as mobile point-of-sale (POS) systems, where your business can accept card payments through mobile devices. This speedy and convenient payment option is especially popular among young consumers.

Pros:

No transaction fees

Email/text notifications of transactions

Cons:

Some features require internet connection or data

3. eChecks

Checks, a traditional form of payment that lost popularity in the digital age, have reemerged with a modern alternative. Electronic checks, or “eChecks,” are now commonly used and accepted through most major banking apps. With an eCheck, you can write in your check information digitally, where an ACH will process it.

EChecks are a popular choice of payment for small businesses like rental property LLCs, transportation businesses, and service-based industries. Some banking apps like Bank of America also allow screenshots of paper checks, digitizing the information as an eCheck for you.

However, much like paper checks, the transaction process is much slower than other payment methods. This is because financial institutions still handle the processing, which can take up to seven business days. If a customer uses incorrect information or has insufficient funds, you may not discover the issue until several days later.

Pros:

Accepted by most major banks

Bridges traditional method with modern technology

Cons:

Longer processing time

4. Online Payment Gateways

If you run an e-commerce business, online payment gateways like Shopify allow your business to process payments completely online. Payment gateways accept multiple forms of payment, including cards, digital wallets, and even eChecks. With various checkout options for consumers and high-level encryption, they're a cheaper, quicker, and more secure way to get paid.

However, payment gateway providers may not accept all card types. You'll also have to pay fees to accept online payments. Fortunately, these fees are generally cheaper than those of credit card companies.

Pros:

Syncs with most payment methods

Uses high-level encryption for security

Cons:

Doesn't accept all credit card providers

5. Contactless Payments

Thanks to “near field communication” (NFC) technology, contactless payments are increasingly common. This payment option only requires a mobile POS system to save and process payment information.

Contactless payment enables customers to pay by hovering over or tapping the POS with their mobile devices synced with a digital wallet. Your business can then issue receipts to the customers via text message or email. This contactless option also works for credit and debit cards with NFC technology.

One inconvenience to note is that there are generally high charging fees for NFC payments. Mobile POS systems with NFC readers can also be expensive.

Pros:

Helps avoid damage to cards and devices

Automated receipts and transaction notifications

Cons:

High processing fees

Expensive devices

6. Digital Invoicing

No more scavenging through paper invoices and chasing down late-paying customers. For service-based business owners like accountants and contractors, digital invoicing can be an efficient payment option. With this software, you can automatically email invoices and reminders to clients while also accepting online payments through the platform.

Platforms like QuickBooks provide digital invoicing software for merchants, where you can access and keep track of all customer information in one place. Some include automation features such as sending an instant receipt once payment is processed.

Pros:

One-stop shop service

Organizes customer information

Cons:

Uncommon outside of service-based businesses

7. Subscription Payments

Clients of personal trainers and other business owners providing ongoing services may find automated payments much more convenient. You can set up subscription-based billing for your customers, streamlining the process and eliminating late payments. Payment gateways like PayPal and Stripe offer this option as an add-on feature.

Drawbacks to consider are the additional fees and customer compliance. Some customers may not feel comfortable consenting to recurring payments. Subscription payments also require you to create a pricing plan and schedule with your preferred billing software, which may charge for the service.

Pros:

Helps avoid late/missed payments

Faster payment process

Cons:

Customers may not feel comfortable using it

Feature usually has an additional fee

8. Cash

While the above digital payment options are increasingly popular, cash will never go out of style. It's still the most traditional form of payment and therefore still good to accept for convenience.

The major advantage of using cash is that there are no additional fees to accept it from customers, so business owners actually save money with this payment method. The only considerations are the risk of theft and mismanaged money, which you can lower with the right business tools and staff.

Pros:

Timeless payment option

No fees

Cons:

Easier to mishandle

How To Choose the Best Payment Option for Your Business?

So, which payment method is right for you? It ultimately comes down to your small business needs. Think about your type of services, monthly profits, and how different payment options may improve or further complicate bookkeeping and cash management. Here are more factors to consider:

Cost: Are the payment processing fees and transaction costs within your business budget? Does it charge consumers?

Features: What other services or options come as a package deal? (e.g., automated receipts, integration with other methods)

Security: Can the options offer fraud protection for payments and personal information?

Customer base: Which payment options are most popular among the age and demographic of your consumers?

Convenience: Do your payment options help streamline or worsen the checkout process?

Loans To Invest in Payment Solutions You Need

Remember that payment technologies are constantly evolving and adaptation is necessary. The convenience of having multiple payment solutions can help keep and attract new customers, thus keeping your small business running.

If you need sufficient funds to invest in modern payment systems, Clarify Capital can help. From small business loans to collateral financing options, our dedicated team of advisors can help you secure immediate capital for your business needs.

Methodology

Clarify Capital surveyed 1,001 people —749 small-business shoppers and 252 small-business owners — on their thoughts and experience with different payment options. Survey data has certain limitations, including telescoping and memory, in relation to self-reporting.