Despite being designed to support small, budding businesses, SBA loans are sometimes seen as too hard to get or only useful for struggling startups. The truth is, many successful businesses use these loans to grow, invest in equipment, or refinance existing debt.

In today's economic climate — with higher interest rates and tougher lending standards — knowing how SBA financing really works can give your business an edge. This guide breaks down the most common myths so you can decide if an SBA loan makes sense for your next move.

Whether you're eyeing a new location, need a cash boost, or want better loan terms, understanding the SBA process might open the door to your next big opportunity.

8 Myths About Small Business SBA Loans

SBA loans are a well-known option, but not always understood. Many small business owners dismiss them based on outdated information or secondhand stories. The truth is, SBA loan programs are some of the most flexible, borrower-friendly financing options available, but misconceptions often keep qualified borrowers from applying. Let's separate myth from reality so you can evaluate whether SBA financing is the right fit for your business.

Myth #1: The SBA Lends Money Directly

Reality: The SBA doesn't issue loans itself. Instead, it works with approved lenders, like banks, credit unions, and online lenders, to fund the loan. The Small Business Administration provides a partial guarantee, which reduces the risk for the lender and opens the door for more businesses to get approved.

Myth #2: SBA Loans Are Only for Startups or Struggling Businesses

Reality: SBA loans aren't just for new or distressed companies. Most borrowers are profitable, stable businesses looking to expand, purchase equipment, or refinance. While startups can qualify, many SBA borrowers have strong cash flow and a solid business plan.

Myth #3: SBA Loan Applications Are Overly Complicated

Reality: The SBA has simplified its application process in recent years. Many loans, especially through the SBA's Preferred Lender Program, use streamlined forms and faster underwriting. With the right documentation ready, you can apply and get funded in less time than most expect.

Myth #4: SBA Loans Have High Rejection Rates

Reality: Approval odds are often higher than conventional loans, especially when applying through community banks or experienced SBA lenders. Credit score, revenue history, and the strength of your business plan all play a role, but SBA programs are designed to help reduce rejection rates.

Myth #5: SBA Loans Are Fully Government-Backed and Risk-Free

Reality: Not quite. The SBA guarantees part of the loan — usually between 50% and 85% — but the lender still takes on some of the risk. That shared risk is what makes lenders more willing to offer better terms, but it doesn't make the loan completely risk-free.

Myth #6: SBA Loans Don't Require Down Payments or Collateral

Reality: Most SBA loans do require a down payment, often around 10% to 30%. Depending on the loan type and amount, you may also need to put up collateral, especially if you're financing something like commercial property or buying a business.

Myth #7: SBA Loans Are Only for Specific Uses

Reality: SBA loans can be used for a wide range of business needs. From working capital and inventory to real estate purchases or debt refinancing, there's probably an SBA option that fits. The most popular choices are the 7(a) and 504 loan programs.

Myth #8: SBA Loans Are Essentially Grants

Reality: SBA loans must be repaid, just like any commercial loan. What sets them apart is their favorable terms: longer repayment timelines, lower interest rates, and flexible use cases. But they are not free money, and defaulting still carries consequences.

SBA vs. Conventional Loans

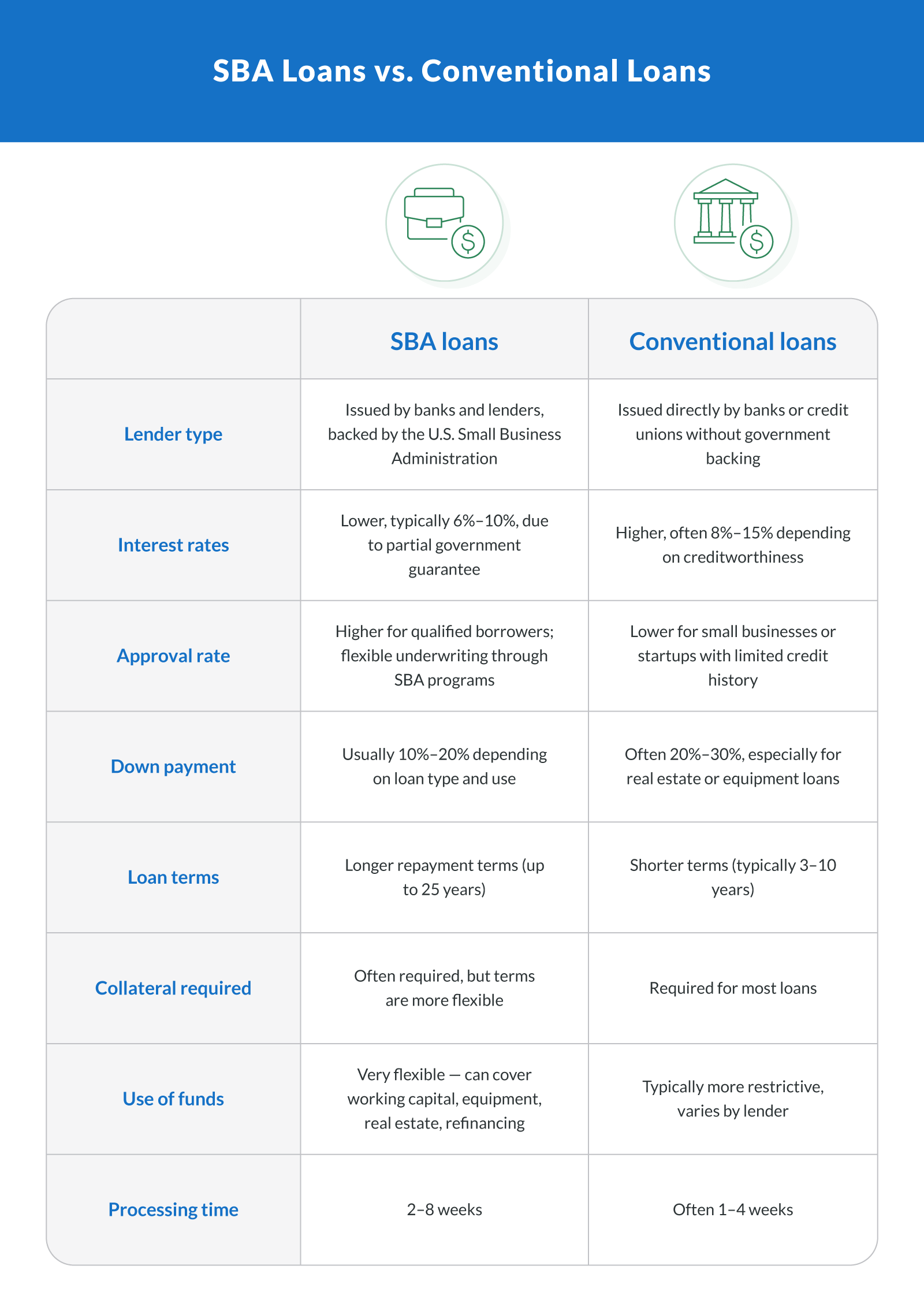

In general, SBA loans come with longer repayment terms, lower interest rates, and more flexible requirements. That can make a big difference for small businesses trying to grow without taking on high-cost debt. While conventional loans might close faster, they're often tougher to get unless you have strong credit or significant collateral.

Here's a table to illustrate the differences:

Let Clarify Capital Help With Your SBA Loan Needs

SBA loans aren't the bureaucratic headache they're often made out to be. Once you understand how they really work, they stand out as one of the most borrower-friendly financing options available to small business owners. With lower interest rates, longer repayment terms, and a range of flexible use cases, from working capital to real estate to refinancing, SBA loans can be a smart fit for businesses at nearly every stage.

Whether you're writing a business plan, expanding into a new market, or exploring better financing options for 2025, understanding the small business SBA loans myth vs reality gap puts you in a stronger position. If you're ready to see what SBA lending could do for your business, Clarify Capital can help.

Explore your options and find the best SBA loan program for your needs, and apply today.

FAQs About SBA Loans

Even after clearing up the biggest myths, many small business owners still have questions about SBA loan eligibility, timing, and usage. Here are answers to some of the most common concerns to help you navigate your next move with confidence.

How long does it take to get an SBA loan?

The timeline typically ranges from 2 to 8 weeks, depending on the loan type, your business documentation, and the lender. If you work with a lender in the SBA's Preferred Lender Program (PLP), you may be able to speed up the process thanks to their streamlined approval authority.

Can SBA loans be used to buy a business?

Yes, SBA 7(a) loans are often used for business acquisitions, including buying an existing company or franchise. These loans are popular with entrepreneurs looking to take over operations with the help of affordable, long-term financing. Microloans may also be an option.

What credit score is needed for SBA loans?

While a credit score of 650 or higher is generally recommended, SBA lenders also consider cash flow, business history, and your business plan. A strong financial foundation can help offset a lower credit score in some cases.

Do SBA loans have prepayment penalties?

Most SBA loans do not include prepayment penalties. However, loans with terms longer than 15 years, especially those used for real estate, may include a small fee if you pay off the balance early, typically within the first three years.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts