Key Takeaways:

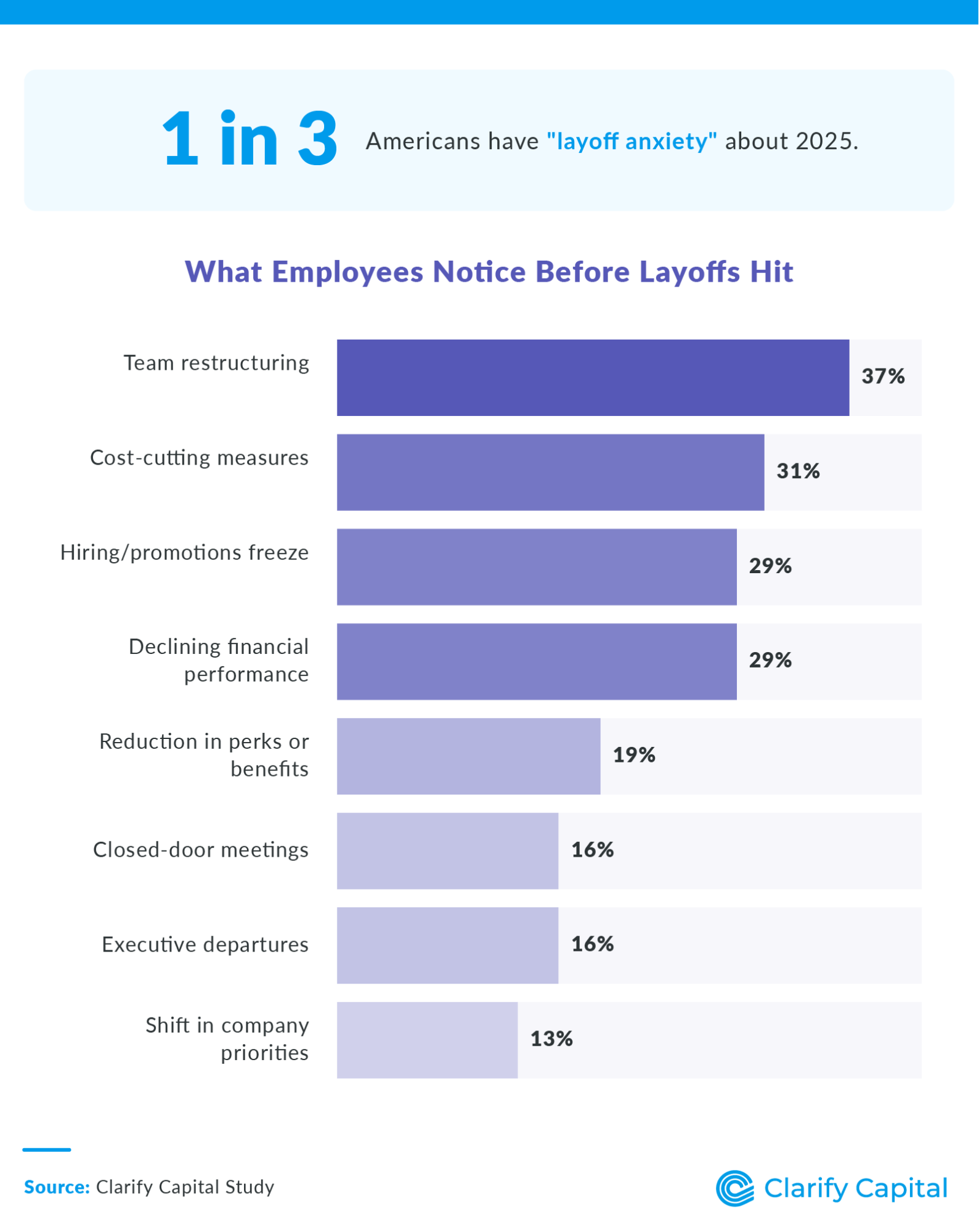

1 in 3 Americans have "layoff anxiety" in 2025.

Layoff anxiety is most common among remote workers (47%) — more than double that of in-office workers (20%).

Nearly 1 in 3 Americans would take a 10-20% pay cut to avoid being laid off.

13% of Americans have no savings, leaving them financially unprepared for a layoff.

69% of Americans prioritize job security over career growth.

Nearly 3 in 4 Americans would still work at a Fortune 500 company despite their mass layoffs.

The Reality of Layoff Anxiety in 2025

1 in 4 Americans do not feel secure in their job, given the current economic climate.

1 in 3 Americans have "layoff anxiety" about 2025.

Layoff anxiety by generation:

Baby boomers + Gen X (combined): 29%

Millennials: 33%

Gen Z: 40%

Layoff anxiety is most common among remote workers (47%) — more than double that of in-office workers (20%).

Layoff anxiety ranked by industry:

Tech

Health care

Finance

Education

Retail

What employees notice most before layoffs hit:

Team restructuring: 37%

Cost-cutting measures: 31%

Hiring/promotions freeze: 29%

Declining financial performance: 29%

Reduced perks/benefits: 19%

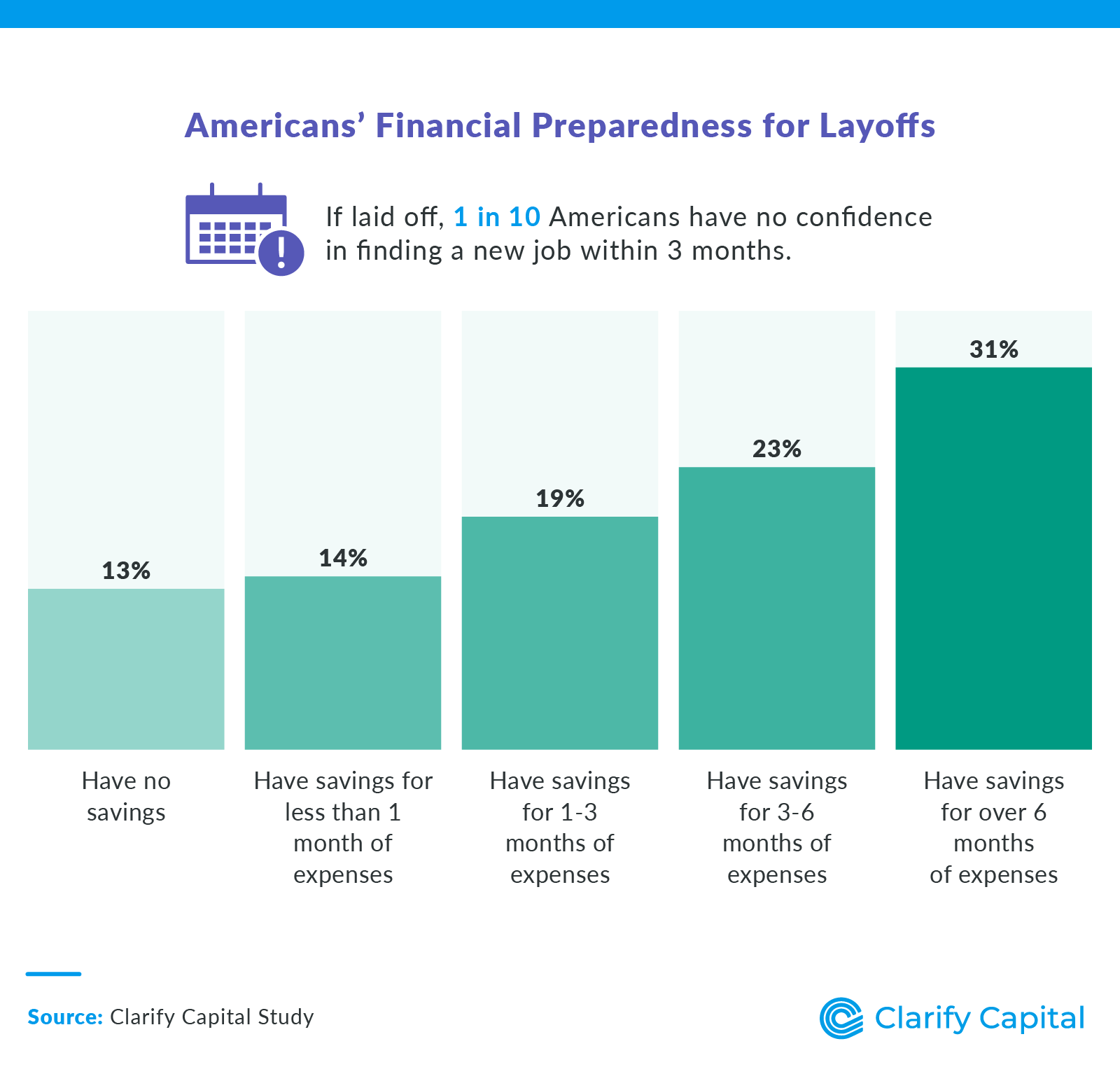

If laid off, 1 in 10 Americans have no confidence they could find a new job within three months.

By generation:

Baby boomers + Gen X (combined): 14%

Millennials: 11%

Gen Z: 11%

13% of Americans have no savings, leaving them financially unprepared for a layoff.

American's Top 5 priorities if layoffs were announced at their company:

Seeking better opportunities elsewhere: 58%

Staying employed and maintaining stability: 54%

Exploring roles at competitors in the same industry: 39%

Taking on temporary or gig work: 33%

Upskilling or pursuing further education/training: 18%

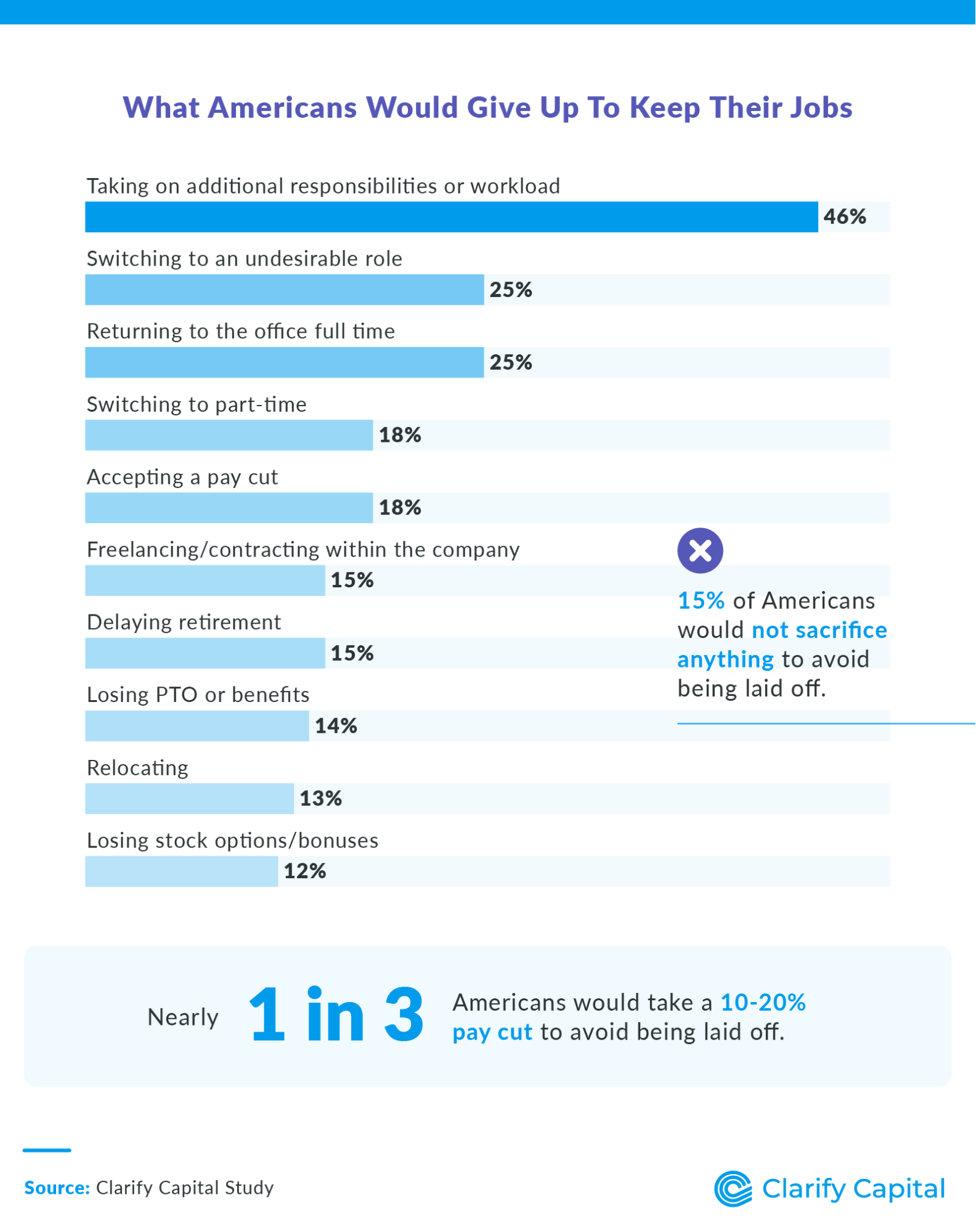

Sacrifices To Stay Employed

Sacrifices Americans would make to keep their job:

Taking on additional responsibilities or workload: 46%

Switching to an undesirable role: 25%

Returning to the office full time: 25%

Switching to part-time: 18%

Accepting a pay cut: 18%

15% of Americans would not sacrifice anything to avoid being laid off.

By generation:

Baby boomers + Gen X (combined): 16%

Millennials: 15%

Gen Z: 13%

Nearly 1 in 3 Americans would take a 10-20% pay cut to avoid being laid off.

On average, Americans would accept a 5% pay cut and give up 5 days of PTO to secure their jobs.

Nearly 1 in 4 Gen X and older generations would delay retirement to avoid being laid off.

17% of remote workers would return to the office full time to avoid being laid off.

Willingness to accept a pay cut to maintain job by generation:

Baby boomers + Gen X (combined): + Gen X: 17%

Millennials: 19%

Gen Z: 14%

Americans' Top 5 concerns about getting laid off:

Financial instability: 55%

Difficulty finding a comparable job: 40%

Inability to afford housing or rent: 31%

Loss of health care/benefits: 30%

Increased debt or inability to pay off loans: 24%

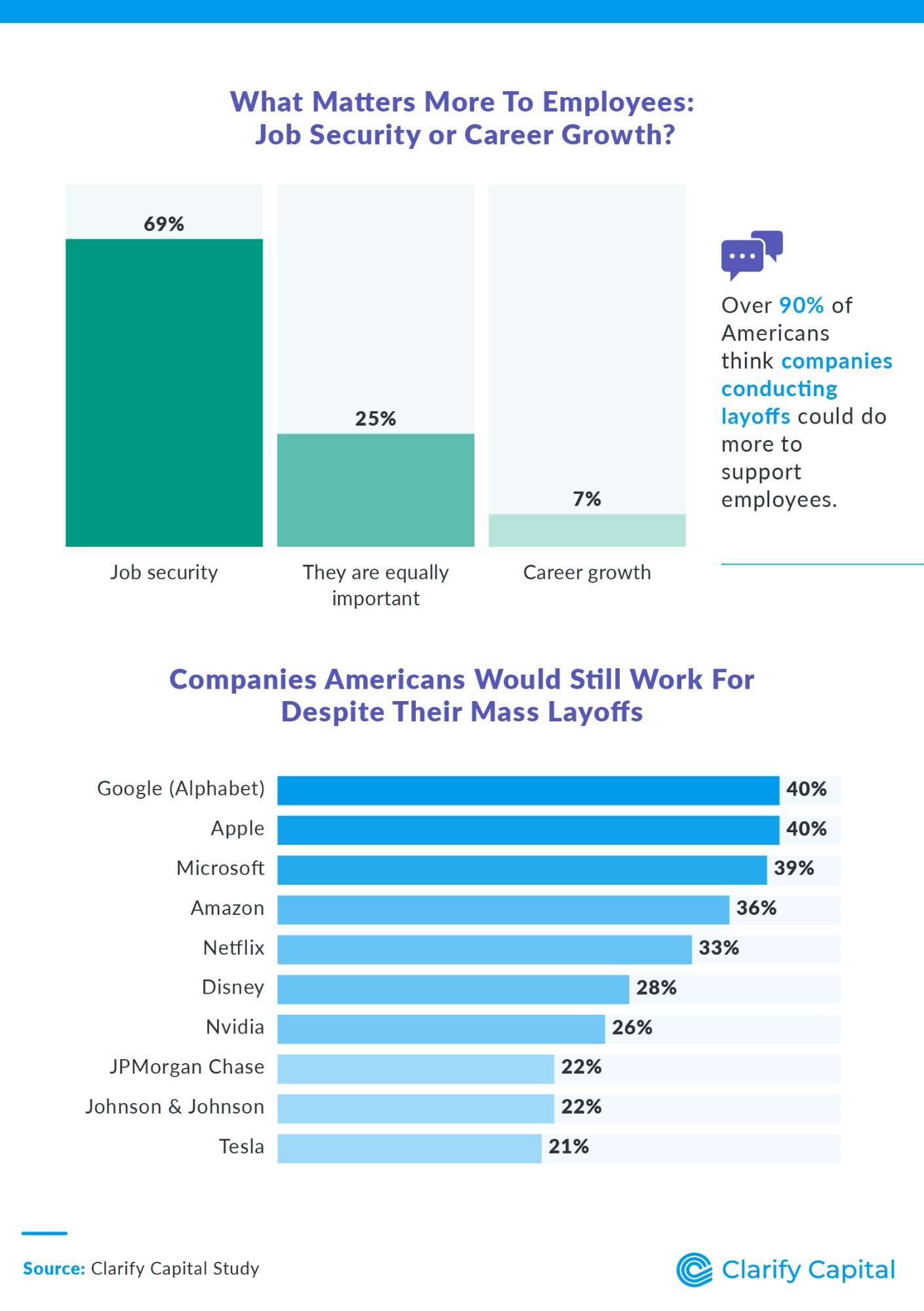

How Employers Can Better Support Workers

69% of Americans think job security is more important than career growth.

25% of Americans think job security and career growth are equally important.

7% of Americans think career growth is more important than job security.

Over 90% of Americans think companies conducting layoffs could do more to support employees.

Nearly 3 in 4 Americans would still work at a Fortune 500 company despite their mass layoffs.

Companies Americans would work for despite mass layoffs:

Google (Alphabet): 40%

Apple: 40%

Microsoft: 39%

Amazon: 36%

Netflix: 33%

Disney: 28%

Nvidia: 26%

JPMorgan Chase: 22%

Johnson & Johnson: 22%

Tesla: 21%

Top companies each generation would work for despite mass layoffs:

Baby boomers + Gen X (combined):

Amazon: 43%

Millennials:

Google: 42%

Gen Z:

Apple, Google, Microsoft (tie): 35%

Methodology

We surveyed 1,000 Americans to investigate how layoff anxiety and economic uncertainty in 2025 shape American workers' fears, decisions, and financial resilience. The average age of respondents was 40, and they comprised 54% males, 45% females, and 1% nonbinary. Their generational makeup included 30% baby boomers and Gen X, 58% millennials, and 12% Gen Z.

About Clarify Capital

Clarify Capital helps business owners secure the financing they need to thrive in today's competitive marketplace, including no-doc business loans and fast business loans. Our tailored financial solutions support entrepreneurial dreams, turning visions into reality.

Fair Use Statement

You're welcome to reference this data for noncommercial use if a link to this source is provided.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts