First off, congratulations on taking your business to the next level. As you know, a limited liability company (LLC) provides you with liability protection that corporations enjoy without double taxation. Now that your company has a formal business structure, it's time for more growth.

As a startup or an entrepreneur, you need capital to start a business. To keep operating and growing, your business needs to make profits consistently. But there's more to making profits than selling as much as you can — you need to manage your cash flow, as well. That's where LLC business loans come in.

You can add financing options as part of your cash flow management strategy. This way, you can utilize business loans as a financial tool to help you achieve your goals or handle unexpected costs. Keep reading to find out more about LLC business loans, how to get one, and how to use it to grow your business.

What Is an LLC Business Loan?

Simply put, an LLC business loan refers to any loan that a business structured as an LLC takes out. These loans are available from all kinds of lenders and take on many forms, such as lines of credit, short-term loans, or SBA loans. The difference lies in the fact that LLCs are legal entities separate from their owners.

This means that LLCs have their own assets, debts, and business bank accounts. Regarding financing, an LLC can have its own credit history and credit score separate from its owner. And when an LLC takes out a loan, the business is borrowing the money (rather than the business owner).

With this type of loan, the business owner's personal liability is reduced, which protects their personal assets. This means that creditors can't go after the owner's personal assets if the business can't pay its debts. Note that this provision becomes null if the LLC owner provides a personal guarantee to a lender.

Differences Between a Business Loan and a Personal Loan

A personal loan, also known as a consumer loan, refers to any amount of money a person borrows for personal expenses. These loans are offered as bank loans or by financial institutions like credit unions and online lenders. Personal loans allow individuals to fund expenses like home renovations, wedding expenses, or medical bills.

Some people also use personal loans to invest in or start a business. Personal loans may be unsecured or secured with collateral, but they're different from other installment loans used to fund specific expenses (e.g., student loans, car loans, and mortgage loans).

On the other hand, a business loan is a loan borrowed for business purposes. In fact, this is the main difference between these types of loans — business loans come with restrictions on what they can be used for (i.e., business owners can only use the funds for business-related expenses, like buying equipment, renting commercial space, or covering working capital expenses).

Similar to personal loans, though, business loans are available from all kinds of lenders and come in a variety of forms. They can be unsecured or secured with collateral, as well. Examples of business loans include SBA loans, merchant cash advances, and cash flow loans.

When Personal Liability Still Applies to an LLC Loan

Forming a limited liability company is a smart way to protect your personal assets, but that protection isn't absolute. Many small business owners are surprised to learn that certain financing agreements can still impact their personal credit score or lead to personal liability.

The biggest exception is when lenders require a personal guarantee. This means you, the business owner, agree to be personally responsible for repaying the loan if your business defaults. It's a common condition for LLCs that are new, have limited revenue, or lack a good credit history.

Other scenarios where personal liability may apply include:

Using personal assets as collateral

Applying with a low business credit score, triggering the need for a stronger personal credit profile

Signing a loan before properly separating personal and business finances (e.g., not having a separate business bank account)

Even with a formal business structure, your personal credit score and financial history still matter, especially for new businesses or small LLCs. When in doubt, review the terms carefully and ask if a personal guarantee is required before signing.

How To Get an LLC Business Loan

If you're interested in business financing but don't know where to start, here are a few steps you can take to get a clearer idea of the LLC financing you need and some tips to increase your chances of getting approved for a loan.

Determine the Loan Amount You Need

Knowing how much you want to borrow is the first step before applying for a loan. This is critical — if you borrow too much, paying it off may strain your cash flow. However, if you don't borrow enough, you might not be able to fund your business plan.

Figure out why you need capital, how you'll use it, and how much you can afford to borrow. Lenders may also ask your reason for getting a loan. Common reasons businesses apply for loans are for buying real estate, getting new equipment to increase production, and hiring new employees.

Calculate the amount you need to implement your plan. Make a list of all the expenditures using exact numbers as much as possible. Then, make a plan for how you'll pay it back, considering that you need to pay interest and other costs related to borrowing.

Explore LLC Business Loan Options

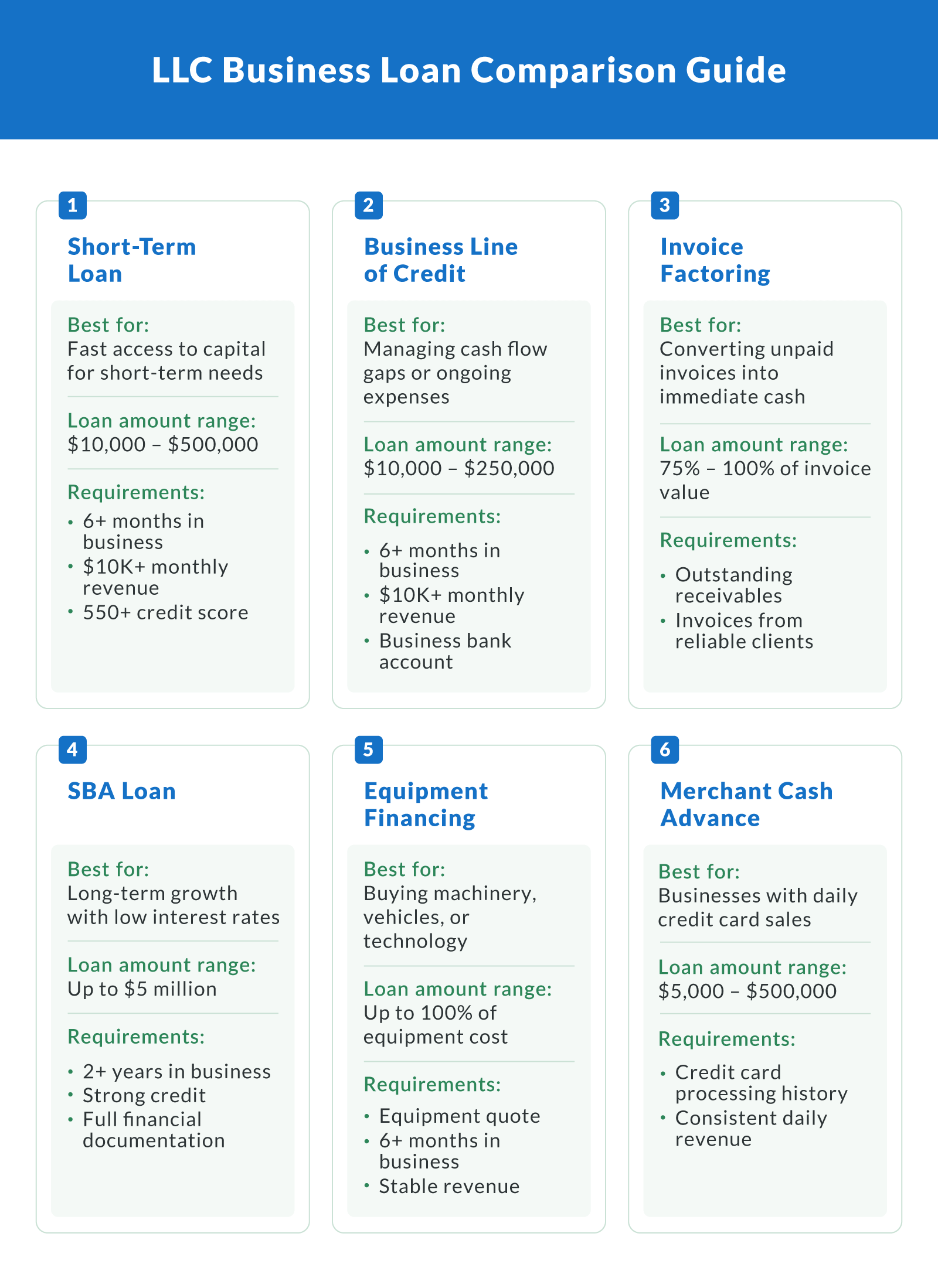

Next, you'll want to explore your business loan options. Here are several small business loans we offer at Clarify Capital:

Short-Term Business Loan

A short-term loan is a financing option with short repayment periods ranging from six months to two years. With this type of loan, you receive a lump sum amount that you pay back through fixed, regular monthly payments. The payments are based on a predetermined interest rate and repayment terms.

Business Line of Credit

A business line of credit gives your LLC revolving credit. Your company gets a set credit limit, which you can withdraw as needed. As you pay back what you owe, the account replenishes, and you can borrow again.

Invoice Factoring

Invoice factoring allows you to borrow money using unpaid invoices as collateral. Basically, your business sells its accounts receivable to a factoring company and receives an upfront payment of 75% to 100% of the total invoice value. Then, the lender collects from your customers and pays your LLC back any remaining amount minus factoring fees.

SBA Loans

The U.S. Small Business Administration (SBA) is a federal agency that helps small business owners get loans and grants. The agency doesn't issue loans itself but instead guarantees up to 85% of loans secured through its different loan programs, like the 7(a) loan or disaster assistance.

Equipment Financing

Equipment financing provides companies with capital to buy any equipment, machinery, and vehicles necessary for business operations. It's a great funding option for businesses to acquire the equipment they need without spending upfront. It's also low risk for both parties because the asset serves as collateral for the loan.

Merchant Cash Advance (MCA)

A merchant cash advance is an agreement that gives your LLC cash in advance to be paid back with an agreed-upon percentage of your future sales. With an MCA, you negotiate with a lender on an advance amount, a payback amount, and a holdback percentage.

The money you receive upfront is the advance. The holdback percentage is what will be deducted daily from your sales until your balance is paid in full. The payback amount is the total loan amount plus fees and interest rates. Note that this type of credit is only available to businesses that accept credit card payments through a business merchant account.

LLC Loan Requirements

Requirements differ for each lender and type of business loan. Some traditional lenders (like traditional banks) have stricter qualifications and a longer application process than online loan providers. For LLC business loans, you'll want to have the following documents ready:

Legal proofs, such as a driver's license, passport, federal tax ID, or an employer identification number (EIN)

A copy of your business license and operating permit

A copy of your LLC's operating agreement

Three to 12 months of recent bank statements

One to two years of business tax returns

One to two years of personal tax returns

Financial statements, such as profit and loss (P&L) statements and balance sheets

Any legal contracts and agreements you have with other third parties

The list above may not cover all the information that lenders ask for, so always be prepared for additional requirements. Don't worry — when you apply with Clarify Capital, you'll have a dedicated adviser who will walk you through the entire process.

Aside from business documents, lenders may also want to see:

Proof of time in business: Most lenders will require that your LLC be in operation for at least six months. This is because they use your time in business to assess their risk. The longer you've been in business, the lower the risk for lending companies.

Record of income: You'll have a stronger chance of getting a loan if your income is at least $10,000 a month. Lenders would like to see that your business has the cash flow to pay back the loan. They also use your income to calculate the loan amount you can borrow.

Credit score: We suggest that you have a personal credit score of 550 or higher. Lenders will also be looking at your LLC's business credit score (if you don't know your company's credit score, check with credit bureaus like Experian before applying for a loan). If your business is fairly new and hasn't established a credit profile yet, your Clarify adviser can advise you on what to do.

Apply for the Loan Through a Trusted Source

At Clarify Capital, our mission is to help you get the funding you need so you can achieve your business goals. We work with more than 75 lenders to get you the best rate. You'll also have a dedicated adviser who will work with you throughout the process.

You won't have to spend time searching for and applying to lenders who won't approve your loan. Instead, you'll have an adviser who can help you choose the best financing option based on your business needs. Your adviser is also there to help you understand the terms of your business loan.

What Lenders Look for When Underwriting LLC Loans

Understanding the underwriting process can help you prepare and increase your chances of approval. Underwriting is how lenders assess your LLC's creditworthiness and ability to repay a loan.

Here are the key factors lenders evaluate during underwriting:

Business bank activity. Lenders want to see a separate, active business bank account with consistent deposits and healthy balances.

Annual revenue. Higher annual revenue demonstrates that your business can manage ongoing debt obligations.

Financial statements. Updated profit and loss statements, balance sheets, and cash flow reports help lenders gauge your business's stability.

Time in business. The longer your LLC has been operating, the lower the perceived risk.

Credit profile. Both your business and personal credit scores may be reviewed, especially if your business is new or lacks a strong business credit file.

Completing a loan application without this information prepared can slow down the process, or worse, trigger a denial. Being transparent and thorough shows lenders you're serious and financially responsible.

Real Examples of How LLCs Use Business Financing

Still unsure how an LLC loan might apply to your business? Here are real-world examples of how different types of LLCs use financing to solve everyday challenges:

Single-member consulting LLC using a business line of credit. A solo entrepreneur sets up a revolving credit line to cover working capital gaps between project invoices and client payments. This allows them to maintain cash flow without dipping into personal savings.

Startup retail LLC using invoice factoring. A new clothing brand sells unpaid invoices to a factoring company to free up funds and cover a supplier order. The upfront cash helps them stay on track without taking on long-term business debt.

Real estate investing LLC using a term loan. A property investment company uses a term loan to purchase and renovate a small commercial property. The loan covers both acquisition and rehab costs, with repayment structured over five years.

Each of these LLCs had different business needs, but they all benefited from business financing options tailored to their stage, cash flow, and repayment goals.

Get the Right Loan To Grow Your LLC

Securing funding as an LLC is all about preparation: understanding what lenders look for, knowing your loan options, and having your financials in order. Whether you're launching a new venture, expanding operations, or managing day-to-day expenses, the right business financing can make all the difference.

At Clarify Capital, we connect small business owners with over 75 lenders to find the best and most competitive rates and loan terms for their unique needs. Ready to take the next step? Apply today to see what you qualify for and get funding in as little as 24 hours.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts