Clarify Capital is a trusted provider of flexible financial services tailored to small business needs. With a simple online application, a wide range of funding options, and personalized service, the company has built a strong reputation for helping entrepreneurs secure capital quickly and confidently. Rather than questioning legitimacy, this article focuses on the real experiences and results shared by verified borrowers to show why Clarify continues to stand out among lenders.

Real Testimonials from Small Business Owners

Thousands of small business owners have shared their positive experiences working with Clarify Capital. These verified Clarify Capital reviews consistently highlight fast funding, knowledgeable loan advisors, and a smooth application process:

"My experience with Clarify Capital was amazing! Within two days, my funding manager, Joe M. was able to help me get options AND funded with a great offer for my business… I truly appreciate Clarify Capital and Joe's assistance!"

— Erika

"We had an amazing experience with Clarify Capital thanks to Shane. From the first call, he was incredibly helpful, patient, and knowledgeable — walking us through every step to ensure we got the perfect funding solution… Highly recommend working with Shane and the Clarify team."

"Absolutely fantastic… Bryan turned my dream into a reality! Worked with Bryan up until the very end. Amazing guy… Never pressured me to do anything… He was sincerely interested in how the business operations were going and wanted to ensure that I was crossing all my Ts! 10/10 recommend."

— Kyle

"Working with Clarify Capital has been an excellent experience! Aaron made the entire funding process straightforward and stress-free… Highly recommend Clarify Capital to any business looking for reliable and professional funding support!"

— K Byrd

"The absolute best experience of acquiring funding for my small business!!… They are efficient, thorough, [and] work quickly… I have greatly appreciated their help, compassion, and continued support!"

— C F

Across all of these testimonials, common themes emerge: clear communication, fast funding within days, and personalized guidance from knowledgeable loan advisors who genuinely care about each borrower's business goals.

Reviewers consistently mention how Clarify Capital's funding advisors took time to explain the process, offer multiple loan options, and follow up after funding, making the experience stress-free and supportive.

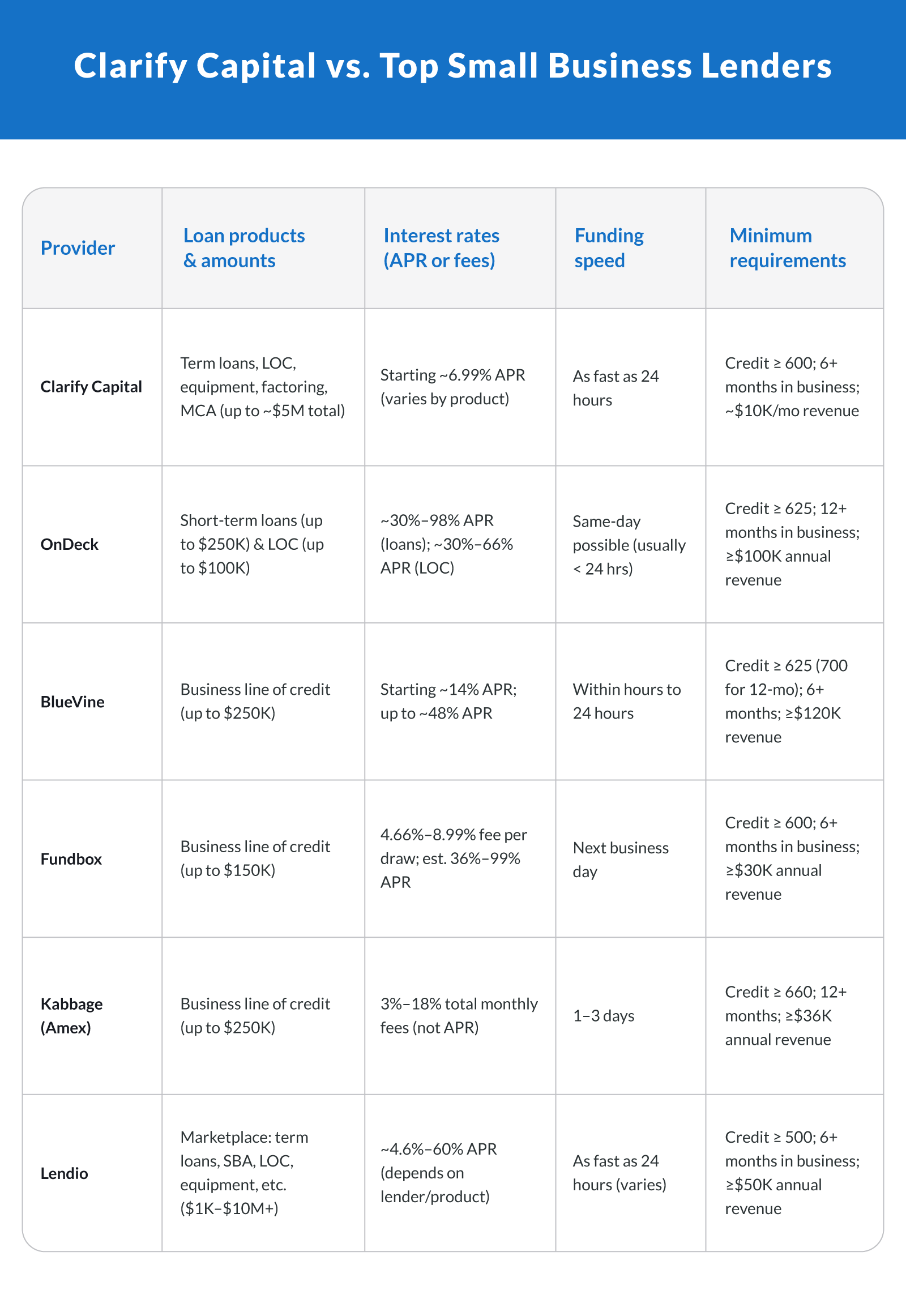

Clarify Capital vs. Other Business Lenders

Small business owners searching for fast, reliable business financing have several options, but not all lenders will be your best choice. We compared Clarify Capital with five other popular providers across key decision factors to help you choose the right financing partner for your business needs:

Where Clarify Capital Stands Out

In general, for businesses that need quick access to capital and value human support, Clarify offers a compelling alternative to more rigid or high-cost platforms. Whether you're managing cash flow, expanding operations, or purchasing equipment, Clarify offers flexibility and personalized support that many borrowers won't find anywhere else.

Clarify Capital stands out for its broad selection of loan options, competitive interest rates, and a streamlined process that makes same-day funding possible for qualified borrowers. Unlike many online lenders that offer only one or two products, Clarify provides access to the following options, making it a versatile option for lots of different business needs:

Term loans. Fixed repayment loans with predictable terms, ideal for general business expansion or one-time investments.

Business lines of credit. Revolving access to funds that you can draw from as needed—perfect for managing cash flow.

Merchant cash advances (MCAs). Funding based on future credit card sales or daily revenue, often used by businesses with inconsistent income.

Equipment financing. Loans or leases specifically for purchasing business equipment or machinery.

Invoice factoring. Sell unpaid invoices to get fast access to working capital, often used by B2B businesses waiting on client payments.

SBA loans. Clarify can match borrowers with SBA loan programs, such as SBA 7(a), through its lender network—though not issued directly by Clarify, they facilitate access.

Another advantage is Clarify's dedicated funding advisors. While other lenders may rely on automated systems, Clarify assigns a personal loan advisor to help guide each applicant through the process, making it easier to understand terms and secure the best deal.

Clarify Capital's combination of fast funding, wide-ranging loan options, and advisor-driven service makes it an ideal provider for entrepreneurs who want more than just a loan—they want a lending partner.

Clarify Capital's Commitment to Small Business Success

At Clarify Capital, supporting small business owners isn't just a service — it's the mission. The company was built to make business financing more accessible, transparent, and efficient. From the moment a borrower applies, they're paired with a dedicated loan advisor who works one-on-one to understand their business goals, financial needs, and long-term vision.

Clarify Capital's core values — speed, transparency, and partnership — are reflected in every step of the process. Funding advisors don't just match you with a loan; they help you choose the right type of financing for your situation, answer your questions, and offer guidance on how to qualify for even better terms down the road.

This level of personal support has helped thousands of business owners make smarter decisions and reach their next stage of growth.

FAQs About Business Loans and Funding Providers

Small business owners often have questions when comparing lenders or deciding which funding solution fits best. This section answers the most common ones in a straightforward way to help clarify the process and build trust with new borrowers.

How Fast Is Clarify Capital's Approval Process?

Clarify Capital offers a streamlined online application that takes just a few minutes to complete. Once submitted, borrowers can receive a decision within hours. In many cases, funds are deposited within 24 hours of approval, making it one of the fastest funding providers in the industry.

What Do Reviews Say About Clarify Capital's Service?

Customer reviews on sites like Trustpilot consistently highlight the responsiveness of Clarify Capital's loan advisors, the clarity of the application process, and the ease of communication throughout the entire experience. Borrowers appreciate the one-on-one support and the ability to get funded quickly with no confusion or hidden fees.

How Does Clarify Capital Compare to Other Lenders?

Compared to many other business lenders, Clarify Capital stands out for offering competitive interest rates, multiple financing options, and a more personalized approach. While some lenders rely solely on automation, Clarify connects borrowers with real loan advisors who help navigate the entire process and recommend the best solution for their needs.

What Funding Options Does Clarify Capital Offer?

Clarify Capital connects small business owners with a variety of funding options to meet different financial needs. Whether you're looking to cover day-to-day expenses, invest in equipment, or access working capital quickly, Clarify's financing solutions are fast, flexible, and accessible. They include:

Term loans. Fixed repayment loans used for expansions, large purchases, or one-time business needs.

Business lines of credit. Flexible, revolving credit you can tap into as needed to manage cash flow.

Merchant cash advances (MCAs). Upfront funding repaid through a portion of future daily sales, ideal for businesses with variable revenue.

Equipment financing. Loans or leases to help purchase or upgrade machinery, vehicles, or other essential equipment.

Invoice factoring. Converts outstanding customer invoices into immediate working capital for businesses waiting on payments.

SBA loans. Government-backed loans with low rates and long terms, offered through Clarify's lender network.

These flexible funding options are available through Clarify Capital's nationwide network of 75+ lenders. Each option includes a simple application process, competitive interest rates, and flexible repayment terms.

Most products are accessible to businesses with at least six months of operating history, $10,000 in monthly revenue, and a credit score of 600 or higher. The online application takes just minutes to complete, and funding can arrive as quickly as the same day.

Why Small Businesses Continue to Choose Clarify Capital

Clarify Capital stands out as a reliable funding partner by offering fast approvals, flexible financing options, and dedicated loan advisors. With high customer satisfaction and a simple application process, small business owners trust Clarify to deliver the capital they need, quickly and with zero hassle.

See why 40,000+ businesses trust Clarify Capital — get a personalized funding quote today.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts