When you need quick access to capital, finding the right loan products that meet your business needs can make all the difference. In this guide, we'll cover six of the best fast business loans and how Clarify Capital can help streamline the funding process.

Clarify Capital — Best for Small Businesses

Why it's a good choice: Clarify Capital connects small businesses with a network of more than 75 trusted business lenders and a team of seasoned funding advisors to help you find the best loans based on your needs. They cater to diverse industries, from retail to professional services, offering various types of business loans, including working capital loans, equipment loans, and invoice financing. Applicants can expect a seamless approval process with minimal eligibility requirements. Clarify supports numerous types of companies, from restaurants and bars to technology businesses. Applicants for fast business loans can receive instant online approval and funding within 24 hours.

Loan amount range: $10,000 to $5M

Minimum credit requirements: Minimum credit score 550 (Bad credit is okay)

Pros:

APR rates starting as low as 6%

No collateral is needed to secure a fast business loan

Easy online application process

No prepayment penalties

Minimal documentation

Dedicated loan advisors who handle all the legwork to find the best loan terms

Fast funding times (as quick as 24 hours)

Cons:

Not all products and services are available in every state

Lower credit borrowers may have more frequent repayment schedules (such as weekly payments)

Loan details:

6+ months in business to be eligible for loans

Need at least $10,000 average monthly revenue

Loan terms can range from six months to two years

Upstart — Best for Bad Credit

Why it's a good choice: Upstart has very flexible credit requirements, making it a more accessible option than many of its contemporaries for those with poor credit history. Borrowers with credit scores of 300 are eligible for loans, and it's possible to pre-qualify for loans with a soft credit check. Lastly, Upstart has customer service representatives available seven days a week.

Loan amount range: $1,000 to $75,000

Minimum business credit score: Varies depending on the lender

Pros:

Quick access to funds within one business day to cover those unexpected expenses

Provides flexible funding to low-credit borrowers

Lenders consider factors such as a business plan, work history, and education when evaluating borrowers

Cons:

High annual percentage rates (APR) for very low credit scores

0 to 12% origination fee

Strict repayment terms

Upstart doesn't accept co-signers

Loan details:

APR can range from 4.60% to 35.99%

Provides a hardship program for borrowers

Requires a minimum annual income of $12,000

Bank of America — Best for Medical Practices

Why it's a good choice: Millions of Americans turn to Bank of America for their regular banking needs, but this institution also provides funding for eligible borrowers. Bank of America offers healthcare practice loans for dentists, optometrists, physicians, and veterinarians — all backed by traditional lenders. Best of all, a project manager can lend expertise to ensure projects finish on time.

Loan amount range: $100,000 to $5 million

Minimum credit requirement: 700 (Good)

Pros:

Fixed-rate loans with terms that last up to five years

0% interest on medical practice loans for the first six months

Offers a 50% discount on admin fees for endorsed group members

Cons:

Merchant cash advances aren't available

The loan process can take a very long time

You may not know your final rate until you receive a loan contract

Loan details:

Working capital is provided with specific loan types

Offers favorable terms, such as 0% interest for a fixed time period

Provides working capital loans to established and startup practices

Offers up to 100% financing based on the options you apply for

However, Clarify Capital also offers medical practice loans up to $5M and can provide funding within 24 to 48 hours.

Fundbox — Best for Startups

Why it's a good choice: FundBox understands the challenges small businesses face. They offer small business financing for companies that are still establishing their brand identity, since they're willing to work with organizations that have been in business for six months or less. Fundbox is also a great choice for startups because their minimum credit score requirement is 600.

Loan amount range: $1,000 to $150,000

Minimum credit requirement: 600 (Fair Credit)

Pros:

Accessible loan offers for new businesses

Lower than average minimum credit score requirement (600)

Rapid funding times — can receive funds within one business day

Cons:

Doesn't build business credit

Fast repayment terms (12 to 24 weeks)

APR can be higher than average (ranging from 10.1% to 79.8%)

Loan details:

No prepayment fees

Weekly repayment schedule

The minimum annual revenue for eligibility is $100,000

Western Equipment Finance — Best for Equipment Financing

Why it's a good choice: Western Equipment Finance specializes in equipment financing for businesses that need to purchase or upgrade machinery, vehicles, or heavy equipment. Instead of offering general working capital, they focus on asset-backed loans, which can make approval easier for borrowers with strong revenue but limited credit history. This lender is a solid fit for established businesses looking for structured terms and competitive rates tied directly to equipment value.

Loan amount range: $10,000 to $10,000,000+

Minimum credit requirement: Typically 600+ (varies by deal and equipment type)

Pros:

Financing tailored specifically for equipment purchases

Higher funding limits than most online lenders

Competitive rates due to equipment-backed structure

Flexible terms based on equipment lifespan

Cons:

Funds are restricted to equipment-related use only

Slower approval and funding than short-term online loans

Not ideal for startups or businesses needing working capital

Loan details:

Equipment serves as collateral

Fixed repayment terms

No use for payroll, inventory, or general operating expenses

Best suited for established businesses with steady revenue

American Express — Best for Merchant Financing

Why it's a good choice: American Express provides merchant financing options to businesses that accept their cards. Amex merchant financing is similar to a merchant cash advance, as borrowers must pay a percentage of future receivables. However, Amex merchant financing provides benefits like partial refunds for borrowers who prepay their loans. Their approach combines speed with tailored repayment plans, making them a strong alternative to traditional bank loans.

Loan amount range: $5,000 to $2 million

Minimum credit requirement: 660 (Good Credit)

Pros:

Competitive factor rates for merchant financing

Fast approval for loans within two to five business days

Early repayment rebates for borrowers who prepay their loans

Cons:

Requires at least two years in business for loan eligibility

Requires a personal guarantee for loans up to $35,000

Loans can't be used to fund real estate or construction projects

Loan details:

Annual revenue requirement of $50,000 or more

Merchant financing options offered in six, 12, or 24-month terms

Daily repayment based on a percentage of credit card receivables

Need money ASAP? Rather than applying to each of these lenders individually, submit one 2-minute application with Clarify Capital to get offers from multiple fast-business-loan providers.

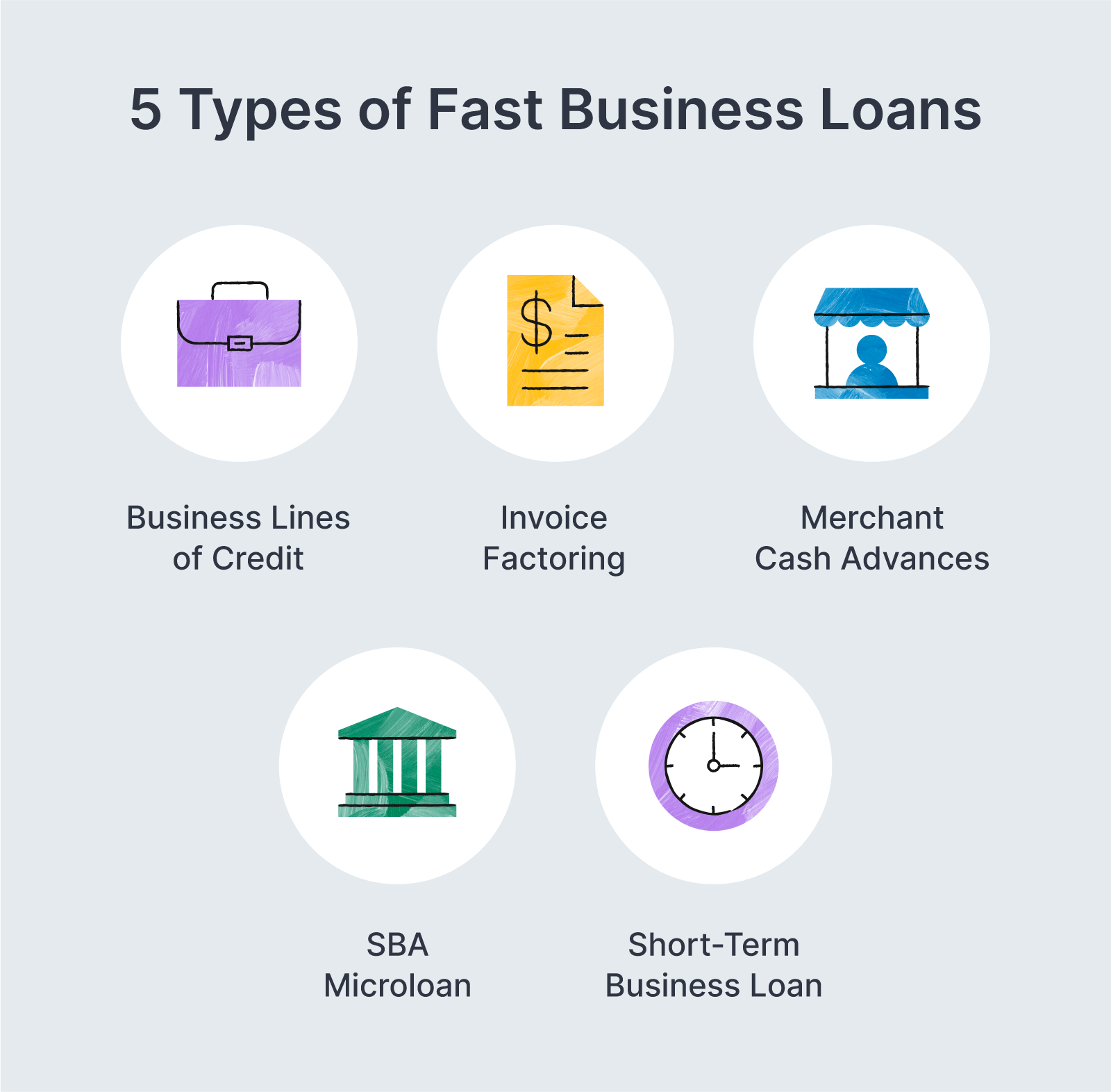

What Types of Fast Business Loans Can I Find?

Whether you need capital to take advantage of profitable business opportunities, repair a crucial piece of equipment, or cover operating expenses, you can find multiple fast business loans online to suit your needs.

Business Line of Credits

A business line of credit is a flexible business financing option that works similarly to business credit cards (at a much lower interest rate than a credit card). With this type of financing, you get access to a revolving credit limit you can pay and draw as needed. In addition, you only pay interest for the amount you borrow, making it ideal for managing cash flow.

Invoice Factoring

Invoice factoring (or invoice financing) allows you to borrow money using unpaid invoices as collateral. It's a popular fast funding option for small businesses that sell products and services on credit. There's no personal credit score requirement, so this financing option is a great way to find business loans for bad credit.

Merchant Cash Advances

With a merchant cash advance (MCA), your business can get funding for a percentage of your future sales. It's a quick business loan option without collateral or personal credit requirements.

SBA Microloan

Microloans are one of the loan programs available through the U.S. Small Business Administration (SBA). SBA loans have some of the lowest interest rates because they're guaranteed. So, if a borrower defaults on the loan, the government pays the lender up to 85% of the unpaid balance.

Short-Term Business Loans

For businesses facing unexpected expenses, small business owners can get unsecured short-term loans with no collateral requirements. With term loans, borrowers receive the loan amount in a lump sum. You repay the loan plus interest in fixed monthly payments within a preset repayment schedule. The term length is usually six months to two years. These loans often have fewer eligibility requirements, streamlining the funding process.

Pros and Cons of Fast Business Loans

Securing small business loans fast comes with a slew of benefits and drawbacks. Here are some of the most common pros and cons of these types of loans.

Pros of Fast Business Loans

Easy and quick access. Lenders can quickly fund borrowers within hours or days.

Low credit or business requirements. Many fast business loan lenders have experience working with subprime borrowers.

Brief application process. Lenders like Clarify Capital have loan applications that can be completed in minutes.

Cons of Fast Business Loans

Higher costs. Fast business loans may have higher interest rates than average and multiple fees.

Limited repayment options. Fast business loans may have mandatory weekly repayments and comparatively brief repayment terms.

Potential to overborrow. Applicants may overborrow if they don't accurately assess their needs and potentially amass excessive debt.

Quickly Find Fast Business Loans With Clarify Capital

Clarify Capital connects you with online lenders and alternative lenders offering options for small business financing. Our online application form takes two minutes to complete, and same-day funding may be available for qualifying applicants.

“How fast can you get a business loan?” Once your application is approved, you'll receive funding in your business bank account within one to two business days. Consider Clarify Capital for instant business loans online.

Fast Business Loans FAQs

Getting access to a fast loan might be the best news for your business, and you want to know more. Here, we'll answer some of the most common questions about fast business loans.

Are Business Loan Payments Tax-Deductible?

Yes, the interest paid on a business-term loan is tax-deductible. It helps businesses lower the overall cost of borrowing. However, you can't use the principal amount as a deductible.

Can I Get a Business Loan With a 500 Credit Score?

Yes, many lenders are willing to offer loans to businesses with a 500 credit score. However, borrowers may have higher interest rates and shorter repayment terms due to their subprime scores.

Can I Get a Loan With Just an EIN?

It is possible to secure a loan with an employer identification number (EIN), though lenders will often consider other factors, such as a borrower's creditworthiness. This is one reason why it helps to build business credit.

How Fast Can I Get a Business Loan?

You can get a business loan in as little as one business day, depending on the lender and financing type. Traditional bank loans often take weeks, while online lenders can fund within 24 hours, especially when offering alternatives like merchant cash advances or short-term working capital products. Clarify Capital connects businesses with online lenders that focus on revenue and streamlined approvals, making same-day or next-day funding possible for qualified applicants.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts