If you're a small business owner exploring business financing, you've likely come across the SBA (Small Business Administration) vs. conventional loan debate. Both are common types of business loans, but each comes with its own terms, eligibility requirements, and benefits. Knowing which is best for your startup or established business can save time, money, and stress down the line.

This article breaks down the key differences between SBA and conventional loans — from interest rates and repayment periods to how lenders assess eligibility. We'll also look at pros and cons, maximum loan amounts, and key factors to consider when choosing between these financing options.

Whether you're funding working capital, equipment, or expansion, this guide will help you understand your options and feel confident in your next steps. By the end, you'll have a better sense of which loan type fits your business goals.

SBA Loans: Pros and Cons

SBA loans are business financing options partially guaranteed by the U.S. Small Business Administration, a government agency that helps small businesses access affordable funding. Approved lenders issue these loans, but the SBA's backing reduces the lender's risk, making them more accessible to small business owners who might not qualify for traditional loans.

Pros of SBA Loans:

Lower interest rates. SBA loans typically offer more competitive interest rates compared to conventional loans.

Longer repayment terms. Business owners may benefit from extended repayment terms, often 10–25 years, which reduce monthly payments.

Lower down payment. Borrowers can often secure financing with down payments as low as 10%.

More lenient credit score requirements. SBA loans may be available to borrowers with limited credit history or less-than-perfect credit.

Cons of SBA Loans:

Lengthy application process. SBA loan applications often require multiple steps and significant time to complete.

Extensive paperwork. Borrowers must submit detailed financial statements, business plans, and documentation to meet eligibility requirements.

Slower funding. Due to the detailed review process, SBA loans can take several weeks or even months to disburse.

SBA loans can be a strong option for newer or smaller businesses that meet the credit and eligibility requirements but may not qualify for conventional bank financing.

Conventional Business Loans: Pros and Cons

Conventional business loans are offered directly by financial institutions like banks and credit unions without government backing. Unlike SBA loans, these loans rely entirely on the lender's risk assessment, which often means stricter qualifications but a more streamlined process. Common types of conventional loan options include term loans, fixed-rate loans, and commercial real estate loans.

Pros of Conventional Loans:

Faster approval process. Conventional bank loans often move more quickly through underwriting, especially with strong documentation.

Lower total cost for well-qualified borrowers. If you have good credit and strong financials, you may be able to secure lower fees or more favorable terms than with SBA loans.

Fewer restrictions on use. These loans are more flexible, so buyers can use the funds toward refinancing, equipment purchases, or business expansion.

Cons of Conventional Loans:

Stricter eligibility requirements. Lenders typically require a longer operating history and solid business performance.

Higher down payment. Many conventional loan programs require larger upfront contributions.

Strong personal credit score needed. Approval typically depends on both business financials and your personal credit history.

Conventional loans are typically best suited for established businesses with stable revenue, strong credit, and assets to use as collateral.

Key Differences Between SBA and Conventional Loans

While SBA and conventional loans may serve similar purposes, they differ significantly in structure, requirements, and borrower accessibility. From interest rates and repayment terms to underwriting and approval speed, these differences can affect which loan is the best fit depending on the type of business and its financial profile. For small business owners comparing loan options, understanding these distinctions is essential for choosing the right financing path.

| SBA vs. Conventional Loans | ||

|---|---|---|

| Feature | SBA Loan | Conventional Loan |

| Eligibility requirements | For-profit business located and operating in the U.S. Must meet SBA size standards for "small" (varies by industry) Business owners must have invested equity and show ability to repay Cannot be ineligible business type (e.g., speculative, gambling, or illegal activity) Personal guarantee may be required for owners with ≥20% ownership Collateral may be required, especially on loans >$50k Good credit history expected; lenders typically want minimum score of 640 | Annual revenue between $50k–$100k Varying lenders require a business plan Average credit score of 670, but some lenders accept as low as 550–570 Personal finance history (bank statements, tax returns, etc.), with some requiring a personal guarantee Time in business: at least two years for many lenders, but some lenders require only six months in business Industry requirement (e.g., gambling and cannabis industries are typically ineligible) Loan proposal for varying lenders List of business debt and obligations (debt-to-asset ratio is considered) |

| Interest rates | Generally lower, set by SBA guidelines | May be higher, but varies by lender and credit profile |

| Repayment terms | Longer terms — up to 25 years for real estate, 10 years for working capital | Shorter terms — typically five to 10 years, depending on loan type |

| Down payment and collateral | Lower down payment (as low as 10%), and may require personal guarantees | Higher down payment required; strong collateral often necessary |

| Approval speed | Slower — due to SBA underwriting and government review | Faster — processed directly by financial institutions or credit unions |

How To Decide Which Loan Is Right for Your Business

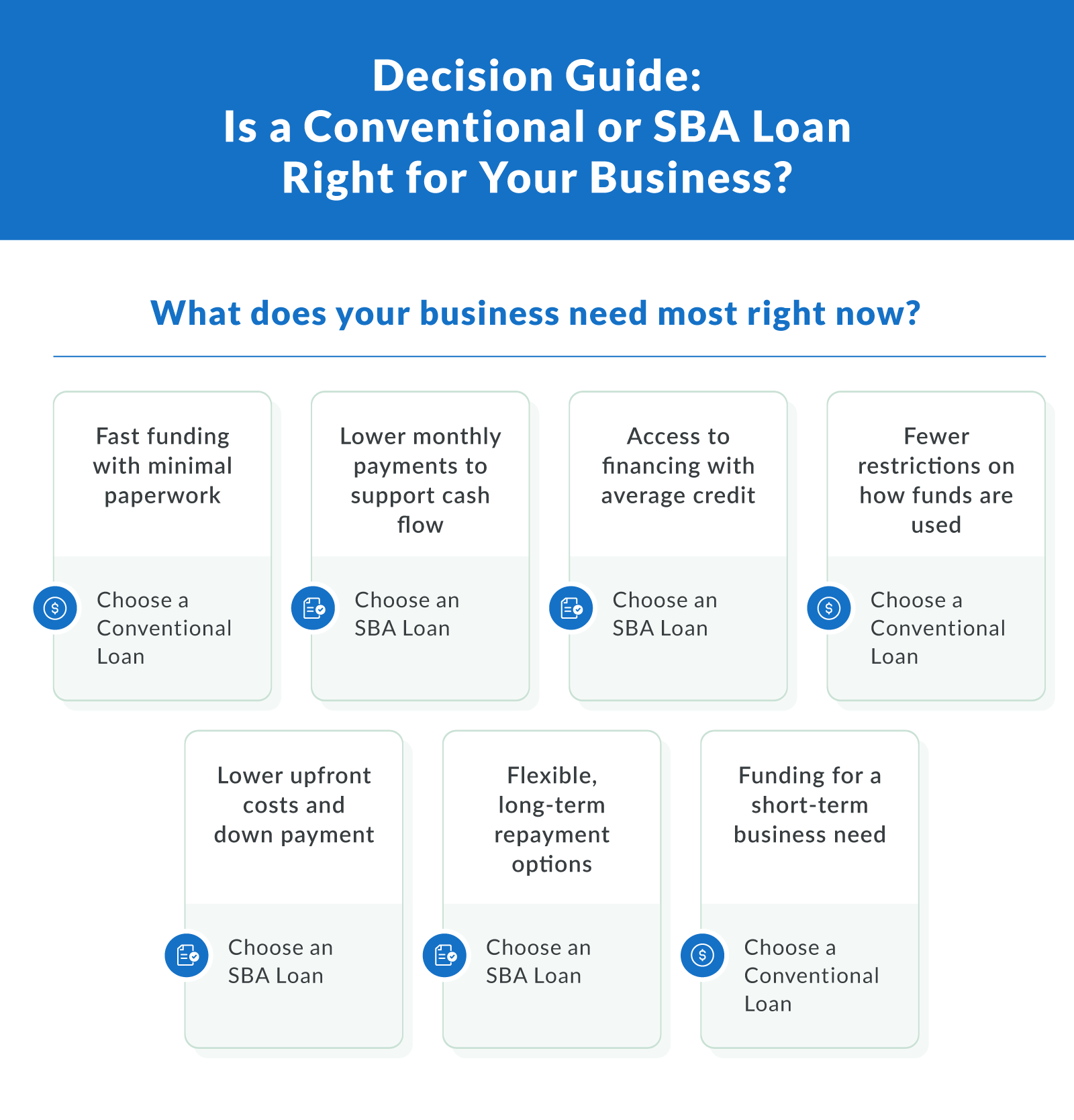

Choosing between an SBA loan and a conventional loan depends on your business needs, credit history, and how quickly you need funds. SBA loans are often better for business owners seeking longer repayment terms, lower monthly payments, and more accessible financing, especially for startups or those with fair credit. On the other hand, established businesses may choose conventional loans when they need faster funding, have a strong business credit score, and want fewer restrictions on how they use the money.

The following can help you decide between these two financing options:

Evaluate your credit score. Check both your personal and business credit scores — they'll influence your eligibility for different loan programs.

Assess your immediate vs. long-term funding needs. SBA loans may offer larger loan amounts and better terms for long-term investments, while conventional loans may suit short-term needs.

Review cash flow stability. Strong, consistent cash flow can help with approval and determine your comfort level with monthly payments.

Consider approval speed requirements. If you need funds quickly, a conventional loan may be the better fit due to faster underwriting.

Have a solid business plan. Especially important for SBA loans, a clear business plan can improve your chances of approval.

Entrepreneurs unsure where to start can work with providers like Clarify Capital, which connects borrowers to both SBA and conventional lenders — helping you find competitive rates and terms that fit your situation.

Here's a clear decision flowchart to help business owners quickly determine whether an SBA loan or a conventional loan better fits their financing needs.

Clarify Capital: Your Partner in Small Business Financing

Clarify Capital works with a network of over 75 lenders, including SBA‑approved and conventional banks, to bring you financing options that suit your business profile. Through this marketplace model, they don't lend directly — instead, they match you with lenders who compete to offer favorable terms.

You can access small business loans up to $5 million, with APRs starting near 6%, and many deals are structured for fast or same‑day funding. Clarify supports a variety of financing options, including working capital, lines of credit, equipment loans, and SBA‑backed funding programs.

If you're a business owner exploring which financing path fits your goals and credit profile, Clarify Capital can help you compare competitive offers tailored to your business needs.

Get started today to see what works best for your situation.

FAQs for SBA Loan vs. Conventional Bank Loan

Many business owners still have specific questions when deciding between SBA and conventional bank loans. This section answers the most common concerns, including eligibility and funding speed, to help you confidently choose the best financing option for your business needs.

Are SBA Loan Rates Higher Than Conventional?

In general, SBA loans have lower interest rates than many alternative financing options, because the SBA caps the maximum rate lenders can charge under its programs. For example, SBA 7(a) loans with fixed rates may fall within a range of about 10.5–15.5 %, depending on loan size and term. Meanwhile, average conventional small business loan rates at banks currently range from 6.7–11.5 % for well‑qualified borrowers.

That said, if you have excellent credit, strong revenues, and low risk, a conventional loan may offer a better rate than some SBA deals. Lenders in that case view you as low risk, so they're more willing to negotiate downward from their typical spreads. The takeaway: SBA loans often offer lower interest rates, especially for borrowers who might not be "top tier," but a conventional loan can outshine an SBA offer when you've got a pristine track record.

What is the 20% Rule for SBA?

The "20% rule" refers to SBA policy that anyone who owns 20% or more of a business applying for an SBA‑backed loan must provide an unlimited personal guarantee under SBA Form 148 (or equivalent). This means that major stakeholders are personally liable if the business defaults, providing lenders with more security.

This rule affects ownership structures and partners in a few key ways:

If you hold 20% or more equity, you're legally required to sign the guarantee.

If no individual or entity owns 20%, at least one owner must still sign the personal guarantee.

Even if you drop below 20% shortly before applying, the SBA may look back six months and require guarantees from anyone who previously held more than 20% ownership.

In partnerships or multi‑owner structures, all persons or entities with 20% or more of direct or indirect ownership typically must guarantee the debt.

Because of this, when forming ownership or bringing in new investors, business owners must plan carefully — the 20% rule can attach substantial personal risk to those with meaningful equity stakes.

Can I Buy a House With an SBA Loan?

No, SBA loans cannot be used to purchase personal residences or non‑business real estate. SBA funds must be used for sound business purposes, and one of the core requirements is that the property be either owned or leased by the business itself.

That said, SBA financing can be used for commercial real estate (land, buildings, renovations) as part of a qualified business project if your business operates a rental property. An example would be operating short‑term rentals (Airbnb) as a legitimate commercial venture (not as personal housing), so long as the property meets SBA occupancy, usage, and collateral rules.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts