As we move through 2025, investors and business leaders are navigating a dynamic economic landscape. From rapid technological advances to shifting global policies, the stock market is seeing both fresh opportunity and continued volatility. In this environment, identifying companies with growth potential is more important than ever, whether you're investing, launching a business, or analyzing market trends.

This guide offers a research-driven look at where growth is happening and how to find it. We'll cover high-growth sectors, key performance indicators, and publicly traded companies leading the charge. With so many variables at play, from innovation and revenue growth to macro risk and liquidity, making informed decisions means digging into the fundamentals.

Whether you're reviewing financial statements, comparing P/E ratios, or consulting a financial advisor, spotting growth potential early gives you a major edge. Clarify Capital is here to help you better understand the market and make confident moves in today's complex financial services environment.

Key Sectors With High Growth Potential in 2025

In a market shaped by innovation and uncertainty, sector selection matters more than ever. Certain industries are showing strong sector performance, even amid broader downturns and volatility. For investors and strategists seeking high growth, focusing on sectors with proven fundamentals, healthy growth rates, and solid past performance can offer a clearer path to long-term returns, especially when balanced with defensive positions like value stocks.

Here are five sectors positioned for outsized growth in 2025:

Technology (AI, SaaS, Cloud Infrastructure)

From artificial intelligence to cloud computing, tech remains one of the strongest engines of growth. Companies like Microsoft, Nvidia (NVDA), and Amazon (AMZN) are leading the next wave of innovation in AI, data infrastructure, and software-as-a-service (SaaS).

These tech stocks have delivered exceptional stock price performance over the last year, with AI stocks driving demand for chips, platforms, and machine learning tools. For investors looking for growth stocks, this remains a dominant sector.

Health care & Biotech (Gene Therapies, Healthtech)

The healthcare sector continues to benefit from structural tailwinds like aging populations and the need for medical innovation. Advances in biotech, gene therapy, and digital health are creating new channels for revenue growth and driving cash flow in startups and incumbents alike.

Despite some pricing pressures and regulatory shifts in the stock market, the long-term valuation outlook remains positive for select high-growth players.

Renewable Energy (Solar, Battery Storage, EV Infrastructure)

Clean energy is gaining traction, powered by ESG mandates and government-backed funding. Growth potential is especially strong in solar, EV charging networks, and next-gen battery storage, with investment flowing into ETFs, infrastructure funds, and index funds.

While this sector can be prone to volatility, strong liquidity and policy momentum make it one of the most important areas to watch. Certain clean energy assets are even gaining attention as modern-day value stocks.

Fintech (Embedded Finance, Digital Payments)

The financial services industry is being reshaped by digital platforms, mobile wallets, and real-time payments. From IPO-ready startups to scaled platforms, fintech continues to disrupt traditional banking.

Companies offering embedded finance, B2B payment solutions, or global transaction tools are seeing strong share price momentum and expanding user bases. For those investing in individual stocks, keeping an eye on fundamentals, innovation cycles, and ticker trends is key to evaluating upside.

E-Commerce & Direct-to-Consumer

While the early surge in digital retail has cooled, long-term growth remains strong in DTC and global e-commerce. Companies like Amazon (AMZN) and Shopify (SHOP) continue to lead in fulfillment, logistics, and customer retention.

Subscription models, flexible supply chains, and scalable platforms are driving both cash flow and revenue growth. With attractive valuations for certain players, this remains a solid segment of the broader stock market for growth-minded investors.

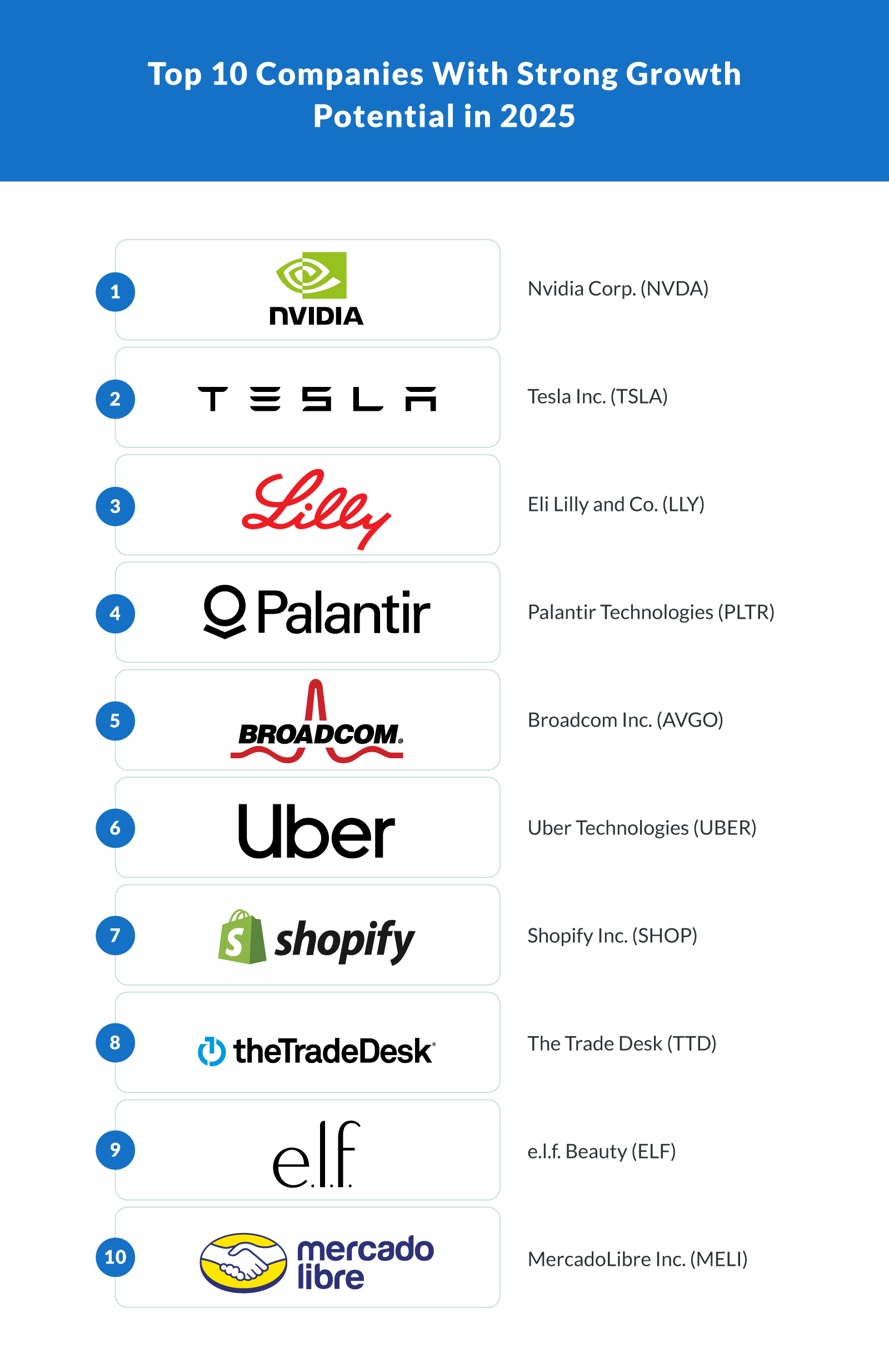

Top 10–15 Companies With Growth Potential

While sector trends help narrow the playing field, individual performance matters when evaluating where to invest or which businesses to watch. These standout companies have shown exceptional momentum in revenue, earnings, or innovation over the past year, and their forward-looking metrics suggest continued upside. Backed by strong fundamentals, strategic positioning, and resilient demand, each of these picks represents a clear example of growth potential in action.

1. Nvidia Corp. (NVDA) – Semiconductors (AI & Graphics)

Nvidia delivered one of the most impressive performances in tech in 2024, with revenue surging 126% to $60.9 billion and GAAP (generally accepted accounting principles) net income soaring 586%. In Q4 alone, revenue rose 78% year-over-year, driven by explosive demand for its GPUs in AI and data center applications. GAAP earnings per share (EPS) hit $11.93 for the year.

Nvidia's chips are the backbone of generative AI and machine learning infrastructure, and its momentum shows no signs of slowing. With a market cap over $3 trillion and a trailing price-to-earnings ratio (P/E) around 35, Nvidia remains the dominant force in AI hardware and accelerated computing.

2. Tesla Inc. (TSLA) – Electric Vehicles & Clean Energy

In 2024, total revenue reached $97.7 billion, and despite muted Q4 growth, Tesla's energy storage business offset some weakness in vehicle sales. It has a market cap over $1 trillion and a high P/E of 173, and investor focus is on future gains. New models, global factory scaling, and autonomous software are expected to drive long-term growth despite near-term volatility.

3. Eli Lilly and Co. (LLY) – Pharmaceuticals & Biotech

Eli Lilly delivered blockbuster results in 2024, with revenue rising 32% to approximately $45 billion and GAAP net income more than doubling to $10.59 billion. Demand for its diabetes and obesity drugs — especially Mounjaro and Zepbound — was the main growth engine, with Q4 sales up 45% and its Mounjaro sales soaring by 60%. In 2024, Mounjaro generated $11.54 billion in sales (more than double the previous year) while Zepbound reached $4.9 billion in its first full year on the market.

GAAP EPS rose to $11.71, a 102% year-over-year gain. With expanding margins, a deep pipeline in obesity and Alzheimer's, and projected 32% revenue growth in 2025, Lilly is now the world's most valuable healthcare company and a top pharma growth pick.

4. Palantir Technologies (PLTR) – AI-Powered Data Analytics

Palantir had a breakout 2024, with revenue climbing 29% to $2.87 billion and U.S. commercial revenue up 68%. The launch of its AI Platform (AIP) significantly boosted adoption, especially in the corporate sector. The company achieved full-year GAAP profitability for the first time, earning $462 million (16% net margin), with GAAP EPS at $0.19—more than doubling from 2023.

Q4 revenue rose 36% year-over-year, maintaining double-digit margins. Palantir's market cap soared past $250 billion, making it one of the top-performing AI stocks of the year. With accelerating demand and a strong backlog, it's emerging as a leading force in enterprise AI.

5. Broadcom Inc. (AVGO) – Semiconductors & Infrastructure Software

Broadcom posted record revenue of $51.6 billion in fiscal 2024 — up 44% year-over-year — fueled by surging AI chip demand and its VMware acquisition. AI-related revenue tripled to $12.2 billion, as cloud providers deployed Broadcom's custom ASICs and networking chips. Its Q4 revenue grew 51% to $14.05 billion, and quarterly GAAP net income hit $4.3 billion.

Although full-year net income declined to $6.17 billion due to one-time merger costs, adjusted operating profit remained strong. Having surpassed a $1 trillion market cap and growing software revenue, Broadcom stands out as a balanced semiconductor and software play heading into 2025.

6. Uber Technologies (UBER) – Ride-Hailing & Delivery Platform

Uber entered a new phase in 2024, posting its first full year of GAAP profitability and delivering revenue growth of 18% to over $40 billion. The company's rebound was led by a resurgence in ride-sharing and continued momentum in delivery. GAAP net income reached $6.9 billion, bolstered by a one-time tax gain. Uber is scaling profitably and expanding its platform advantage.

7. Shopify Inc. (SHOP) – E-commerce Platforms & Tools

Shopify powers over 2 million merchants globally with its cloud-based platform for online selling. The company earns revenue through subscriptions and transaction fees, with added growth from services like Shopify Payments and Shopify Plus.

In 2024, Shopify delivered $8.88 billion in revenue — up 26% from 2023 — and processed a 24% increase in gross merchandise volume. GAAP net income rose to approximately $1.3 billion, and Q4 revenue growth hit 31% year-over-year. With strong free cash flow margins and consistent 25%+ growth over seven quarters, Shopify remains a standout in the internet sector as e-commerce and digital selling continue expanding.

8. The Trade Desk (TTD) – Digital Advertising Technology

The Trade Desk runs the world's largest independent demand-side platform, enabling brands and agencies to buy digital ad space across the open internet in real time. With digital advertising continuing to shift away from traditional media and walled gardens, TTD has positioned itself as a key player, especially through its focus on privacy-first tools like Unified ID 2.0.

In 2024, the company rebounded from a slower 2023, growing revenue 26% to $2.44 billion and doubling net income. Strength in connected TV and retail media, plus 95%+ customer retention, confirms its momentum as a top mid-cap tech growth stock.

9. e.l.f. Beauty (ELF) – Cosmetics & Personal Care

e.l.f. Beauty grew net sales by 77% in fiscal 2024 to $1.02 billion, marking its first year crossing the billion-dollar mark . It became the #1 U.S. brand in eye cosmetics and saw Q4 sales jump 71% YoY. Net income rose to $127.7 million and gross margin exceeded 70%, driven by mix and pricing. e.l.f.'s viral marketing and Gen Z appeal make it a small-cap standout.

10. MercadoLibre Inc. (MELI) – E-commerce & Fintech Leader in Latin America

MercadoLibre, often called the “Amazon of Latin America,” is a dominant force in both e-commerce and fintech. Its 2024 net revenue grew 38% in to $20.8B, while its credit portfolio surged 75% YoY. Net income nearly doubled to $1.91B, and GAAP EPS hit $37.69. Q1 2025 revenue and net profit rose 37% and 44%, respectively.

How to Identify High-Growth Companies

Spotting companies with real growth potential requires more than hype. It takes a closer look at business metrics, market positioning, and financial strength. Whether you're evaluating a public stock or assessing a private company, consistent revenue growth, solid fundamentals, and a healthy balance sheet are strong indicators of long-term upside. Liquidity, valuation, and access to capital also play a major role in a company's ability to scale and respond to market changes.

Here are a few key ways to identify high-growth opportunities:

Key Indicators (Revenue Growth, TAM, Product-Market Fit)

Look for strong top-line expansion, expanding margins, and product innovation that meets large or underserved markets. A sizable total addressable market (TAM), steady cash flow, and increasing customer adoption often signal momentum that can support sustained growth.

Research Tools (PitchBook, Statista, Morningstar)

Platforms like PitchBook and Morningstar help investors analyze private and public company performance. Use them to monitor sector trends, evaluate liquidity, and benchmark companies using financial ratios and ticker-level insights.

Analyst Ratings and Insider Activity

Analyst upgrades, target price revisions, and insider buying can indicate confidence in a company's future performance. Combine these signals with a close look at valuation, growth forecasts, and management's track record to get a fuller picture of the opportunity.

Investment Strategies for 2025

In a rapidly shifting economic climate, having the right mix of investment strategies is essential. Investors are weighing global uncertainty, rising innovation, and changing consumer behavior, all while balancing risk and return. Whether you prefer individual stocks, index funds, or mutual funds, understanding how to position your portfolio can make a significant difference in outcomes. That's especially true for those targeting high-growth companies in 2025.

Here are a few key strategies to consider:

Diversification and sector allocation. Allocating capital across multiple industries helps reduce exposure to sector-specific downturns. Blending dividend stocks, growth names, and defensive plays improves resilience while leaving room for upside.

Long-term vs. short-term holdings. Holding periods should align with your goals and risk tolerance. While short-term trades can capture momentum, longer-term investments often reward patient investors with compounding returns, especially when focused on companies with a strong track record of performance.

ESG considerations in company selection. Environmental, social, and governance (ESG) factors are playing a bigger role in investor decision-making. Fund inflows into sustainable assets are growing, and ESG-focused strategies are now influencing the makeup of many major mutual funds and index funds. For long-term investors, ESG alignment may also point to stronger operational resilience.

Fund Your Next Business Investment With Clarify Capital

The year ahead presents a unique mix of opportunity and uncertainty, but for those who know where to look, the potential is significant. From breakthrough technologies and biotech innovation to fintech disruption and clean energy expansion, 2025 is shaping up to be a defining moment for companies with growth potential.

This guide has highlighted the sectors with the strongest outlook, the growth stocks leading the way, and the metrics investors can use to identify long-term winners. While past performance isn't everything, tracking growth rate, cash flow, and valuation can help you make smarter, more strategic decisions, whether you're managing your own portfolio or working with a financial advisor.

Clarify Capital supports business owners and investors who are ready to move forward with confidence. If you're looking to invest in your business, fund new initiatives, or strengthen your position in today's stock market, you don't have to do it alone.

Explore your options and apply today to get matched with funding solutions designed for forward-thinking entrepreneurs.

Frequently Asked Questions

Understanding how to identify and evaluate growth opportunities is key to making informed investment and business decisions. Below are answers to common questions investors and entrepreneurs have when looking for companies with strong potential in 2025.

What Are Signs of a High-Growth Company?

High-growth companies typically show consistent revenue growth, a rising growth rate, and clear market demand for their product or service. Other signals include expanding market share, strong leadership, and scalable business models. Digging into a company's fundamentals, such as profit margins, unit economics, and customer retention, can also help determine whether it belongs in the growth stocks category.

How Do Macroeconomic Trends Impact Company Growth?

Larger economic forces like interest rates, inflation, and government policy directly affect business performance. Tariffs can raise supply chain costs, while rate hikes may dampen consumer spending or borrowing. Political events, including elections and policy shifts under figures like President Trump, often lead to market volatility and capital reallocation. Historically, sectors react differently to downturns, and investor sentiment on Wall Street plays a big role in determining which industries see inflows or pullbacks.

What Tools Can Investors Use to Track Company Performance?

Professionals rely on platforms like Morningstar, Bloomberg, and Yahoo Finance to monitor a company's ticker, track mutual funds that hold the stock, and review earnings reports. Key metrics include EPS (earnings per share), price target estimates from analysts, and changes in stock price over time. Reviewing a company's track record for delivering results, not just hype, is essential to making sound investment decisions based on past performance.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts