What Is Inventory Financing?

Inventory financing is a form of business financing that allows companies to secure funding by using existing inventory or future purchase orders as collateral. It's commonly structured as a short-term inventory financing loan, helping business owners bridge the gap between buying stock and making sales.

To qualify, lenders typically assess the value of the inventory or the inventory listed in a purchase order. The loan amount is then calculated based on a percentage of that value, usually between 50% and 80%. This ensures that the lender is protected if the borrower defaults.

Key factors that influence eligibility include:

Inventory list and inventory value. Lenders require detailed documentation of the products used as collateral.

Credit score and credit history. Both personal and business creditworthiness are evaluated.

Financial statements and tax returns. These help verify revenue stability and debt load.

Application process and documentation. Financial institutions may ask for proof of ownership, sales projections, and supplier information.

Main Types of Inventory Financing

Business owners can access various inventory financing options to suit different cash flow needs, business models, and inventory cycles. From a traditional inventory loan to a revolving inventory line of credit, the right type of loan can provide the flexibility or stability your operation needs.

Understanding the differences between financing options is critical. Factors such as repayment terms, interest rates, and eligibility requirements can vary significantly from one product to another.

For example, a short-term loan might offer quick access to cash with faster repayment, while a term loan could provide longer periods and lower monthly payments, but with stricter qualifications.

By comparing the structure and cost of each short-term or long-term financing product, business owners can avoid overextending themselves and instead secure funding that supports steady growth. The key is finding a solution that aligns with your sales cycles, margins, and inventory turnover rate.

Inventory Loan

An inventory loan is a lump-sum financing option secured by a business's inventory. With this structure, the lender provides a one-time inventory financing loan based on the inventory value, and the business repays it over time with fixed monthly payments.

This type of loan is typically short-term, with standard repayment terms ranging from three to 18 months, though some terms extend up to 36 to 60 months.

The loan amount depends on the appraised value of the inventory used as collateral, which may include finished goods, raw materials, or other business assets. Because the lender assumes more risk, interest rates are usually higher than traditional business loans.

Businesses may turn to inventory loans when they need immediate capital to stock up before peak seasons, take advantage of bulk supplier discounts, or respond quickly to a spike in demand. While effective for short-term financing, this option requires careful cash flow management to keep up with regular payments.

Inventory Line of Credit

An inventory line of credit is a type of business line of credit that provides ongoing access to funds based on your inventory value. Unlike a lump sum loan, it works as revolving credit; you can borrow up to a set credit limit, repay what you use, and borrow again as needed.

This flexibility is ideal for seasonal businesses or companies experiencing regular fluctuations in sales. It allows business owners to manage working capital more efficiently by only using funds when necessary, such as during slow periods or just before peak demand.

The amount you can borrow is tied to your inventory and overall creditworthiness, including business financials and past repayment history. Repayment terms typically involve interest-only payments during the draw period, followed by a repayment phase where both principal and interest are due.

An inventory line of credit offers a strategic buffer, allowing you to stay stocked and responsive without locking into rigid loan structures.

Merchant Cash Advance

A merchant cash advance (MCA) provides upfront funding in exchange for a percentage of future credit card sales. It's not a traditional loan but a lump-sum cash advance repaid daily or weekly through automatic deductions from your card transactions.

This option offers flexibility because repayment is tied to sales volume; payments are lower on slow days and higher on busy ones. However, MCAs have higher interest rates than most other financing products, often resulting in a higher total repayment.

This short-term loan alternative can help small businesses with limited credit histories or inconsistent cash flow access capital quickly. It benefits companies with strong credit card sales, such as restaurants or retail shops, that need fast funding for urgent expenses or inventory restocks.

While convenient, business owners should weigh the cost carefully. Aggressive repayment terms and overall cost may offset the ease of access and fast approval.

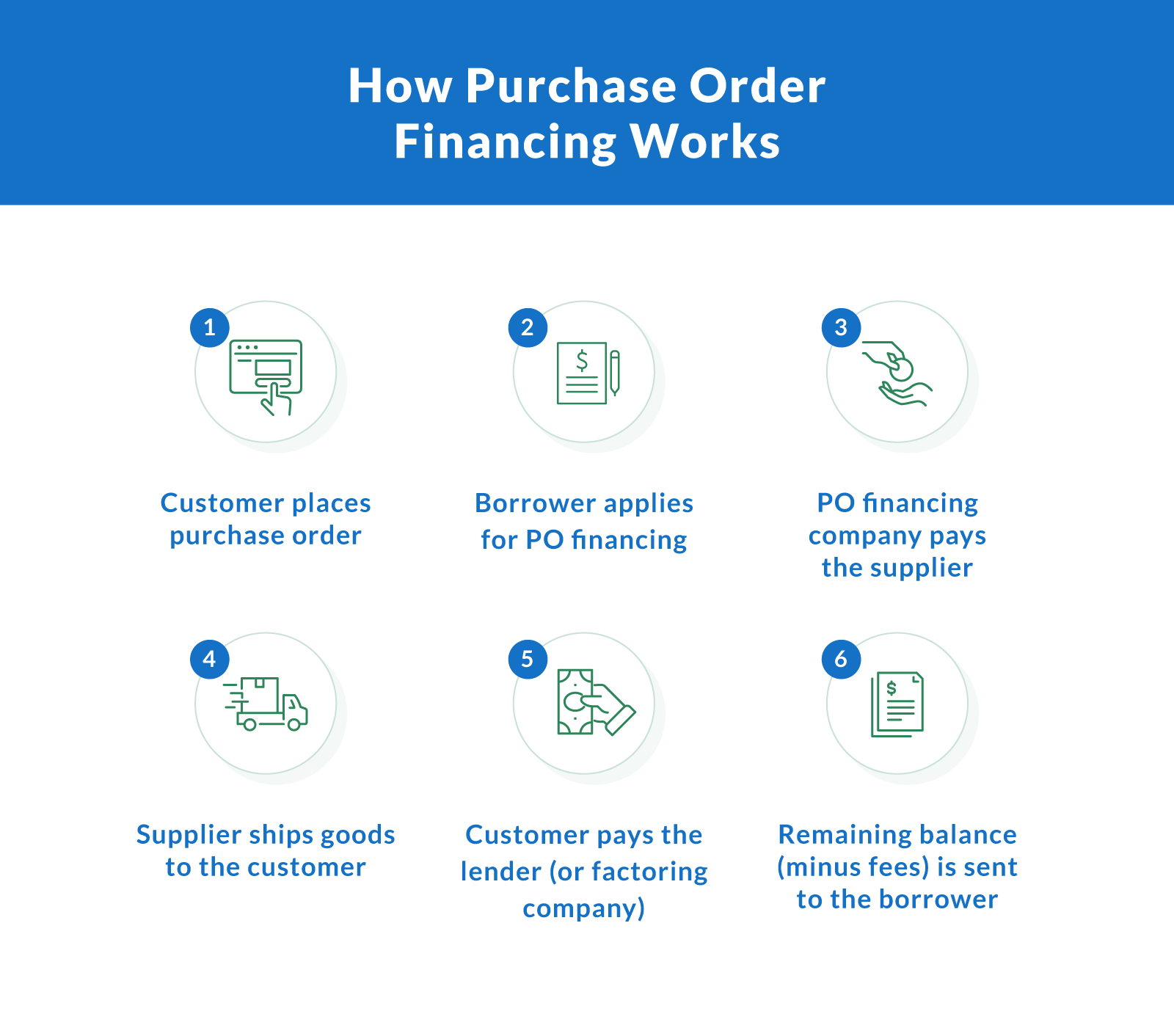

Purchase Order Financing

Purchase order financing is a short-term funding option that helps businesses fulfill large customer orders when they lack the cash to purchase inventory upfront. Instead of turning down a big sale due to limited working capital, the company presents a purchase order to a lender, who pays the supplier directly.

This solution benefits wholesalers and retailers who receive bulk orders but can't afford to cover the cost of goods. The lender provides the loan amount based on the confirmed order, enabling the business to complete the sale and meet customer demand without tapping into existing cash reserves.

Purchase order financing typically requires payment once the invoices are collected from the customer, making it a low-risk, short-term option that supports growth without long-term debt. It is ideal for businesses facing temporary cash flow gaps during high-volume sales periods or product launches.

Interested in knowing if purchase order financing is right for you? Clarify Capital can help you find out.

Factoring and Receivable Financing

Invoice factoring and receivable financing are two business financing methods that turn unpaid invoices into immediate working capital. Both help companies unlock cash tied up in accounts receivable, but they function differently.

With invoice factoring, a business sells its invoices to a third party (a factoring company) at a discount. The factor takes over collection, and the business gets most of the invoice value upfront, minus a fee.

On the other hand, receivable financing uses invoices as collateral for a loan. The business retains ownership of the invoices and is responsible for collecting payments. Then it repays the lender according to agreed-upon repayment terms.

Both options improve cash flow, especially for companies with long billing cycles or slow-paying clients. However, factoring may affect customer relationships, since the third party handles collections. Receivable financing offers more control but typically requires stronger credit.

Used strategically, these tools can ease cash crunches without taking on long-term debt, especially during periods of rapid growth or delayed customer payments.

Floorplan Financing

Floorplan financing is a specialized loan structure designed for businesses with high-cost product lines, such as auto dealers, appliance retailers, or heavy equipment suppliers. It allows companies to borrow funds to stock inventory, with the loan amount secured by the products on hand.

Repayment is typically tied to inventory turnover; businesses repay the lender as each item is sold. This aligns financing with cash flow, making it easier to manage large-ticket inventory without exhausting working capital.

However, if sales are slow, the risk of liquidation increases. Lenders may reclaim unsold products to recover their investment, which can disrupt operations and damage supplier relationships.

For businesses with expensive, slow-moving inventory, floorplan financing meets specific business needs. It offers access to inventory while deferring payment until products generate revenue. However, careful sales forecasting and tight inventory control are required to avoid financial strain.

Asset-Based Lending and Business Loans

Asset-based lending is a type of loan in which funding is secured by a business's physical assets, such as equipment, raw materials, or inventory. It's commonly used by companies that may not qualify for small business loans through traditional banks due to limited credit or inconsistent revenue.

Unlike unsecured business loans, asset-based financing is less focused on credit scores and more reliant on the strength of your balance sheet. Lenders evaluate the quality and value of the collateral and the borrower's credit history to determine loan terms and risk.

This financing structure gives businesses access to capital based on what they already own, making it useful for companies with substantial assets but limited liquidity. It's often a fit for manufacturers and wholesalers looking to convert materials or equipment into working capital.

While flexible, asset-based lending still requires detailed financial records and regular collateral appraisals, it best suits businesses with strong asset management practices.

Comparing Financing Options

Inventory financing comes in multiple forms, each with distinct structures, requirements, and benefits. To choose the best funding option for your business needs, it's important to compare how these loan types differ in eligibility, repayment terms, and interest rates — and what kind of lender typically offers them.

Here's a side-by-side comparison of standard inventory financing solutions:

| Financing Options Comparison | ||||

|---|---|---|---|---|

| Types of loans | Repayment terms | Interest rates | Eligibility requirements | Best for |

| Inventory loan | Fixed monthly payments (3-12 months) | 8-25% | Inventory value, credit history, business financials | Retailers or wholesalers needing upfront stock purchases |

| Inventory line of credit | Revolving; interest-only during draw | 7-30% | Inventory records, business revenue, decent credit | Seasonal businesses managing inventory cycles |

| Merchant cash advance | Daily or weekly % of credit card sales | High (factor rates 1.1–1.5) | Strong credit and sales history | Small businesses needing fast, flexible access to capital |

| Purchase order financing | Rapid when customer pays invoice | N/A (Fee-based) | Verified purchase order, reliable customer payment | Wholesalers with large customer orders and cash shortfall |

| Invoice factoring | Immediate cash; factor collects payment | 0.5-5% | Unpaid invoices, customer creditworthiness | Businesses with long billing cycles, or slow-paying clients |

| Receivable financing | Loan repaid after invoice is paid | 1-5% | Solid credit, strong receivables | Businesses wanting to retain control of collections |

| Floorplan financing | Repay as inventory sold | 4-10% | High-cost inventory, inventory turnover tracking | Auto dealers, equipment, retailers, furniture stores |

| Asset-based lending | Varies by asset lender | 7-17% | Valuable assets (e.g., raw materials, equipment, balance sheet strength) | Manufacturers or wholesalers needing capital from owned assets |

Choosing the right type of loan depends on your short-term cash needs, your ability to meet repayment terms, and your ability to maintain strong lender relationships. Understanding how each option supports your inventory strategy can help you avoid financial strain while staying fully stocked.

Choosing the Right Financing Option

Selecting the right inventory financing solution depends on your business's specific challenges and goals. Below are a few common scenarios and the types of financing that may align best with each:

Seasonal businesses with fluctuating forecasts may benefit from an inventory line of credit, which provides flexible access to capital as demand shifts.

Companies facing large one-time orders might find that purchase order financing helps them cover production costs without straining cash flow.

High-cost inventory models may be better suited to floorplan financing or asset-based lending, which allow businesses to leverage inventory as collateral.

ROI and Payment Example Scenario

To understand how financing choice impacts repayment and cash flow, let's compare a $200,000 loan amount under two standard options: an inventory loan and invoice factoring.

Scenario 1: Inventory loan

Loan amount: $200,000

Repayment terms: 12 months

Interest rate: 14% APR

Monthly payments: ~$17,942 (principal + interest)

Total repayment cost: ~$215,300

With this structure, the business repays the loan in fixed monthly payments, offering predictability but requiring consistent cash flow. While it's a straightforward loan, it places more pressure on revenue stability and inventory turnover.

Scenario 2: Invoice factoring

Invoice value: $200,000

Advance rate: 85% ($170,000 upfront)

Factoring fee: 3% per 30 days

Collection period: 60 days

Total cost: $12,000 in fees

Total received: $188,000

Factoring provides immediate cash without scheduled monthly payments, which helps ease cash flow strain. However, it delivers less capital upfront and has higher effective interest rates, especially over longer periods. Key differences include:

Total cost. An inventory loan is more cost-effective long-term, while factoring is more expensive due to fees.

Cash flow impact. Loans create fixed obligations, while factoring adapts to your sales cycles.

Best fit. Use an inventory loan for planned growth and choose factoring to manage short-term cash flow gaps tied to unpaid invoices.

Both serve specific needs — the choice depends on your revenue rhythm and ability to manage consistent repayments.

Qualification Checklist

Applying for inventory financing involves proving your business's eligibility and repayment ability. Lenders like Clarify Capital evaluate your financial position and the value of the inventory used as collateral. Here are their minimum loan requirements:

$10,000 a month in revenue.

Over six months in business.

Have a business bank account.

Be located in the U.S.

Clarify Capital loans offer same day funding for credit scores over 550. Curious to see if you qualify? Fill out their two-minute online application to get some clarity.

Real-World Use Cases: How Inventory Financing Helps Businesses

This section highlights three examples of how different businesses can use inventory financing tools to solve cash flow issues, manage seasonal demand, and support growth initiatives.

1. Boutique Clothing Brand: Launching a New Product Line

A small fashion label can use purchase order financing to fund manufacturing for a seasonal capsule collection. If they were facing limited cash reserves, they'd present a big retailer's purchase order to a financing provider. The lender would pay the supplier directly, enabling the brand to stock the product on time. Once the retailer fulfills payment, the designer could repay the advance. This would help them meet customer demand and avoid scaling back their launch.

2. Seasonal Retailer: Managing Fluctuating Demand

A holiday decor retailer can use an inventory line of credit to prepare for their busiest quarter. They would have only borrowed throughout the year when building up inventory before the season. As sales soar, they would repay some of the principal and then borrow again the following year. This revolving structure would align perfectly with their inventory cycles, keeping cash flow steady while staying well stocked.

3. Wholesaler: Improving Cash Flow With Factoring

A regional wholesaler supplying boutique stores could use invoice factoring if delayed customer payments started constraining operations. They would gain immediate working capital by selling their unpaid invoices to a factoring provider at a discount. This boost would keep their purchase orders flowing and help them avoid late supplier payments, all without taking on additional debt.

Why these examples work:

They reflect real challenges, seasonality, cash flow gaps, product launches, and inventory timing.

They showcase diverse financing tools, each matched to a business's operational rhythm and risk profile.

They avoid overgeneralized or generic descriptions, offering a more grounded sense of how these tools function in practice.

Pros and Cons of Inventory Financing

Inventory financing offers flexible business financing for companies that need to restock, expand, or keep up with customer demand, but like any funding tool, it comes with tradeoffs.

Pros

These are the upsides to inventory financing:

Improved cash flow. Freeing up working capital allows businesses to cover expenses and invest in growth without waiting for sales to come in.

Inventory availability. Enables businesses to stay fully stocked during peak demand or ramp-up periods.

Flexible repayment terms. Options like revolving credit lines or short-term loans let business owners choose structures that match their revenue cycles.

Accessible for asset-rich businesses. Companies with valuable inventory or purchase orders can secure funding even without stellar credit.

Cons

There are downsides to consider, too:

Higher interest rates. Inventory financing often comes with higher borrowing costs due to increased risk than traditional loans.

Liquidation risk. If sales slow, lenders may reclaim inventory to recover losses, especially with floorplan or asset-based financing.

Restrictive lender requirements. Detailed inventory records, purchase orders, and documentation are required; not all businesses qualify.

Creditworthiness matters. While some options focus more on inventory value, many lenders still factor in credit history, which can limit access or lead to less favorable terms.

When used strategically, inventory financing is a powerful tool, especially for businesses balancing growth opportunities with cash flow constraints. However, understanding the upside and potential pitfalls is key to making the right move.

Key Takeaways for Business Owners

Understanding the different types of inventory financing is essential for making smart, strategic decisions supporting cash flow and inventory management. Whether you're a small business gearing up for a seasonal rush or a wholesaler navigating fluctuating sales, choosing the right financing option can keep your operations running smoothly without overextending your capital.

Every business has unique cycles and demands. Aligning your business financing strategy with your specific needs ensures you have the proper inventory at the right time without jeopardizing your budget.

If you're ready to find the best solution for your inventory challenges, explore your options with Clarify Capital — apply today.

FAQs: Inventory Financing

This section provides quick, clear answers to common concerns about business loans, inventory loan structures, eligibility, and the application process. Whether you're curious about how credit history affects approval or what documentation is needed, this section simplifies the key details.

What Are the Steps Involved in Getting an Inventory Financing Loan?

The application process for an inventory financing loan involves several key steps that help the business and the lender assess fit and risk. Here's how to prepare:

Gather financial statements. Include recent balance sheets, income statements, and cash flow reports.

Organize tax returns. Submit personal and business returns, typically from the past two years.

Prepare an inventory list. Provide detailed records of your existing inventory, including quantity and value.

Compile purchase orders (if applicable). Show confirmed orders to demonstrate future revenue and demand.

Check your credit history. Know your business and personal credit scores, as lenders use them to assess eligibility.

Once submitted, the lender reviews your documents to evaluate your financial health, credit history, and inventory value as collateral. They'll also assess whether your business has stable revenue and a clear repayment ability. If your profile meets their standards, you'll receive approval terms, and funding typically follows within days.

How Does Inventory Financing Differ From Traditional Business Loans?

The most significant difference between inventory financing and traditional business loans lies in the type of collateral and how lenders evaluate risk. Traditional banks often require broad business assets or real estate as collateral and heavily emphasize creditworthiness, revenue history, and long-term financial stability.

In contrast, inventory financing is secured specifically by your current or incoming inventory. The lender evaluates the value and liquidity of your inventory rather than relying solely on your credit score or asset base.

Repayment terms also differ. Traditional loans typically involve longer repayment periods with fixed monthly installments, while inventory financing may offer shorter terms, revolving credit lines, or repayment tied to inventory turnover.

This makes inventory financing more flexible, but often more expensive, and better suited for businesses with strong product demand but less established credit.

Can I Apply for an Inventory Loan With No Credit History or No Existing Inventory?

It's difficult, but not impossible, to secure an inventory loan without a strong credit history or existing inventory. Most lenders rely on these factors to assess creditworthiness and reduce risk. However, some financing options for small businesses in early growth stages still exist.

For businesses lacking traditional qualifications, lenders may offer alternatives like merchant cash advances or short-term working capital loans based on revenue potential. A strong business plan, detailed projections, and clear inventory needs can help demonstrate reliability and justify funding.

While approval may come with higher costs or stricter terms, newer businesses can still access funding by showing potential for growth and repayment, even without a lengthy credit track record or stocked inventory.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts