Have you ever landed a major customer order but didn't have enough cash on hand to fill it? For small business owners, this scenario is both an exciting opportunity and a serious financial challenge. Without the working capital to pay suppliers upfront, even a large order can feel out of reach.

That's where purchase order (PO) financing steps in, with a fast, flexible way to get the funds you need without draining your reserves. In this article, we'll explain what purchase order financing is, how it works, and who typically uses it. We'll also share the pros and cons, costs involved, and how it compares to other business funding options.

Learn whether PO financing fits your needs and how to move forward if it does.

What Is Purchase Order Financing?

Purchase order financing is a short-term funding solution that helps businesses pay suppliers to fulfill large customer orders.

When a business receives a large purchase order but lacks the cash flow to pay the supplier, PO financing offers a bridge. A PO financing company steps in to cover the supplier's costs upfront, allowing the business to complete the sale without tying up its working capital.

After the goods are produced and shipped to the customer, the customer pays the PO financing company directly, and the business receives the remaining balance after fees are deducted.

Small businesses often use purchase order financing to avoid missing out on growth opportunities due to temporary cash shortages. It's especially popular among wholesalers, distributors, resellers, and exporters who handle tangible goods.

PO financing shines in situations where businesses need a short-term cash infusion to fill a large customer order but want to avoid long-term debt or giving up equity.

How Does Purchase Order Financing Work?

Purchase order financing is a short-term financing solution that helps businesses pay suppliers when they receive a large customer order but don't have the cash to fulfill it. Instead of turning down the deal or overextending your working capital, a PO financing company steps in to cover the supplier costs upfront.

Here's how the purchase order funding process typically works:

Customer places a purchase order. A business receives a large order from a reliable customer but doesn't have the cash to fulfill it.

Borrower applies for PO financing. The business applies with a PO financing company, submitting the purchase order and supplier quote.

Lender pays the supplier. If approved, the lender pays the supplier directly to produce and ship the goods.

Supplier ships goods to customer. Once production is complete, the goods are delivered to the end customer.

Customer pays the lender directly or via factoring. When the customer receives the goods, they pay the PO financing company (or a factoring company if invoice financing is used).

Remaining balance (minus fees) goes to the borrower. After collecting payment, the lender deducts fees and sends the remaining amount to the business.

This financing solution supports cash flow by covering supplier costs upfront and reducing the delay between selling and getting paid. PO financing is especially useful for wholesalers, distributors, and resellers that rely on large but infrequent orders to drive revenue.

Who Qualifies for PO Financing?

If you're a small business owner wondering whether you can qualify for purchase order financing, the good news is that lenders focus more on your customers' ability to pay than your own.

While your business's financial health matters, the approval process mainly hinges on the strength of your customer relationships and the reliability of your suppliers. In fact, for startups and new businesses with limited credit history, PO financing can be an easier path to funding compared to traditional loans.

Here's what lenders typically look for during the approval process:

Valid purchase order. You must have a legitimate, verifiable purchase order from a creditworthy customer.

Reliable customer. The customer placing the order should have strong creditworthiness, a solid track record of paying invoices, and established operations.

Qualified supplier. You must work with a supplier capable of fulfilling the order accurately and on time.

Satisfactory credit history. While your credit score isn't the main focus, lenders may still review your business and personal credit history.

Clear financial statements. You should be able to show basic financials that demonstrate operational stability.

Positive track record (if applicable). If you're a newer business, prior successful transactions or customer references can help strengthen your application.

Ultimately, your customers' creditworthiness carries more weight than your own financial standing. That makes purchase order financing an attractive option for small business owners and startups that have strong sales opportunities but are still building their internal credit profiles.

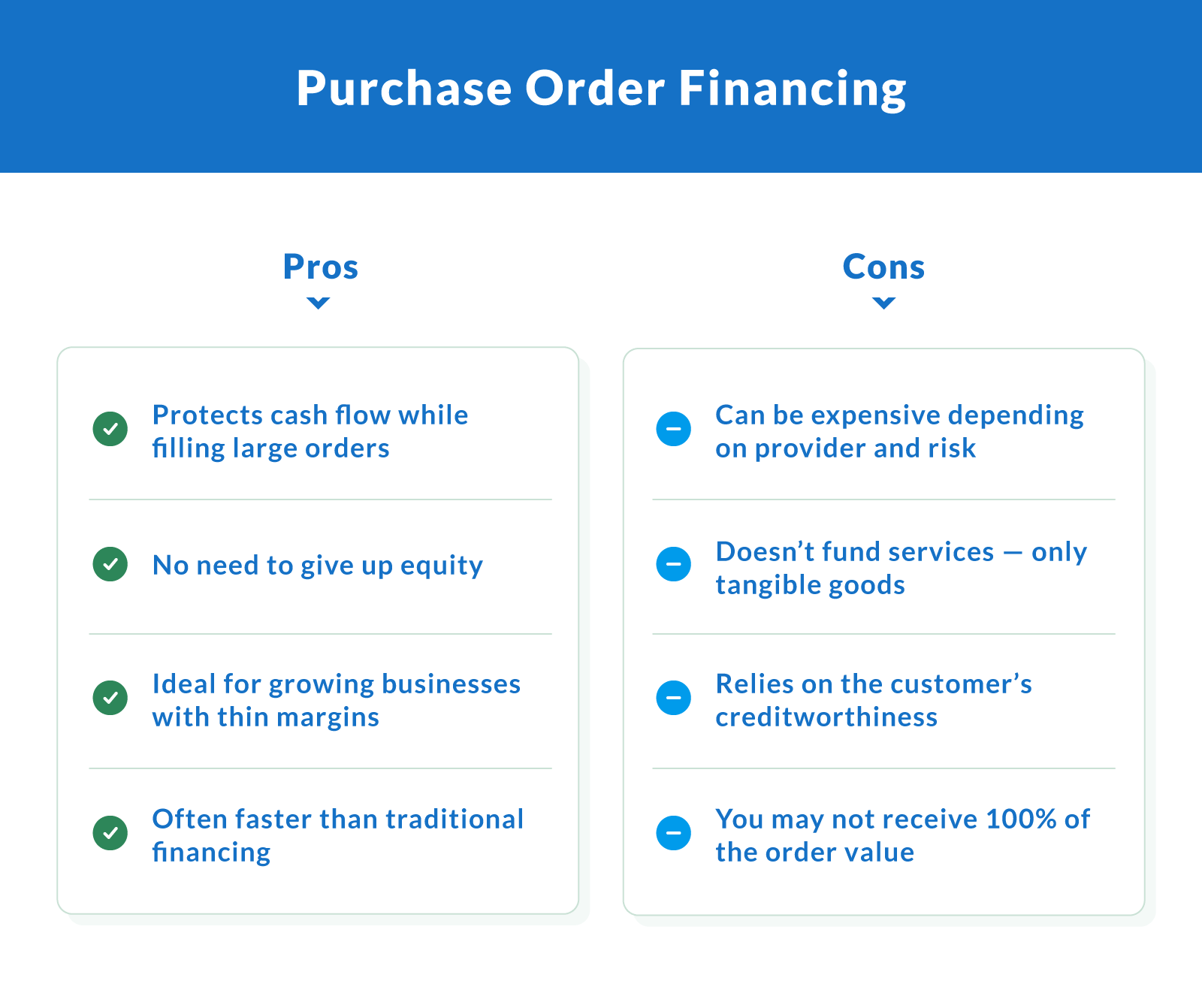

Pros and Cons of Purchase Order Financing

Purchase order financing can be a helpful tool for small business owners who need to cover supplier costs before getting paid by a customer. It's often used to protect cash flow when filling large orders — especially for wholesalers, distributors, and growing companies with limited capital on hand.

Still, it's not the right fit for every situation. Below is a breakdown of the benefits and risks, including both financial and operational impacts.

Pros:

Protects cash flow while filling large orders. You don't need to drain your reserves to cover supplier costs.

No need to give up equity. Unlike raising capital from investors, PO financing lets you maintain full ownership.

Ideal for growing businesses with thin margins. You can take on more volume without waiting on customer payments.

Often faster than traditional financing. Approvals can happen quickly if the customer is reliable.

Cons:

Can be expensive depending on provider and risk. Fees and interest rates vary and can add up quickly.

Doesn't fund services — only tangible goods. It won't help if your business delivers labor or consulting.

Relies on the customer's creditworthiness. Approval is often based more on your buyer than your business.

You may not receive 100% of the order value. Lenders typically advance a portion and hold the rest until repayment.

How Much Does Purchase Order Financing Cost?

The purchase order financing cost varies depending on several factors, but it's generally higher than traditional loans because it covers short-term, higher-risk transactions. Providers typically base financing fees and interest rates on the length of the financing term, the credit profile of the customer placing the order, and the overall risk level of the deal.

Most PO financing companies charge either a weekly or monthly fee until the customer pays in full. Rates often range from 1.5% to 6% per month, depending on the specifics of the transaction. For example, if you received a $100,000 purchase order and your financing fee is 3% per month for two months, the total financing fees would be $6,000.

After the customer pays the lender, the provider deducts its fees and sends the remaining balance to you, giving you the cash you need without tying up your own cash on hand.

It's important to review terms carefully because PO financing is often more expensive than a term loan or traditional bank financing. However, when used strategically, it can be a smart way to fulfill large orders and drive growth without overextending your resources.

PO Financing vs. Other Business Funding Options

While purchase order financing offers a specialized solution for covering supplier costs tied to large customer orders, it's not the only option for small businesses looking to boost cash flow. Other types of business funding may offer more flexibility depending on your situation.

Here's a side-by-side comparison of different financing options, all of which are available through Clarify Capital:

| Financing option | Use case | Speed | Cost | Qualification criteria |

|---|---|---|---|---|

| Purchase order financing | Paying suppliers for large customer orders | Fast after approval, but timing depends on supplier and customer payment | Moderate to high (based on customer risk) | Strong customer credit, valid purchase order, supplier details |

| Business line of credit | Flexible access to cash for inventory and expenses | Fast — can be same-day approval, 24–48 hours funding after approval | Moderate (interest only on drawn funds) | Good credit score, consistent revenue, business history |

| Invoice factoring | Converting unpaid invoices into immediate cash | Very fast — typically 24–48 hours to fund once invoice is verified | Moderate to high (based on invoice quality) | Strong customer credit, unpaid invoices, business documentation |

| Working capital loans | Covering operational needs, inventory, growth | Very fast — approvals same day, funds often available within 24–48 hours | Moderate (fixed interest rate) | Proof of revenue, decent credit score, financial statements |

| Short-term business loans | Quick capital for urgent expenses or opportunities | Very fast — approvals can happen same day, funds available within 24 hours | Higher (short repayment term) | Basic business financials, proof of income, time in business |

Compared to traditional financing like a credit card or term loan, purchase order financing offers a niche advantage for businesses that sell tangible goods and need to pay suppliers upfront to complete customer orders.

What You Need To Apply for a Loan Through Clarify Capital

When applying for a business loan through Clarify Capital, the process is simple and fast — but you'll want to have a few key documents and details ready to speed things up.

Here's what you typically need:

Basic business information. Include your legal business name, business address, and tax ID number (EIN).

Three months of recent business bank statements. These help verify your company's revenue and cash flow.

Valid government-issued ID. You'll need to provide identification for the business owner or authorized signatory.

Monthly revenue details. You'll need to show at least $10,000 in monthly revenue to qualify.

Business history information. Your business should have been operational for at least six months.

Credit score information. A credit score of 500+ is ideal — the higher your score, the better the rates you may receive.

U.S. incorporation or operation. Your business must be located or officially incorporated in the United States.

Once you submit your online application (which takes less than two minutes), your dedicated Clarify advisor will walk you through the next steps and help you choose the best financing option for your goals.

When To Use Purchase Order Financing

Purchase order financing isn't necessary for every order, but it can be a powerful tool when cash flow is tight or large opportunities arise. PO financing helps businesses fulfill big customer orders without risking their working capital or turning down growth.

Here are some of the best situations where purchase order financing can help:

Receiving large orders without enough cash on hand. PO financing covers supplier costs, so you can complete big sales without straining resources.

Managing supplier costs during rapid growth. When orders increase faster than cash flow, PO financing can help bridge the gap.

Preserving working capital for other expenses. Instead of tying up funds in production, you keep cash available for payroll, rent, or marketing.

Fulfilling short-term customer orders with tight deadlines. PO financing speeds up production without waiting for internal cash cycles.

Growing without overextending financial risk. You can accept bigger orders without worrying about draining reserves or taking on unnecessary debt.

Application Process and What You'll Need

Applying for purchase order financing is straightforward, but being prepared can make the application process even faster.

Most PO financing companies require a few key documents to evaluate your request. Here's what you'll typically need:

Customer purchase order. A valid, detailed order from a reliable customer ready to receive goods.

Supplier details. Information about the supplier, including cost estimates and fulfillment timelines.

Estimated costs. A breakdown of supplier charges, production expenses, and shipping fees.

Proof of customer reliability. Evidence like the customer's credit history, payment track record, or previous order history.

Basic financial statements. Documents showing your business's general financial health, such as a profit and loss statement.

Since your customer's credit history and financial stability carry a lot of weight, preparing accurate, detailed information will speed up your approval with a PO financing company.

Is Purchase Order Financing Right for You?

Purchase order financing is a great option for small business owners who need short-term help covering supplier costs for large orders. It's particularly useful if your business has strong customer relationships but limited cash flow or if you're a new business still building credit. Before applying, it's smart to compare financing options, review the full cost structure, and think about how PO financing will impact your cash flow and profit margin.

This financing solution works best when you have a reliable customer, a trustworthy supplier, and a clear timeline for fulfillment. Good decision-making around financing options, including reading contracts carefully and weighing the total costs, will help you use purchase order financing to grow your business without creating financial strain.

If you're ready to see if PO financing can help you take on bigger orders and grow your business, apply through Clarify Capital today. It only takes two minutes to get started, and your dedicated advisor will help you find the best funding option based on your business needs.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts