Whether you're an owner-operator with a few routes or managing a growing last-mile delivery fleet, there are business financing solutions built to help you bridge revenue gaps, upgrade equipment, or expand your services. And the need is massive: In 2023, the U.S. trucking industry generated $987 billion in freight revenue, yet 95.5% of fleets operate 10 or fewer trucks, meaning most are small businesses with limited resources.

This guide breaks down the best loan types for local trucking companies, how to qualify, and which lenders offer the most accessible terms. If you're exploring funding options to support business growth or stay ahead of expenses, you're in the right place.

Loan Options for Local Trucking Businesses

Whether you're looking to expand your fleet or simply cover fuel and maintenance between jobs, there are loan options built for the trucking industry's unique cash flow and equipment needs. Below are six financing options that can help local trucking and last-mile delivery businesses manage operations and grow.

| Local and Delivery Fleet Financing Options for Trucking Companies | ||||

|---|---|---|---|---|

| Loan type | Best for | Interest rates/fees | Terms | Highlights |

| SBA 7(a) loans |

|

|

|

|

| Working capital loans |

|

|

|

|

| Commercial truck loans |

|

|

|

|

| Equipment financing |

|

|

|

|

| Invoice factoring |

|

|

|

|

| Short-term loans |

|

|

|

|

SBA 7(a) Loans

SBA 7(a) loans (also known as small business loans) are one of the most flexible and affordable loan programs for trucking companies, especially those planning long-term investments like fleet expansion or new facility space. While the application process takes longer, you benefit from competitive and lower interest rates, long repayment terms, and large loan amounts.

Best for: Business expansion, truck purchases, and refinancing existing debt

Interest rates: Typically 5.5%-8%

Terms: Up to 10 years for working capital; up to 25 years for equipment

Highlights: Backed by the Small Business Administration (SBA loans), these offer lower rates and longer terms but require strong credit and detailed financials

Working Capital Loans

When trucking companies face fluctuating cash flow between delivery contracts, working capital loans provide fast relief. These loans help cover everyday operating costs, like fuel, tolls, and payroll, so you can keep moving while waiting for customer payments to come in.

Best for: Managing fuel costs, payroll, and seasonal cash flow dips

Interest rates: 7%-20% depending on credit profile

Terms: Six to 24 months

Highlights: Fast approval and funding, especially useful between delivery payments or contracts

Commercial Truck Loans

If your business needs to acquire new trucks or replace aging ones, commercial truck loans are built for that purpose. These loans are usually secured by the truck itself, making them more accessible for trucking businesses without perfect credit.

Best for: Buying or leasing new or used delivery vehicles

Interest rates: 6%-16%

Terms: 3 to 7 years

Highlights: Truck financing is secured by the vehicle; great for owner-operators or fleet upgrades with predictable monthly payments

Equipment Financing

From GPS systems to reefer trailers, equipment costs can add up fast. Equipment financing gives you access to critical tools without large upfront investments. This option is ideal for trucking companies focused on long-term growth and modernization.

Best for: Upgrading trailers, maintenance tools, or logistics software

Interest rates: 5%-15%

Terms: Two to six years

Highlights: Covers physical asset purchases; doesn't tie up working capital and equipment serves as collateral

Invoice Factoring

Instead of waiting 30-60 days for clients to pay, invoice factoring lets you turn unpaid invoices into immediate working capital. A factoring company gives you a cash advance and takes a small percentage once the invoice is collected.

Best for: Converting outstanding freight invoices into immediate cash

Rates: 1%-5% of invoice value (weekly or monthly fees)

Terms: Ongoing factoring agreements

Highlights: Improves cash flow without taking on debt; approval based on receivables, not credit score

Short-Term Loans

Short-term business loans are ideal for fast cash, especially if you're dealing with an unexpected repair or covering fuel ahead of a job. These loans have quicker underwriting and fewer documentation requirements than traditional financing, and provide you with a lump sum to use as needed.

Best for: Covering urgent repairs or fuel during contract delays

Interest rates: 10%-35%

Terms: Three to 18 months

Highlights: Quick online approvals with flexible repayment; ideal for emergency business expenses

How To Choose the Right Loan for Your Fleet

Choosing the right type of financing depends on your business's current size, financial health, and long-term goals. Most trucking companies in the U.S. are small operations. In fact, only 2.6% of fleets have more than 20 trucks. That makes flexible, fast-access funding especially important for local and short-haul businesses.

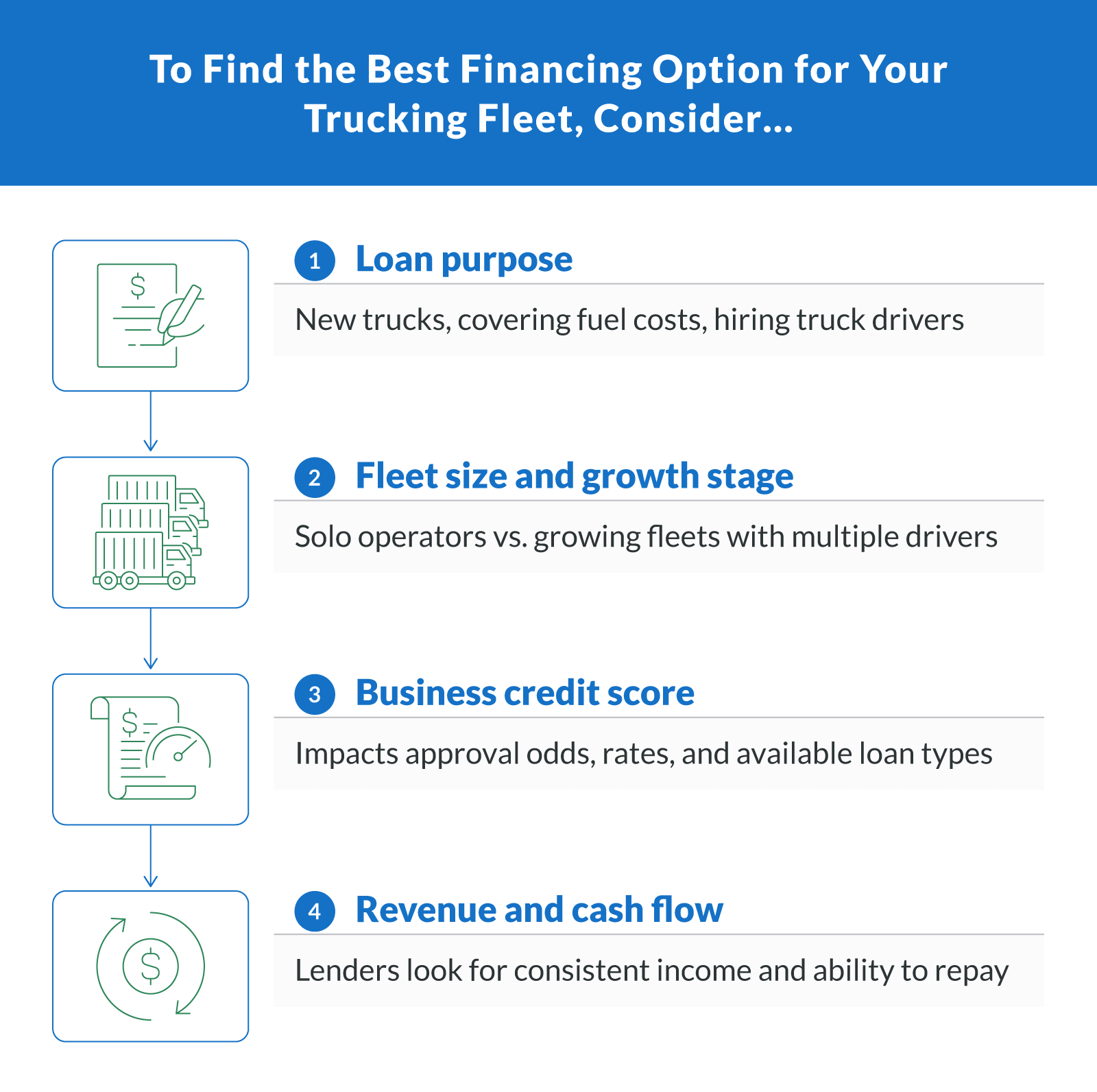

Here are key factors to consider when comparing loan options:

1. Loan Purpose

Are you looking to purchase new trucks, cover weekly fuel costs, or hire more truck drivers? Start by matching your business needs with the right type of financing:

Equipment financing for buying trucks or trailers

Working capital loans for covering operating costs

Invoice factoring for smoothing out irregular cash flow

2. Fleet Size and Growth Stage

Smaller operations or solo owner-operators often benefit from short-term or asset-based funding. If you're scaling up or managing multiple drivers, you may need higher loan amounts or revolving credit.

Startup fleets may struggle to qualify for traditional loans without strong revenue or credit

Established businesses can access more competitive rates and flexible repayment terms

3. Business Credit Score

Your business credit score plays a major role in loan approval, access to low interest rates, and terms. Lenders often look at both personal and business credit, especially for new businesses with limited history. Improving your score over time can unlock lower rates and higher borrowing limits.

4. Revenue and Cash Flow

Lenders want to see consistent income, even if you're operating a lean fleet. Documented revenue and positive cash flow help demonstrate repayment ability. Most lenders will ask for at least three months of bank statements or recent tax returns.

What Lenders Look for When Approving Trucking Loans

Before approving a loan application, lenders want to know that the trucking business or borrower can repay the funds on time. That means reviewing a mix of financial documentation, creditworthiness, and operational details to assess eligibility. While criteria can vary by lender and type of loan, most follow a common checklist.

1. Monthly Revenue

Most lenders require a minimum monthly revenue, often between $10,000 and $25,000. Higher revenue can qualify you for larger loan amounts or lower rates. Even seasonal businesses can qualify if you can show steady cash flow during peak periods.

2. Credit History

Your credit history, both personal and business, affects your approval odds and interest rate. While some lenders accept lower credit scores, a strong credit profile signals financial reliability. For newer businesses, personal credit often weighs more heavily.

3. Business Plan and Purpose

Be ready to explain how the funds will be used. A simple business plan that outlines your goals, like expanding your delivery fleet or upgrading equipment, can build lender confidence.

4. Documentation

To verify income and operations, most lenders will request:

Recent tax returns (business and/or personal)

Business bank statements (typically three to six months)

Proof of operating licenses or insurance

Breakdown of major business expenses

Having this paperwork organized makes your loan application process faster and easier.

5. Down Payment (When Applicable)

For equipment loans or commercial truck loans, some lenders require a down payment, which is typically 5% to 20% of the purchase price. A larger upfront payment can reduce your monthly burden and boost your approval odds.

FAQs About Trucking Company Financing

Below are answers to common questions truckers and fleet owners ask when exploring business funding options for growth, equipment, or daily operations.

Can I Get a Loan To Expand My Local Delivery Fleet?

Yes. Many lenders offer trucking company loans specifically designed for expanding delivery fleets. If you have steady monthly revenue and a solid business history, you may qualify for equipment financing, working capital loans, or even SBA-backed options. Expanding fleets can often leverage existing trucks as collateral to secure better terms.

How Do I Get a Truck for My Business With No Money?

If you don't have cash for a down payment, look into commercial truck loans that offer zero-down options or flexible equipment leasing. Some lenders will approve truckers and business owners with limited upfront capital if they have strong credit and revenue. Alternatively, invoice factoring or short-term loans can free up working capital to cover your first payment.

Are There Grants Available for Trucking Companies?

Grants for trucking businesses are limited but do exist, especially for sustainability initiatives (e.g., electric trucks or fuel efficiency upgrades). Local economic development programs and transportation departments may offer region-specific funding. However, most business funding for truckers comes in the form of loans, not grants.

How Hard Is It To Get a Truck Loan?

Getting a truck loan can be relatively straightforward if you have a decent credit history, proof of income, and a consistent operation. New businesses may face more challenges, but lenders that specialize in trucking often offer startup-friendly programs, even for those with bad credit. Just be prepared to submit documentation like bank statements, tax returns, and equipment quotes.

How To Get a Loan for a Trucking Company?

Start by identifying the type of financing your business needs, whether it's to purchase trucks, bridge cash flow gaps, or invest in maintenance. Then gather key documents: revenue statements, business licenses, and your credit history. Complete an online application through a lender like Clarify Capital to get matched with funding offers that fit your profile. Having a clear business plan can also strengthen your chances of approval.

Final Thoughts on Trucking Company Loan Options

Local trucking and delivery businesses face unique challenges, from managing fuel costs to upgrading equipment without disrupting routes. The good news is that there's a loan program for nearly every stage of your business. The right financing can help you maintain momentum and meet your short- and long-term business needs.

By understanding your cash flow, credit profile, and loan goals, you can choose a funding option that works with, not against, your budget. From SBA loans to invoice factoring, these programs are designed to help you grow without overextending your finances.

Apply now with Clarify Capital to find the right financing solution for your delivery fleet.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts