Key Takeaways:

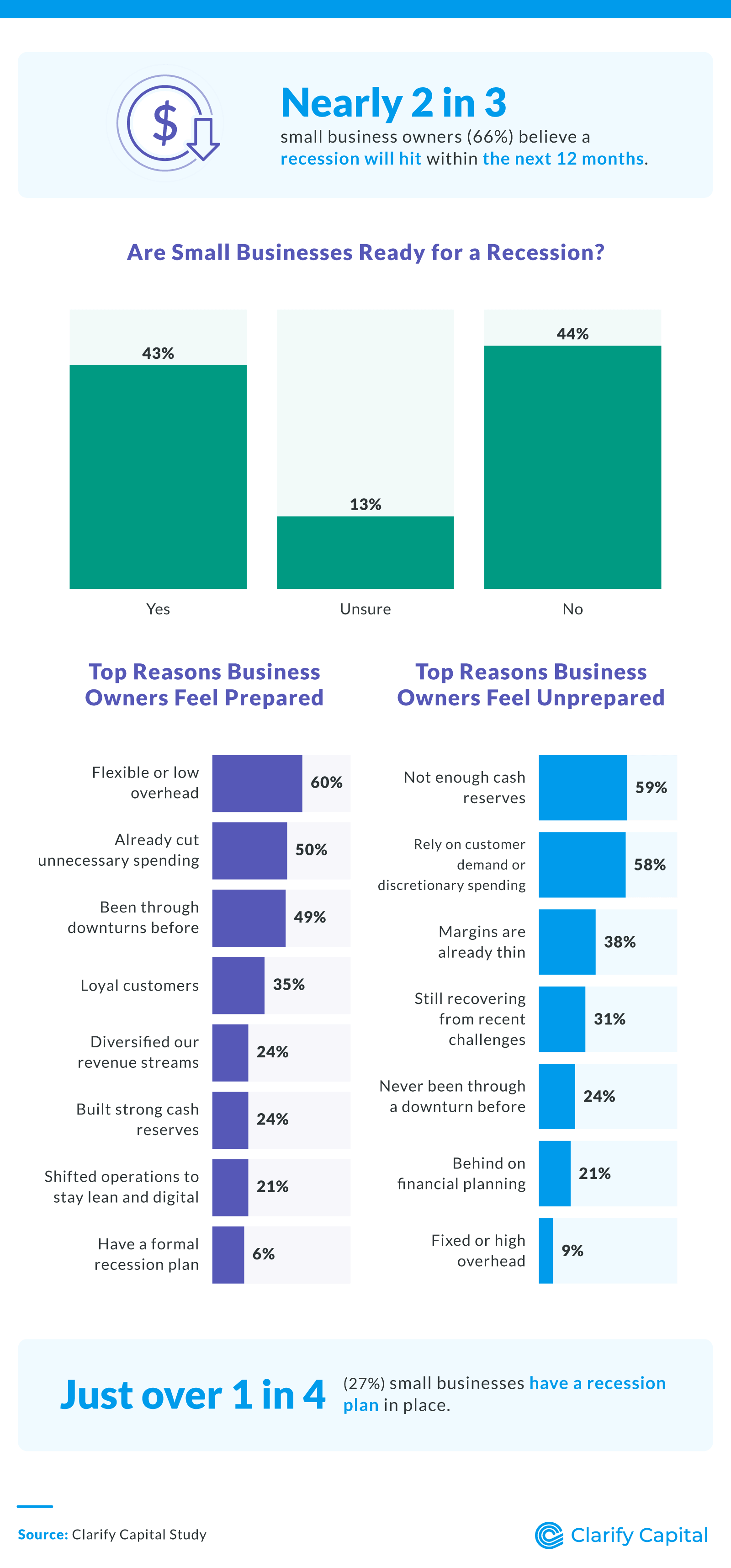

About 2 in 3 small business owners (66%) believe a recession will hit in the next 12 months.

Over 1 in 3 business owners who attempted to secure funding (36%) said it was more difficult in the past year.

Over 1 in 4 small business owners (28%) don't feel confident in their ability to access capital if needed during a downturn.

Nearly 2 in 5 small business owners (39%) admit they're operating without a financial safety net.

Just over 1 in 4 small businesses have a recession plan.

Recession Prep: Few Have a Plan, Many Feel Exposed

Over 1 in 3 small business owners (39%) said the media is underplaying how bad the economy really is. Only 35% said coverage is accurate, while 26% believe the threat is being overhyped.

66% of small business owners believe a recession will hit in the next 12 months.

Millennial business owners were more likely to feel unprepared. Over half (56%) said they weren't ready for a recession, while just 1 in 3 (32%) felt prepared.

Gen Z business owners were more confident about a downturn: 61% felt prepared, while 1 in 3 (30%) said they weren't.

Top Areas Where Businesses Feel Most Vulnerable in a Downturn

Cash flow and revenue consistency: 50%

Client/customer retention: 36%

Sales and marketing: 29%

Supply chain or inventory: 29%

Operational overhead: 15%

Top Industries Most Prepared for a Recession

Legal

Finance

Hospitality

Top Industries Least Prepared for a Recession

Marketing

Arts/Entertainment

Retail

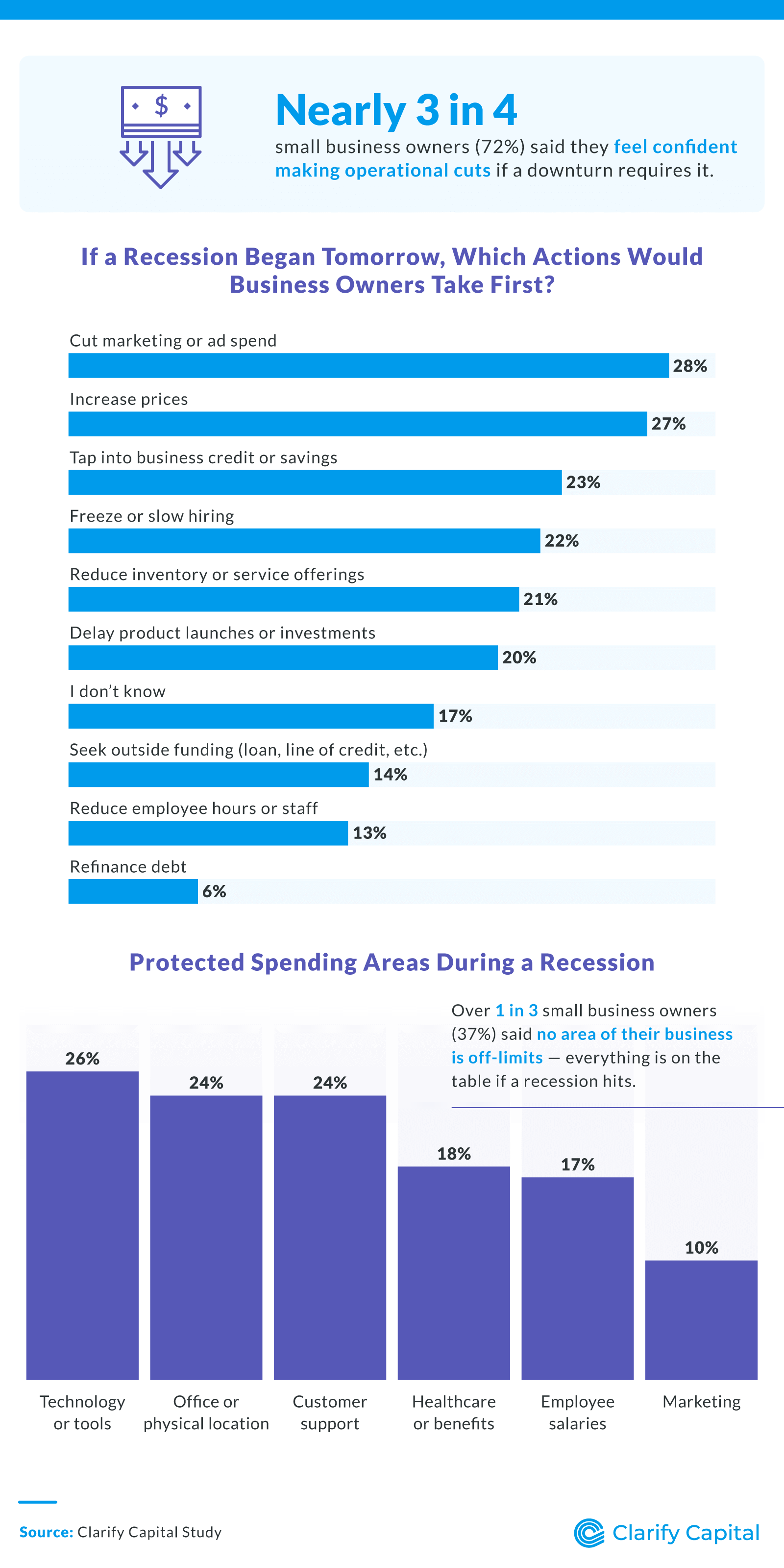

Top 5 Actions Businesses Have Taken Amid Economic Volatility

No changes yet: 40%

Reduced discretionary spending: 36%

Delayed new purchases or upgrades: 32%

Raised prices to offset costs: 17%

Paused hiring or expansion plans: 15%

How Many Small Businesses Have a Recession Plan?

No, not preparing at this time: 43%

Not yet, but working on one: 30%

Yes, an informal plan: 23%

Yes, a detailed, documented plan: 4%

What's Keeping SMB Owners Up at Night?

Over 1 in 3 business owners who attempted to secure funding (36%) said they faced more difficulty doing so in the past 12 months.

Over 1 in 4 small business owners (28%) said they do not feel confident in their ability to access capital if needed during a downturn.

Nearly 2 in 5 small business owners (39%) admit they're operating without a financial safety net.

Financial Safety Nets Small Businesses Currently Have

Cash reserves or emergency savings: 39%

A business credit card or line of credit: 34%

A business savings account or CD: 17%

Access to family/investor capital: 15%

An active small business loan: 4%

Industries Most Confident in Making Operational Cuts During a Downturn

Marketing

Hospitality

Finance

Education

Legal

Methodology

We surveyed 300 American small business owners to uncover how small business owners in the U.S. are actively preparing for a potential recession. The average age was 43; 42% were female, 57% were male, and 1% were non-binary.

About Clarify Capital

Clarify Capital helps business owners secure the financing they need to thrive in today's competitive marketplace, including no-doc business loans and fast business loans. Our tailored financial solutions support entrepreneurial dreams, turning visions into reality.

Fair Use Statement

If you'd like to share insights from this report, you're welcome to do so for noncommercial purposes. Just be sure to include a link back to Clarify Capital and provide proper credit.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts