Opening or growing a chiropractic practice takes just as much capital as it does clinical skill. From leasing space to buying therapy tables and digital X-ray machines, chiropractors often turn to chiropractic business loans to fund these high-cost needs. Whether you're launching a new office or scaling to serve more patients, access to chiropractic financing can make or break your health care business growth plan.

Chiropractic is big business. In 2025, it's projected that the U.S. chiropractic industry will generate $22.2 billion in revenue, and that number keeps climbing thanks to growing demand for non-invasive pain care. But starting a practice isn't cheap. Startup costs typically range from $50,000 to $100,000, depending on your specific needs, like location, staffing, and equipment.

The good news? Chiropractors have more small business loan options than ever, from SBA loans and lines of credit to fast funding solutions for those with less-than-perfect credit. This guide breaks down the most relevant financing paths, how to qualify, and how to choose the best loan for your practice goals.

| Chiropractic Business Loan Comparison | |||

|---|---|---|---|

| Loan type | Best for | Key benefits | Considerations |

| SBA loan |

|

|

|

| Equipment financing |

|

|

|

| Merchant cash advance |

|

|

|

| Short-term loan |

|

|

|

Why Chiropractors Seek Business Loans

Running a chiropractic practice goes far beyond just treating patients. It's a full-scale small business operation. Chiropractors often need funding to cover both startup and growth-related expenses, from real estate to marketing. As the industry grows, expanding at 9.2% annually, competition increases, making it critical to invest in high-quality care and modern tools to attract and retain patients.

One of the biggest funding needs is equipment. Chiropractic tables, digital X-ray machines, and cold laser therapy devices often cost between $10,000 and $30,000, depending on the brand and features. Many business owners also seek capital to:

Expand to a second location. Growth often requires upfront investments in commercial space and remodeling.

Hire new staff. Bringing on associates or front-desk personnel requires payroll funding before revenue catches up.

Cover delayed insurance reimbursements. Waiting weeks or months for payment can strain cash flow.

Invest in marketing. Attracting new patients means spending on SEO, local advertising, and social media outreach.

Whether you're starting fresh or scaling up, access to a working capital loan can help smooth operations and unlock long-term growth.

Types of Chiropractic Business Loans

Chiropractors have access to a wide range of loan options, each suited to different practice goals, from buying new equipment to expanding into a second location. Choosing the right financing depends on how quickly you need funding, your credit score, and whether you're investing in long-term growth or bridging short-term cash flow gaps.

Whether you're launching a new chiropractic office or optimizing an existing one, the right practice loan can help you maintain quality care while managing costs. Below are the most common chiropractic business loans to consider.

SBA Loans

Backed by the Small Business Administration, SBA loans offer some of the most attractive terms for chiropractic business owners. These loans typically come with lower interest rates, long repayment periods (up to 10 years), and higher loan amounts, making them a great option for chiropractors opening new clinics or renovating existing spaces.

However, the SBA loan application process can take several weeks due to stricter eligibility requirements and documentation. Working with an SBA lender like Clarify Capital can help speed things up.

Equipment Financing

Chiropractic equipment, like digital X-ray machines, decompression tables, and laser therapy systems, can cost anywhere from $10,000 to $30,000. Equipment loans help you acquire new equipment without large upfront payments, preserving cash flow for marketing or staffing needs.

These loans are often structured so that the chiropractic equipment itself acts as collateral, which can make approval easier, even for newer businesses. Many lenders offer flexible repayment options tailored to the expected lifespan of the equipment.

Merchant Cash Advances and Short-Term Loans

If your chiropractic office faces delayed insurance payouts or seasonal revenue dips, a merchant cash advance (MCA) or short-term loan can provide fast access to working capital. These products are typically easier to qualify for, even with bad credit, and don't require extensive paperwork.

While interest rates are higher than traditional term loans, MCAs offer speed and flexibility. Chiropractors with lower credit scores or urgent funding needs may find this a practical solution for bridging gaps in cash flow.

How To Apply for Chiropractic Financing

Applying for chiropractic business loans doesn't have to be complicated, especially if you know what lenders are looking for. Preparing your documents and understanding the process will help improve your chances of fast approval.

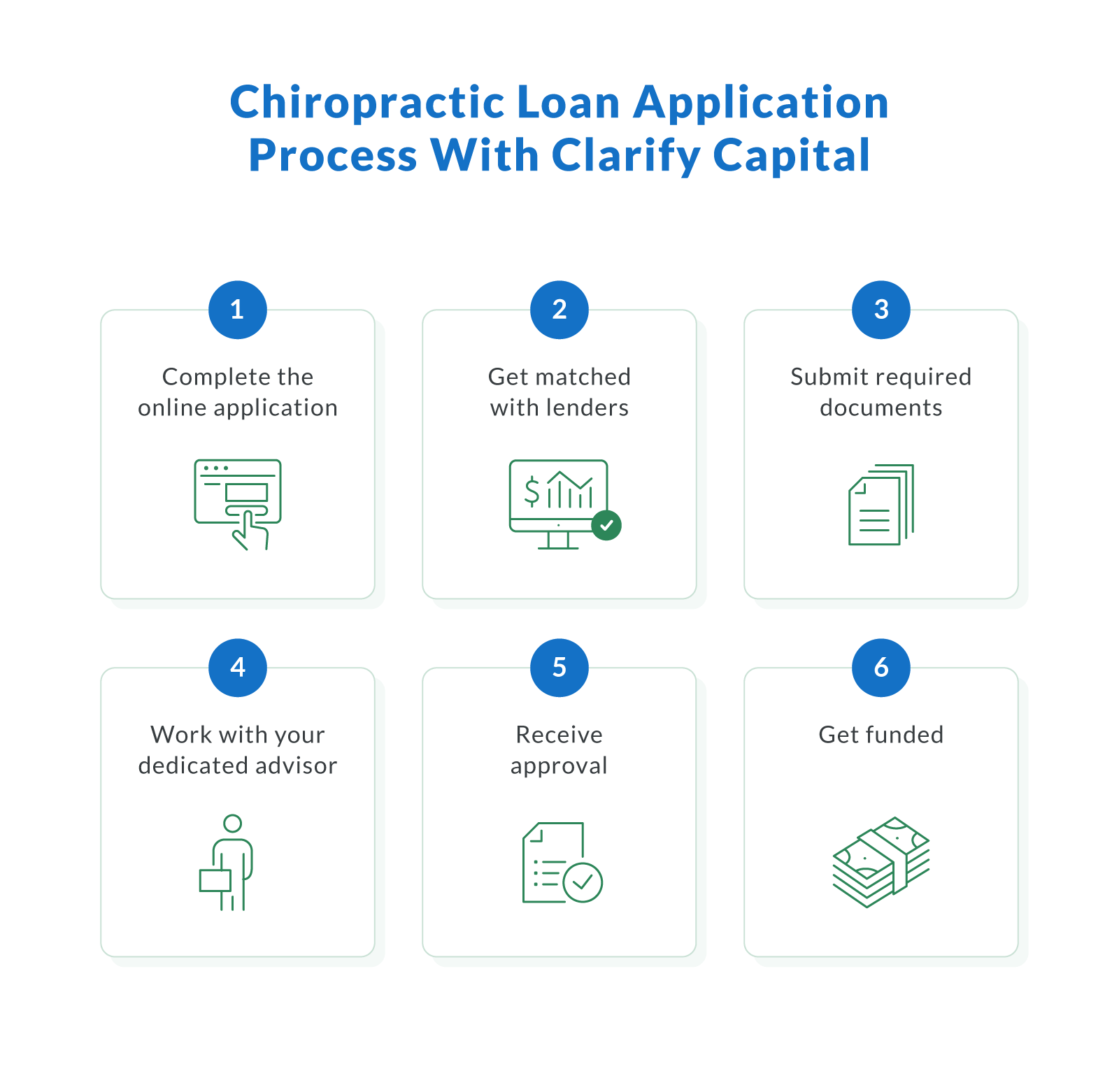

Here's a step-by-step guide to help you navigate the loan application process:

Outline a strong business plan. Most lenders want to see a detailed business plan that outlines your chiropractic services, market opportunity, projected revenue, and how you plan to use the loan. This is especially important for newer practices or if you're applying for an SBA loan.

Review your personal credit history. Your personal credit score will play a major role in the application process, especially if your business is new or doesn't yet have its own credit profile. Aim for a score of 650 or higher to access the widest range of loan options.

Gather required documentation. Lenders typically request three to six months of business bank statements, tax returns (personal and business), profit-and-loss statements, and any existing debt schedules. For equipment financing, include quotes or invoices for the equipment you plan to purchase.

Compare lenders and loan types. Match your needs to the right type of loan, whether it's a line of credit for flexible access, a term loan for renovations, or a merchant cash advance for short-term working capital.

Submit your loan application. Apply online or through a dedicated loan advisor. Clarify Capital offers a simple application process and matches chiropractors with lenders that meet their specific goals and credit profile.

Communicate clearly during underwriting. Quick responses to follow-up questions or document requests can speed up approval. Most lenders give conditional decisions within 24-72 hours if all documents are in order.

By staying organized and proactive, you can shorten the approval timeline and get the funding you need, without disrupting your ability to serve patients.

Estimate Your Loan Needs

Before applying for financing, it's important to understand how much funding your chiropractic business truly needs and how much you can realistically repay. Borrowing too much can lead to cash flow issues, while underfunding may stall your growth plans.

Start by reviewing your business goals and projected revenue. Are you looking to open a second office, invest in new chiropractic equipment, or cover short-term payroll gaps? Your loan amount should align with these objectives while accounting for your ability to handle monthly payments.

Chiropractors in the U.S. earn an average annual salary of $213,000, which provides a solid income base for repaying most small business loans. However, you'll want to consider the full financial picture, monthly operating costs, personal expenses, and any existing debts before committing to a repayment plan.

To estimate the right loan size and terms:

Tally all project-related expenses. Include commercial real estate, equipment, marketing, and staffing needs.

Calculate your debt service coverage ratio (DSCR). Lenders often look for a DSCR of 1.25 or higher to approve your loan.

Model repayment terms. Use an online loan calculator to test different interest rates, repayment periods, and monthly payments.

Account for seasonal cash flow dips. Choose terms that provide flexibility if your patient volume varies throughout the year.

A realistic loan estimate helps ensure your chiropractic practice stays financially healthy, without overextending your resources.

Ready To Grow Your Chiropractic Practice?

Chiropractic professionals are uniquely positioned to benefit from small business loans, whether you're opening a new location, upgrading therapy equipment, or bridging a short-term cash gap. The right chiropractic business financing can help stabilize cash flow and strengthen your practice's competitive edge.

With so many funding options available, from SBA loans and equipment financing to merchant cash advances and lines of credit, it's important to choose a lender that understands the needs of chiropractic business owners. Factors like loan amount, interest rates, repayment flexibility, and approval speed all play a role in making the best decision.

Clarify Capital simplifies this process with fast approvals, transparent terms, and a dedicated advisor to guide you. Whether you're planning your first practice or scaling an existing practice, we'll help you find the best business loans for your specific goals.

Explore your chiropractic financing options with Clarify Capital today, or schedule a quick consultation to get personalized funding support.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts

![7 Best Equipment Financing Companies and Loan Options [2024]](/assets/blog/best-equipment-financing-companies/best-equipment-financing-companies-small-3874c9814fbefadd9f9419a140059f72e2893541ce88c7548a49986f0e852ee2.jpg)