Securing funding is one of the biggest hurdles small business owners face, especially when you're short on time and need capital to seize a growth opportunity. Between confusing lender requirements and dense application processes, it's easy to feel stuck. But here's the good news: getting a small business loan today is more accessible than ever, thanks to fintech innovation and expanded financing options.

In 2026, lenders are increasingly relying on real-time financial data and automated underwriting to speed up decisions and reduce friction for borrowers. Understanding these shifts can give you a competitive edge and help you secure funding more quickly.

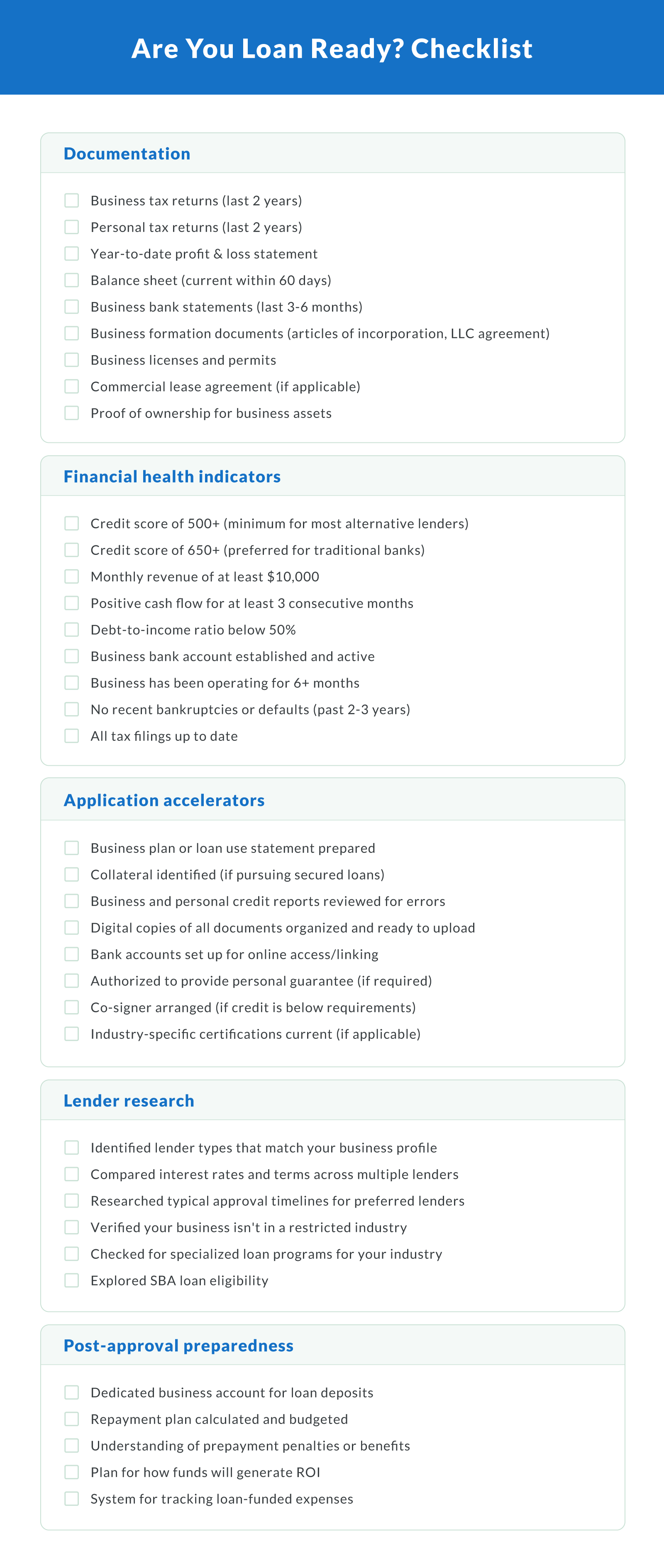

This guide will provide a loan eligibility checklist, help you navigate loan applications, and choose the right funding option for your business needs. We'll cover everything from credit score requirements to approval odds by lender type, plus tips for speeding up the application process and improving your chances of getting approved quickly.

Understanding Business Loan Eligibility

Before you dive into a loan application, it's important to understand what lenders are actually looking for. Every lender, whether it's a bank, credit union, or online platform, has unique eligibility benchmarks. The most common include your credit score, business revenue, and how long your company has been operating.

Some lenders may also evaluate your business's industry, online presence, or recurring revenue as additional indicators of creditworthiness. Being prepared with this information can streamline your application.

Minimum Credit Score and Financial Benchmarks (2026 Data)

In 2026, FICO scores continue to play a central role in the loan approval process. Lenders evaluate both your personal credit score and your business credit score (if applicable). A strong credit history not only boosts your approval chances but also helps you qualify for better rates and terms.

Here's how scores generally break down:

Good credit. 670 or higher.

Fair credit. 580 to 669.

Bad credit. Below 580.

While many traditional lenders require good to excellent credit, credit unions and online lenders like Clarify Capital may work with borrowers who have lower scores as low as 550 or a limited credit history. They also focus on business performance and revenue consistency. This gives more business owners a chance to access funding when traditional banks decline.

Time in Business and Revenue Requirements

Lenders want to see that your business has a track record. Most funding sources require at least six months of operational history and consistent monthly revenue, especially if you're applying for unsecured loans.

Clarify Capital requires at least $10,000 in monthly revenue and a minimum of six months in business. This gives lenders confidence in your ability to repay the loan and manage ongoing cash flow.

How Approval Rates Vary by Lender Type

Your chances of getting approved can vary dramatically depending on where you apply. Traditional banks often have the strictest requirements and lowest approval rates. They typically favor established businesses with strong credit, high annual revenue, and multiple years of tax returns. Credit unions may be more flexible and provide personalized service, but you often need to be a member to apply.

Online lenders are the most accessible. They evaluate your cash flow, sales volume, and business activity, not just your credit score. As a result, they tend to approve a wider range of borrowers, including startups and business owners with lower credit scores. Digital underwriting models, often used by online lenders, can reduce approval times from days to hours.

SBA loans, backed by the U.S. Small Business Administration, are a middle ground. They offer lower interest rates and long repayment terms but require detailed documentation and take longer to process. SBA Express loans can provide faster decisions, typically within 36 hours, making them a viable option for business owners needing quicker access to funds.

Whether you're running a startup business or are an experienced small business owner, knowing which lender fits your profile is key to getting funded faster.

Clarify Capital can help match you with the right lender based on your specific revenue, industry, and credit profile.

Challenges Faced by First-Time Borrowers

Getting a business loan for the first time can be frustrating, even for motivated, capable entrepreneurs. From confusing requirements to rigid lender policies, many first-time applicants hit roadblocks they didn't anticipate.

Newer business owners may not realize how much lenders rely on documentation like tax returns and business bank statements. Preparing these early can reduce back-and-forth and improve approval speed. This section breaks down the most common barriers and outlines steps you can take to overcome them.

Top Reasons Loans Are Denied (Debt, Credit, and Policy Restrictions)

Lenders deny loan applications for several reasons, most of which boil down to perceived risk. Here are the biggest red flags they look for:

Limited or poor credit history. Without a strong credit track record, either personal or business, it's difficult for lenders to assess your reliability. A weak business credit score or a personal credit score under 600 often triggers automatic rejection.

High debt-to-income ratio. If your existing debts outweigh your income, lenders may assume you can't take on more. This applies even if your business assets are solid.

Incomplete business plan. A vague or unrealistic plan indicates that you haven't thought through your growth strategy. This can be especially harmful for a startup without a proven financial history.

Missing or outdated financial statements. Lenders need up-to-date tax returns, profit and loss statements, and balance sheets to assess your financial health. Incomplete documents are a common reason for denial.

Industry restrictions. Some lenders have policies against lending to high-risk or highly regulated industries like cannabis, gambling, or adult services, even if the business is profitable.

First-time small business owners often run into these issues simply because they don't know what lenders expect. Accessing lender-specific checklists or working with a funding advisor can make this process smoother.

Emotional and Practical Stressors of the Process

Beyond the paperwork, the loan application process can feel personally overwhelming. Entrepreneurs juggle their day-to-day business needs while digging through tax returns, updating financial records, and responding to lender requests.

Waiting for approval adds another layer of pressure, especially when working capital is tight. Many worry about how to cover operational costs if the loan is delayed, what monthly payments will look like once repayment begins, and whether the loan terms will actually fit their needs.

The fear of being denied after all that effort can be discouraging. But with the right prep, most of these issues can be avoided or mitigated. Some online lenders provide prequalification tools or soft credit checks, giving you a clear sense of approval odds without affecting your score.

First-Time Borrowers: Example Case Studies

Take Sarah, a first-time entrepreneur who launched a small retail startup with minimal capital. Despite her bad credit, she worked with an online lender that looked beyond her personal credit score and focused on her store's strong early sales. By documenting her revenue growth and clearly outlining how she'd use the funds, she secured $25,000 in business funding, enough to expand her inventory.

Or consider James, a freelance web developer who struggled to get a traditional loan due to limited business assets and no formal business plan. He turned things around by organizing his tax returns, updating his financial statements, and writing a concise plan that highlighted his recurring contracts. He was approved by a nonprofit lender that specializes in funding new businesses.

Stories like these show that even with poor credit or limited history, small business owners can still meet eligibility requirements and get the funding they need to grow.

Clarify Capital works with many first-time borrowers, helping them build strong applications, even with minimal documentation.

Exploring Fast Business Loan Options

When you're short on time but big on business needs, the speed of funding becomes just as important as the terms. Luckily, the lending landscape in 2026 includes faster and more flexible alternatives to traditional bank loans.

Online Lenders and Fintech Platforms

Digital lenders have redefined small business financing. With online applications, algorithm-based underwriting, and minimal paperwork, these platforms offer funding in as little as 24 hours. More importantly, they evaluate you differently from a traditional bank.

Instead of relying solely on your credit report or personal credit score, online lenders focus on:

Your business performance. Performance factors include monthly revenue, transaction history, and profitability.

Cash flow health. Regular deposits in your business bank account carry more weight than long credit histories.

Ease of access. Many require just six months in business and a minimum monthly revenue, often around $10,000.

Some lenders may approve funding based on future receivables or recent sales trends, providing fast capital without full documentation.

Because of these looser requirements, even businesses with average credit or limited track records can qualify. Interest rates may be higher than a traditional bank loan, but the convenience and speed often outweigh the cost, especially for time-sensitive opportunities.

SBA Express and Microloans vs. Traditional Loans

Not all fast options are costly. Government-backed programs through the U.S. Small Business Administration (SBA) offer some of the most accessible types of financing, with simplified applications for smaller loan amounts.

SBA 7(a) Express loans offer up to $500,000 with a quicker turnaround, typically within 36 hours for a decision. SBA microloans (usually under $50,000) are ideal for startups and underserved borrowers. They're distributed through local nonprofits, so approval criteria tend to be more flexible.

In contrast, traditional bank loans still offer the best interest rates and longest repayment terms, but they're slow. The average bank loan can take several weeks to process, requiring extensive documentation and a strong credit profile.

For many borrowers, SBA-backed options strike a balance between cost and accessibility. Even for microloans, borrowers should prepare basic financial statements and a business plan to strengthen their application.

Speed vs. Cost Trade-Offs

Here's the real trade-off in fast funding: you'll often pay more for speed.

Let's compare three scenarios:

Traditional term loan. You may qualify for a low APR and a repayment term of five to 10 years, but approval can take two to six weeks. This loan type is best for long-term investments like real estate or major expansions.

Business line of credit. Offers flexible access to capital when you need it, often funded in under a week. Rates vary widely but tend to be higher than traditional loans.

Cash advance. Fastest funding available, sometimes same-day, but carries the highest interest rates and requires daily or weekly repayments. Best for urgent short-term needs.

While business lines of credit offer revolving access, some borrowers prefer the simplicity of a lump sum through a cash advance or short-term loan for immediate needs. Always review the total repayment amount and not just the interest rate. Tools like an amortization calculator can help you plan monthly payments accurately.

Tips To Improve Loan Approval Chances

Getting approved for a business loan doesn't need to be a shot in the dark. With strategic preparation and the right approach, you can significantly boost your chances of securing funding quickly. Let's explore actionable steps that can transform you from a questionable applicant to a lender's ideal candidate.

Clarify Capital recommends starting with a self-assessment using their online eligibility check to identify gaps in your application before you apply.

Financial Prep: Documents, Credit Building, and Cash Flow Proof

Lenders need evidence that your business is financially sound before approving your loan application. Preparing the right documentation ahead of time can streamline the process and increase your approval odds.

Start by organizing your financial statements, including profit and loss reports, balance sheets, and cash flow projections. Most lenders require at least the last two to three years of tax returns to verify your business income and expenses. Make sure these documents tell a consistent story about your company's financial health.

Your personal credit score remains one of the most important factors in business loan approvals. Even established businesses with strong revenue may face rejection if the owner's credit is poor.

Take steps to improve your score by:

Paying down debt. Reduce your credit utilization ratio by paying down existing balances on personal and business credit cards.

Correcting errors. Review your credit report for inaccuracies that might be dragging down your score.

Establishing business credit. Open business credit cards and vendor accounts that report to business credit bureaus to build your business credit score separate from your personal one.

Demonstrating strong cash flow is critical to loan approval. Lenders want to see that you generate enough revenue to cover operational expenses plus loan payments. Organize bank statements that show consistent deposits and healthy account balances.

If your annual revenue meets or exceeds industry averages, highlight this fact in your application. Lenders may also want to see gross vs. net revenue trends, so showing growth over time can be a major plus.

Choosing the Right Lender for Your Profile

Not all lenders are created equal, and matching your business profile to the right funding source can make the difference between approval and rejection. Traditional banks typically offer the lowest interest rates but have the strictest eligibility requirements.

They generally prefer businesses with:

At least two years in operation

Good to excellent personal credit scores (680+)

Strong annual revenue and profitability

Online lenders provide faster funding with more flexible criteria, making them ideal for:

Newer businesses (six or more months)

Owners with fair credit (550–650)

Businesses needing capital quickly

Credit unions often offer personalized service and competitive rates comparable to those of banks, but you'll need to become a member. The Small Business Administration partners with lenders to provide SBA loans with government guarantees, making them accessible to businesses that might not qualify for conventional financing.

If you have bad credit, focus on lenders that emphasize business performance over personal credit history. Many loan programs now exist specifically for credit-challenged entrepreneurs, though these typically come with higher rates to offset the lender's risk. A personal guarantee or pledged revenue may help you access better terms even with subprime credit.

For startups or businesses with less than six months of operations, consider microloans from nonprofit organizations, which often have more lenient eligibility requirements focused on community development. However, Clarify requires at least six months in business to qualify for funding.

Fast-Track Tactics: Linking Bank Data, Immediate Response, and Document Readiness

When speed matters, these strategies can accelerate the application process and get funds in your account faster.

Digitize your application process by linking your business bank accounts directly to lender platforms. Many online lenders and some traditional institutions now offer secure API connections that instantly verify your cash flow and transaction history, eliminating days of manual review.

Prepare a complete loan application package before you apply, including:

Business and personal tax returns (last two to three years)

Financial statements (balance sheet, P&L, and cash flow)

Business plan with detailed projections (especially for startups)

Business bank statements (usually the most recent three to six months)

Business license and formation documents

Being ready with supporting documents that prove business assets can strengthen your application. Equipment, real estate, or inventory can sometimes be used as collateral to secure better terms or overcome credit challenges.

Respond immediately to any lender's requests for additional information. Delays in providing supplementary documentation are among the most common reasons for extended approval timelines. Set up email alerts and check your spam folder regularly during the application process.

Consider offering a personal guarantee if your business lacks sufficient history or assets. While this increases your personal risk, it often leads to faster approval and better financing options, particularly for newer businesses. Being responsive and organized throughout the process positions you as a responsible borrower and can help expedite the underwriting process.

Talk to a Funding Expert Today

Fast, flexible funding is within reach, especially when you're backed by the right lender. If you're ready to grow your business with a small business loan, now's the time to act. Whether you're comparing financing options or need help completing your loan application, a Clarify advisor is ready to support you.

Start your funding journey with a quick, no-obligation application; it takes just two minutes. You could receive approval and access to capital within 24 hours. Apply now and experience how working with the right lender can transform your business finances in days, not weeks.

Frequently Asked Questions

Business owners often have a lot of questions when exploring loan options, especially around approval speed, credit requirements, and accessibility. This FAQ section addresses some of the most common concerns, helping you better understand what to expect when applying for business funding in 2026. Whether you're building credit, need cash fast, or want to compare loan types, the answers below can help clarify your next steps.

How Long Does It Take To Get Approved?

The application process timeline varies depending on the lender type. A traditional bank might take several weeks, or even months, due to stricter documentation requirements and slower internal processes. In contrast, online lenders can often approve and fund a small business loan within 24–72 hours, especially if your documentation is ready.

For SBA loans, standard 7(a) applications may take two to six weeks, while SBA Express options backed by the Small Business Administration can move much faster. Clarify Capital offers an expedited loan application process that can deliver business funding in as little as one day.

Can You Get a Business Loan With Bad Credit?

Yes, bad credit doesn't automatically disqualify you. Many online lenders specialize in working with borrowers who have a lower personal credit score or limited credit history. Expect higher interest rates, but you can increase approval odds by offering a personal guarantee or pledging business assets or personal assets as collateral.

For secured business loans, even a score as low as 500 can be workable depending on revenue, time in business, and overall risk profile. Strengthening your business credit score and cleaning up your credit report can also improve your options over time.

What Type of Business Loan Is Easiest To Get in 2026?

The easiest types of business loans to access in 2026 vary based on your business profile. Microloans from nonprofit lenders and community development groups often have the most relaxed requirements, which is ideal for startups or underserved business owners. Online lenders provide the fastest access with fewer credit hurdles.

Other relatively accessible options include equipment financing, business credit cards, cash advances, or a business line of credit, especially if you can provide a personal guarantee. These loan options tend to offer quick decisions and flexible use of funds, even if you're still building your credit or business history. Clarify Capital offers same-day approval for many of these loan types if you meet their revenue and time-in-business thresholds.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts