Ever wondered how some businesses manage to keep their shelves stocked without dipping into their cash reserves? The answer often comes down to trade credit — a simple but powerful tool that lets businesses buy now and pay later.

Unlike bank loans or credit lines, trade credit is built into everyday supplier relationships and doesn't require a formal application process. It's especially helpful for small businesses that need flexibility to manage cash flow, fund inventory, or deal with seasonal slowdowns.

In this article, we'll explain what trade credit is, how it works, and why it's such a popular option for small business owners. You'll also learn how to manage trade credit responsibly, how it impacts your financial statements, and how it compares to other types of short-term financing. We'll even look at its role in international trade and help you decide if it's the right fit for your business.

What Is Trade Credit?

Trade credit is a type of short-term financing where a business purchases goods or services and pays the supplier at a later date, rather than making immediate payment. Also commonly referred to as supplier credit or open account terms, this arrangement allows businesses to receive inventory or services now while delaying payment for 30, 60, or even 90 days.

In the business-to-business world, trade credit serves as an essential financing tool that helps companies manage their cash flow effectively. Unlike traditional loans that require applications through financial institutions, trade credit happens naturally within normal business transactions.

This arrangement gives businesses breathing room to sell their inventory or use services before payment becomes payable, freeing up working capital for other pressing operational needs. For many small and growing businesses, trade credit is one of the most accessible types of financing available, requiring no formal loan applications or credit checks in many cases.

How Trade Credit Works

The trade credit process typically follows this pattern in day-to-day business operations: A supplier delivers goods or services to a business customer (the borrower) along with an invoice that specifies the credit terms, total amount payable, and due date. Instead of requiring immediate payment, the service provider extends a short-term financing arrangement, essentially saying "pay me later" according to the specified terms.

A practical example

A boutique clothing store orders $5,000 worth of inventory from a wholesale supplier with "Net 30" trade credit terms. The store receives the merchandise right away, puts it on display, and has a full month to sell these items before payment becomes due.

The clothing store benefits by not having to deplete its cash reserves or rely on other financing to stock its shelves. Meanwhile, the supplier builds a relationship with a repeat customer and secures future sales. No promissory note or formal loan documentation is typically required — just the invoice with specified payment terms that both parties understand and agree to follow.

This arrangement works on mutual trust and established payment history, with suppliers often checking a business's credit record before offering open account privileges to new customers.

Who Uses Trade Credit and Why

Trade credit functions as a lifeline for businesses across numerous industries, offering a practical solution to manage cash flow without formal loans. This financing approach is especially prevalent among:

Small business retailers. These businesses use supplier credit to stock shelves and build inventory without depleting cash reserves.

Wholesalers and distributors. These middlemen often operate on thin margins and use trade credit to bridge the gap between buying from manufacturers and selling to retailers.

Manufacturers. Production companies leverage trade credit for raw materials and components while products are being assembled and sold.

Service providers. Professional firms and contractors often extend trade credit to clients while simultaneously receiving it from their own suppliers.

Seasonal businesses. Companies with cyclical revenue rely on trade credit to manage slow periods until cash flow improves.

Trade credit offers several benefits for businesses seeking flexible financing options:

Flexibility in cash management. Trade credit helps preserve working capital for urgent needs like payroll while allowing inventory expansion to drive sales volume.

Alternative to traditional financing. Many small businesses use trade credit instead of relying on credit cards or loans from financial institutions.

Accessibility for new companies. Businesses still building credit history can establish payment reliability through trade credit arrangements.

Solution for challenging industries. Companies in sectors where financial institutions impose strict lending requirements can still access inventory through trade credit.

Seamless business integration. Trade credit requires no separate applications or approval processes, making it one of the most widely used financing options in business-to-business transactions.

Advantages and Disadvantages of Trade Credit

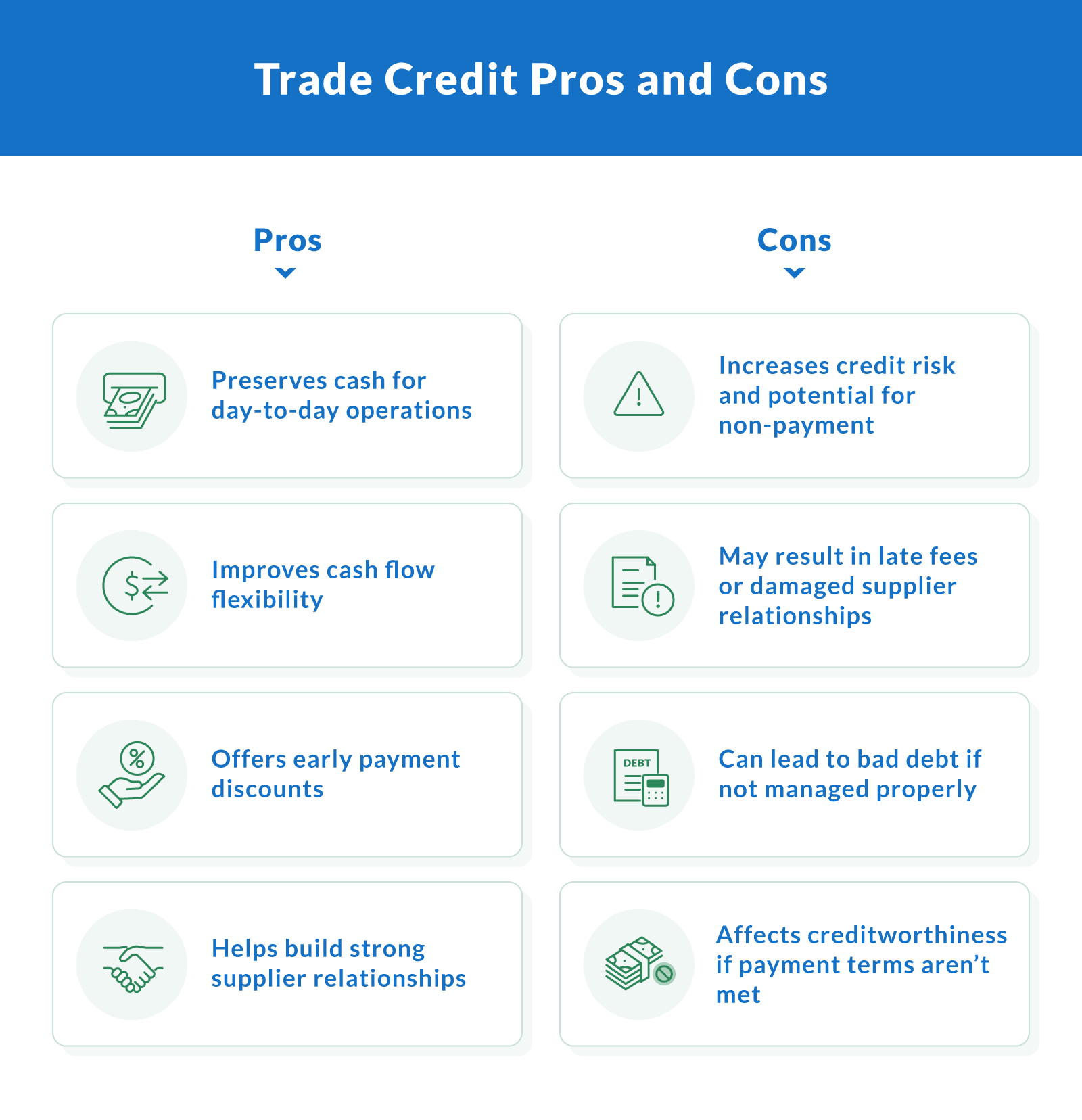

Trade credit offers significant benefits for managing short-term capital requirements, but it also comes with potential risks that require careful management:

How To Manage Trade Credit Responsibly

Strong credit management practices protect your business, whether you're extending or receiving trade credit. Responsible management reduces risk while maximizing the cash flow benefits this financing option provides.

Follow these guidelines to develop effective trade credit policies:

Conduct thorough credit checks. Before extending trade credit to customers or accepting it from suppliers, research their payment history and financial stability to assess creditworthiness.

Establish clear credit limits. Set boundaries based on customer size, relationship length, and payment history to manage your exposure to potential non-payment.

Document payment terms in writing. Create clear agreements specifying due dates, early payment discounts, and late payment penalties to prevent misunderstandings.

Implement monitoring systems. Regularly review outstanding receivables and payables to identify potential issues before they affect your cash flow or relationships.

Consider trade credit insurance. This protection covers losses from customer non-payment, which helps when working with new clients or expanding into unfamiliar markets.

Poor credit management practices often lead to strained business relationships and financial difficulties. Creating structured systems for evaluating risk, setting appropriate limits, and monitoring payment performance will help you establish a foundation for sustainable trade credit relationships that support your business growth.

How Trade Credit Affects Your Finances and Statements

Trade credit shows up in several places on your financial statements and plays a big role in how healthy your business looks on paper. It impacts your balance sheet, cash flow, and how lenders view your business during underwriting. Whether you're using trade credit or offering it to customers, keeping a close eye on how these transactions are recorded helps you stay profitable and prepared for real-time decisions.

Balance Sheet

Trade credit transactions appear on your balance sheet as either assets or liabilities, depending on whether you're the buyer or seller. These entries are a snapshot of your company's short-term financial obligations and incoming revenue, affecting your liquidity ratio and perceived financial health.

Accounts Payable and Receivable

If your business uses trade credit to purchase goods or services, the owed amount appears as accounts payable under current liabilities. These are short-term debts that must be settled within a set period — usually 30 to 90 days. If you're on the other side and offer trade credit to customers, the money owed to you is recorded as accounts receivable, a current asset.

Delayed Payments and Financial Reporting

Delayed payments directly impact your working capital and can skew financial statements if not closely monitored. A backlog of unpaid invoices could signal cash flow problems to lenders reviewing your books during underwriting. Tracking both payable and receivable accounts in real time helps you maintain accurate records and identify potential issues before they affect profitability.

Trade Credit vs. Other Financing Options

What type of loan is a trade credit? It's not a traditional loan, but it works like one. Trade credit is a short-term financing option where a supplier allows a business to purchase goods or services and delay payment until a later date. There's no cash transferred, no interest charged, and no lender involved. Instead, it's a trust-based arrangement between businesses, often referred to as supplier credit or open account terms.

Trade credit is a great fit for preserving cash flow, but it's not your only option. If you need working capital for payroll, inventory, or equipment, and can't delay payment, cash-based financing may be a better match.

Here are short-term financing options available through Clarify Capital:

Business line of credit. Access working capital as needed and only pay interest on what you draw.

Term loan. Receive a lump sum with fixed payments over a set period.

Merchant cash advance. Get fast funding repaid through a percentage of daily card sales.

Equipment financing. Spread out the cost of new or used equipment over time.

Invoice factoring. Turn unpaid invoices into immediate working capital.

To help you compare, here's a quick breakdown of how trade credit stacks up against other short-term financing options:

| Financing option | Cost | Speed of access | Repayment terms | Flexibility |

|---|---|---|---|---|

| Trade credit | Typically free | Immediate (at sale) | 15–90 days | Limited to vendors |

| Business line of credit | Varies by lender | 24–48 hours | Flexible, draw as needed | High |

| Term loan | Fixed interest | 24–72 hours | Set monthly payments | Moderate |

| Merchant cash advance | High (factor rate) | Same-day to 24 hrs | Based on daily sales | High |

| Equipment financing | Fixed interest | 1–3 days | Monthly, tied to asset | Moderate |

| Invoice factoring | Fee per invoice | Same-day to 48 hrs | Repayment via collections | High |

Note: These figures reflect industry standards and typical lender timelines, but actual terms may vary based on provider, creditworthiness, and business profile.

Use trade credit when you have strong vendor relationships and need to delay payment without taking on debt. For broader business financing needs, explore funding options that provide flexibility and access to capital when you need it most.

Trade Credit in International Trade

Trade credit is important in international trade, especially across supply chains and global partnerships. It allows businesses to keep goods moving without needing to pay upfront, helping importers, exporters, and distributors keep operations running smoothly.

Suppliers and service providers often extend trade credit to trusted partners overseas using clear credit terms. This builds strong relationships and helps businesses scale across borders. But it's not without risk. Different countries have their own regulatory requirements, and contracts must be enforceable across jurisdictions.

To protect themselves, many companies use trade finance tools like letters of credit or export credit insurance. These options help manage insolvency risk and make it easier to offer trade credit in unfamiliar markets. As with any financing decision, smart risk management is key, especially when you're working internationally.

Is Trade Credit Right for Your Business?

Trade credit can be a simple way to keep your business moving without dipping into your cash reserves — but it's not right for everyone. If you have strong vendor relationships and a solid payment track record, it's a great way to manage inventory and free up working capital.

Before relying on trade credit, take a step back and look at your credit history and overall financial health. Check your credit report, understand your exposure to credit risk, and think about how delayed payments might affect your cash flow. For some businesses, it's a flexible tool that supports growth. For others, it might add more pressure than it solves.

Need a broader financing solution to support your business goals? Get fast, flexible working capital through Clarify Capital.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts