Escalating tariffs are challenging businesses throughout all sectors of the U.S. economy. Companies are facing higher prices for imported materials and components, forcing difficult decisions about absorbing costs or passing them to consumers.

A global trade war — marked by proposed and imposed tariffs, as well as retaliatory measures from key trading partners such as Canada, China, and the European Union — may be escalating under the Trump administration. These economic policy shifts are disrupting global trade patterns, forcing American businesses to reassess their operations, supply chains, and pricing strategies. As tariffs increase costs and reshape market dynamics, companies must develop both immediate solutions and long-term adaptation strategies to remain competitive.

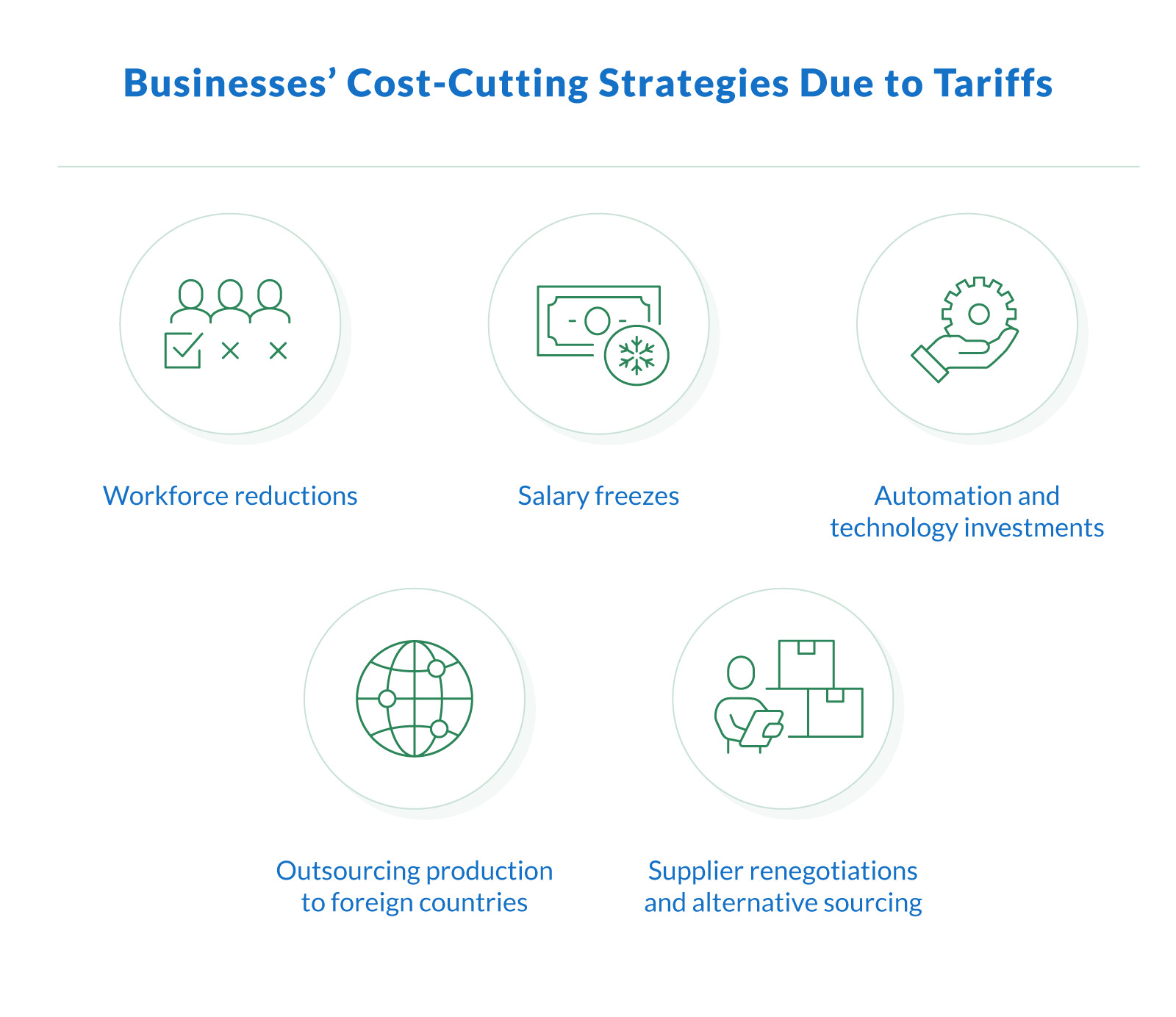

This article examines how businesses can adapt to the economic pressures of tariffs. From workforce reductions to automation investments, we explore the practical tactics businesses are employing to offset tariff costs and the long-term implications for the U.S. economy and consumers.

What Are Tariffs, and How Do They Impact the Economy?

Tariffs function as taxes on imported goods and materials, creating immediate financial pressure on U.S. businesses that rely on international supply chains. Here's how they affect businesses and consumers:

Higher Costs for Businesses

When the government imposes import tariffs, companies must pay these additional fees when bringing foreign-made components or finished products into the country. These higher costs create a difficult choice — absorb the financial hit internally or pass the burden to consumers.

For many U.S. businesses, global supply chains have become integral to operations, with components often crossing multiple borders before becoming finished products. When tariffs disrupt these established supply chains, the ripple effects extend beyond the initial cost increase. Domestic producers sometimes benefit from reduced foreign competition, but many manufacturers who rely on imported materials face significant challenges.

Price Hikes Affecting U.S. Consumers

When businesses can no longer absorb tariff costs, they typically pass these expenses on to consumers through higher prices. This transfer of costs has created noticeable price increases across numerous product categories, affecting everyday purchases for U.S. households nationwide. The average U.S. household is estimated to pay hundreds of dollars more annually due to tariff-related price increases — an additional financial burden that varies significantly based on consumption patterns.

Consumer behavior shifts in response to these higher prices, with many households adjusting their purchasing habits. As consumer prices rise, many shoppers reduce discretionary spending, seek alternative products, or delay major purchases altogether. This changing demand creates additional challenges for businesses already struggling with higher costs.

Real-World Examples of How American Businesses are Coping with Tariffs

Business owners across the U.S. are implementing creative solutions to navigate tariff challenges, often sharing their experiences and strategies with peers online.

This Reddit user's company has shifted from suppliers in one international country to those in another:

"For the past 3 years, the medical device company I work for has been shifting parts manufacturing from China to Malaysia. This has also been an intellectual property concern since we know for 100% certainty that China has been trying to copy our products."

Another suggests increasing the value proposition of products and services to justify higher prices in order to pass the cost burden of tariffs onto consumers:

"Raising prices? Sure, but do it strategically. Test bundling, subscriptions, or premium positioning instead of just slapping on extra costs."

This Reddit user suggests transparently communicating the reason for the price increase:

"Unfortunately, new tariffs have increased our costs, so we've had to increase prices accordingly.”

Adaptation to tariff challenges often requires creative thinking beyond simply absorbing costs or raising prices — whether by relocating supply chains to avoid tariffs entirely or reimagining product offerings to justify necessary price increases.

Cost-Cutting Measures for Businesses

In order to offset the financial burden of tariffs imposed by President Donald Trump, many businesses are implementing cost-cutting strategies to maintain profitability. These measures help companies navigate rising expenses but often come with long-term consequences for workers and economic growth.

Workforce reductions. Many businesses are laying off employees to cut payroll expenses, particularly in domestic industries that rely on imported materials. This impacts economic growth and federal revenue as fewer workers contribute to tax revenue.

Salary freezes. Some companies are avoiding layoffs by freezing salaries, limiting raises, or reducing employee benefits to control costs. While this keeps jobs intact, it affects worker morale and purchasing power.

Automation and technology investments. Businesses are turning to automation and AI-driven processes to reduce reliance on human labor. While this improves efficiency, it also decreases job opportunities in certain domestic industries.

Outsourcing production to foreign countries. Some companies are moving manufacturing operations overseas to avoid tariffs on imported materials. Shifting production to foreign countries with lower trade restrictions allows businesses to stay competitive but can contribute to the U.S. trade deficit.

Supplier renegotiations and alternative sourcing. Businesses are seeking new suppliers to lower costs, sometimes choosing domestic producers over international ones if incentives or tariff exemptions make it financially viable.

Supply Chain Adjustments: Rerouting Trade and Seeking New Partners

Companies facing tariff challenges may consider several supply chain restructuring options to minimize their exposure to these additional costs. In the current trade environment affecting relationships with China, the EU, Mexico, and Canada, businesses might explore these strategic adjustments:

Regional diversification. Manufacturers heavily dependent on Chinese goods might explore shifting portions of their production to countries with fewer trade restrictions or where U.S. tariffs have less impact on imports.

Domestic expansion. Investing in U.S. domestic industries rather than Mexican, Chinese, or Canadian exports might reduce reliance on international trade altogether, potentially creating new markets for U.S. goods less affected by retaliatory tariffs from trading partners.

Supply chain transparency improvements. Implementing more sophisticated tracking systems can help identify exactly where components originate, potentially allowing more strategic routing to minimize exposure to targeted tariffs.

These adjustments require careful consideration but might yield benefits beyond tariff avoidance, including greater supply chain resilience, reduced transportation costs, and potentially positive impacts on gross domestic product through increased domestic activity.

Trade Agreement Leverage

Despite ongoing tensions, existing trade frameworks like USMCA (formerly NAFTA) with Canada and Mexico offer strategic advantages. Businesses can restructure supply chains to source components from these countries instead of China, establish assembly operations to qualify products as North American-made, or take advantage of specific product categories with negotiated tariff exemptions — all while maintaining relatively efficient supply chains due to geographic proximity.

While these strategies could help mitigate tariff impacts on foreign and U.S. imports, they also introduce new challenges in establishing quality control standards with new suppliers and navigating the complex trade relationships that continue to evolve between major economic powers.

Business Financing Options To Consider

For businesses navigating tariff challenges, accessing adequate financing can provide the working capital needed to implement adaptive strategies. Here are several loan options to consider when seeking funds for supply chain adjustments or offsetting tariff-related costs:

SBA loans. These government-backed loans offer lower interest rates and longer repayment terms, making them ideal for major supply chain restructuring projects. Requirements include good credit (typically 650+) and at least two years in business.

Term loans. Traditional business loans provide lump-sum capital with fixed monthly payments, perfect for one-time investments in domestic production facilities or technology upgrades. Quick funding is available for qualified borrowers.

Business lines of credit. This flexible financing option allows you to draw funds as needed for ongoing supply chain adjustments, paying interest only on the amount used. Revolving credit lines can help manage cash flow fluctuations caused by tariff impacts.

Equipment financing. If you're investing in domestic production to avoid tariffs, equipment loans can fund up to 100% of machinery purchases while using the equipment itself as collateral.

Invoice factoring. For businesses experiencing cash flow constraints due to tariff-related price increases, selling unpaid invoices can provide immediate working capital without adding debt.

Each financing option has unique qualification requirements and use cases. Working with a funding partner who understands the complexities of tariff impacts can help identify the most suitable solution for your specific situation.

Adapting to Trade Challenges

The continued impact of tariffs may force U.S. businesses to reconsider how they balance short-term financial pressures with long-term competitiveness. The financial burden of these changes ultimately affects the broader U.S. economy, influencing everything from employment rates to federal revenue collection.

While some domestic industries may benefit from reduced foreign competition, the overall cost of tariffs can create significant challenges for many sectors. Economists continue to debate whether proposed tariff policies will deliver the intended economic growth or further complicate international trade relationships. White House policy signals suggest that new tariff strategies implemented during Donald Trump's administration may influence future trade practices.

The fact of the matter is that businesses that want to survive must stay adaptable as these trade tensions evolve. Businesses that successfully navigate these challenges can emerge with more resilient operational models that are better equipped to weather future economic uncertainties.

Flexible funding options can provide the working capital you need to adjust strategically. Get business financing solutions tailored to your specific situation through Clarify Capital, and receive funding in as little as one business day.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts