Same-day business loans are a fast and accessible form of small business financing designed to provide immediate working capital. Unlike traditional business loans from banks — which often require extensive paperwork, high credit scores, and weeks of processing — same-day options are built for speed and flexibility.

If you need funding quickly and don't want to be held back by a formal credit check, this guide will help you explore your options. Whether you're covering payroll, restocking inventory, or handling emergency expenses, fast approval can make all the difference.

Throughout this article, you'll learn how same-day loans work, how lenders assess financial health beyond credit scores, and what to consider when choosing a financing solution — even with less-than-perfect credit.

| Types of Same-Day Business Loans Available | |||

|---|---|---|---|

| Loan type | Best for | Credit check | Funding speed |

| Short-term working capital loans | Payroll, emergencies, or covering gaps in revenue | Not required by some alternative lenders; instead, they assess cash flow and revenue | Often within 24 hours |

| Revolving business lines of credit | Flexibility, draw what you need, repay, and reuse | Not always required; some lenders approve based on financial records | Same or next-day once approved |

| Merchant cash advances (MCAs) | Fast cash based on daily sales, no fixed payments | Typically, no hard inquiry; approval based on sales volume | As fast as the same day |

| Invoice factoring or financing | Up front capital in exchange for unpaid customer invoices | Based on customer payment history, not the business owner's credit | Often within 24–48 hours |

| Equipment financing | Buying or leasing machinery or vehicles without a strong credit history | May not be required if equipment is used as collateral | Generally, within a few days |

| Microloans | Startups or small businesses needing under $50,000 | Some nonprofits skip credit checks, focusing on business potential | Typically 1–2 weeks, depending on the lender |

| Working capital loans | Covering day-to-day expenses like payroll, rent, and supplies | Not always needed; focus is on cash flow and financial records | Often same-day or next-day |

Can I Really Get a Business Loan the Same Day Without a Credit Check?

Yes, you can get up to $750,000 in a single day with alternative lenders. Here's how it works:

Apply in just two minutes through platforms like Clarify Capital using an online application.

Get approved in as little as two hours, depending on your revenue, time in business, and cash flow.

Funds may be deposited by the end of the day, often within hours of approval.

No hard credit check is required for most funding options. Many lenders use cash flow, invoices, or sales volume instead of personal credit scores. While there's no hard inquiry, a soft pull or verification through your business checking account may still occur as part of revenue-based underwriting.

Even new businesses or those with credit scores as low as 500 may qualify for fast funding through merchant cash advances, revenue-based loans, or invoice factoring.

Types of Business Loans With No Credit Check

Many business lenders offer funding solutions that don't require a traditional credit check. These financing options are ideal for small business owners who need quick capital but may not qualify for traditional loans due to a low credit score or limited credit history. The right type of loan depends on the business's needs, revenue, and ability to repay.

Below are some common business loan options that provide flexible funding alternatives, along with tips on how to secure each without a credit check.

Short-Term Loans

Short-term loans provide businesses with quick access to cash for unexpected expenses, enabling them to meet immediate operational needs, cover payroll, or make inventory purchases. These loans are typically repaid within a few months to a year and often come with higher interest rates compared to long-term financing options. Small business owners use short-term loans to manage cash flow fluctuations and cover urgent business needs when traditional financing isn't an option.

Businesses should demonstrate consistent revenue, maintain a strong business bank account, and provide proof of steady cash flow to show repayment capability to improve approval odds without meeting credit requirements. Some lenders may also consider collateral, such as inventory or accounts receivable, to secure financing.

Business Line of Credit

A business line of credit offers entrepreneurs flexible access to capital, enabling them to withdraw funds as needed and only pay interest on the amount actually used. It's almost like a business credit card, in a way.

Unlike a traditional term loan, a business line of credit is revolving, meaning it can be reused once repaid. This gives businesses flexible repayment options. Lenders evaluate eligibility criteria based on annual revenue, time in business, and cash flow stability. The repayment schedule varies depending on the lender and borrowing amount, making this a versatile financing option for managing operational expenses.

To secure a business line of credit without a credit report, focus on showing strong financial records, such as bank statements and annual revenue trends. Some lenders may approve businesses based on cash flow stability and existing assets, so preparing detailed financial projections can also strengthen your application.

Merchant Cash Advance (MCA)

A merchant cash advance provides funding based on a business's future credit card sales rather than requiring a traditional credit check. MCA providers assess factor rates and eligibility based on daily revenue, making this a fast but often expensive financing option. Since repayments are automatically deducted from credit card sales, businesses with high daily transaction volumes may find this option beneficial for meeting short-term funding needs.

Since approval is based on credit card sales, businesses looking to secure an MCA should have consistent daily transactions and a well-maintained merchant account. Maintaining a low chargeback rate and providing several months of sales history can increase approval chances and help secure better factor rates.

Invoice Factoring and Invoice Financing

Invoice factoring and financing allow businesses to access funding based on unpaid invoices rather than their credit history. Factoring companies purchase outstanding invoices at a discount, providing immediate cash while collecting payments from customers. Businesses with poor credit can benefit from this financing option, as lenders evaluate receivables and a company's business bank account, rather than relying solely on a credit check. Factor rates vary depending on invoice value, customer reliability, and industry risk.

To qualify without a credit check, businesses should have reliable customers who consistently pay their invoices on time, as lenders assess client creditworthiness rather than the borrower's credit score. Organizing invoices, maintaining accurate financial records, and selecting factoring companies that specialize in your industry can help secure better terms.

Equipment Financing

Equipment financing provides funding specifically for purchasing or leasing business equipment. Loan amounts depend on the cost of the equipment and the borrower's financial health. Repayment terms vary based on lender policies and business revenue, with some financing options requiring collateral while others may be unsecured. This type of business financing is ideal for companies that require new machinery, vehicles, or technology to sustain operations and drive growth.

Businesses should be prepared to offer the equipment itself as collateral and demonstrate consistent cash flow to improve their eligibility for no-credit-check equipment financing. Lenders may also require a detailed plan for how the equipment will generate revenue, so having clear projections and proof of stable business operations can be beneficial.

Microloans

Microloans help small business owners with limited credit history secure financing in smaller amounts than traditional loans. These loans are often offered by nonprofit organizations or government-backed programs such as the U.S. Small Business Administration (SBA), making them an accessible option for startups and entrepreneurs. Loan amounts typically range from a few thousand to $50,000, with repayment terms varying based on lender policies and borrower qualifications.

Providing a well-documented business plan, financial statements, and proof of revenue potential can strengthen an application and help you secure a microloan without a credit check.

Working Capital Loans

Working capital loans help businesses cover operational expenses when cash flow is tight. These short-term financing options provide flexibility for managing payroll, rent, utilities, and inventory purchases. Loan options vary depending on business needs and lender requirements, with eligibility criteria often based on revenue and time in business rather than credit scores.

For businesses juggling multiple repayments, working capital loans also support strategies like business debt consolidation and help simplify obligations and reduce total interest paid.

To get a working capital loan without a credit check, emphasize stable business revenue, consistent cash flow, and strong financial records. Demonstrating the ability to manage short-term obligations through business bank statements and accounts receivable reports can help improve your chances of approval. You can even calculate it yourself.

How To Apply for a Same-Day Business Loan

Applying for a same-day business loan requires preparation to ensure a smooth application process. While simpler than traditional loans, lenders still have eligibility criteria to assess business stability and repayment ability.

Understanding your eligibility and repayment terms is crucial in selecting the best financing solution. While same-day loans can provide quick relief, remember to consider the long-term financial implications and costs. Choosing the right loan product ensures that your business remains financially strong and positioned for growth.

Need funding fast? Submit your application now and get matched with top options — same-day funding is just a few clicks away.

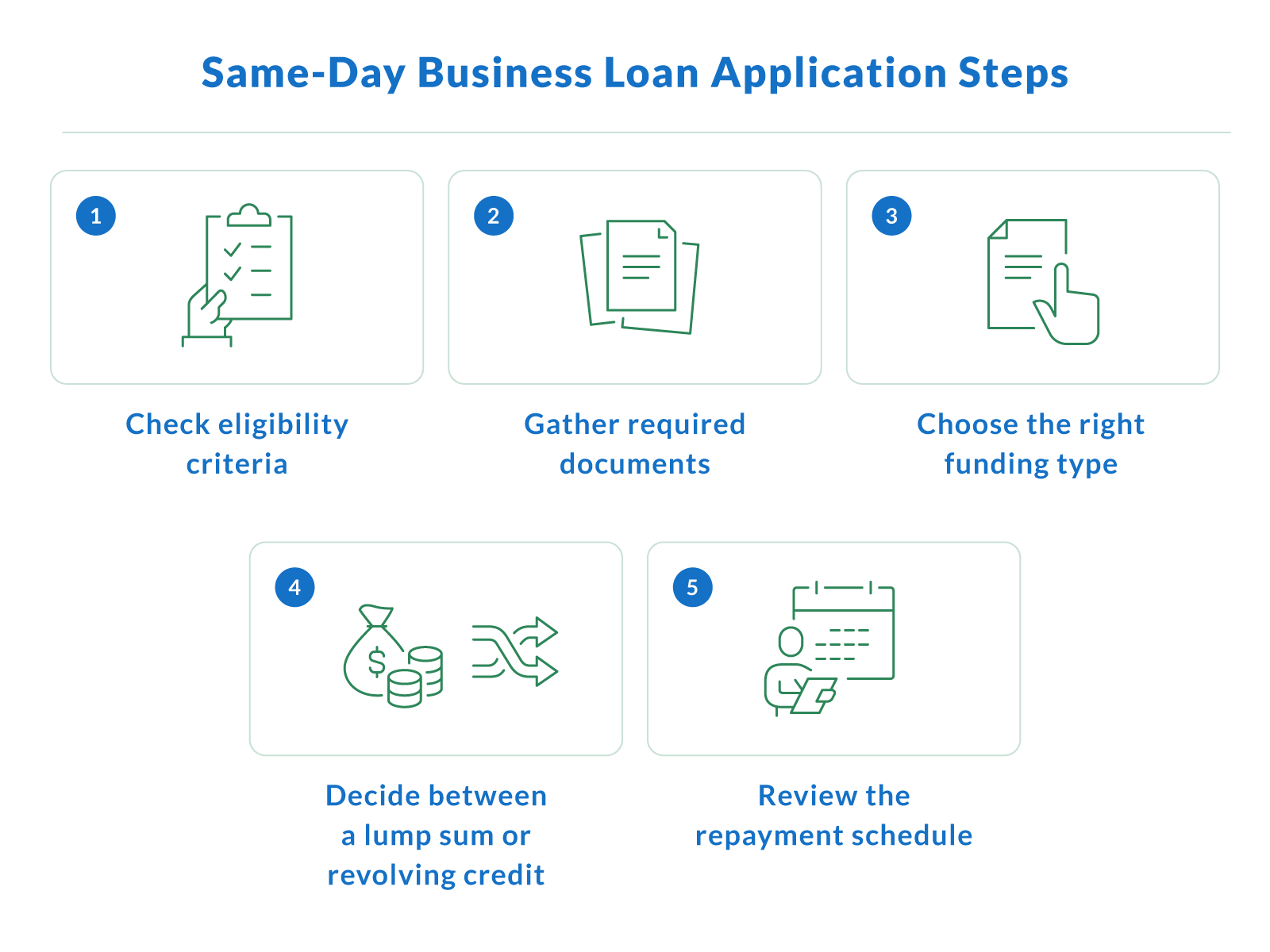

To complete a loan application successfully, business owners should follow these steps:

Check eligibility. Most lenders require minimum revenue, several months in business, and a business bank account. Clarify Capital requires a minimum of $10,000 in monthly revenue, six months of operation, and an active business bank account and/or savings account.

Gather documents. Lenders typically request bank statements, proof of revenue, and occasionally a business plan. Clarify Capital asks for three months of recent bank statements to verify business income.

Choose the right funding solution. Select the solution that best fits your needs based on the loan types discussed earlier.

Decide between a lump sum or revolving credit. Lump-sum loans provide all funds up front, while revolving credit lets you draw funds as needed.

Review the repayment schedule. Understand the payment frequency, total cost, and interest rate before agreeing to the terms.

Submit your application online. Online loans make the approval process fast and convenient. Applying through Clarify Capital takes just minutes — and once approved, your loan funds could arrive as soon as the same day.

A well-prepared application improves your chances of approval and speeds up funding so you can cover urgent expenses or invest quickly in growth.

Tip: Clarify Capital's streamlined process lets you submit one application and get matched with multiple options.

Apply Now for Same-Day Business Funding

Securing financing without a credit check can be a game-changer for businesses that need immediate capital. Whether you're looking for a merchant cash advance, a business line of credit, or invoice factoring, there are funding options tailored to different business needs.

Understanding your eligibility and repayment terms is crucial in selecting the best financing solution. While same-day loans can provide quick relief, remember to consider the long-term financial implications and costs. Choosing the right loan product ensures that your business remains financially strong and positioned for growth.

If you're ready to explore funding solutions that align with your business goals, start your application today at Clarify Capital.

No-Credit-Check, Same-Day Business Loan FAQ

Many small business owners turn to alternative lenders for fast business loan options when traditional banks and a credit union require a strong credit history. With the rise of online lenders, business financing has become more accessible to entrepreneurs who may not meet strict underwriting requirements.

This FAQ addresses common questions about no-credit-check, same-day business loans.

Can I Use My EIN To Get a Loan?

Applying for business funding may or may not require providing an EIN (Employer Identification Number), but it typically involves additional requirements. Businesses with an established credit profile may qualify for loans solely under their EIN, while startups or companies with limited credit may need additional financial documentation.

Can I Get a Same-Day Business Loan Without a Credit Check?

Yes, you can obtain a business loan on the same day you apply, without a credit check. Some lenders skip the traditional credit check altogether. Instead, they review cash flow, invoices, or credit card sales. Clarify partners with lenders that consider real-time revenue instead of your credit score and often approve in under four hours.

Is an MCA Really a No-Credit-Check Option?

A merchant cash advance typically does not require a hard credit inquiry. Approval is based on your business's daily sales or future revenue projections. However, a soft pull may be used to verify your identity or confirm good standing with your financial institution.

Does a No-Credit-Check Loan Affect Personal Credit?

In most cases, no. These loans are based on your business's financial health and are not reported to personal credit bureaus unless you default. Late or missed payments may result in collections activity that could impact your credit report and trigger overdraft issues if linked to a debit card.

Can I Get an SBA Loan With a 500 Credit Score?

SBA loans are backed by the Small Business Administration and generally have a minimum credit score requirement. While a FICO score of 500 is typically too low for SBA loans, borrowers may still explore other loan options, such as microloans, invoice factoring, payday loans, or merchant cash advances. Eligibility depends on factors like annual revenue, time in business, and collateral availability.

Do No-Credit-Check Loans Get Reported to Credit Bureaus?

It depends on the lender, but no-credit-check loans are usually not reported to credit bureaus for on-time payments. That means if you repay everything on time, it won't help you build credit. If you fail to meet the repayment requirements, your loan may be sold to a collection agency, which will be reported to credit bureaus and negatively impact your credit score.

What Should I Know About Installment Loans with Bad Credit?

Installment loans offer fixed monthly payments and are available even for borrowers with bad credit. While they may come with a higher annual percentage rate, they can still be a useful option depending on the loan terms. Make sure you understand any application fee and how long it takes for final approval. Some lenders provide financial education to help borrowers improve their credit standing over time.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts