ACH business loans (also commonly referred to as ACH cash flow loans, ACH advances, ACH line of credit, or automated clearing house loans) can be used for a variety of business needs.

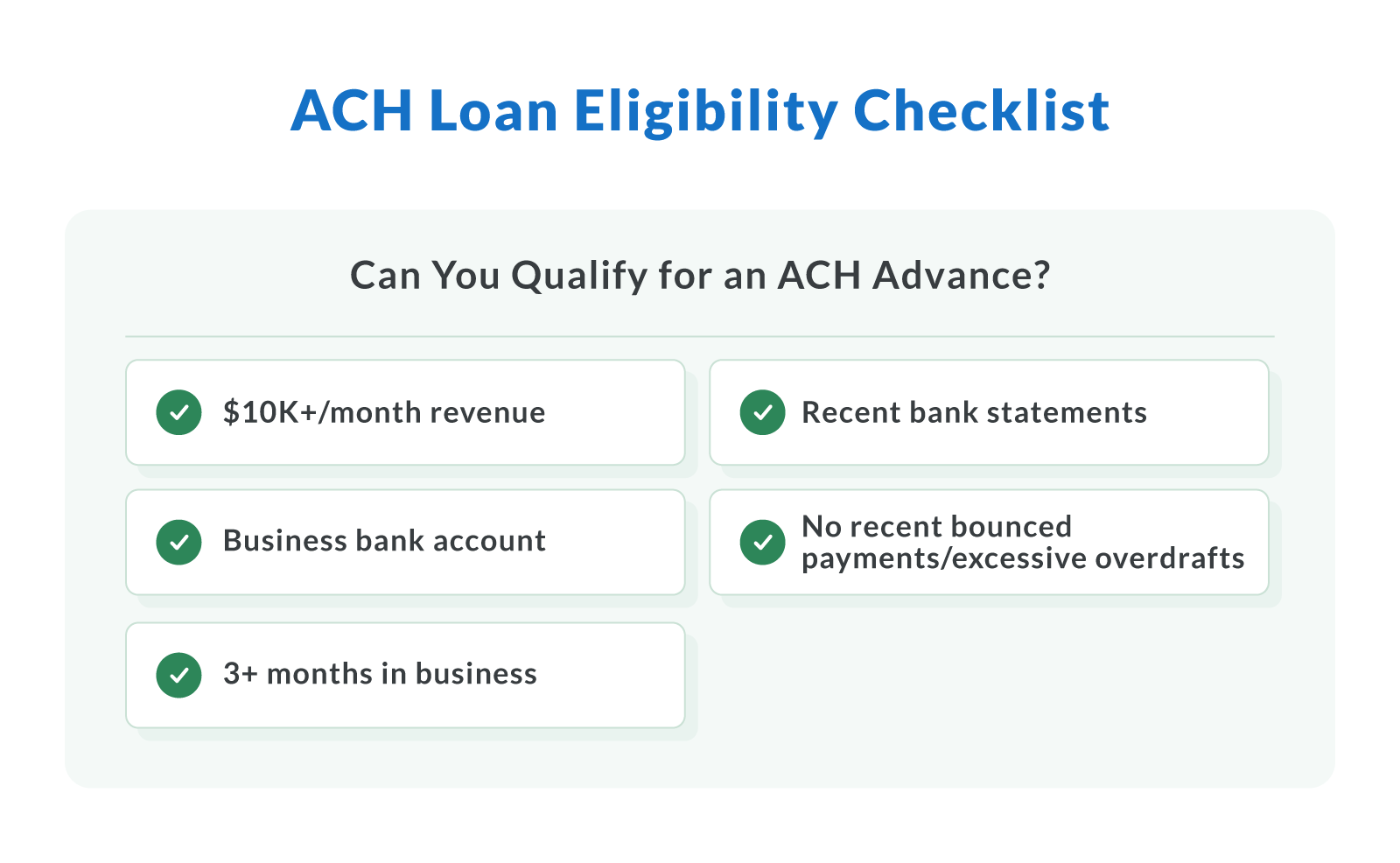

Small business owners typically use ACH loans to cover cash flow gaps and secure quick access to working capital. Eligibility is based primarily on monthly business revenue instead of credit scores.

Because credit standing isn't the main factor in determining funding eligibility, ACH loans are a great option for small business owners with subpar credit. If you've been denied traditional small business financing, such as an SBA loan, an ACH loan might be right for you.

At Clarify, we believe that all small business owners should be given access to financing, regardless of their situation. We work hard to find small business loan options that work for you, so you can achieve your business goals. When you finance through Clarify, we treat you like family.

In 2026, ACH loans are priced using a factor rate (e.g., 1.10 to 1.50) applied to the principal, meaning the total cost is transparent up front. Most borrowers receive a decision within hours, and funding can be completed in as little as 24 hours, with minimal paperwork and no collateral required.

Whether you're recovering from a slow month, planning payroll, or need fast capital to restock inventory, ACH cash flow loans offer one of the fastest and most flexible financing options available.

The ACH Repayment Process

Repaying your ACH loan is simple, predictable, and designed to fit your business cash flow. Unlike traditional loans that may require manual payments or paper checks, ACH loans use automated payments directly from your business bank account.

Here are the ACH repayment mechanics:

Set up your ACH loan: When you complete your loan agreement, your lender links the repayment schedule to your checking account. This setup ensures payments happen automatically, without any extra effort from you.

Automatic withdrawals: Your loan payments are pulled via ACH transactions on the schedule you choose, whether daily, weekly, or monthly. You don't need to write paper checks or log in each time.

Fixed payment amounts: Each payment is calculated up front using your agreed interest rates and pricing, so you always know exactly what will be withdrawn.

Payment processing and monitoring: Payments are securely processed through the National Automated Clearing House Association (NACHA) network. You can monitor your account to see average daily balance updates and confirm each ACH payment.

Once all your payments are made, your ACH withdrawals stop automatically. Your loan is closed. No surprises, no extra steps.

Benefits of ACH Loans

Cash flow-based loans offer several benefits, making them a good financing option for small business owners with wide-ranging needs. At Clarify, we streamline our loan process to make securing capital simple and easy.

Full Transparency

You won't find any hidden fees in our loan products. Other lenders include sneaky terms and prepayment penalties, which work against the borrower. At Clarify, we take pride in being the most transparent loan provider. Small business owners love working with us because we take an honest approach and always have the borrower's best interest in mind.

Quick Application Process

Our application process is speedy and straightforward. We understand that small business owners are busy dealing with complex operations. We move quickly and do the hard work, so you can focus on running your business.

Most ACH loans are approved within a few business hours, and funds can be deposited via ACH transfer on the same day.

Flexible Repayment

Every business is unique, and small business owners have varying needs and preferences for repayment terms. ACH loans are one of the most flexible financing options. Small business owners can pay the borrowed funds back on a schedule that works for them, whether daily, weekly, biweekly, or monthly.

Repayments are automatically debited from your business checking account, so you never have to worry about missing a due date.

All Credit Scores Can Be Eligible

Having less-than-stellar credit can be a major hindrance when it comes to financing. Traditional financing relies heavily on credit standing to determine loan eligibility. If you've been denied a traditional loan because of your credit, ACH advances tend to be a great alternative option. You can get approved regardless of your credit.

ACH lenders focus more on revenue and deposit activity than on credit history. As long as you have a consistent cash flow, your personal credit score is less important.

Minimal Paperwork Required

ACH loans require far less paperwork compared to alternative loan products from financial institutions. Unlike other lenders that require endless documentation, Clarify only requires the essentials. We strive to make the loan application process as easy as possible and limit the number of business days until you receive a direct deposit into your bank account.

Most lenders require just three months of business bank statements to get started — no tax returns, credit card statements, or lengthy forms required.

No Collateral Needed

Cash flow loans are an unsecured type of financing, which means that you won't need collateral for approval. No collateral means less risk for business owners.

Need fast funding with no collateral or credit requirements? Apply today for a same-day ACH advance through Clarify Capital.