Whether you're replacing an aging wrecker or expanding your fleet, tow truck financing can help you get the job done without draining your cash reserves. With the towing business expected to grow from a $2.3 billion market in 2023 to $3.9 billion by 2033, securing the right financing options now can position your tow truck company for long-term success.

Tow trucks aren't cheap, and neither are the operating costs that come with running a competitive towing company. From light-duty rollbacks to heavy-duty wreckers, financing lets you spread the cost over time, manage monthly payments, and stay on top of your cash flow. Flexible loan and lease options make equipment ownership more accessible for startup companies and established businesses alike.

This guide breaks down the most popular tow truck financing options, including SBA loans, equipment loans, and tow truck leasing. We'll also show you how to apply, what lenders look for, and how to get pre-approved, even if you have bad credit.

| Tow Truck Financing Options Comparison | |||||

|---|---|---|---|---|---|

| Loan type | Typical terms | Funding speed | Ideal use case | Pros | Cons |

| SBA loan | 10–25 years | 7–30 days | Established businesses with strong credit | Low interest rates, long terms | Slow approval, high documentation requirements |

| Equipment loan | 3–7 years | 2–10 days | Buying new or used tow trucks | Fast approval, truck acts as collateral | Higher interest rates than SBA loans |

| Tow truck lease | 2–5 years | 1–7 days | Startups or those needing flexibility | Lower upfront cost, flexible terms | You don't own the truck at lease end |

| Bad credit loan | 1–5 years | 1–5 days | Businesses or owners with poor credit | Fast funding, less stringent requirements | Higher interest rates, shorter terms |

| Line of credit | Revolving | 1–3 days | Ongoing operational needs like repairs or fuel | Flexible use, quick access | Variable rates, may require strong finances |

Loan vs. Lease: Which Is Better for Your Tow Truck Business?

When financing new or used equipment or trucks, most business owners choose between tow truck leasing or taking out a commercial loan. Both commercial truck financing options have their advantages, but the right fit depends on your business's size, cash flow, and long-term business goals.

Leasing gives you lower upfront costs and predictable monthly payments, making it appealing for newer businesses or those looking to conserve cash. On the other hand, loans provide full ownership, depreciation benefits, and often lower total costs over time.

Let's say you're financing an $80,000 rollback. A typical loan with a 6% interest rate might carry a monthly payment of around $1,288. This is a significant chunk of change, but one that leads to full asset ownership once the truck is paid off.

If you're a startup towing business, leasing may offer more flexibility with fewer financial hurdles. But if you're an established operator looking to build equity in your fleet, a loan could offer better long-term value.

| Leasing vs. Owning a Tow Truck | ||

|---|---|---|

| Feature | Loan | Lease |

| Ownership | You own the truck once it's paid off. | You use the truck during lease, but return it unless there's a buyout option. |

| Down payment | Typically 10%–20% of the truck's value. | Often little or no down payment required. |

| Monthly payments | Higher monthly payments, but builds equity. | Lower monthly payments, but no ownership. |

| Tax benefits | Can depreciate the vehicle; interest may be deductible. | Lease payments may be deductible as operating expenses. |

| Upfront costs | Includes taxes, registration, and a sizable down payment. | Minimal upfront costs. |

| End-of-term options | Keep the truck, sell it, or trade it in. | Return the truck, renew lease, or buy it at residual value. |

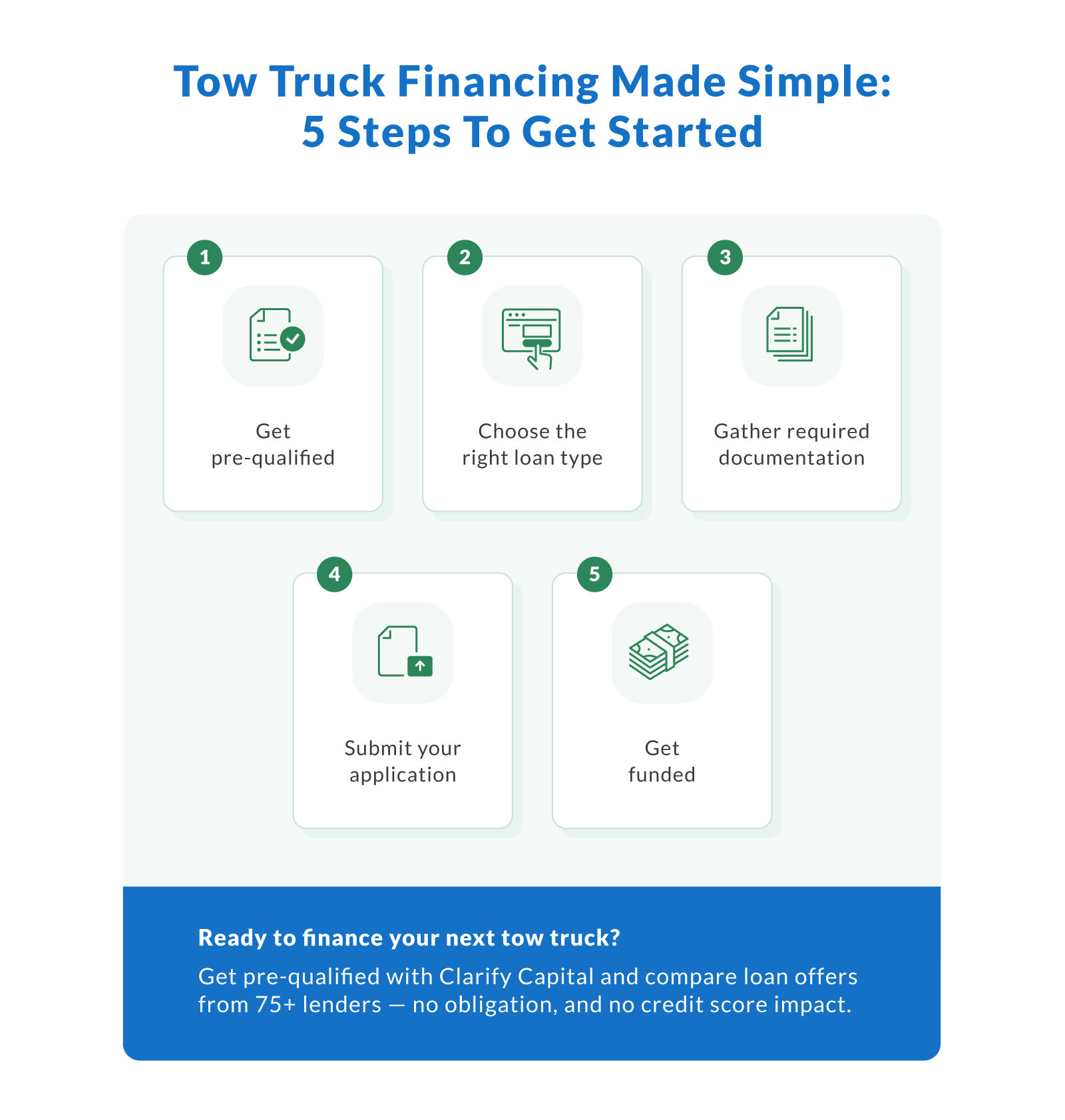

How To Finance a Tow Truck: Step-by-Step Guide

Getting the right financing for your next wrecker or rollback doesn't have to be complicated. The process is straightforward when broken down for any level of business, such as launching a startup towing company or adding to your fleet. Here's how to finance a tow truck, even with bad credit or limited credit history.

Step 1: Get Pre-Qualified

Start by getting pre-approved through a trusted financing company like Clarify Capital. Pre-qualification gives you a ballpark loan amount, expected rates, and repayment terms without impacting your credit score. Many lenders work with business owners across a range of credit scores, from 500 and up.

Step 2: Choose the Right Loan Type

Decide which financing options fit your towing business best. For example, if you're looking for ownership, go with an equipment loan. If you want lower monthly payments and flexibility, leasing might be better. Tow truck leasing is popular for light- and medium-duty vehicles due to minimal down payment requirements.

Step 3: Gather Required Documentation

Prepare the paperwork most lenders request, including:

Business license and registration

Bank statements (3–6 months)

Driver's license and proof of insurance

Business plan and revenue forecasts (especially for startups)

Equipment details if buying a used tow truck

Step 4: Submit Your Application

Complete the loan application online or with your Clarify advisor. Our lenders will evaluate your credit score, time in business, cash flow, and towing equipment needs. If you have bad credit, highlight consistent income, strong contracts, or provide a co-signer.

Step 5: Get Funded

Once approved, you can receive funds in as little as 24–48 hours. Use the capital to purchase your next tow truck, upgrade to a heavy-duty rollback, or buy a used wrecker at auction. Some business owners also combine funds with a line of credit to cover insurance, fuel, and maintenance.

How Much Does a Tow Truck Cost in 2025?

If you're planning to finance a new tow truck or expand your fleet, understanding current market pricing helps you borrow smart. Tow truck cost varies widely based on the type of truck, age, and specs, each impacting your loan amount and monthly payment.

Below are average cost ranges for 2025:

| Tow Truck Cost Breakdown | ||

|---|---|---|

| Truck type | Typical cost range | Use case |

| Light-duty tow truck | $55,000–$80,000 | Towing passenger cars and smaller vehicles |

| Medium-duty truck | $80,000–$120,000 | Local tows, small commercial vehicles |

| Heavy-duty wrecker | $150,000–$300,000+ | Hauling semis, buses, and large equipment |

| Flatbed (rollback) | $75,000–$110,000 | Versatile use — safely transporting immobile cars |

| Used tow trucks | $25,000–$70,000 | Budget-friendly option for newer tow businesses |

When deciding between a new tow truck and used tow trucks, consider depreciation, financing needs, and business needs. New trucks come with better warranties and tech, but depreciate faster. Used trucks have lower upfront costs, which can reduce your monthly payment. This is ideal for startups or businesses with cash flow concerns.

Keep in mind that heavy-duty wreckers and flatbeds usually require larger loan amounts, so choosing the right financing option, with flexible terms and low interest rates, is key to protecting profitability. Financing also lets you preserve working capital for fuel, payroll, and maintenance.

Can I Get a Tow Truck Loan With Bad Credit?

Yes, borrowers with a low credit score can still qualify for tow truck financing, though loan terms may be more limited. If your score is between 600–650, some financing companies will work with you, especially if you have consistent business revenue or provide a larger down payment.

Many startup operators worry that bad credit shuts the door on funding. In reality, lenders weigh more than just personal credit. They also evaluate:

Business credit (if established)

Bank statements and cash flow

Length of time in business

Value of the tow truck or equipment as collateral

To improve your odds, consider:

Offering collateral. This could be the commercial vehicle you're financing or other commercial assets.

Getting a cosigner. A guarantor with stronger credit can increase lender confidence.

Reducing debt-to-income ratio. Pay down high-interest balances before applying.

Applying through a platform like Clarify Capital. We match borrowers, including those with challenged credit, to lenders who offer flexible financing solutions.

While interest rates will likely be higher for subprime applicants, you can still access competitive options that meet your financing needs. Getting pre-approved also helps clarify what terms you qualify for, without affecting your credit score.

Get Pre-Qualified for Tow Truck Financing

Whether you're launching a new towing business or expanding your fleet, the right tow truck financing can make all the difference. Clarify Capital simplifies the financing process for business owners by offering fast approvals, flexible terms, and access to 75+ trusted lenders, all tailored to your specific needs and without the hassle.

Our dedicated funding advisors understand the tow truck industry and can assist with everything from financing a light-duty rollback with winches to investing in a heavy-duty wrecker. Clarify makes it easy to access working capital, equipment loans, and other capital needs — sometimes as fast as the same day.

Take the next step toward growing your tow truck business with confidence.

Apply now to schedule a free consultation. Visit our heavy equipment financing page for more info.

FAQs About Tow Truck Financing

Have questions about tow truck financing options? Here are answers to common concerns business owners have when comparing loans, leases, and SBA programs.

What Credit Score Do I Need To Finance a Tow Truck?

Most lenders prefer a credit score of at least 620 to qualify for tow truck financing, though some financing companies will work with lower scores if you have strong revenue or collateral. Higher scores (680+) unlock competitive interest rates, lower down payment requirements, and more flexible terms. If your score is below 600, you may still qualify through subprime lenders or by offering a larger upfront payment.

Is Leasing a Tow Truck Better for Startups?

For startup towing businesses, tow truck leasing can be a smart short-term solution. Leasing reduces your upfront costs and often includes maintenance, helping preserve cash flow while you grow. However, you won't build equity in the vehicle. Leasing is best for newer businesses needing lower monthly payments, while purchasing is ideal for established businesses looking to build long-term assets.

What Are SBA 7(a) vs. 504 Loans for Tow Trucks?

SBA loans offer two strong tow truck financing options. SBA 7(a) loans can be used for trucks, working capital, or general business purposes. They offer up to $5 million with long repayment terms and lower interest rates. Meanwhile, SBA 504 loans are designed for large fixed assets, typically real estate or heavy equipment, and require a larger down payment, but offer fixed-rate financing.

Both loan types require a full loan application, strong financials, and time in business.

How Long Does Tow Truck Loan Approval Take?

Approval time depends on the type of financing and your lender. SBA loans can take 2–6 weeks due to government-backed underwriting. Conventional equipment financing or working capital loans from private lenders can be approved in 24–72 hours, especially if you apply through Clarify Capital's streamlined process.

Can I Deduct Interest on My Tow Truck Loan?

Yes, interest paid on a business vehicle loan is typically tax-deductible. As long as the tow truck is used for business purposes, the IRS typically allows you to deduct loan interest, along with related costs like fuel, maintenance, and depreciation. Speak with a tax professional to structure deductions correctly based on your financing and vehicle usage.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts