This article presents our key findings about how employees and employers across industries view the noncompete ban and its potential consequences. How many people would consider changing jobs or starting their own business, and what can businesses do to retain their talent in the face of increased job mobility?

This study offers insights into this and more. Let’s see what the noncompete ban could mean for the future of work.

Key Takeaways:

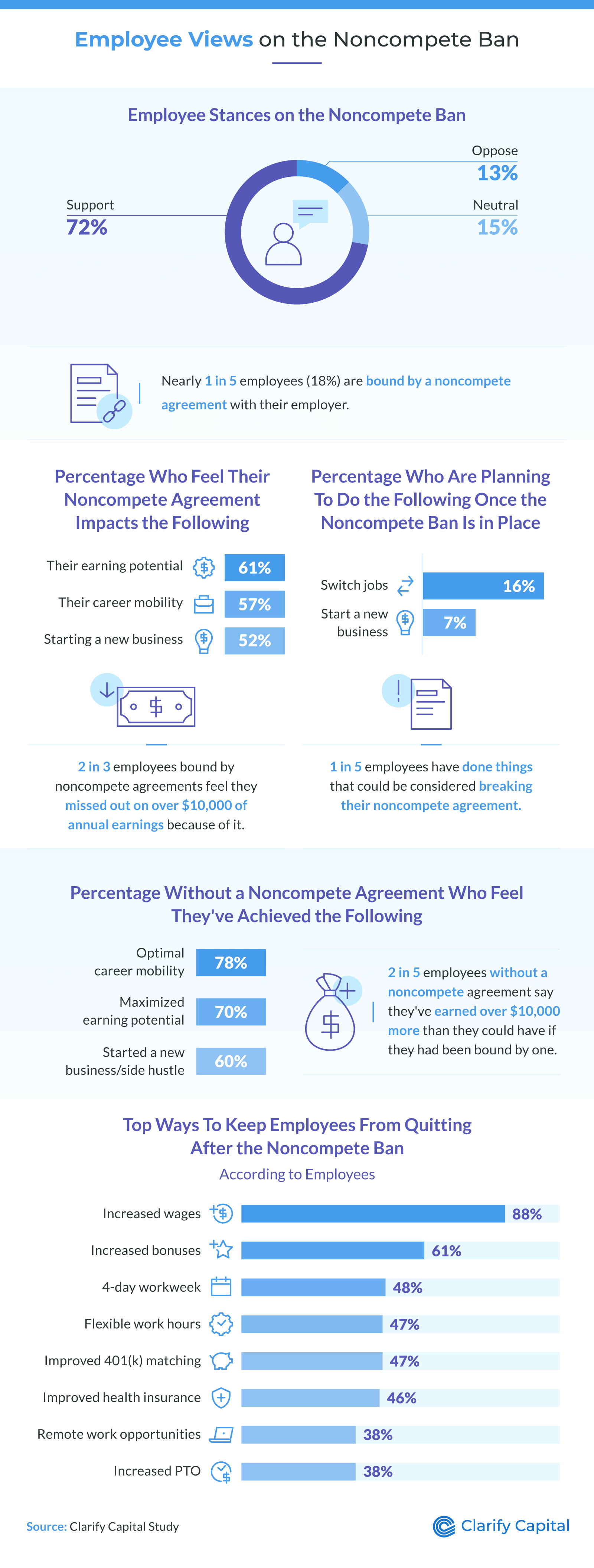

72% of employees and 70% of business executives support the noncompete ban.

16% of employees currently bound by a noncompete agreement plan to switch jobs once the ban is in place.

1 in 5 employees have done things that could be considered breaking their noncompete agreement.

According to employees, increased wages, increased bonuses, and a 4-day workweek are the top three incentives that would keep them at their current company following the noncompete ban.

24% of business executives believe employees at their company will leave for new employment opportunities due to the noncompete ban; 16% believe employees will leave and start a rival business.

The Employee Perspective

2 in 3 employees bound by noncompete agreements feel they missed out on over $10,000 of annual earnings because of it.

Employees working in manufacturing are the most likely to support the noncompete ban (84%). Support for the ban across industries is as follows:

- 78% of tech employees

- 76% of retail/distribution employees

- 71% of education employees

- 68% of healthcare employees

- 65% of finance/accounting employees

Employees working in manufacturing are also the most likely to be signed to a noncompete by their current employer (32%).

Employees 30 years old and younger bound by a noncompete agreement are the most likely to have done things that could be considered breaking it (29%).

The Employer Perspective

Over 1 in 4 business executives (26%) have required new employees to sign a noncompete agreement, with those in manufacturing being the most likely to have done so (61%).

Business executives in education are the most likely to support the noncompete ban (83%), followed by 80% in tech and 80% in retail/distribution.

Business executives in healthcare are the least likely to support the noncompete ban (60%).

Business executives in finance/accounting are the most likely to believe employees at their company will leave for new employment opportunities (37%) or to start a rival business (29%) due to the noncompete ban.

Methodology

For this study, we surveyed 502 employees and 504 business executives about their perceptions of the noncompete ban and its impact on their workplace and career. Among the industry breakdowns mentioned, at least 6% of respondents reported working in that sector.

About Clarify Capital

Clarify Capital gives financial backing to small businesses, offering up to $5 million in loans with competitive rates and quick processing times. We personalize the lending experience and help entrepreneurs advance their business goals.

Fair Use Statement

This content is free to share for noncommercial use. Please remember to link back to the original article.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts