Get inside the minds of the sharks and discover what separates a winning pitch from one that sinks. This article breaks down key patterns from "Shark Tank" by using real data and examples of successful companies that every entrepreneur can learn from — whether they're prepping for TV or pitching to investors off-screen. We'll explore what makes certain products stand out, how much money founders should ask for, and which shark might be the best fit for your business idea.

What the Data Tells Us About "Shark Tank" Success

"Shark Tank" may be one of the most popular TV shows for entrepreneurs, but appearing on ABC is just the beginning. Behind the scenes, real data reveals powerful insights into what gets funded — and why. By understanding patterns in successful pitches, startup founders can position their business ideas for stronger valuations and better investor interest. Whether you're eyeing the tank or just curious about trending investor strategies, this section breaks down what the numbers say about getting a deal.

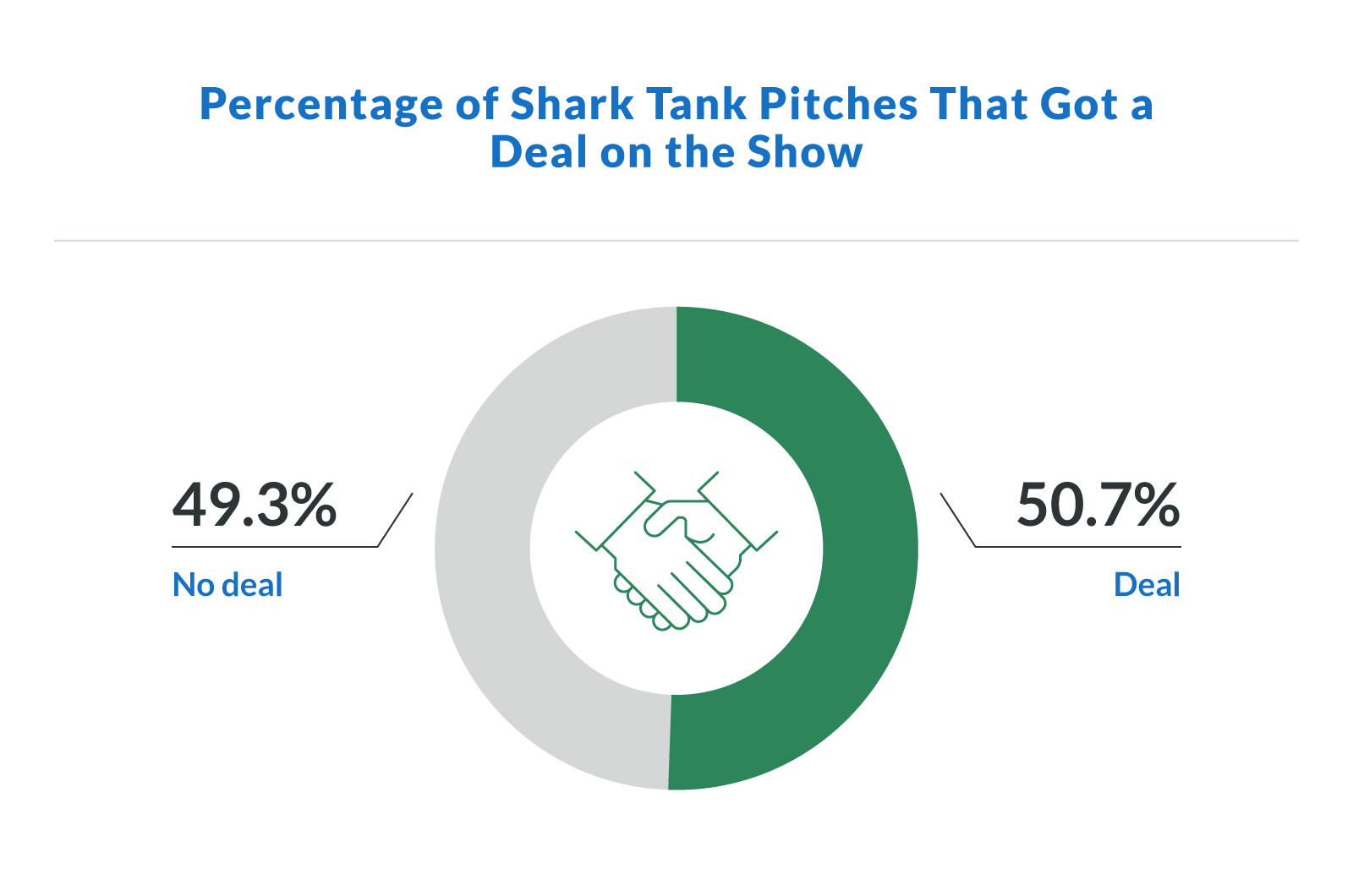

Half of the Entrepreneurs Walk Away With a Deal

Getting on "Shark Tank" can bring national visibility, but it doesn't guarantee a deal. In fact, 50.7% of entrepreneurs who pitch on the show walk away with an investment. That means nearly half leave empty-handed — proving that exposure alone isn't enough.

While appearing on ABC helps with brand awareness, it's not a substitute for a great product, strong pitch, and solid business fundamentals. The most successful stories from the show tend to come from entrepreneurs who not only impress with their vision but also prove they've done the work to build something viable.

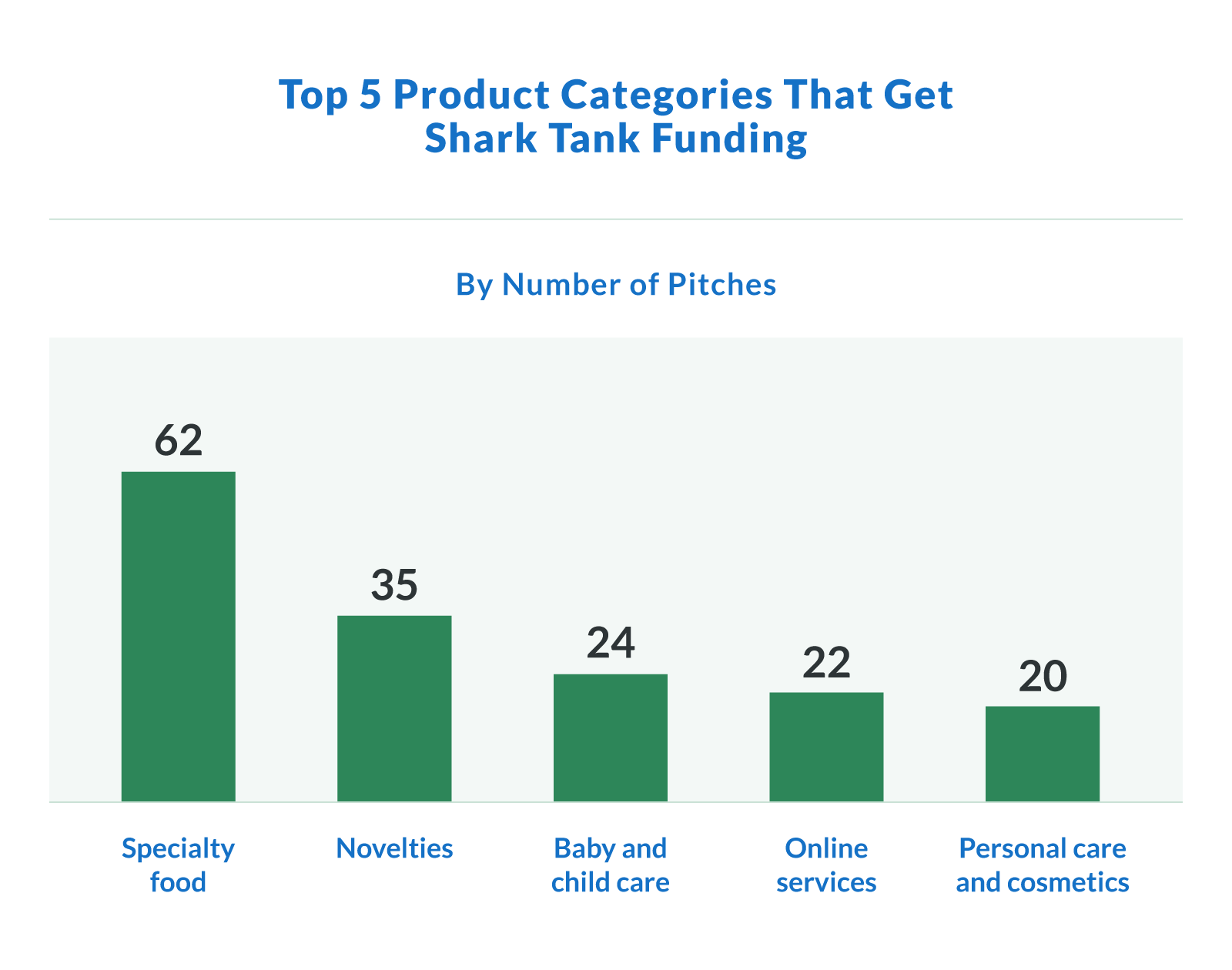

The Top Product Categories That Get Funded

The five most popular categories pitched on the show are:

Specialty food: 62 pitches

Novelties: 35

Baby and child care: 24

Online services: 22

Personal care and cosmetics: 20

This trend suggests that the simpler and more relatable your business is, the more likely it is to resonate with both the sharks and the viewing audience. Consumer-facing products — especially those that solve everyday problems — often become household names after airing. Think about how food trucks, eco-friendly goods, and other trending product types quickly catch fire on social media.

How Much Should You Ask For?

Valuation is always front and center in the tank. Based on the data, successful founders tend to stick within a sweet spot that balances ambition with realism. Among winning deals on "Shark Tank", the average ask is $228,522 in exchange for 16.7% equity, placing the average valuation around $1.94 million.

These numbers show that keeping your ask under $250,000 — and offering a fair equity split — may increase your odds of landing a deal. Sharks want to see the upside, but they also want to feel that the valuation reflects current traction and potential. For startups, especially those without massive sales, a modest request signals that the founder understands both their business and investor expectations.

Are Two Founders Better Than One?

Pitching as a team may offer more than moral support — it might actually improve your chances of getting funded. Startups with multiple entrepreneurs have a 54.0% success rate on the show, compared to 49.1% for solo founders.

Having a co-founder can add credibility to the pitch. It shows investors that the startup isn't reliant on just one person and allows the team to showcase a broader range of skills and experience. Whether you're covering finances while your partner explains the product or just backing each other up when the sharks challenge your numbers, that tag-team approach could be what tips the scale in your favor.

What the Sharks Look for in a Pitch

While "Shark Tank" on ABC gives entrepreneurs a shot at landing a deal with any of the panelists, knowing what each shark tends to invest in can help you tailor your pitch. Whether you're launching a consumer product, a tech startup, or a niche service, understanding individual shark preferences can make the difference between a handshake and a hard pass.

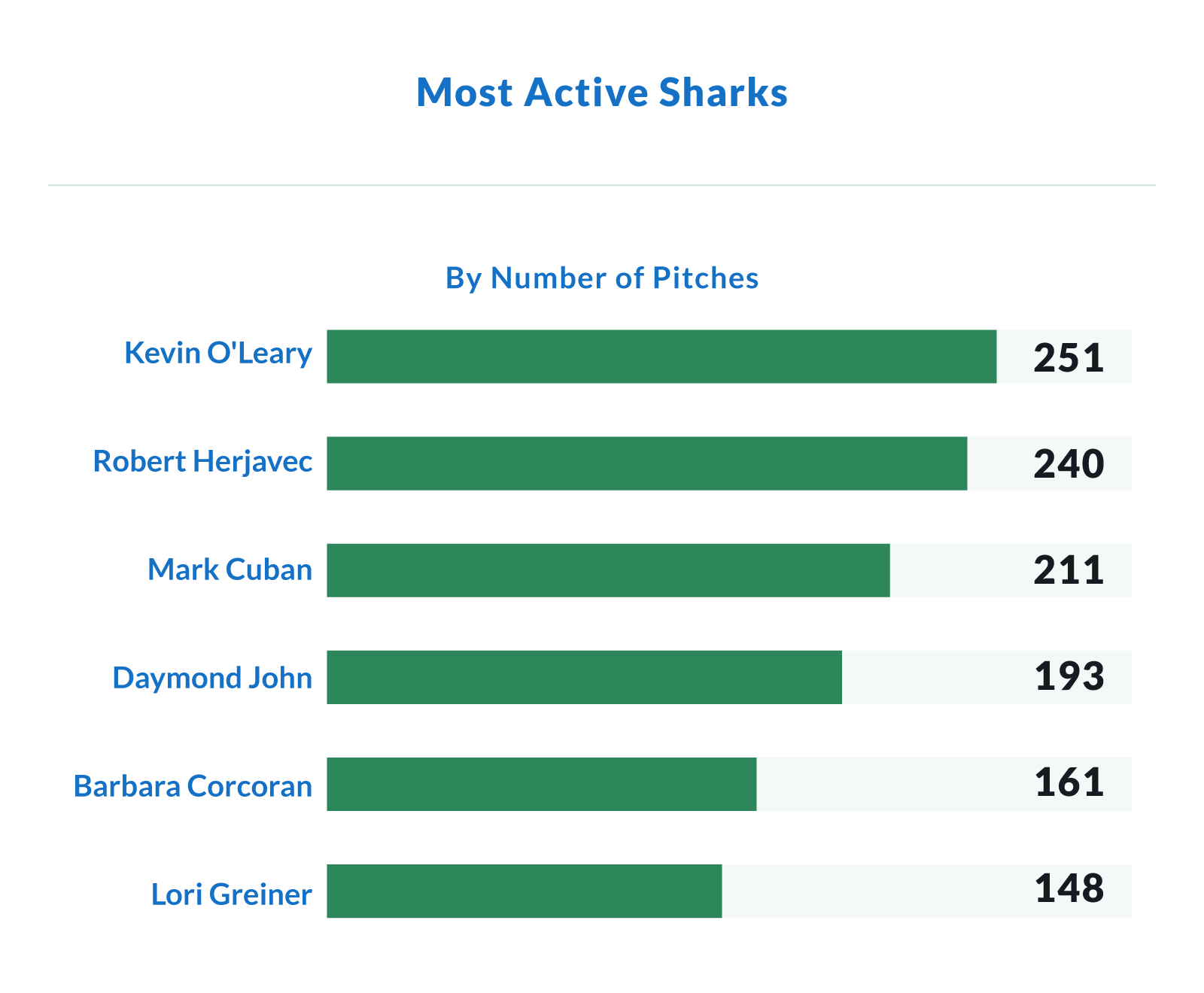

Who Bites the Most?

Some sharks are more active dealmakers than others. Kevin O'Leary, for example, leads the pack with the highest number of appearances in successful deals, followed closely by Robert Herjavec and Mark Cuban. These numbers reveal not just who's most involved but who's likely to see value in a wide range of pitches.

Here's who bites most often:

Kevin O'Leary: 251 appearances in deals

Robert Herjavec: 240

Mark Cuban: 211

Daymond John: 193

Barbara Corcoran: 161

Lori Greiner: 148

Matching Your Product to the Right Shark

Matching your pitch to the right investor can make or break your shot in the tank. Each shark has a unique investing style, so aligning your product with their strengths is key to standing out.

Here's a quick breakdown of what each shark typically looks for:

Lori Greiner. If you have a consumer-facing product that solves a common problem — and looks great on TV — Lori might be your best bet. Lori Greiner invested in hits like Scrub Daddy, Simply Fit Board, and The Comfy. Her QVC experience gives founders fast access to massive retail exposure.

Mark Cuban. Focused on innovation and scale, Mark looks for startups that can grow quickly and disrupt their industries with technology. He's the go-to shark for apps, platforms, and data-driven businesses.

Daymond John. Known for his branding expertise, Daymond is a strong fit for fashion, lifestyle, and consumer product companies that need help building recognizable identities.

Barbara Corcoran. Often drawn to passionate founders with straightforward, relatable ideas. She invests in people as much as the product, favoring grit and storytelling.

Kevin O'Leary. As a numbers-driven investor, Kevin prefers businesses that are already profitable with strong margins. He often structures deals with royalties or performance-based terms.

For trending startups aiming to become household names, choosing the right shark can open doors to QVC, Amazon, retail partnerships, and long-term growth.

Case Studies: "Shark Tank" Products That Made It Big

Some "Shark Tank"investments go beyond a deal — they become cultural touchstones and multi-million-dollar brands. From viral Christmas sweaters to wearable blankets and eco-friendly household tools, these startups turned one shot on ABC into long-term growth, retail partnerships, and lasting recognition. Below are examples of iconic success stories, as well as highlights from the dataset of companies that landed deals and maintained a strong online presence.

Scrub Daddy. One of the most successful "Shark Tank" products of all time, Scrub Daddy, was created by Aaron Krause and backed by Lori Greiner. With her help — and QVC power — the smiling scrubber went from garage invention to household name. It has earned over $300 million in lifetime sales and continues to expand into major retail stores and Amazon. What started as a simple cleaning sponge became a must-have product, proving that practicality and presentation go a long way.

Bombas. Co-founded by David Heath and Randy Goldberg, Bombas turned socks into a mission-driven brand. With every pair sold, a pair is donated to homeless shelters — a model that resonated with both consumers and sharks. The company has reportedly surpassed $100 million in revenue and is one of the most beloved success stories in "Shark Tank" history.

Squatty Potty. The bathroom aid that no one expected to go viral ended up being one of the smartest investments on the show. With strong branding and viral video marketing, The Squatty Potty has made millions in sales and become a staple in homes across the country.

The Comfy. A cross between a hoodie and a blanket, The Comfy became an instant hit thanks to its comfort-focused appeal. This wearable blanket quickly took off with help from Lori Greiner and has dominated Amazon's cozy product category since appearing on "Shark Tank".

Everlywell. This at-home lab testing kit company gained massive traction after its appearance on the show. From food sensitivity tests to hormone panels, Everlywell aligned perfectly with consumer demand for convenient, private healthcare — and the brand's growth has put it on Forbes' radar.

Cousins Maine Lobster. Founded by cousins Jim Tselikis and Sabin Lomac, this authentic Maine lobster food truck concept grew into a national franchise. Backed by Barbara Corcoran, they expanded into multiple cities and brick-and-mortar locations, serving up lobster rolls coast-to-coast.

Dude Wipes. Originally pitched as a humorous product, Dude Wipes struck a chord with consumers looking for something better than dry toilet paper. It's now a mainstream personal care brand with a loyal following and major distribution in national retailers.

Simply Fit Board. Another Lori Greiner success story, this balance board was easy to demo and went viral thanks to its visual appeal. After its TV debut, Simply Fit Board racked up huge sales through QVC, Amazon, and retail stores.

PlateTopper. It's a kitchen tool that turns any plate into an airtight food storage container. The founder asked for $90,000 in exchange for 5% equity, valuing the company at $1.8 million.

180 Cup. This multi-functional party cup doubles as a shot glass, making it perfect for tailgates and social events. The founder pitched for $300,000 for 15% equity, giving the company a $2 million valuation.

Shark Wheel. The company reinvented the wheel with a Q-shaped design that improves speed, grip, and stability. Commonly used on skateboards and strollers, the product stood out for its innovation. The team asked for $100,000 for 5% equity at a $2 million valuation.

Coolwraps. These shrink-wrap gift bags can be sealed with a household hair dryer, offering a quick and stylish solution for gift wrapping. The founder requested $100,000 for 40% equity, valuing the company at $250,000.

Ten Thirty One Productions. This entertainment company produces horror-themed live attractions and experiences. The founder sought $2 million for 10% equity, placing the company's valuation at $20 million.

Tipsy Elves. This ugly Christmas sweater company gained significant recognition after appearing on "Shark Tank" in 2013, where they secured $100,000 in funding from Robert Herjavec for 10% of the company.

These case studies show that success on "Shark Tank" is about more than landing a deal — it's about execution afterward. From viral marketing to retail strategy and product innovation, these brands became household names by capitalizing on the momentum and forming powerful partnerships.

Turning "Shark Tank" Lessons Into Real-World Funding

You don't need to pitch on national TV to fund your next big move. While "Shark Tank" deals come with big visibility, many entrepreneurs grow successfully by accessing working capital through trusted business financing partners. Whether you're launching a product, managing seasonal cash flow, or scaling operations, having fast access to capital can be a game-changer.

Clarify Capital makes it easy to explore funding options without giving up equity. With a 2-minute application and access to over 75 lenders, you can find the right loan or line of credit to match your goals.

Popular options for small businesses include:

Term loans. These provide a lump sum of capital with fixed repayment terms, which are ideal for funding product development, marketing campaigns, or large inventory purchases.

Business lines of credit. This revolving credit option gives you access to funds as needed, making it perfect for managing cash flow, ordering supplies, or taking advantage of unexpected opportunities.

Equipment financing. This option allows you to purchase or upgrade equipment without straining your cash flow — great for product-based businesses or mobile operations like food trucks.

Merchant cash advances. Get fast funding based on future sales, which can help businesses with strong revenue but limited credit history stay on track.

Invoice factoring. Convert outstanding invoices into immediate cash so you can keep operations moving without waiting on customer payments.

Pitch Like a Pro, Whether or Not You're on TV

Success on "Shark Tank" isn't just about standing in front of the sharks — it's about clarity, preparation, and knowing your business inside out. Whether you're aiming to pitch on ABC or looking to secure funding off-screen, the most important factors remain the same: strong product-market fit, reasonable valuation, and a clear growth plan.

For entrepreneurs ready to take the next step, getting funded is easier than you think. Clarify Capital helps startups secure fast, flexible financing to grow — no TV pitch required.

Apply now to get matched with top lenders in under 2 minutes. Startups grow faster with the right partner. Let Clarify Capital help you make it happen.