Key Takeaways:

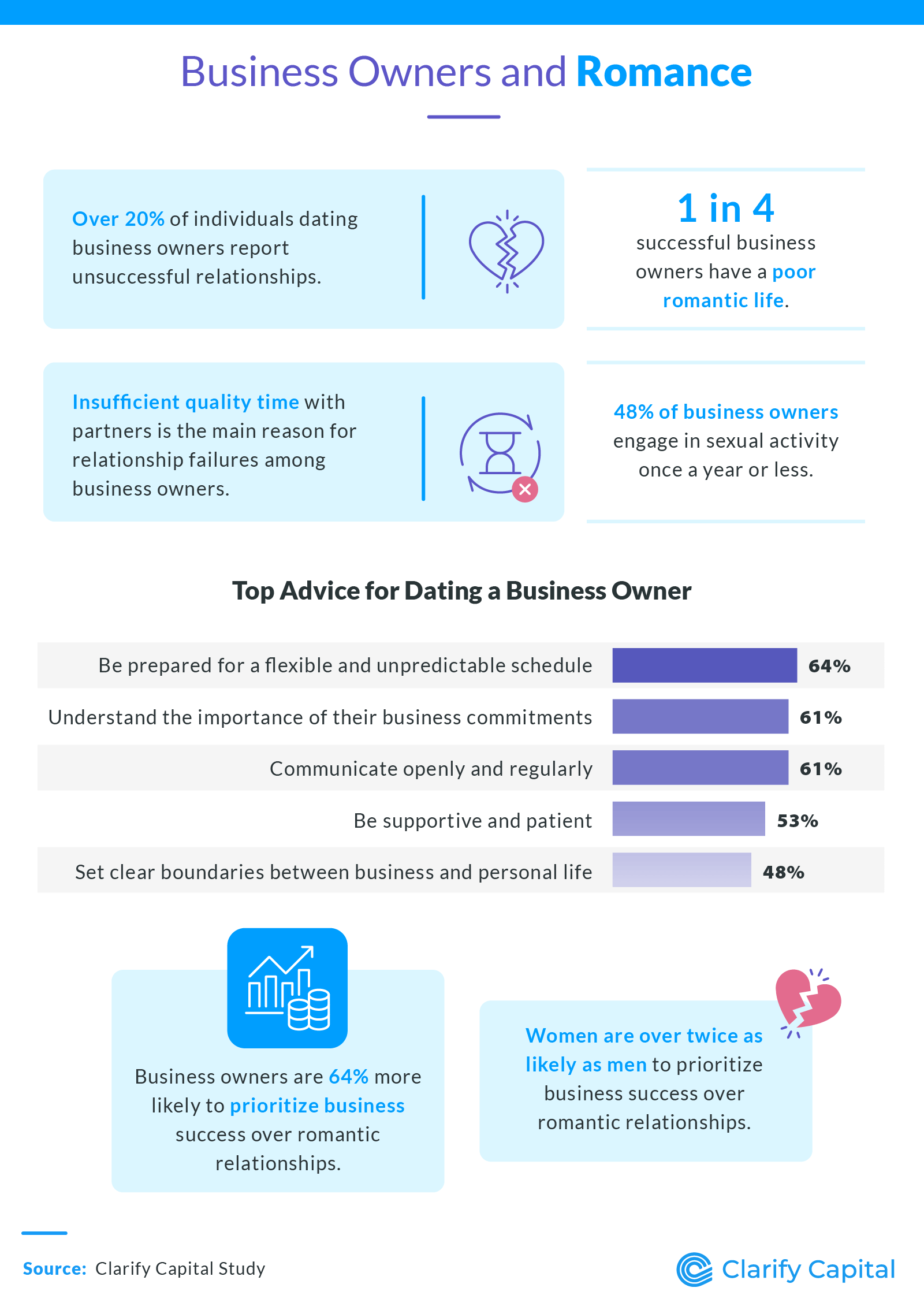

1 in 4 business owners with successful enterprises report having a poor romantic life.

The primary cause of relationship failures among business owners is a need for sufficient quality time spent with their partners.

Business owners are 64% more likely to prioritize the success of their business over their romantic relationships.

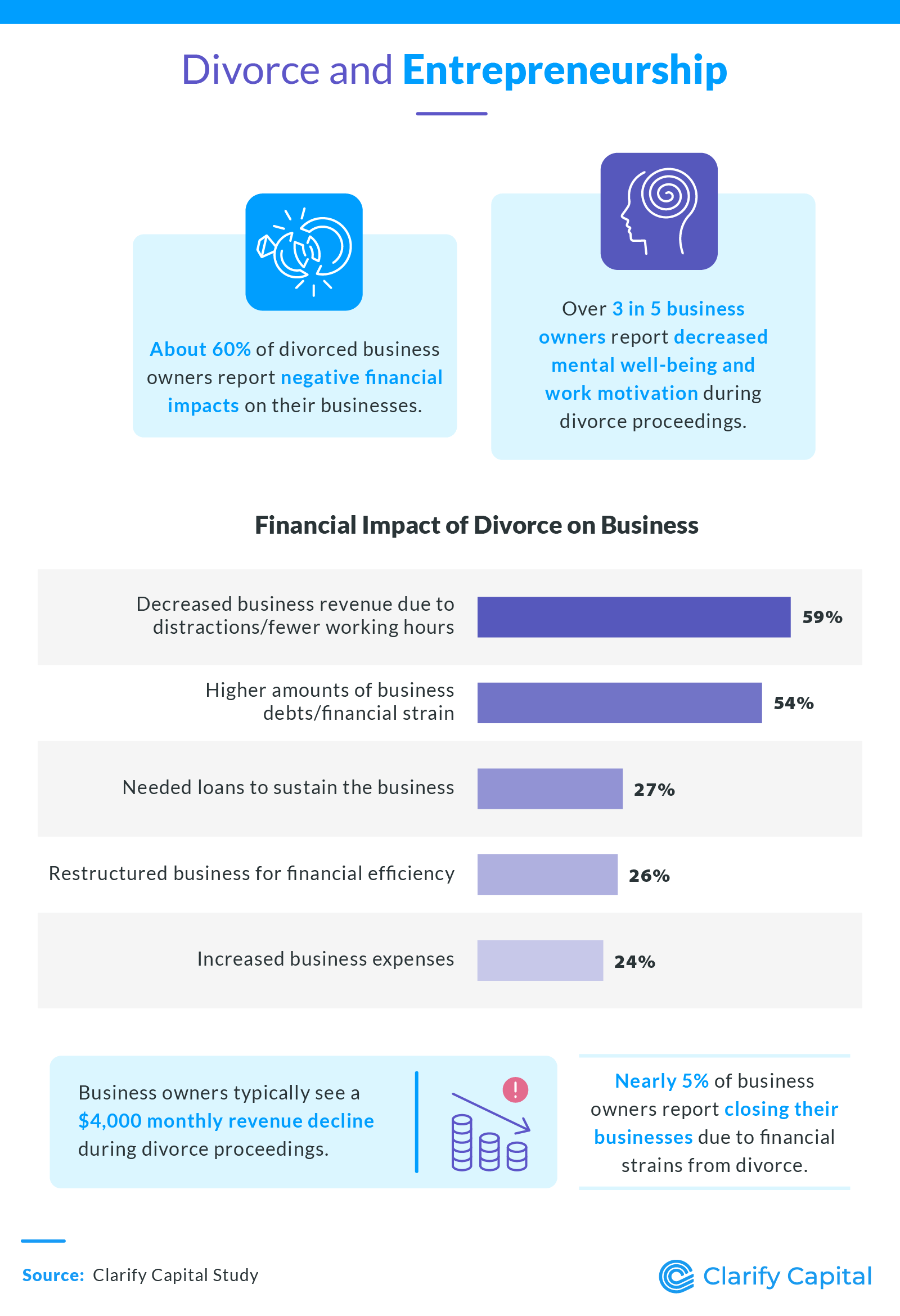

57% of business owners say divorce led to negative financial impacts on their businesses.

Business owners experienced an average monthly revenue decline of approximately $4,000 during their divorce proceedings.

Love on the Ledger

The top qualities female business owners value in a romantic partner are:

- Honesty (37%)

- Respect (27%)

- Kindness (25%)

The top qualities male business owners value in a romantic partner are:

- Honesty (45%)

- Intelligence (30%)

- Sense of humor (22%)

Over half of business owners report their current romantic life is poor.

46% of business owners are dissatisfied with their current sex life.

Over 1 in 4 business owners are unsatisfied with their work-life balance.

33% of business owners have been romantically involved with another business owner.

Business owners highlight key relationship dynamics to consider before starting a relationship with someone who owns a business:

- Balance between personal and professional life (71%)

- Comfortability with time constraints (45%)

- Comfortability with high levels of responsibility and stress (40%)

Nearly 70% of divorced business owners couldn’t focus on their business during their divorce.

57% of business owners who went through a divorce say it had negative financial impacts on their business.

35% of business owners relied on informal support from friends and family during or after their divorce to help manage their business.

Nearly 1 in 4 business owners didn’t seek professional support, such as a counselor or financial adviser, during or after their divorce to help manage their business.

Methodology

Clarify Capital surveyed 800 Americans and 200 business owners to explore the unique intersection of love, business, and finances. The average age of American respondents was 31; 45% were male, 54% were female, and 1% were nonbinary. The generational representation was 2% baby boomers, 9% Gen X, 44% millennials, and 45% Gen Z. The average age of business owners was 53; 45% were male, 54% were female, and 1% were nonbinary. Their generational representation was 29% baby boomers, 47% Gen X, and 24% millennials.

About Clarify Capital

Clarify Capital specializes in helping American small business owners succeed by offering the best rates and terms for their financial needs. We’re committed to a simple, transparent process, putting our clients first and providing fast funding and flexible payment options, all while ensuring privacy and data security.

Fair Use Statement

If this topic resonates with your audience, feel free to share the insights from our article. We request that the sharing be strictly for noncommercial purposes and include a link to this page, allowing your readers full access to our comprehensive study and its methodologies.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts