Are you a medical professional looking to grow or expand your practice? From new diagnostic equipment to a second commercial space, medical practice loans can help you do just that.

With health care being one of the fastest-growing industries for small business owners, lenders consider medical practices highly profitable investments.

In this guide, we’ll walk you through what medical practice loans are, how to apply for one, and how you can use it.

What Are Medical Practice Loans?

Medical practice loans are industry-specific funding options for physicians to manage or expand their practices. That includes chiropractors, dentists, and other health care providers.

These loans are only available to established medical providers, such as those with small and growing practices, not to individuals in residency. Compared to other loans, they are long-term solutions with extended repayment terms of up to 25 years. You can get medical practice loans from business banks or private and online lenders, borrowing as much as $5 million or more.

Since medical professions generally have high-earning potential, they’re considered good investments. Many lenders will offer perks, like support programs and fee discounts, to secure you as a borrower.

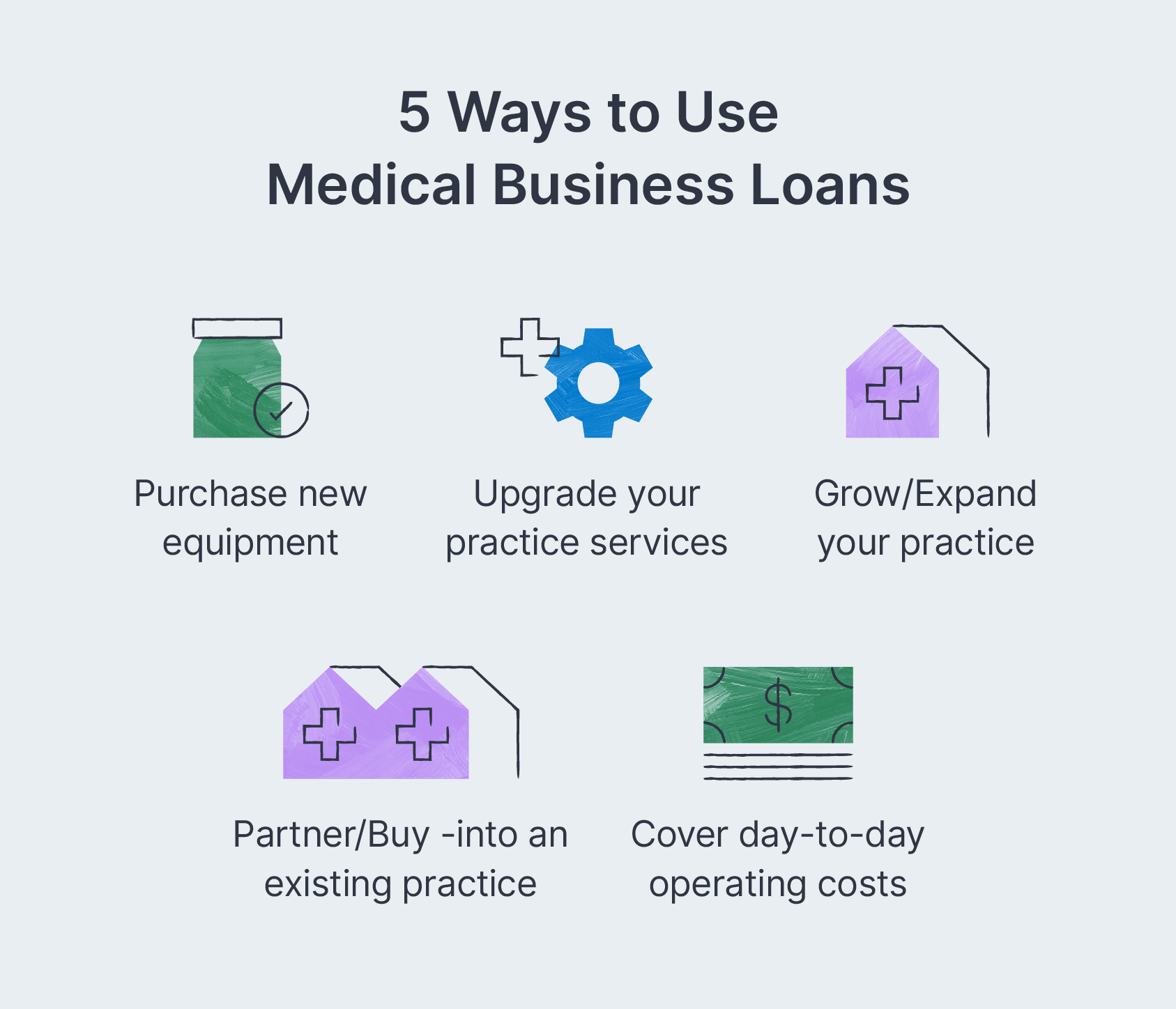

How You Can Use Medical Business Loans

Here are common ways you can use the funds from your loans to stay competitive and improve patient experience:

Equipment Costs: Buying or repairing essential equipment needed for your practice, including diagnostic equipment, sterilizer machines, and surgical instruments.

Practice Development: Investing in technological small business tools and upgrades, like online booking services and record-keeping software, to provide convenience and better service to your patients.

Practice Expansion: Making facility improvements and purchasing your rented office space. An additional commercial space can help expand your client base and potentially earn capital appreciation in the future.

Partner Buy-in: Supplying the funds you need to merge with or become a partner in an existing practice.

Operating Costs: Working capital to run payroll, consolidate debt, advertise, and cover any necessary expenses for day-to-day operations.

Strategic Use of Financing for Long-Term Growth

Securing medical practice loans is not just about covering short-term expenses—it’s about strategically using business financing to build a thriving, sustainable healthcare practice. Here’s how medical professionals can maximize their loan options for long-term success.

Invest in New Technology. Keeping up with the latest medical equipment can improve patient care and boost profitability. Consider equipment financing or leasing to acquire new equipment without depleting cash reserves.

Expand Your Practice. Use SBA loans or commercial real estate loans to open a second location or renovations to an existing practice to attract more patients.

Build a Financial Safety Net. A business line of credit offers flexibility to cover unexpected operational costs while keeping cash flow stable.

Strengthen Marketing Efforts. Allocate a portion of funding toward patient outreach, digital marketing, and brand-building to attract new clients.

Optimize Staffing & Training. Hiring specialized medical staff or investing in continued education can enhance service quality and long-term profitability.

By aligning business loans with a strategic growth plan, healthcare professionals can ensure their medical business thrives in a competitive market.

Types of Loans for Medical Professionals

Medical practices tend to have a strong earning potential, making acquiring business loans fast and easy. You’ll need to select the right type of loan for your medical practice financing needs.

SBA Loans

An SBA loan can provide some of the best interest rates and term lengths, secured by the U.S. Small Business Administration (SBA), guaranteeing up to 85% of your loan. Loans are through an SBA-approved lender. The SBA 7(a) is the most commonly used loan type, where borrowers can receive up to $5 million in working capital with a 25-year term.

Pros:

- Flexible and guaranteed

- Higher capital availability

- Low interest rates

Cons:

- Stricter eligibility

- Slower timeline for disbursement

Equipment Loans

Many banks and the SBA offer equipment financing, where your medical equipment will serve as collateral for funds. With an equipment loan, you can purchase or repair existing equipment needed for your practice.

Pros:

- Flexible financing

- Collateral in place of down payment

- Faster access to funds

Cons:

- Collateral limitations

- Possibly higher interest rates

Long-Term Loans

Long-term loans, also known as “term” or traditional business loans, provide a lump sum of funds with a repayment plan of regular intervals of three to ten years. These longer repayment periods are generally set at fixed, equal payments, helping keep monthly payments low and manageable.

Pros:

- Manageable and predictable repayment

- Generally low-interest

- Fast application process

Cons:

- May require collateral

- Repaying more over an extended timeframe

Short-Term Loans

Short-term loans also provide a lump sum of funds with regular, fixed payments but with shorter repayment periods. The life of short-term loans typically ranges from six months to two years. This loan type is popular for funding small businesses, where you can use it for cash flow or to cover unexpected expenses.

Pros:

- No collateral needed

- Tax-deductible interest on loan payments

- Fast application process

Cons:

- Higher interest rates

- Shorter repayment term may not work for all businesses

Invoice Financing

Invoice financing, also referred to as invoice discounting, is a type of financing method where you sell your company’s unpaid client invoices at a discount to a third-party factoring company. This option helps businesses raise capital using their outstanding invoices, creating accessible cash flow to cover short-term obligations.

Pros:

- Upfront payment of up to 100% of the invoice value

- Invoices serve as the collateral

- Easier to qualify for

Cons:

- May charge application and termination fees

- Only for businesses with invoice transactions

How to Apply for a Medical Practice Loan

Applying for a medical practice loan will vary depending on the type of lender and loan. Eligibility will also vary by loan type, so check the credit approval and time in business requirements in advance. With these in mind, the following general steps will help you prepare for a loan application.

1. Determine How Much Funding You Need

First, calculate how much funding you’ll need to borrow and why. You can use a loan calculator for an accurate estimate of your medical practice as well as how much you can afford to repay monthly. Identifying these values for lenders can help boost your approval odds.

2. Gather Necessary Documents

With business financing, especially a health care practice, you’ll want to prepare all informational and supportive documents about your business for lenders to review. Here are the most typical requirements:

- Financial statements (e.g., balance sheet, income statement)

- Business licenses and certifications

- A business plan

- Tax return statements

- Business and personal credit reports

- Collateral (if applicable)

3. Submit Your Application for Approval

Now that you know how much funding you’ll need and have all the necessary documents ready, you’re all set to submit your application. After approval, you’ll receive the loan agreement terms to review and sign before receiving your disbursement.

While the approval process can take up to three months with traditional lenders, our team at Clarify Capital can get you approved and quickly funded in two days or less.

Hidden Costs in Medical Practice Loans and How to Budget for Them

When securing medical practice loans, many healthcare professionals focus on loan amounts, interest rates, and repayment terms, but hidden costs can significantly impact cash flow. Understanding these additional expenses helps business owners make informed decisions and effectively manage operational costs.

Common Hidden Costs to Watch For

Origination Fees. Some lenders, especially traditional banks, charge upfront fees to process the loan application. These fees can range from 1% to 5% of the total loan amount.

Prepayment Penalties. If you repay your loan early, some business loans impose penalties for lost interest revenue. Always check your loan terms before considering early repayment.

Late Payment Fees. Missing a payment can result in hefty fees and damage your credit score, making future business financing more expensive.

Administrative Costs. Loan programs may require annual servicing or documentation fees, such as updated tax returns and financial statements.

Insurance Requirements. Many medical practice financing agreements require life or business insurance to protect lenders, which can add to ongoing operating expenses.

Budgeting for Hidden Costs

Review the Fine Print. Carefully read all disclosures in your loan application to identify potential fees.

Negotiate Terms. Some funding options, especially through SBA loans, allow for negotiation on fees and repayment terms.

Set Aside Contingency Funds. Keep a portion of the loan reserved for unexpected expenses like equipment repairs, leasing issues, or cash flow fluctuations.

Financing Alternatives for Physicians

If you’re not approved for a loan or need additional funds to boost cash flow, there are alternative financing options available that medical professionals can use:

Business Line of Credit: Works like a business credit card, where lenders approve you for a maximum credit line, and you can withdraw funds as needed. You’ll only pay interest on the funds you use.

Merchant Cash Advance (MCA): A type of financing where an MCA lender provides a lump sum upfront in exchange for a percentage of your future sales. MCAs have easier qualifications and can be an alternative solution if you’re not eligible for a traditional loan.

Small Business Grant: A free, lump sum of money that the government and private organizations award to small business owners. While these don’t require repayment, you must meet eligibility and will likely need to submit a grant proposal.

Online Lenders: More lenient than banks with eligibility requirements and typically have a quick turnaround time. This medium allows online lenders to secure your funds faster.

State or Federal Loan Programs for Healthcare Businesses

Beyond traditional lenders and online lenders, many healthcare professionals can access state or federal loan programs designed to support medical practitioners, dentists, veterinarians, and other business owners in the field.

Federal Loan Programs

SBA 7(a) Loans. Backed by the Small Business Administration, these loans offer business financing up to $5 million with favorable loan terms for expanding or purchasing a medical business.

SBA 504 Loans. Ideal for purchasing commercial real estate or new equipment, this loan program provides long-term, fixed-rate financing options for medical professionals.

National Health Service Corps (NHSC) Loan Repayment Program. This program assists healthcare practitioners in underserved areas by providing loan forgiveness for certain business loans.

State Loan Programs

Many states offer their own funding options for medical practice financing, often through economic development agencies or specialized loan programs. These can include:

Low-interest bank loans for medical equipment purchases.

Tax incentives for expanding healthcare services in rural or underserved areas.

Grants or subsidies for launching a startup medical practice.

FAQs

Can I still apply for a medical practice loan as a nontraditional physician?

As more holistic forms of health care and wellness treatment become available, you may still be eligible for a medical practice loan as a nontraditional physician. Check with different lenders about their eligibility requirements.

Are there any limitations to what you can purchase with medical practice loans?

Lenders are usually not restrictive, leaving the medical professional to use the funds on what they deem appropriate for running their practice. However, keep federal regulations in mind and avoid using business funds for personal obligations.

What credit score do I need for a medical business loan?

With any loan, creditworthiness is usually always a factor. Most underwriting bank lenders require at least a 600 credit score to apply for a business loan. If your score is lower, they may require you to provide collateral. Alternative lenders are more accepting of low credit scores but usually have higher interest rates depending on your credit history.

Do I need to provide collateral for a medical practice loan?

Most medical practice loan options don’t require collateral, but some do. For example, equipment financing allows you to use your equipment as collateral. The requirement depends on whether your loan is secured or unsecured.

How quickly can I receive funds once approved?

When working with Clarify Capital, funds are typically transferred to your account the same day your application is approved. The entire application process can take 1-2 business days.

Find the Best Loan for Your Medical Practice

With medical practice financing, you’ll have the funding you need to grow your business and stand out from competing practitioners. If you’re unsure of the right loan, Clarify Capital will do the work for you.

Our experienced team works with nationwide lenders to find the best rates with fast approvals. Secure a custom-tailored small business loan by filling out a quick application and speaking with a dedicated loan advisor.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts