Buying an established business can be a great opportunity. It offers entrepreneurs a way to own a company while skipping the expense and risk associated with the startup stage. But many people don’t have the capital to do it.

That’s where Clarify Capital comes in. We offer financial assistance to entrepreneurs who need capital to buy a company. If you’re looking for loan options to buy a business, read on to learn about what you’ll need to get that funding.

Can You Get a Loan To Buy an Existing Business?

Yes, you can get a loan to buy an existing business. To qualify for a loan, though, lenders will consider a number of factors, like your personal credit score, the amount you need to borrow, how you’ll use it, and the type of business you want to buy.

You may also need to provide a solid business plan and a cash flow forecast to support your loan application. Adding the purchase price of the company and the value of the business based on its financial history and profitability will also give you bonus points.

Of course, if you’re a business owner with a good track record in managing and growing a company, your chances of getting approved for a loan are already good. If you’re buying a new business for the first time, you may need to show more proof that it will be profitable. For this type of loan, you could provide a personal guarantee (in other words, you’ll be personally responsible for paying back the loan if the business can’t) or offer personal assets as collateral.

At Clarify Capital, we help entrepreneurs get approved for up to $5 million in small business loans. Whether you’re looking for a loan to buy another business or need working capital for your own company, talk to a Clarify advisor today to discuss your financing options.

How To Get a Loan To Buy a Business

Getting a loan to buy a current business is usually similar to any other business loan application. Here’s a general overview of how to get one:

Choose a Good Lender

When you’re applying for a loan, shop around for a good lender. You don’t want to spend much time applying to lenders who don’t offer the loans you need.

You’ll also want to avoid lenders with vague terms. Look for one who will treat you with respect and clearly explain the application process. Fast funding and flexible repayment terms are other green flags to look for.

Clarify Capital strives to help you get the funding you need so you can achieve your business goals, whether that’s buying a business with an existing customer base or growing a company from the ground up.

We work with more than 75 lenders to get you the best rates. You’ll also have a dedicated advisor who will work with you throughout the process. They’ll help you choose the best financing option based on your business needs.

Apply for a Loan

Before beginning the loan application process, calculate how much you need to borrow. You don’t want to borrow so much that you can’t pay it off. On the other hand, if you don’t borrow enough, you might lose out on buying a business because you don’t have enough capital.

Once you’ve figured out how much you need to borrow, calculate the interest rates and make sure you can afford the repayments. Then, apply for a loan and prepare the documents you need to support your application.

For business acquisition loans, you may need bank statements to show your personal finance history, financial statements from the business (like balance sheets that show annual revenue — you’ll likely need to get these from the current owner), and your tax returns. The lenders may ask for a letter of intent where you explain why you need the loan and how you’re going to use the funds.

Use Your Loan To Grow Your Business

Some reasons small business owners apply for loans are to expand their operations, take advantage of growth opportunities, and cover working capital. This may include getting new equipment to increase production or buying commercial real estate to expand storefronts or manufacturing areas.

Loans also provide support for business owners to cover gaps in cash flow and pay their day-to-day business expenses. These include paying salaries and wages, purchasing inventory, and paying rent.

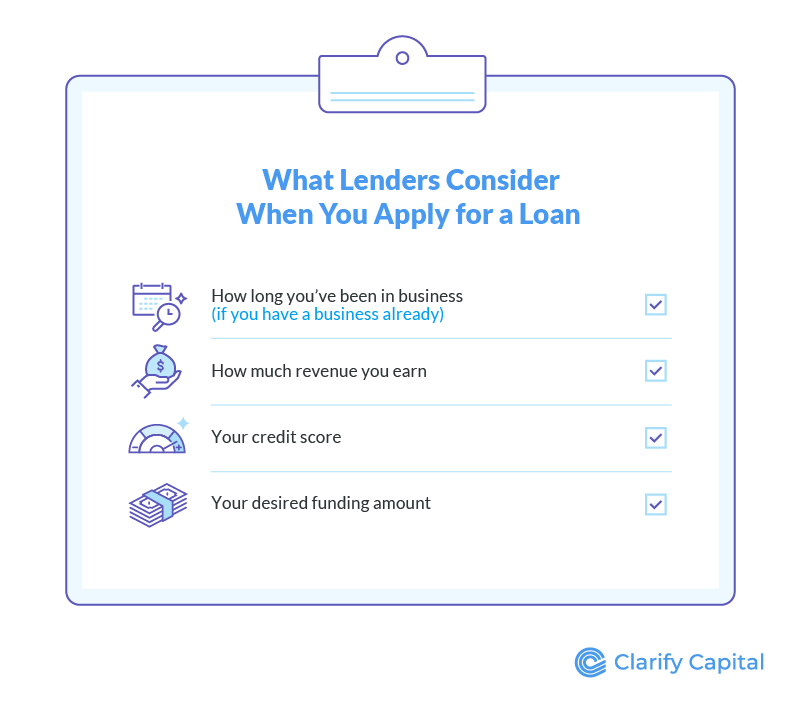

What Lenders Consider When You Apply for a Loan To Buy a Business

Different lenders have different eligibility requirements, but here are what most loan providers typically look for when you apply for a loan:

How Long You’ve Been in Business (If You Have a Business Already)

If you’re applying for a loan for a business purchase, your past success in running a company will increase your chances of getting approved for a loan. This is because lenders use your time in business to measure your creditworthiness. Having been successful in another business lowers the risk of lending to you.

Many lenders want you to have been in business for at least six months to qualify for a loan. But if you don’t have a business or haven’t been operational for at least six months, contact us and speak to a Clarify advisor to discuss your options.

How Much Revenue You Earn

Clarify recommends that businesses have an average monthly income of $10,000 for easy approval with online lenders. But if your business or the company you’re trying to buy earns less than $10,000 a month, you can still get approved. Contact us and talk to a Clarify advisor directly so we can discuss your funding options and help you craft a strong application.

Your Credit Score

Most lenders require a certain credit score to get approved for business loans, so we recommend borrowers have a credit score of at least 550. But don’t let a “bad credit score” stop you from considering business loans as financing options. Contact us directly and speak to a Clarify advisor to discuss what you may qualify for.

Your Desired Funding Amount

The loan amount you want to borrow may also affect your ability to be approved.

Clarify helps small business owners get approved for loans up to $5 million, but lenders may approve or deny your loan application to buy a business depending on factors including your income, your personal or business credit score, and the type of financing or term loan you need. They’ll also look at your business track record and any business valuations, assets, and liabilities of the company you’re trying to buy.

If you have any questions about your loan application, contact Clarify. We’re ready to answer questions and discuss funding options based on your needs and situation.

Types of Loans for Purchasing an Existing Business

There are several financing options available to entrepreneurs looking to acquire an existing business, each with unique benefits and requirements. Here’s an overview of some common loans used for business acquisitions:

SBA Loans

Small Business Administration (SBA) loans can help entrepreneurs buy a business. The SBA 7(a) loan is one of the most popular options.

SBA loans are known for their competitive interest rates and relatively long repayment terms. These loans are partially guaranteed by the government, reducing the risk to lenders and often leading to more favorable terms for borrowers. However, SBA lenders do require thorough documentation and can take longer to process.

Business Lines of Credit

A business line of credit offers flexibility that traditional loans don’t. It lets business owners borrow up to a certain amount and pay interest only on the amount borrowed.

This is especially helpful for managing cash flow during the acquisition process or covering unexpected expenses that arise afterward.

Secured Loans

Secured loans are backed by collateral, such as real estate, inventory, or other valuable assets. The main advantage of secured loans is that they often come with lower interest rates compared to unsecured loans, since the lender has less risk thanks to the collateral.

But keep in mind that if a borrower fails to make payments, the lender has the right to seize the collateral to recoup the loan amount.

Seller Financing

This is where the business seller provides a loan to the buyer. This can be an attractive option for both parties since it cuts out the need for traditional bank financing and can have more flexible repayment conditions.

Seller financing lets the buyer pay off the purchase price over time, often with interest. This can work well when the seller is confident in the buyer’s ability to manage the business. However, financing through a traditional lender might be safer for some buyers who prefer more structured and regulated loan terms or legal protections, which aren’t always part of these private financing agreements.

Conventional Bank Loans

These traditional bank loans typically offer fixed interest rates and a set repayment schedule. To qualify for a conventional bank loan, borrowers usually need good credit scores, a solid business plan, and sometimes collateral to secure the loan.

When considering purchasing an existing business, it’s important to explore all your financing options. Speak with advisors as Clarify Capital to understand the terms and requirements of each loan type. We’ll help you pick the loan you need to acquire a business.

Getting Business Acquisition Financing

Buying a business can feel like navigating a maze. The good new is you have plenty of options, from the more traditional routes like SBA loans and secured loans to the flexible solutions of seller financing and business lines of credit.

It’s worth weighing all these options. Consult the financial experts at Clarify Capital — they’ll help crunch some numbers and assess what each choice means for your future. After all, the right financing choice lays the groundwork for your success and growth. Here’s to making a decision that propels your business forward with the right balance of caution and ambition.

FAQs for Loans to Buy a Business

Below, we have answers to some of the most common questions about buying an existing business.

Can I Get a Business Loan If I Have Poor Credit?

Yes, you can be approved for a business loan, even with a poor credit history. Contact us and speak to a Clarify advisor so we can help you. You only need one lender to fund you, and we work with more than 75 of them!

Can I Get a Business Loan With No Money Down?

Yes, you can get a business loan with no money down. Most small business loans don’t require a down payment or collateral for business loan approval.

Is It Hard To get Approved For a Small Business Loan?

The application process for a small business loan is very simple with Clarify Capital. You can fill out our online application form in two minutes, get approved, and receive the money in your bank account in as little as 24 hours!

Unlike traditional bank loans and loans from credit unions and other financial institutions, Clarify offers small business financing with fewer requirements. We make the process easier and quicker, and we strive to help you find a business loan that suits your needs.

Start an Application (It won’t impact your credit.)

How Does the Asking Price of the Business Impact My Loan Application?

Lenders will evaluate the asking price against the business’s financials and market value to make sure you’re asking for the right loan amount. The asking price also reflects the business’s earning potential, which lenders use to gauge the risk associated with the loan.

What Is Due Diligence and How Does It Affect My Financing Options?

Due diligence is a comprehensive assessment of the business you’re planning to buy and includes reviewing its financial records, legal standings, and operational efficiency. Thorough due diligence should identify any potential risks or liabilities, such as outstanding liens, which can impact your financing options. Lenders will consider your due diligence findings when approving your loan.

What Should I Look for in a Loan Agreement When Buying a Business?

When reviewing a loan agreement for buying a business, pay close attention to the loan terms, interest rates, monthly payments, and any prepayment penalties. Also, understand the loan requirements, including collateral and personal guarantees. A Clarify Capital advisor can help make sure the agreement aligns with your financial projections and business plans.

How Do I Determine the Right Loan Program for My Business Purchase?

Determining the right loan program involves understanding your business needs and the purpose of the loan. Compare different loan programs, considering the loan terms, interest rates, and loan requirements. Consulting with a financial advisor at Clarify Capital can help you decide which program is best for your business acquisition strategy.

How Can I Make Sure My Monthly Payments Are Manageable?

To make sure you can afford your monthly payments, aim for a loan with terms that fit your cash flow and budget. Consider loans with competitive interest rates and longer repayment terms to reduce the monthly payment amount. Accurately projecting your business’s post-acquisition revenue can also help you choose a loan that won’t strain your finances.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts