Small Business Administration (SBA) trucking loans help trucking companies access affordable capital with competitive interest rates and longer repayment terms than most traditional financing options. For many business owners, this type of loan provides essential support for managing cash flow, upgrading equipment, purchasing trucks, or expanding operations.

Here's everything you need to know about leveraging SBA loans to grow your trucking business.

What Is an SBA Loan and Why Do Trucking Companies Need Them?

SBA loans are partially guaranteed by the U.S. Small Business Administration, reducing the risk for lenders and offering better loan terms for trucking companies. SBA loans specifically support small business owners, including those in the transportation industry, providing essential working capital for growth and operational stability.

Types of SBA Loans for the Trucking Industry

There are different SBA loan programs available for trucking companies, each catering to distinct business needs and circumstances. Understanding the specifics of each type helps you choose the best option for your business.

SBA 7(a) Loan

The SBA 7(a) loan is the most popular and versatile loan program offered by the SBA, ideal for trucking companies needing flexible financing to achieve a wide range of business goals, from fleet expansion and refinancing existing business debt to acquiring commercial real estate.

Flexible use. Funds can be allocated for multiple purposes, including purchasing new trucks, refinancing business debt, or acquiring real estate.

Loan amount. Up to $5 million, making it suitable for significant investments.

Repayment terms. Up to 25 years for real estate and up to 10 years for working capital.

Reduced rates for qualified candidates. Veteran-owned trucking businesses may qualify for reduced or waived guaranty fees under certain SBA funding years.

SBA Microloan

The SBA Microloan program is particularly beneficial for smaller trucking companies and startups needing limited funding for specific business operations, such as working capital, inventory purchases, or minor expansions.

Loan amount. Typically, up to $50,000.

Use of funds. Ideal for immediate operational needs, purchasing inventory, small equipment, or working capital.

Repayment terms. Usually up to six years, offering manageable monthly payments.

How Does an SBA Loan Work?

An SBA loan works by providing financial support to small businesses through approved lenders. The SBA doesn't directly lend the funds but guarantees a significant portion of the loan, reducing lender risk.

Trucking companies apply for these loans through approved lenders, which assess factors like credit score, business plan, financial stability, and collateral. After approval, loan amounts are disbursed, and repayment terms are set based on the type of loan secured.

Benefits of SBA Loans for Trucking Businesses

SBA loans are highly beneficial, especially for owner-operators and smaller transportation companies. One major advantage is lower interest rates, significantly reducing your monthly payments and making financing more affordable. Additionally, these loans offer extended repayment terms, allowing borrowers ample time to manage repayments effectively and supporting healthy business cash flow.

Another significant benefit is their flexible use. SBA loans accommodate various trucking business needs, from buying new trucks and refinancing existing business debt to improving your fleet's maintenance and funding real estate acquisitions. This adaptability helps business owners tackle multiple business needs without having to secure multiple loans.

Moreover, SBA loans help trucking businesses improve cash flow management by offering predictable monthly payments and lower interest rates. This stability allows owner-operators and transportation companies to better manage operational expenses like fuel, maintenance, payroll, and other day-to-day costs.

Benefits for Owner-Operators and Small Transportation Companies

For owner-operators and smaller transportation companies, SBA loans offer targeted financial benefits that facilitate growth. With lower down payment requirements, these businesses can access significant funding without high upfront costs. SBA loan programs also enhance cash flow predictability, enabling business owners to manage operational expenses such as payroll, fuel, and maintenance with greater ease and confidence.

SBA loans often do not require substantial collateral beyond the purchased equipment or real estate, minimizing risk for the borrower and making these loans particularly attractive for smaller enterprises with fewer available assets.

Common Uses of SBA Loans in the Trucking Industry

SBA loans are highly flexible financing options tailored to meet a variety of trucking business needs. Common uses include:

Fleet expansion. Purchasing new trucks or upgrading existing commercial vehicles to expand operations or enhance efficiency.

Working capital. Covering day-to-day operational expenses, including payroll, fuel, insurance, and maintenance, ensuring consistent cash flow during fluctuating revenue periods.

Equipment upgrades. Acquiring advanced trucking technology, safety equipment, or logistics software to improve performance and reduce operational costs.

Debt refinancing. Consolidating high-interest business debt into lower-interest SBA loans, improving cash flow, and reducing monthly payments.

Commercial real estate purchases. Buying or leasing warehouses, truck depots, and maintenance facilities to support operational expansion and efficiency.

Eligibility Requirements for Trucking SBA Loans

The application process includes lender reviews of these key documents, ensuring applicants meet the Small Business Administration's requirements. Being thorough and transparent in your financial documentation improves your chances of loan approval.

Lenders assess your trucking business on financial stability, repayment capacity, and overall business credibility. Trucking businesses typically need to meet the following criteria to qualify, including:

Solid personal and business credit scores. Usually, at least 620, although higher scores improve loan terms.

Stable financial statements. Demonstrating consistent cash flow and revenue.

Adequate collateral. Often trucks, trailers, or real estate, depending on loan size.

Comprehensive business plan. Outlining operational plans, market analysis, and detailed financial projections.

Business documentation. Recent tax returns, profit-and-loss statements, and balance sheets.

To qualify for an SBA trucking loan, understanding the eligibility criteria is essential. Lenders generally require businesses to demonstrate financial stability and a clear ability to repay the loan. This typically involves reviewing your personal and business credit scores, evaluating financial statements, and assessing your overall credit history.

Additionally, businesses must meet specific criteria set by the SBA, such as being a for-profit enterprise based in the United States, meeting size standards defined by the SBA, and proof of adequate cash flow to service loan repayments.

Collateral requirements vary depending on the loan amount and type of loan. Real estate, equipment like trucks, and other business assets are often used as collateral. In some cases, a down payment might be necessary, particularly for larger loans.

Business owners are also required to submit comprehensive financial statements, including recent tax returns and financial records, alongside a robust business plan that clearly outlines their current operations, financial projections, and growth strategy. These documents help lenders assess your business's long-term viability and determine eligibility.

Challenges Trucking Companies Face With SBA Loans (and Faster Alternatives)

SBA trucking loans offer competitive interest rates and long repayment terms, but they're not always the fastest or easiest option. Before applying for an SBA 7(a) loan or SBA-guaranteed financing, it's important to understand the common hurdles trucking businesses run into.

Key challenges for trucking companies include:

Lengthy approval timelines. SBA loan approval can take weeks due to underwriting, documentation checks, and SBA review.

Extensive documentation. Borrowers must provide tax returns, financial statements, cash-flow reports, business plans, and, in some cases, freight contracts. This can slow down the loan application process.

Strict credit and eligibility requirements. Many SBA lenders prefer applicants with strong credit histories, steady accounts receivable, and proven cash flow, which are requirements that can be challenging for newer trucking startups or companies facing seasonal dips.

Collateral requirements. SBA 7(a) loans often require trucks, trailers, or real estate as collateral. Not all trucking companies have enough available assets, especially if they already finance part of their fleet.

Cash-flow strain during the wait. Freight payments often come on net-15, net-30, or net-45 terms, while repairs, fuel, and insurance require immediate payment. Waiting weeks for SBA loan funding can create pressure on day-to-day operations.

If you can't wait weeks or don't qualify for an SBA loan, faster options exist. Equipment financing, working capital loans, lines of credit, and invoice factoring can offer same-day or next-day funding. Clarify works with trucking companies that need business financing quickly, whether for repairs, truck purchases, or interim funding while pursuing an SBA loan.

How Trucking Companies Can Apply for an SBA Loan

Securing an SBA trucking loan involves several clearly defined steps, making the application process straightforward and transparent:

Identify your needs. Clearly outline your financial requirements, including loan amount and intended use.

Gather documents. Collect the necessary paperwork, including financial statements, tax returns, credit reports, and your detailed business plan. Your business plan may include fleet details, freight contracts, average miles per truck, DOT history, maintenance costs, and projected revenue.

Choose a lender. Select an SBA-approved lender like Clarify Capital, who understands the trucking industry, to facilitate the application process.

Submit your application. Work closely with your chosen lender to complete and submit your SBA loan application.

Undergo lender evaluation. The lender will review your financial history, creditworthiness, and collateral.

Get approved and funded. Upon approval, loan amounts are disbursed typically within a few business days.

Understanding SBA Loan Eligibility and Requirements

Qualifying for an SBA trucking loan involves meeting specific eligibility requirements set by the Small Business Administration and the SBA lender. While these requirements can be detailed, preparing the necessary information in advance will significantly streamline your application process.

Key eligibility requirements include:

Business size standards. Your trucking company must meet the SBA's definition of a small business, typically based on your annual revenue or number of employees.

Operational location. You must operate primarily within the U.S. and legally conduct business.

Credit history and score. A strong personal and business credit score, typically above 680, is crucial for approval and securing lower interest rates.

Collateral. SBA trucking loans often require collateral, such as the trucks themselves, equipment, or commercial real estate.

Demonstrable repayment ability. Your business must provide evidence of positive cash flow and sufficient profitability through financial statements, such as balance sheets and income statements.

Solid business plan. You must submit a comprehensive business plan outlining your operations, projected growth, market analysis, and detailed financial projections.

Beyond these foundational criteria, lenders also review personal credit histories and financial disclosures to determine overall creditworthiness. Borrowers with lower credit scores can still qualify for SBA loans, but lenders typically favor businesses with stronger credit histories, resulting in lower interest rates and more favorable repayment terms.

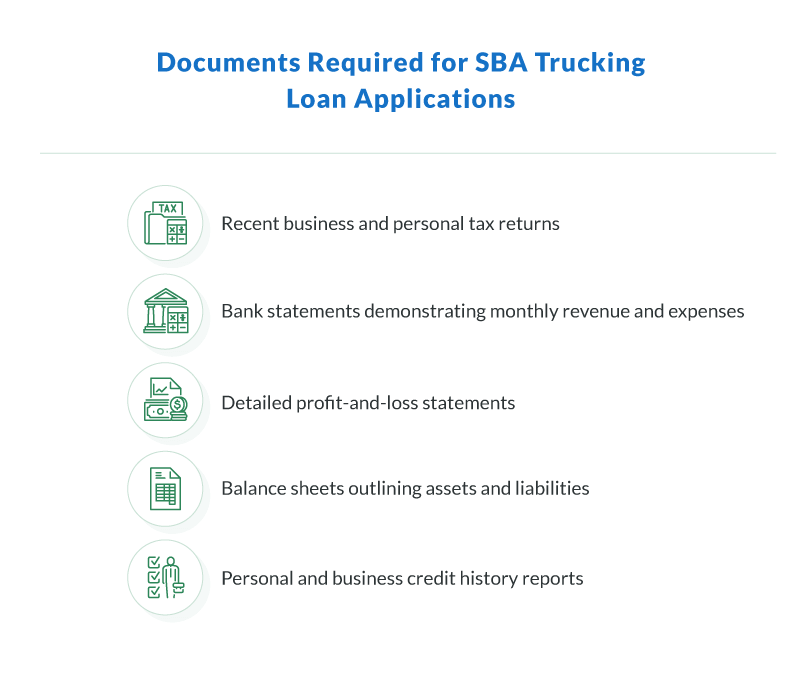

The documentation you'll likely need includes:

Recent business and personal tax returns

Bank statements demonstrating monthly revenue and expenses

Detailed profit-and-loss statements

Balance sheets outlining assets and liabilities

Personal and business credit history reports

Gathering and organizing these documents upfront will help reduce delays and ensure you present your trucking business effectively, increasing your chances of approval with preferred lenders.

SBA Loans for Trucking: Pros and Cons

SBA loans are a strong financing option for trucking companies looking for competitive interest rates and longer repayment terms. Still, they aren't always the fastest solution for owner-operators or small fleets that need immediate access to working capital or truck financing. Here's a quick snapshot of what to expect:

Pros:

Lower interest rates. SBA-guaranteed loans typically come with more affordable interest rates than most traditional business financing or equipment loans.

Longer repayment terms. SBA 7(a) loans offer up to 10 years for working capital and up to 25 years for real estate, helping trucking businesses manage cash flow more easily.

High maximum loan amounts. With loan amounts up to $5 million, trucking companies can purchase trucks, trailers, equipment, or even property for operations.

Flexible use of funds. Borrowers can apply SBA funding toward truck purchases, refinancing, repairs, fuel costs, or general small business working capital needs.

Cons:

Slow approval timelines. SBA loans can take several weeks due to documentation and underwriting, which is challenging for trucking businesses that need fast funding.

Strict eligibility requirements. Lenders look closely at credit score, cash flow, collateral, and overall credit history, which can be difficult for trucking startups or inconsistent freight seasons.

Heavy paperwork. Borrowers must provide tax returns, financial statements, business plans, and trucking-specific documentation, making the process more time-consuming.

Comparing SBA Loans To Other Financing Options

When considering business financing, understanding the differences between small business loans and traditional business loans can help you make an informed choice:

Interest rates. SBA loans typically offer lower interest rates due to the SBA's guarantee, reducing lenders' risk.

Repayment terms. SBA loans generally have longer repayment terms, giving you greater financial flexibility and lower monthly payments compared to traditional business loans.

Loan accessibility. SBA loans, though beneficial, involve detailed paperwork and longer approval timelines. Traditional loans may be quicker but often carry higher interest rates.

Here's a side-by-side feature comparison between SBA trucking loans and conventional business loans.

| SBA Trucking Loan vs. Traditional Business Loans | ||

|---|---|---|

| Feature | SBA trucking loan | Traditional business loans |

| Interest rates | Lower | Higher |

| Repayment terms | Long-term flexibility | Shorter terms |

| Loan approval time | Longer (weeks-months) | Shorter (days-weeks) |

| Collateral | Usually required | Often required |

| Suitable for | Larger, long-term investments | Immediate, short-term expenses |

Alternatives to SBA Loans for Trucking Businesses

While SBA loans offer excellent financing options, trucking companies might also consider alternative solutions tailored to specific business needs. Each alternative offers distinct benefits, interest rates, repayment terms, and eligibility criteria.

Business line of credit. Ideal for managing cash flow fluctuations or covering short-term expenses, a business line of credit provides flexible, revolving credit. Interest rates are typically higher than SBA loans, but you only pay interest on the amount borrowed.

Factoring or invoice financing. Trucking companies with outstanding invoices can quickly access working capital by selling accounts receivable to a factoring company. While invoice factoring offers immediate cash, rates can be higher than traditional loans or SBA options.

Equipment financing and leasing. Specifically designed for acquiring trucks, trailers, or essential gear, equipment loans use the equipment itself as collateral, often offering low interest rates and streamlined qualification criteria compared to unsecured financing.

Short-term loans and microloans. These loans provide smaller funding amounts quickly, making them suitable for urgent needs or smaller trucking companies. Interest rates tend to be higher with shorter repayment terms than SBA loans, but eligibility requirements are usually more flexible.

Comparing these alternatives, you'll find SBA loans offer some of the lowest interest rates and longest repayment terms, but often require extensive documentation and longer approval times. In contrast, alternative financing methods typically offer quicker funding with fewer requirements, albeit at potentially higher costs. Carefully assess your trucking business's financial situation, needs, and eligibility before choosing the right solution.

How SBA Loans Impact Cash Flow in the Trucking Industry

Cash flow is critical for the trucking industry, which faces fluctuating revenues and ongoing operational costs. SBA loans, with their predictable monthly payments and favorable repayment terms, significantly stabilize financial planning. Trucking companies benefit from knowing their exact monthly financial obligations, reducing uncertainty and enabling better management of operational costs.

Moreover, favorable repayment terms provided by SBA loans help trucking companies manage business expenses more effectively. These terms allow companies to plan for slow periods, fuel price fluctuations, and unforeseen maintenance or operational costs, ensuring financial stability and growth over the long term.

Need Funding Faster? Get a Quote in 24 Hours

SBA trucking loans provide business owners with flexible and affordable access to capital, offering lower interest rates and extended repayment terms. It's an ideal choice for trucking companies seeking working capital to purchase equipment, expand operations, or refinance existing debt without the constraints of higher-cost, short-term financing.

While SBA loans deliver considerable advantages, it's essential to evaluate your business's financial situation, long-term goals, and ability to manage loan repayments. Trucking companies that have a solid credit history, a comprehensive business plan, and adequate collateral will benefit significantly from SBA financing.

Ready to secure competitive financing for your trucking business? Clarify Capital is here to help you every step of the way. Apply for an SBA trucking loan today, tailored specifically for your needs, and start the path toward sustainable growth and financial stability.

FAQ About SBA Trucking Loans

Below, we answer some common questions:

Can Owner-Operators Qualify for SBA Loans?

Yes, owner-operators can qualify for SBA loans, provided they meet eligibility criteria, including creditworthiness, financial stability, and proper business documentation.

Are There SBA Loans Specifically for Purchasing New Trucks?

While not specifically dedicated, SBA loans such as the SBA 7(a) program are commonly used to finance new truck purchases or upgrades.

What Is the Typical Repayment Period for SBA Loans in Trucking?

Repayment periods for SBA trucking loans typically range from five to 25 years, depending on the loan type and amount borrowed.

How Does SBA Loan Approval Work for Transportation Companies?

Transportation companies submit their applications through SBA-approved lenders, who review financial documentation, creditworthiness, and business plans before issuing approvals.

Is Real Estate Accepted as Collateral for SBA Loans?

Yes, real estate is frequently accepted as collateral for SBA loans, offering business owners favorable loan terms due to reduced risk for lenders.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts