Key Takeaways:

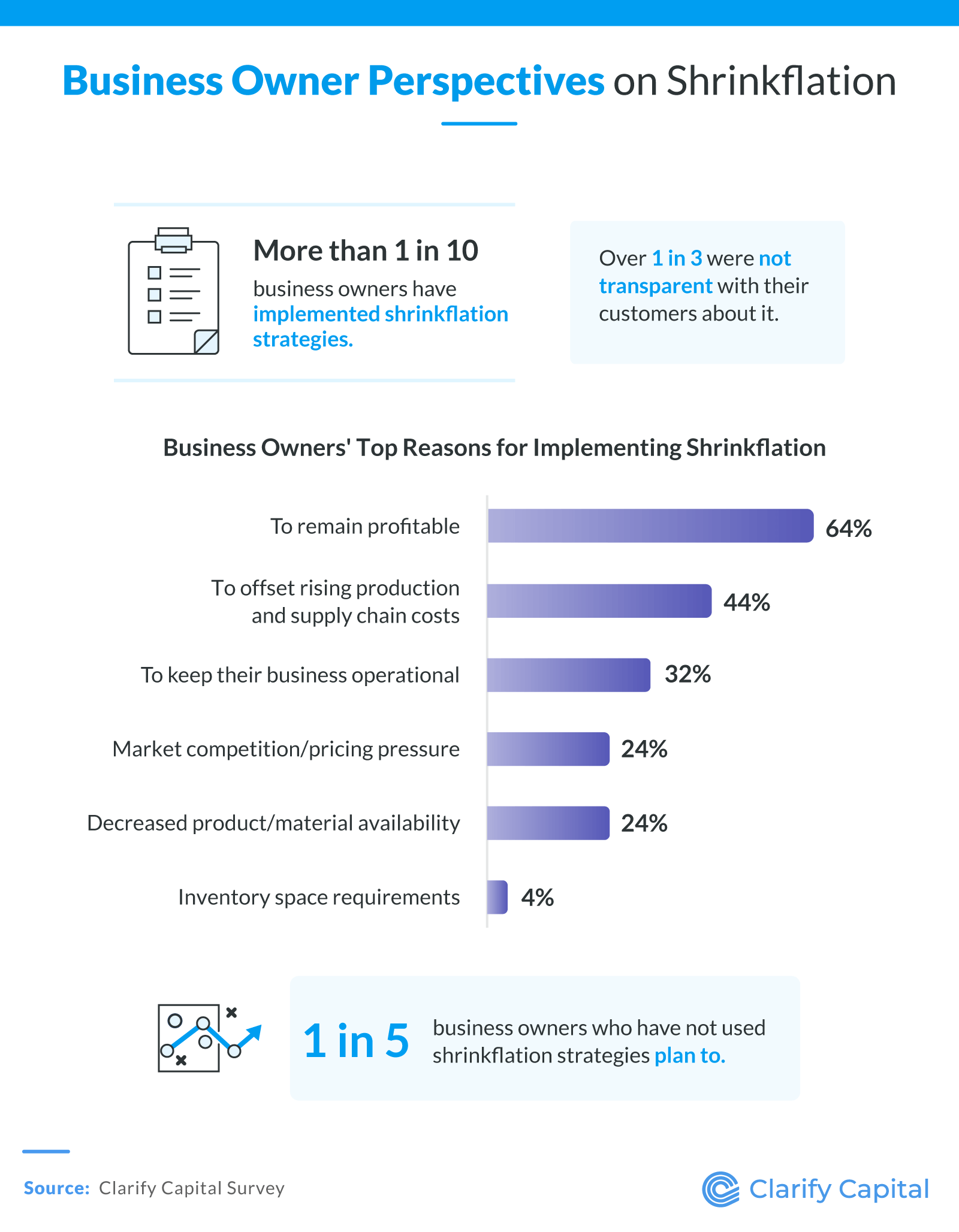

More than 1 in 10 business owners have implemented shrinkflation strategies.

Of those, over one-third were not transparent with customers about doing so.

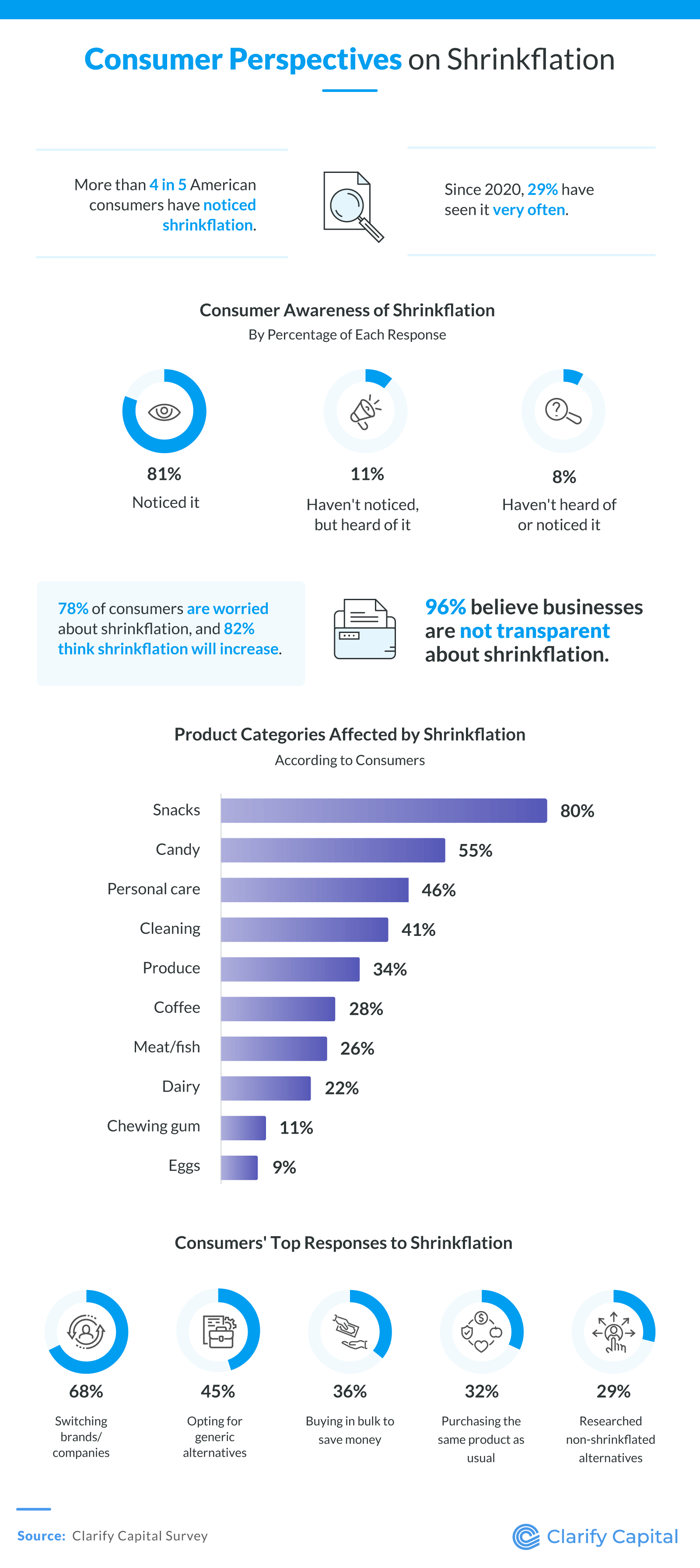

More than 4 in 5 Americans have seen shrinkflation, most frequently in snack (80%), candy (55%), and personal care (46%) products. Since 2020, 29% say they have seen it very often.

More than 2 in 3 have switched companies or brands due to it.

Business Owners’ Reasoning and Plans

More than 1 in 10 business owners (12%) have used shrinkflation as a strategy. Of those, more than one-third (36%) were not transparent with their customers about it.

Business owners’ most common reasons for shrinkflation are to stay profitable (64%) and to offset rising production and supply chain costs (44%).

1 in 5 business owners who have not used shrinkflation say they will.

Impacted Products and Consumer Response

More than 4 in 5 Americans have seen shrinkflation. Since 2020, 29% say they have seen it very often.

The top categories in which consumers see shrinkflation are:

- Snacks (80%)

- Candy (55%)

- Personal care products (46%)

- Cleaning products (41%)

More than 2 in 3 have switched companies or brands due to shrinkflation, while almost half (45%) have opted for generic alternatives.

Methodology

We surveyed 202 business owners and 800 consumers to gather their perspectives about product shrinkflation on March 7, 2024.

About Clarify Capital

Clarify Capital is dedicated to empowering small business owners by providing instant business loans up to $5 million with low rates and fast approval. We offer every entrepreneur a personalized and supportive experience.

Fair Use Statement

Want to tell others about our shrinkflation findings? You are welcome to share our data for noncommercial purposes, provided you include a link to this page as an attribute of our work.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts