Minorities own over 10 million small businesses in the United States, and that number is growing. Also, between 2017 and 2022, the number of Black-owned businesses grew by nearly 57%, making up more than half of all new employer firms created during that period.

Still, many founders face unequal treatment in the lending process. Recent data shows Black-owned firms are denied financing far more often than white-owned firms, and Hispanic entrepreneurs report similar barriers.

These gaps aren't a reflection of talent or potential. Instead, they reflect an outdated system. Your business deserves fair access to capital. That's why Clarify Capital prioritizes business performance over credit history, offers fast approvals, and requires no collateral, making funding more accessible and equitable for underserved entrepreneurs.

In this guide to the best business loans for minority-owned businesses, you'll find tailored financing options that offer fast approvals, low rates, and minimal requirements, empowering you to access the capital you need without the barriers of traditional lending.

What's Considered a Minority-Owned Business?

A minority-owned business refers to a company that is at least 51% owned, operated, and controlled by a minimum of one U.S. citizen who belongs to a minority group. For instance, if a business has two or more owners, 51% of the company must be controlled and managed by the minority partner. If the company is publicly traded, at least 51% of the shares must be minority-owned to be considered under this category.

For this definition, a minority person refers to an individual with an ethnic background of African American, Asian, Hispanic, Alaskan Native, or Native American. The term may also apply to Alaska Native corporations, North American tribes, and Native Hawaiian organizations.

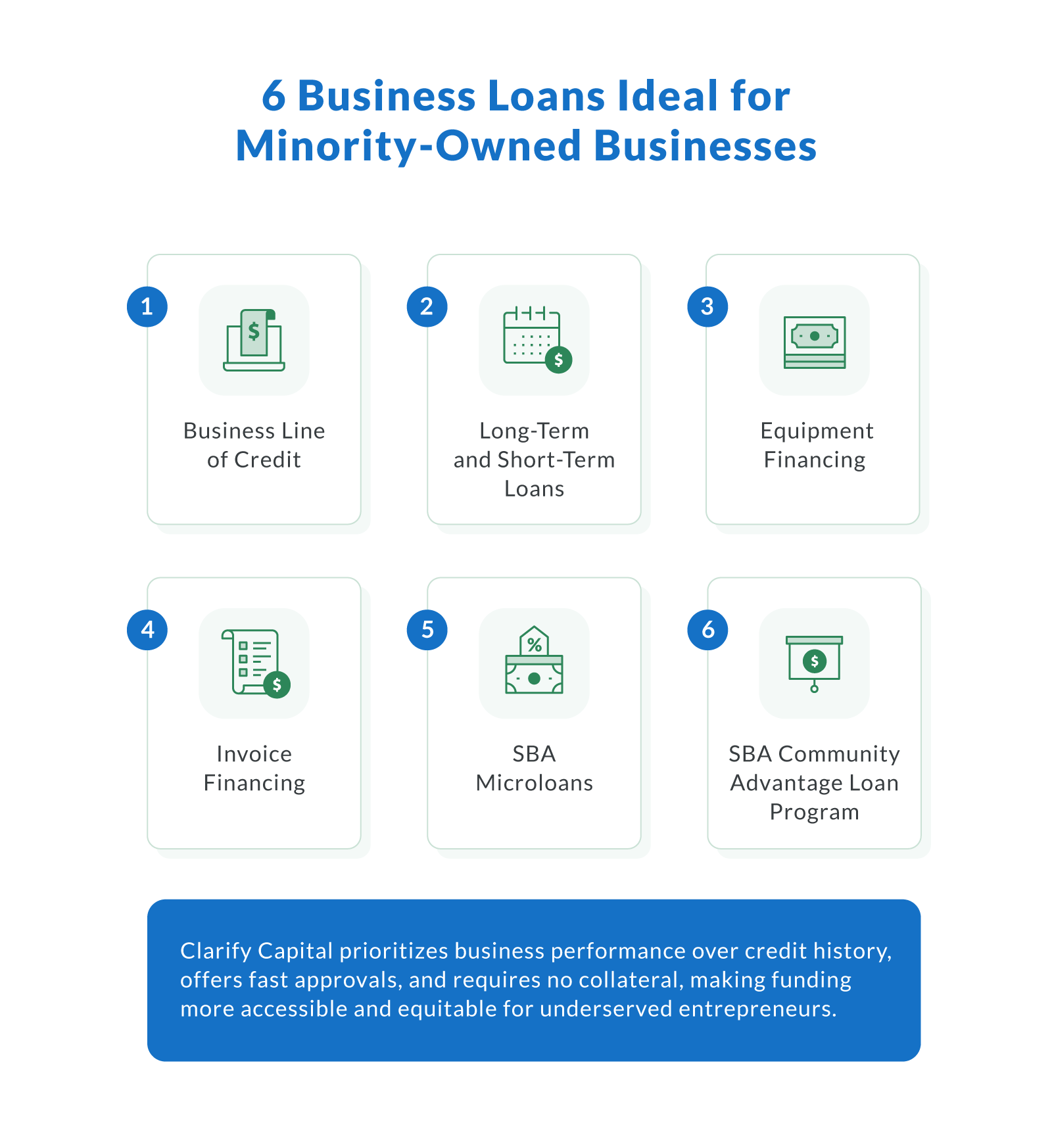

Top 6 Business Loan Options for Minority-Owned Businesses

One of the biggest reasons small businesses fail — especially minority-owned companies — is the lack of capital or funding. At Clarify Capital, we want to do our part to help solve this problem. We strive to simplify the process of choosing the right loan for your business needs.

Below are the best business loans, with over 10,000 business owners approved and funded so far!

1. Business Line of Credit

These are ideal for business owners who want a flexible funding option to manage day-to-day business expenditure.

Business lines of credit work like a business or personal credit card, but you can enjoy much lower interest rates. When you're approved, you get a specified amount of revolving funds that you can draw from on demand.

The key benefit of a line of credit is that you only pay interest on the funds your business withdraws for use, and there are no restrictions on the type of expenses you can pay for. You can purchase new equipment, stock up on inventory, hire more staff, or open a new location.

Benefits of a business line of credit:

Business owners with bad credit scores can secure funding

Low APRs starting at 6%

Working capital is available on demand as needs arise

Only pay interest on the funds you withdraw

Improves your personal credit rating

No prepayment penalties

2. Long-Term and Short-Term Loans

These loans are ideal for business owners who want instant approval regardless of their credit score, without giving any personal guarantee or collateral.

Short-term loans are a popular financing option, and also the most traditional way of raising working capital. With short-term loans, you receive a lump sum amount that you pay back plus interest over a specified term.

Repayment terms are usually between six months and two years. Short-term loan funds are best used as working capital, to cover emergency expenses, take care of payroll, purchase inventory, and pay for other immediate business expenses.

Long-term loans are a financing option similar to short-term loans, except you can pay back the capital over a longer period of time, typically from three to 10 years. Some loans, like SBA loans, have even longer terms of up to 25 years. Long-term small business loans are best used for buying real estate, purchasing equipment or vehicles, renovating or expanding your business space, refinancing existing debt, and more.

With long-term loans, you have more time to repay, and you'll likely have lower monthly payments compared to other business loans. However, it can be more challenging to qualify for long-term loans unless you have an established business and a strong credit score.

Clarify has the highest approval rates for minority term loans and offers early payoff incentives that further reduce your costs. The entire funding process takes as little as one day, with interest rates starting at 7%. Another benefit is that you don't need to provide any collateral or personal guarantee to secure a short-term loan.

Benefits of term loans include:

Fixed interest rate

Early payoff incentives that lower costs

Fast business loan option

Any personal credit score can get approved

All types of minority-owned businesses are eligible for approval

No prepayment penalties

No collateral or personal guarantee requirements

3. Equipment Financing

Equipment financing, also called equipment loans, is a great way for businesses to fund the purchase of any equipment or machinery. The process is quick, and you can borrow up to 100% of the money you need. Equipment loans can be used on a wide array of purchases, including technology, vehicles, and commercial machinery.

The term length of the loan is dependent on the expected life of the equipment you're buying. And the equipment serves as collateral for the loan, so there's no personal guarantee needed.

Benefits of equipment loans include:

Low documentation or paperwork

Highly competitive APRs due to the collateral

Bad personal credit is okay

4. Invoice Financing

This is ideal for business owners who want to get paid instantly for outstanding customer invoices.

Invoice financing allows business owners to borrow capital with unpaid invoices as collateral. With this type of loan, a factoring company will give you 85% to 99% of the total invoice amount upfront. Once the invoices clear, the lender will pay you any remaining amount after deducting factoring fees.

With invoice financing, lenders care more about your customers' creditworthiness, so this is a great option for business owners with less-than-stellar credit scores.

Benefits of factoring include:

High approval rate

No personal credit score requirements

Instant infusion of cash flow without taking on debt

The only collateral needed is the unpaid accounts receivable

5. SBA Microloans

Ideal for business owners who have good credit scores and need less than $50,000 in funds.

The U.S. Small Business Administration (SBA) is a federal agency that provides support to entrepreneurs and small businesses through loans, grants, and business development programs. The SBA Microloan Program is fully funded by the federal government and administered by approved lenders who are mostly nonprofit organizations and business centers.

With the Microloan program, loan amounts up to $50,000 are available to small business owners who have lower incomes or those with no credit history. These are typically awarded to startups or new businesses trying to expand. Business owners can use microloan funds to cover working capital, purchase inventory or raw materials, and buy equipment or machinery.

Benefits of SBA microloans include:

Low interest rates for minorities with great credit scores and a business plan

Good option if you need less than $50,000 and are not in a rush to secure funding

Other SBA Loans

Other SBA loan options, such as SBA 7(a), SBA 8(a), and SBA 504 loans, can also support minority-owned businesses seeking affordable financing and long-term growth.

The 7(a) program offers working capital and flexible repayment terms, while the 8(a) program helps disadvantaged businesses access federal contracting and mentorship opportunities. For real estate or large equipment purchases, the 504 loan provides low-cost, fixed-rate financing through Certified Development Companies (CDCs) that often serve underserved communities.

6. SBA Community Advantage Loan Program

The SBA Community Advantage program is designed to expand affordable financing to minority-owned businesses, startups, and companies in underserved markets.

Offered through mission-driven lenders like CDFIs and nonprofit organizations, these loans provide amounts up to $350,000 with flexible repayment terms and more inclusive eligibility requirements than traditional banks.

Additional Support Resources for Minority-Owned Businesses

These agencies don't provide loans directly, but they help minority founders access financing, strengthen eligibility, and connect with funding partners.

Minority Business Development Agency (MBDA)

The Minority Business Development Agency (MBDA) is focused entirely on supporting minority-owned businesses and minority entrepreneurs. Through its nationwide business development programs, MBDA Business Centers offer technical assistance, help companies access business financing, and connect founders to funding options like lending programs, Community Development Financial Institutions (CDFIs), and small business grants for underserved communities.

These resources are especially valuable for Hispanic, Native American, Black, and Asian business owners seeking stronger financing options and federal contracting opportunities.

National Minority Supplier Development Council (NMSDC)

The National Minority Supplier Development Council (NMSDC) helps minority business owners enter corporate supply chains by offering trusted certification and access to business funding opportunities.

Members gain visibility with major corporations, support from nonprofit organizations, and connections that strengthen long-term growth for disadvantaged businesses and other minority-owned enterprises.