Over 1.6 million firms across the United States are owned by veterans, including service-disabled veterans. This number continues to increase year after year. After serving our country, building your own business becomes the next mission — and you deserve support every step of the way. In this guide to business financing for veterans, we'll discuss:

Best funding options for veterans

Eligibility requirements for a small business loan

How to get approved and receive capital in 24 to 48 hours

How to secure the most competitive interest rates

Answers to common financing questions veterans have

So, if you want quick access to working capital for your veteran-owned business or startup, this guide can help. Let's dive in.

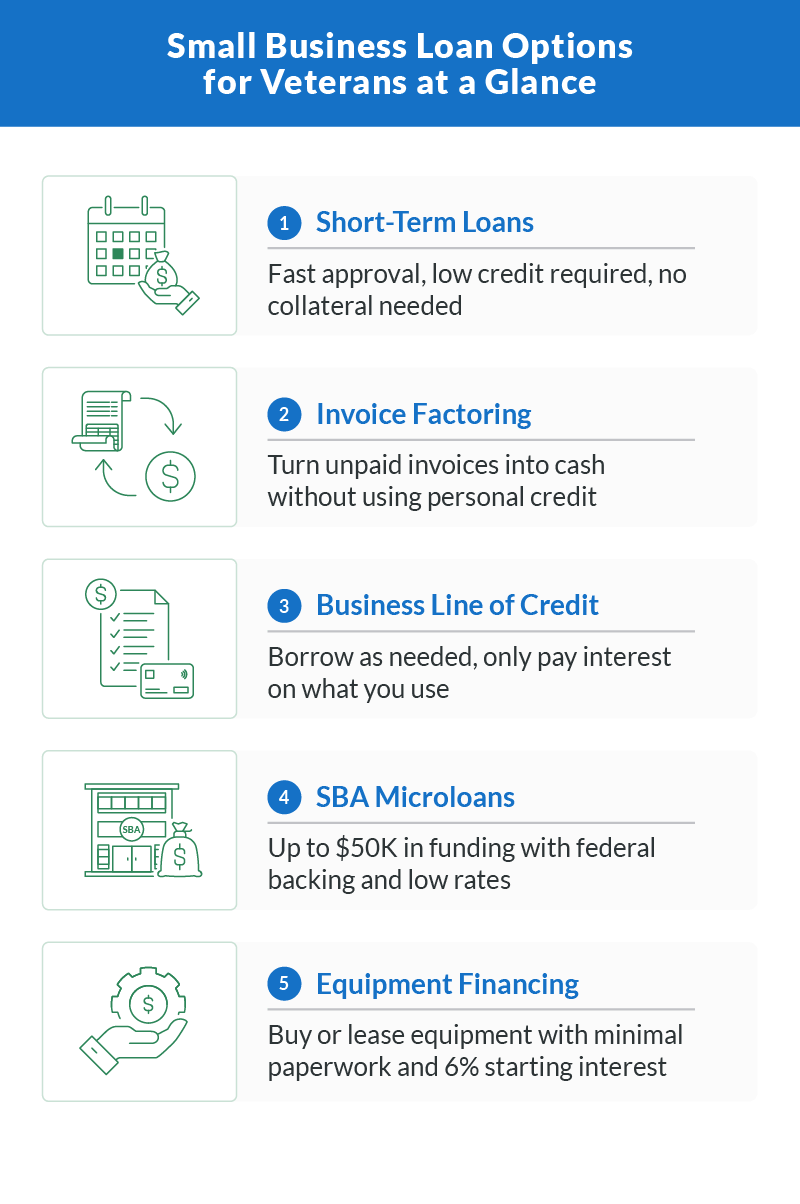

Top 5 Business Loan Options for Veterans

With so many loan programs, borrowing capital can feel confusing. Having helped over 10,000+ veterans and active-duty members access working capital, we understand that finding the right loan type for your situation is no easy feat. We've streamlined the process and outlined the most common types of loans for military veterans, National Guard members, and other active-duty military members, so you can focus on business development.

1. Short-Term Loans for Veterans

Best for: Veterans with all types of credit who desire quick approval with no collateral needed.

Short-term loans are the preferred funding option for veteran entrepreneurs. You receive a fixed amount of money with a fixed interest rate to be paid back over a predetermined term length. Term loans are the most common way to receive capital. Term lengths tend to last between six and 24 months, on average.

Clarify has the best approval rates for veteran term loans and offers early payoff options to make reducing costs easy. Credit score requirements are low, and collateral and personal guarantees are never required. Interest rates start as low as 6%, and the funding process is fast, taking as little as one day.

The advantages of term loans for veterans include:

Prepayment penalties are never assessed

All credit scores can apply

Collateral and personal guarantee aren't needed

Fixed APR with a predictable payment structure

Fast financing

Any veteran-owned business is eligible for approval

2. Invoice Factoring for Veterans

Best for: Veterans who want to get paid quickly for unpaid customer receivables.

Factoring, also known as invoice financing, enables vets to use unpaid invoices as collateral to borrow capital. Lenders provide around 85% to 100% of the outstanding invoice amount to borrowers upfront for fast access to capital as invoice-related cash flow gaps occur.

The remaining outstanding balance is paid to your company after the invoice clears. Personal credit scores aren't considered for this type of funding, making it an excellent option for veterans with bad credit.

The benefits of invoice factoring include:

All personal credit scores can get funded

No more waiting for capital to be paid to access capital

Use unpaid receivables as collateral

3. Business Lines of Credit for Veterans

Best for: Veterans desiring flexibility with how they manage funds.

Business lines of credit are similar to traditional credit cards, although they have much lower interest rates than consumer cards. You're extended a certain amount of capital and can borrow up to that allotted amount. As you repay, the pool of funds replenishes, and you can keep borrowing as you go. You only pay interest on any funds you withdraw, and you can use the credit line to pay for any business-related expenses.

The benefits of invoice factoring include:

Low interest rates

Helps build credit

Interest is only assessed on the capital you withdraw

No prepayment penalties

Veterans with poor credit can get approved

Flexible and convenient access to funds

4. SBA Microloans for Veterans

Best for: Veterans with great credit needing less than $50,000 in funds.

The microloan program is open to all small business owners. These U.S. Small Business Administration (SBA) loans can be a good match for veteran-owned small businesses seeking up to $50,000 backed by the federal government.

The application process tends to be slow-moving, so many veterans choose to finance with term loans or credit lines over this option. You can also learn more about the SBA Express loans and SBA Veterans Advantage programs at SBA.gov.

Benefits of SBA microloans for veterans include:

Competitive interest rates for veterans with higher credit scores

Ideal for those who have time to wait on funding and require less than $50K

Reduced guaranty fees (upfront fees associated with the loan program)

How One Veteran Used SBA Resources To Grow

Tamiko Bailey, a service-disabled veteran and U.S. Air Force alum, turned a garage startup into Bailey's Premier Services, which is now a multi-state defense contractor supporting government aviation operations. With help from SBA programs like the Veterans Business Outreach Center (VBOC) and business training resources, she strengthened her business plan and expanded her veteran-owned small business far beyond its early beginnings.

After struggling with high-interest loans, Bailey secured an SBA 7(a) loan to refinance debt and access working capital, later obtaining a second SBA loan to support continued growth. Today, her company employs more than 160 people across 11 states, serves federal government agencies, and remains active in veteran community initiatives. Her story is a strong example of how veteran entrepreneurs can thrive with the right small business financing and support.

5. Equipment Financing for Veterans

Best for: Veterans who want to purchase or rent new or used equipment.

Equipment financing is available to veterans who want to secure capital for the purpose of buying equipment. The application process for equipment financing is fast and can be used to fund an array of equipment needs, like software, machinery, and appliances.

These loans typically last 24 to 72 months, but the term length depends on the projected life of the equipment, which can be shorter or longer than this. The equipment can be used as collateral to secure the loan.

Benefits of equipment financing for veterans include:

Low personal credit scores are okay

Finance up to 100% of the equipment

Interest rates as low as 6%

Minimal paperwork needed